July 6, 2009

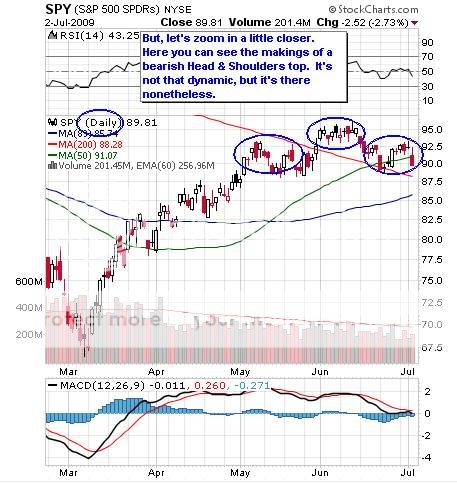

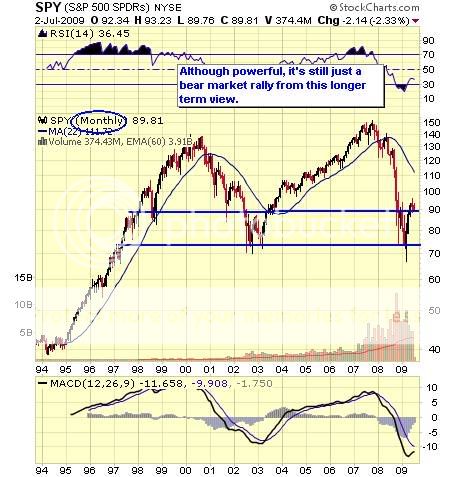

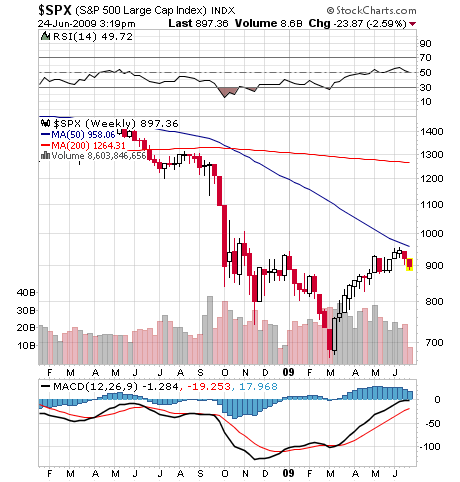

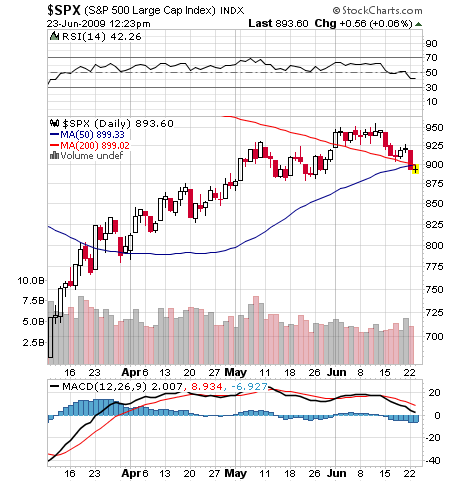

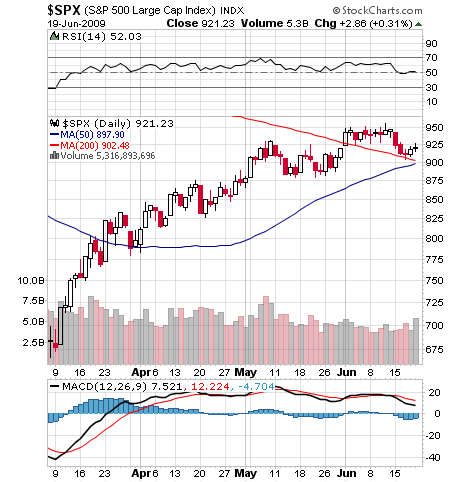

1) OK, so I don?t really open beer bottles with my teeth and do my own tattoos. But my call that the ?golden cross? in the S&P 500 on June 23 was a bogus one turned out to be a bulls eye, and the abuse I piled on the analysts who predicted an upside breakout was richly deserved. I have kept a laser like focus on the real technical picture that has been unfolding for the last two weeks, that of a bearish head and shoulders top. David Fry nicely does the scut work on technical matters for me though his excellent? ETF Digest blog. His chart and comments below are about to force us all to become historians, for it is setting up a perfect replay of 1937. That was when Roosevelt buckled under pressure from conservatives disgusted with four years of record government spending and groundbreaking social programs, and balanced the budget, igniting the second down leg of the Great Depression. It is no coincidence that both Chair of the Council of Economic Advisors, Christine Romer, and Fed Governor, Ben Bernanke, are authorities on this era. Thanks to Thursday?s diabolical employment numbers, Mr. Market is now telling us that a ?W? recession and the second stimulus package it will demand are on the table. There is room for a short play here on US stocks. Look at the ProShares Ultra short S&P 500 (SDS), which is down 54% since March 9, and is overdue for a rebound. It will give you a nice 200% short position in a falling market. Please pass the church key.

2) Perhaps it was deliberate that AMC Channel featured an Arnold Schwarzenegger film festival this weekend. Was the gratuitous violence of Terminators, Judgment Day, and the End of the World intended to drive us all to the negotiating table (?speak to the hand?)? We now have a new currency in circulation, Golden State ?script?, which is thoughtfully being printed in green as I write this. Of course the banks haven?t said they will accept this past July 10, so many spent the July 4th weekend at Big Five Sporting Goods stockpiling ammo and drinking water (everyone here already owns guns), possibly inspired by the Arnold movies. Many schools have already cancelled summer school, so of course, the malls are full of jobless kids lounging around and smoking cigarettes, with nothing to do. Towns are going without fireworks celebrations, and worried citizens are bracing themselves for a complete cessation of state services by the fall. Obama has wisely turned a blind eye to all of this, leaving we non taxing big spenders to stew in our own manure. With everyone of all parties thoroughly disgusted with their leaders, I?m surprised that the grass roots campaign for a state initiative to dump the two thirds majority required to pass a budget hasn?t welled up yet. Does France still have that guillotine thing? Is it available for rent? Will they take California ?script??

