Featured Trades: (FXI), ($SSEC)

2) Time to Sell US Stocks. So with the US stock market up almost every day in March, investors are hanging you by your ankles outside a window on a high floor, threatening to let go unless you increase your allocation to equities. How do you escape from this dire predicament? Buy Chinese stocks, where the Shanghai index ($SSEC) has been in a slow sideway grind for the past nine months. The recent move up in copper is hinting that there may be another leg up afoot in the Middle Kingdom.? China?s economy is still too strong by half, and has one of the few central banks in the world that is actually tightening. My friend, Dennis Gartman of The Gartman Letter tells me that a nice pennant formation is setting up in Shanghai that is breaking out to the upside. In any case, I always sleep better at night long equities in an economy that is growing at 8%-9%, than one that is poking along at 2%-3%.? The best way to play this is the China ETF (FXI).

Featured Trades: (MALCOLM GLADWELL)

3) An Evening With Malcolm Gladwell. I spent an evening with the New Yorker Magazine columnist, Malcolm Gladwell, author of The Tipping Point, Blink, and Outliers, and probably the most prolific publisher of original, consensus challenging ideas today. Half English and half Jamaican, the preeminent challenger of cliches and stereotypes was himself a cliche and a stereotype, wearing the standard issue New York intellectual?s blazer, pressed shirt, blue jeans, and loafers, to compliment his gaunt face and conspicuous afro. His latest book challenges the myth of meritocracy, that luck is a bigger factor in success than privilege or education, that in fact all meritocracies are rigged. Bill Gates built Microsoft not by being brilliant, but by having the good fortune to be raised by a family who could send him to one of the few Seattle high schools that then had a computer program. The Beatles made it only because they practiced? more than any other group in history. The falling crime rate since the seventies was not the result of a series of new, tough anti crime laws, but the removal of lead from gasoline in 1973, which literally drove young inner city dwellers violently insane. Successful hockey players are almost exclusively born during the first three months of the year, enabling them to beat the crap out of younger, smaller competitors in their junior years. It is cheaper to deal with the homeless than ignore them, because of the massive drain they create on the public health system. He cited the infamous example of the drunk, ?Million dollar Murray,? who single handedly drained the budgets of Reno, Nevada?s emergency rooms. Gladwell?s arguments may not be accurate, or even right, but he certainly forced you to look at problems from a new perspective.

Featured Trades: (STRATEGY LUNCH)

1) Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in a number of venues around the country this year. The first two will be held in San Francisco on April 23, and in New York on May 7. A three course lunch will be followed by a 45 minute PowerPoint presentation and a 30 minute question and answer period. I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Premium tickets are available for $250, and standard tickets for $95. I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The San Francisco lunch will be held at 12:00 noon on Friday, April 23, at the Marines? Memorial Association. The club can be found at 609 Sutter Street, San Francisco, CA 94102. For visitors from out of town, I have reserved a block of rooms at the Marines? Memorial Association, which is an excellent four star hotel only two blocks from the city center at Union Square and the cable cars. They are available at a special member?s discounted rate of $169 for weekdays and $179 for weekends.

The New York lunch will be held at 12:00 noon on Friday, May 7, at the New York Athletic Club. The club can be found at 180 Central Park South, New York, NY 10019.

I look forward to meeting you, and thank you for supporting my research.

Featured Trades: (HEDGE FUNDS)

2) Enter the Golden Age for Hedge Funds. I think we are entering a new golden age for hedge funds. I haven't seen as many visible, easy to understand growth differentials since the eighties since the last golden age, when we all made fortunes going long high growth markets and currencies, like Japan and the yen, and shorting low growth ones, like those for US stocks and the dollar. Today, China is growing at 9% a year, the US 2.5%, and Europe 1%, so you buy the FXI and short the euro. Think of it as a race between a Porsche, a '56 Chevy, and a Trabant, that you can bet on, without handicapping. How hard is that? I'm sorry, but I don't have armies of PhD's in math and computer science running warehouses full of Cray computers, like Renaissance does. I have to rely on really simple trading strategies, like sell high and buy low. This is why so many of the currency trades I have been recommending this year have been working so well, like shorting the euro against the dollar, the yen against the dollar, the Ausie/euro cross, and the loonie/euro cross. There are also a huge divergences in industries within single countries. In the US technology and commodities firms are enjoying true 'V' shaped recoveries, while great swaths of the economy, like the auto makers, commercial and residential real estate are comatose, with 'L' shaped recoveries at best. Get the macro and sector calls right, and single stock picks become almost an afterthought. Perhaps this explains why money has been flooding into hedge funds this year. The financial crisis rightly cleaned out a couple thousand wanabees chasing marginal returns with super leverage, and the survivors are certifiably bomb proof.