3) It?s not often that the investor?s relations department of a company you follow sends you an e-mail telling you their stock is worthless. Neverless, that was the message I received from General Motors (GMGMQ) yesterday. Since the company filed for chapter 11, it has traded between $0.25 and $2.25, and has often been the best percentage gainer of the day ($0.50 to $0.75 is a 50% move up). No doubt, most of this is hedge fund buying of stock to close out short positions. Otherwise, the bean counters may force you to carry the positions for years, tying up capital and deferring your performance bonus. But then again, there are always some dummies out there who think the stock is cheap at $0.25, on its way back up to $150.

4) I had dinner with Neil MacFarquhar, UN Bureau Chief and former Cairo Bureau Chief for the New York Times, to get the latest view of what is happening on the Arab ?street.? MacFarquhar grew up in Libya around the time I tried to visit the country in the sixties (I was turned away at the Tunisian border), speaks and writes fluent Arabic, and has lived in Egypt, Kuwait, Israel, Cyprus, and Saudi Arabia, so he should know. Until now, the US has tried to turn everyone into Americans, which is why Bush?s policies were doomed to failure. As a result, our form of government has a bad name, which Iraqis now equate with violence and bloodshed. The political process in the Middle East is dead, with most countries run by dictatorships backed by secret police. Many have used the war on terrorism simply to lock up their own pro democracy dissidents, and of course, our outsourcing of torture there is well known. However, the bombings in Riyadh and Casablanca have clearly moved sentiment against Al Qaida. Ironically, the Arab cable TV network, Al Jazeera, has become a tremendous force for change by giving air to debate and alternative views, even though it has been opposed by the US for years. With 25% inflation and 30% unemployment, the mullahs have to eventually lose control in Iran, with the demographics running strongly against them. Obama was right to launch new initiatives the first week of his administration in the region, where leaders have learned they can resist foreign peace efforts by waiting them out. For more on the Middle east, see my interview with ex Bush diplomat Richard Haas . I covered the Middle East myself as a journalist in the seventies and for Morgan Stanley during the eighties, and what Neil says makes a lot of sense.