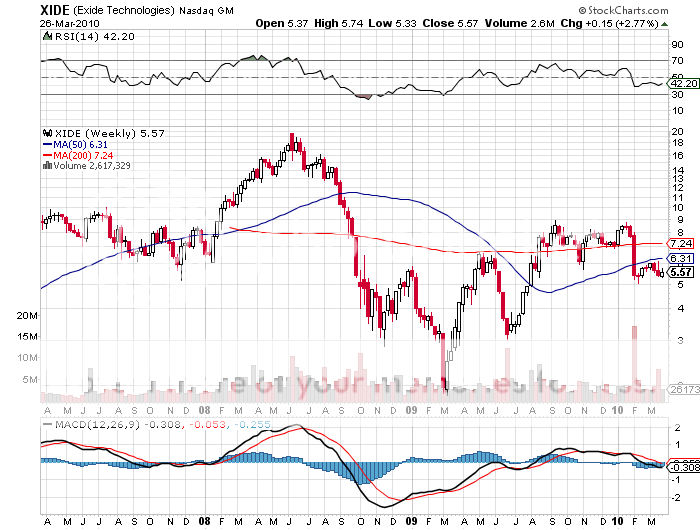

Featured Trades: (JOHN PETERSEN), (JCI), (XIDE)

3) The Skinny on Batteries With John Petersen. John Petersen is an attorney specializing in venture capital investments in the alternative energy space with Fefer, Petersen & Cie in Berne, Switzerland.? He argues that the entire electric car movement is a complete fraud orchestrated by a few big car companies pandering to growing numbers of ?green? consumers. Batteries are expensive, and do a poor job of replacing a gas tank. For example, the $100,000 all-electric Tesla roadster uses 6,000 model 18650 cell phone type batteries, which is akin to using ?6,000 hamsters to pull a stage coach.? Deutsche Bank says that there are enough new factories on the drawing board to build batteries generating 36 million Kwh by 2015. These will be used to power vehicles like the $44,300 Nissan Leaf, which launches in December, and will be powered by several hundred larger, soda can sized batteries. But even if the world?s total battery output is devoted solely to vehicles like the Leaf, fuel savings would amount to only 600 million gallons of gasoline a year, worth only $1.8 billion, about five hours worth of global oil production. If these batteries were devoted to hybrid vehicles like the Prius, the energy savings would amount to 3.8 billion gallons worth, a much more substantial $11.4 billion. The low hanging fruit for investors in the fuel efficiency race can be found by pushing forward existing, simpler, and cheaper technologies. A great example is the ?stop-start? integrated starter/alternator. Cars burn about 10% of their fuel idling at traffic lights while driving in cities. ?Stop-start? turns the engine off, and then restarts it when the light turns green. European car manufacturers are rushing forward with this fuel saver, which costs about $600 per vehicle, to meet stringent CO2 standards. The system requires more advanced batteries which can handle dozens of engine starts a day, instead of a handful. The Department of Energy recently handed $34 million to Xide Technology (XIDE) to develop just such a product using a lead-carbon formula. Global auto parts supplier Johnson Controls (JCI) is also involved in the space. The play here is that far more versatile batteries can command much higher prices, possibly $150, compared to the average $57 for traditional car batteries. Those taking a look at XIDE will find a $429 million market cap selling at $5.57/share versus $20 a year ago. In the meantime, car companies are going to hold back on making major capital investments in lithium battery power trains until the technology becomes proven. Better to invest in a company that may become profitable next year, rather than in five years, or never. To learn more about John Petersen?s views on alternative energy, please visit his blog at www.altenergystocks.com. You can also find an archive of his past work at http://seekingalpha.com/author/john-petersen/articles. You can contact him directly at fefer.petersen@gmail.com. To listen to my complete interview with John Petersen on Hedge Fund Radio, please click here.