5) Ouch! The non-farm payroll came in at minus 467,000. What a spanking! The monthly figure is 100,000 worse than the expectations of most suicide prone economists, and took the unemployment rate up to 9.5%. There are now 14.5 million unemployed, an all time high, at least 20 million underemployed, and who knows how many more who have taken pay cuts, unpaid vacations, and furloughs. That leaves an ever diminishing pool of employed who are going to spend us into a recovery. Commodities got slammed across the board, stocks got trashed, and for a minute I thought they were going to run out of red arrows. Traders shorting the long bond got stopped out of their positions, yet again. Looking at the data, it is clear that this is the worst case scenario. Even construction and government jobs, the beneficiaries of so much Federal largess, are still falling. Only employment in education and health care is rising. This comes on top of yesterday?s disastrous figures showing sales at Chrysler fell 42%, Toyota (TM) 34.6%, General Motors (GMGMQ) 33.6%,

and Honda (HMC) 29.5%. At least this will put that annoying ?green shoots? crowd out to pasture. The Obama crowd has to be sweating bullets now, having fired their best shot at the enemy, with no apparent impact. Here comes the ?L?. Please see my ?Sell in May and Go Away? report.

QUOTE OF THE DAY

?CIA coups are underrated,? said Neil MacFarquhar, UN Bureau Chief and former Cairo Bureau Chief for the New York Times.

Global Market Comments

July 2, 2009

Featured Trades: (BA), (COAL)

1) I spent the evening with Dr. Janet Yellen, the president of the Federal Reserve Bank of San Francisco. She thinks that thanks to the government?s tax cuts and spending programs, we will be out of the recession by the end of this year. After massive inventory liquidation, the auto industry in particular is poised for a rebound. Financial markets are now in better condition than we imagined possible six months ago. However, the pace of the recovery will be frustratingly slow, and it could take several years to return to full employment. Since the majority of the Fed board members feel that inflation will be stuck at 2% for years to come, deflation presents a greater risk than inflation. We are not by any means out of the woods yet. Rising energy prices and interest rates are a potential drag on the economy. Commercial real estate is at the top of her worry list, as falling rents and capital values could create a downward spiral, further impairing the banks. China?s wishes for an alternate reserve currency are impractical. Answering questions as only a UC Berkeley professor can, she further confirmed my belief that we are looking at an ?L? shaped recovery at best (see here and here). However, she did pour some cold water on my idea that the TBT has further to run. ?Inflation running up to untoward levels doesn?t make any sense,? she averred.

2) It?s amazing that Al Franken won his state Supreme Court case over Norm Coleman for the Minnesota Senate seat, just as the Clean Energy Act of 2009 comes up for a vote (see my June 26, 2009 Newsletter). Now the Democrats can ram the bill through, no questions asked, leaving fuming Republicans on the sidelines bitching to Fox News. This is one of those seemingly insignificant events which will have a huge impact on history. The last one of these I can remember was when a Cuban orphan named Elian Gonzalez washed up on a Miami beach, and ultimately threw the Cuban vote, the state of Florida, and the entire national election against Al Gore. The bad news is that the cost of your utility bill, gasoline bill, tax bill, and everything else you buy is going up. Those unhappy readers in the Midwest and South can expect more of their income to get shifted towards the two coasts. The good news is that you get to breathe, and your kids will live a full life.