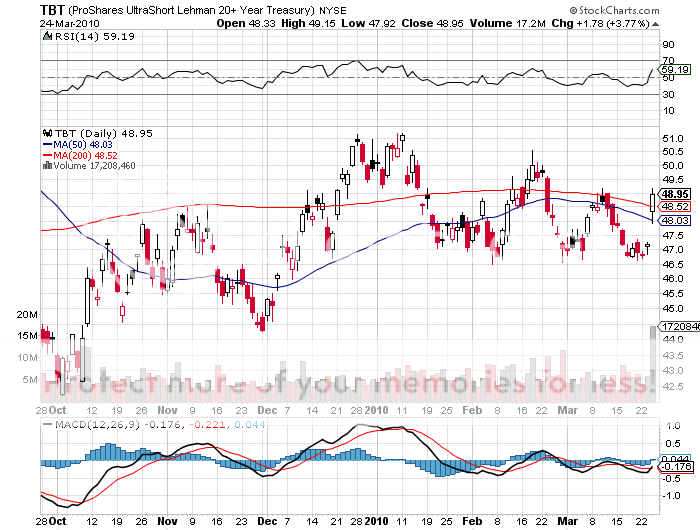

Featured Trades: (TBT), (TBF)

1) The Days Are Numbered for US Treasury Bonds. I was so busy writing about the collapse of the yen yesterday that I didn?t have a chance to comment on the nearly failed Treasury auction. The government offered? $42 billion five year bonds for sale which came in at a surprisingly high yield of 2.605%, with a bid to cover ratio at an uncomfortably high 2.55. The traders now choking on this paper looked like they had been kicked in the scrotum, and falsetto voices were breaking out everywhere in an odd disharmony. Apparently, it is not a good idea to hold a bond auction a week before the Fed ends its $1.2 trillion quantitative easing program. The continuing debt crisis in Greece has many investors asking if the next shoe to fall will be on American soil. Some analysts suggested that the buyer?s strike was the result of the health care bill which passed on Sunday, paving the way for larger and longer deficits. There were also suspicions that China was boycotting the issue to protest the ?currency manipulator? hearings scheduled for congress on April 15. I vote for all of the above. The leveraged short Treasury bond ETF (TBT) certainly liked it, popping nearly 10% this week from $46.60 to $50.25. Don?t go apoplectic yet. I still think the zero interest rates and the disinflationary deep freeze will push the big break out for this fund further into the future. So keep trading the range at every opportunity. Deleveraging is such a bitch.

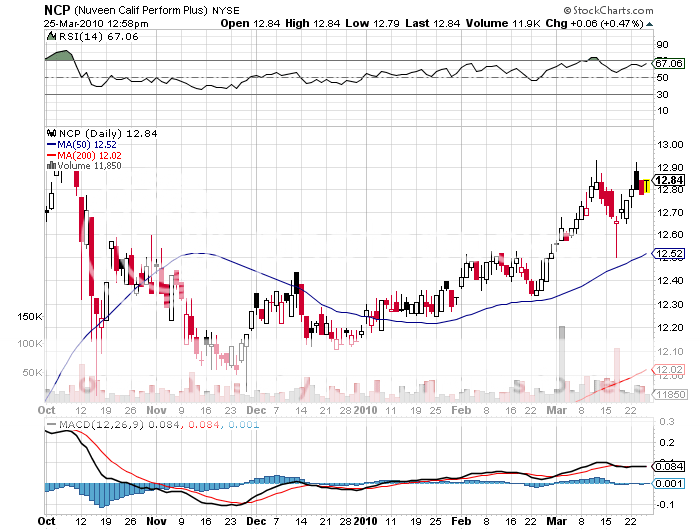

Featured Trades: (CALIFORNIA), (VCV), (NCP), (NVX)