3) Let me tell you first that my family has a long history with Boeing (BA). During WWII, my dad got down on his knees and kissed the runway when the B-17 bomber in which he served as tail gunner (two probables, one confirmed) made it back despite the many holes. Some 40 years later, I got down on my knees and kissed the runway when a tired and rickety Boeing 707 held together with spit and bailing wire, which was first delivered as Dwight Eisenhower?s Air Force One in 1955, flew me and the rest of Reagan?s White House Press Corp to Tokyo and made it there in one piece. I even tried to buy my own B-17 in the nineties (the Piccadilly Lilly), but was outbid by Paul Allen on behalf of his Seattle Museum. So it is with the greatest difficulty that I examine this company in the cold hard light of a stock analyst. Nevertheless, to say that investors are disappointed by the umpteenth outsourcing caused postponement in the 787 Dreamliner is an understatement. They took the Dow stock down 23% from $53 in days. In fact, long suffering shareholders have been pummeled by a torrent of bad news, with the cancellation of the Pentagon?s futuristic $160 billion Land Warfare Weapons Program and Quantas yanking an order for 15 Dreamliners. But I?m a firm believer in buying when there is blood in the street, and I see bucketfuls. BA is selling at 8.7 times earnings, a huge discount to competitors Lockheed Martin (LMT) at 10.5 times and Raytheon (RTN) at 10.9 times. It has $3.3 billion in cash, a 4% dividend, and an increasingly scare A+ rating on its debt. BA?s immensely profitable defense business still accounts for 52% of revenues. When the super fuel efficient Dreamliner does come through, the three year, $151 billion order backlog for 890 planes will deliver a huge kicker for earnings. Its main competitor, Airbus, does have the minor problem in that its planes keep falling apart fully loaded with passengers. If you can get BA under $40, you?d be getting a best of breed company at a mongrel price.

4) I wanted to get the low down on clean coal to see how clean it really is, so I visited some friends at Lawrence Livermore National Laboratory. The modern day descendent of the Atomic Energy Commission, where I had a student job in the seventies, the leading researcher on laser induced nuclear fission, and the administrator of our atomic weapons stockpile, I figured they?d know. Dirty coal currently supplies us with 50% of our electricity, and total electricity demand is expected to go up 30% by 2030. The industry is spewing out 32 billion tons of carbon dioxide (CO2) a year and the global warming it is causing will lead us to an environmental disaster within decades. Carbon Capture and Storage technology (CCS) locks up these emissions deep underground forever. The problem is that there is only one of these plants in operation in North Dakota, a legacy of the Carter administration, and new ones would cost $4 billion each. The low estimate to replace the 250 existing coal plants in the US is $1 trillion, and this will produce electricity that costs 50% more than we now pay. And while we can build a wall to keep out immigrants, it won?t keep out CO2. This is a big problem as China is currently completing one new coal fired plant a week. In fact, the Middle Kingdom is rushing to perfect cheaper CCS technologies, not only for their own use, but also to sell to us. Since it appears that Obama is not willing to wait on anything, expect to hear a lot of sturm und drang about CCS this year. The bottom line is coal can be cleaned, but at a frightful price. For more on this see my June 15 Newsletter.

QUOTE OF THE DAY

?We are slogging through the starkest economic landscape in our lifetimes,? said Dr. Janet Yellen, president of the Federal Reserve Bank of San Francisco.

Global Market Comments

July 1, 2009

Featured Trades: (VIX), ($BVSP), (RSX), ($BSE), (FXI), (EEM), ($KOSPI), (TBT), (JNK), (PHB), (HYG), (FCX), (X), (CHK), ($XEU)