2) California Muni Bonds Are a Steal Here. The California governor's election is heating up, and the muck slinging is getting hot and heavy. The downside is that front runner Meg Whitman, of EBay fame, has launched such an aggressive, saturating, and negative TV campaign against rival, Steve Poizner, that he won't be able to safely walk the streets in a few months. And this is just to capture the Republican nomination! The upside is that a treasure trove of data is coming out that puts a glaring spotlight on the root of the Golden State's problems. It's really all about prisons, which have soared from 3% of the state's domestic product in 1979 to 11% last year, and 80% of that spending is going to compensation. It costs $6 billion a year to pay 60,000 prison guards, most of whom make over $100,000 a year with overtime, more than it costs the state to educate 670,000 college students. You can thank three strikes laws, vastly expanded sentencing, and sweetheart deals over benefits with the prison guards union, the state's most powerful. During the same three decades, spending on health and human services has remained stable at 32%. Whatever the outcome of the election, I think tax free California municipal bonds are a screaming buy here, for this simple reason. The state's $70 billion in general obligation debt, which is used mostly for infrastructure, is at the very top of the seniority structure, followed by $150 billion in retirement benefits debt. These claims are untouchable. All of the budget cuts going forward will take place with the junior claims in the obligation structure, mostly schools and social services. That is why we are seeing rioting at UC Berkeley every week. And with the stock market up 70% in a year, capital gains will start kicking in, which in peak years account for 40% of total state tax revenues. Buy the California municipal bond funds, (VCV), (NCP), and the (NVX).

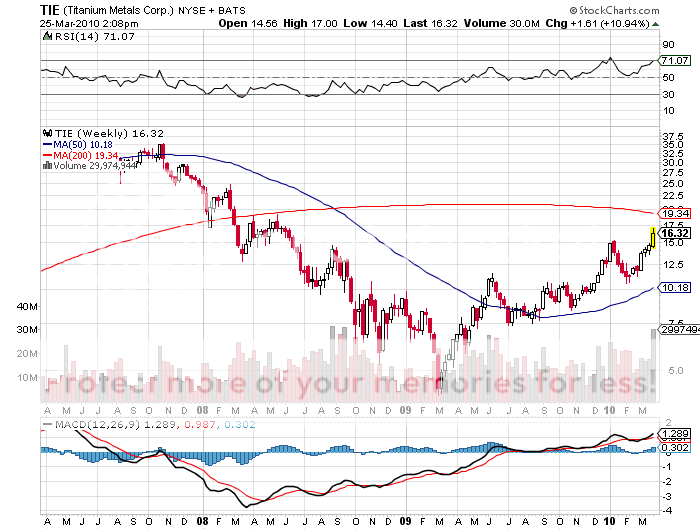

Featured Trades: (TITANIUM), (TIE), (BA)

3) Playing Catch Up With Titanium. One of the many sectors I knew would go up a lot, which I just plain didn't have time to write about, is titanium stocks. But the top titanium producer in the US, Titanium Metals Corporation (TIE), has popped 43% in the past month, giving me the one fingered salute, so I feel obligated to bring it to your attention. Titanium is named after the Titans because it is incredibly strong, lightweight, flexible, corrosion resistant, and is a great conductor of heat. The metal of the gods is only 56% the weight of an equal volume of steel. It is also extremely expensive to refine, process, and fabricate. The required Kroll process to make titanium sponge (TiCl4), is tedious, toxic, and time consuming, requiring vast amounts of Chlorine. China is the world' largest supplier of titanium sponge, and the aircraft industry consumes 76% of global production (it is also the key ingredient of the white paint used in all those Chinese furniture imports). That makes the metal a great call on the aircraft industry. With US airlines struggling to make ends meet during good times, and dropping like flies in bad, and military spending on the wane, you would think this is a call that you'd rather turn a deaf ear to. But you'd be wrong. It is in fact yet another call of emerging market prosperity, as aircraft orders from airlines based in the developing world have been skyrocketing. Not only that, the amount of titanium used in aircraft has increased from zero in 1964 to 17% today and is still rising as it brings greater fuel efficiencies. This is all a roundabout way of saying that you should keep TIE on your radar, and buy it on any substantial dips.