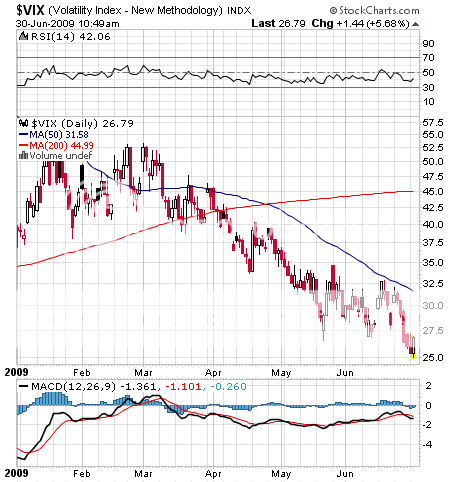

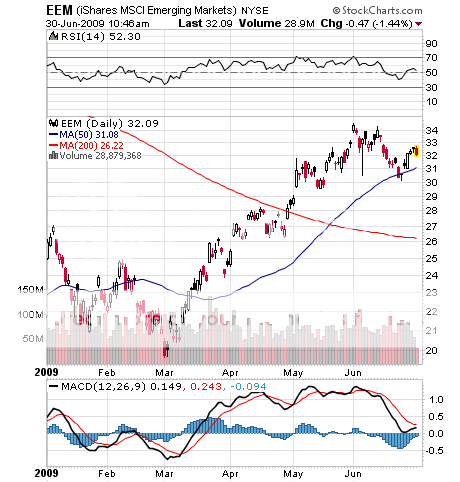

1) Equities: UP

The collapse of the volatility index (VIX) is telling us that the horrific, gut churning, 10% daily moves are over. But equities are no longer a US play. Extracting the insane leverage of the last decade means chopping the US growth rate down from a booming 5% to an anemic 2%. This is not a strong argument to buy American companies, which is why most analysts only see the indexes recovering 10%-20% this year. You might just get tedious range trading after the late 2008 dead cat bounce. The real action will be in the BRIC countries, which will see upside returns double what you will get with the S&P 500. Buy Brazil?s Bovespa ($BVSP), Russia?s RSX (RSX), India?s Bombay Sensex ($BSE), and China?s FXI (FXI) or Hang Seng. And it may be time to spell BRIC with a ?K? by throwing in the Korean Kospi ($KOSPI) as a sweetener.

Grade: A+. The VIX went down virtually every day this quarter, plunging from 46% to 25%, so a ton of money was made on short volatility and time decay plays. My call that the export sensitive BRICK?s were a ?Buy? was a total home run, as they massively outperformed the US. At their H1 highs, Brazil was up on the year 45%, Russia 100%, India 58%, China 41%, and Korea 32%. At its highpoint the S&P 500 was up on the year by a woefully anemic 6%. With 80%-90% of the world?s economic growth over the next ten ears expected to come from emerging markets, Bricks are the place to be.?? Although you may get a decent pull back this summer, this trade has much, much further to run. We are still in the first inning of a 12 inning overtime game. If you want to be conservative and diversified, buy the iShares MSCI Emerging Market basket ETF (EEM), up 38% on the year, on the next major dip.

2) Bonds: Treasuries Down, Private Debt Up.

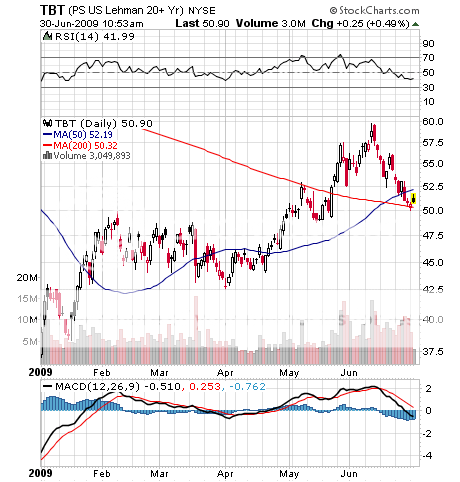

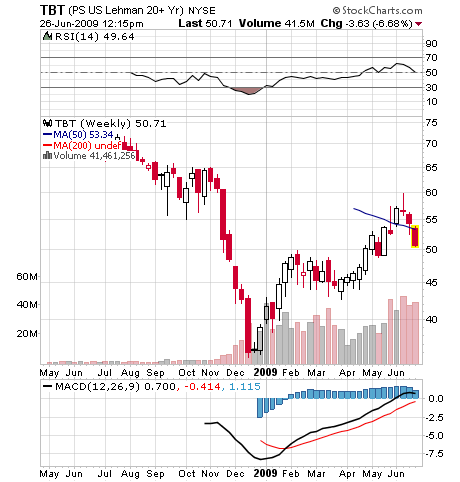

As I have been vociferously arguing in these pages for months, US Treasury bonds are witnessing the final stages of an overinflated bubble, and you don?t want to be anywhere near this asset class when it bursts. Take out the flight to quality and year end balance sheet window dressing bid from this market, and you have an accident begging to happen. Take in the long term inflationary impact of Obama?s plans, and you have a 30 year contract that peaked at 142 last week which is really only worth 70. It?s just a matter of time before massive government issuance buries largely foreign buyers. Throw in the 50:1 leverage offered by a long bond futures contract, and the profit potential of a short position is so enormous that there are not enough zeros on my calculator to total it up. Buy the Lehman 20 year plus ultrashort bond ETF (TBT). Unfreezing of the debt markets will move the prices for every other type of debt off of their current throw away levels. Buy corporates of every grade with a heavy weighting in junk, or fixed income securities backed by REIT?s, emerging markets, credit cards, student loans, or subprime loans. A convenient way to do this is to buy the ETF?s for the Lehman High Yield Bond Fund (JNK), the PS Corporate High Yield Bond Fund (PHB), and the iShares iBoxx Fund (HYG).

Grade: A+. My recommendation to short the Treasury?s long bond was spot on, with the US Lehman 20 year 200% short ETF (TBT) soaring by 60%. With the government?s printing presses running overtime, this is going to be your new free lunch. We have had a ten point pullback from the top, which may allow latecomers an entry point. The junk bond ETF?s PHB (up 16%) and HYG (up 11%) also were profitable, but did less well, as credit concerns linger. I believe these positions have further to run. But we need to see a real economic recovery, not just a mirage of a few green shoots, to get some serious upside movement from here. For the short term, the easy money has been made.

3) Commodities: UP

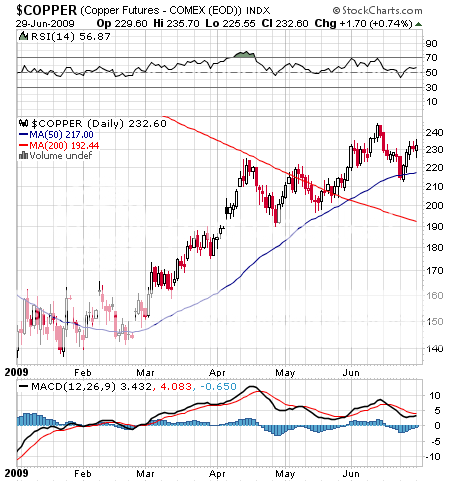

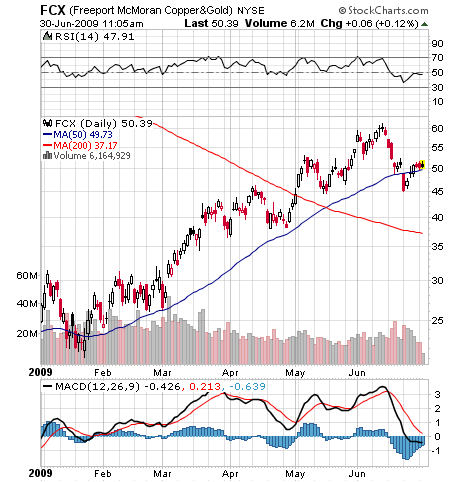

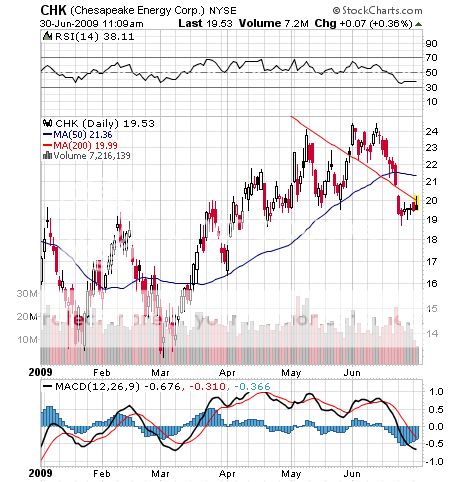

After giving up almost all of their 21st century gains, virtually all commodities, including grains, softs, energies, and metals, are due for a recovery. A good part of the sell off resulted from the disappearance of financing, which is slowly working its way back into the market. Now that newbie investors who never should have been involved, like pension funds, have bailed on this asset class, conditions are set for some serious base building. Commodities will be the principle beneficiaries of an epochal trend away from paper assets, towards hard assets, that will be the dominant investment theme for the next decade or two. Chinese and Indians still want to raise their standard of living faster than these substances can be grown, or ripped, or pumped out of the ground. Now Obama is adding America to the infrastructure build out story. A safe way to play this is through beaten down, dividend yielding, producing equities like Freeport McMoran (FCX) for copper, Chesapeake Energy (CHK) for natural gas, and US Steel (X) for steel and iron ore.?? However, don?t expect huge gains until we see signs of a global economic recovery by the middle of the year. Then watch out.

Grade A+. Commodities and their underlying stocks have been the place to be in 2009. You really couldn?t miss, with grains, softs, energies, and metals all doing well. Freeport McMoran rocketed by 148% on a robust 75% move in copper.?? Oil is up 78%, and gold ran 17% before its current pullback. The only letdown has been natural gas, which due to huge new discoveries, supply and storage difficulties unique to this one energy source, and the threat of imports, has fallen by 30%. However, my stock pick in the area, Chesapeake Energy (CHK), jumped by a robust 53%. Again, this trade has a long way to run. While they stopped making almost everything in this recession, the world hasn?t stopped making more people. They are all going to need to eat, travel on more roads, and live in more houses. The emerging market thirst for a higher standard of living is as strong as ever. Look for crude to move to $200/barrel on the next spike. Move your portfolio out of paper assets into hard ones.

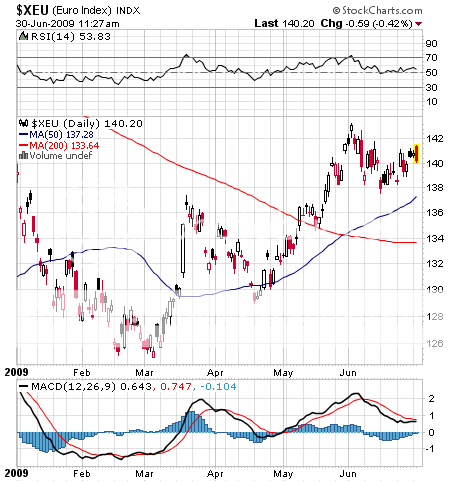

4) Currencies: Dollar and Yen Down, Everything Else Up

Since we are smack dab in the middle of a six year trading range, I don?t really have a handle on what the buck is going to do short term. Could we see $1.20 or $1.00 for the greenback in an event driven overshoot, short term? You betcha! But longer term, the trend is still down. Obama?s highly inflationary reflationary policies will eventually lead to an utter collapse in the dollar. If they are successful, the economy will recover, bringing Americans back to their old low saving, high consumption, high importing ways, adding fuel to the fire. Don?t bet against the 45 year trend. No one ever got rich betting against the US consumer. Expect to pay $2.00 for a Euro in the years ahead. Take that European vacation now!

Grade: Pass. Here we are, Uncle Buck dead unchanged against the Euro on the year at $1.40. Since I really didn?t take a view, I don?t deserve a grade, so pass/fail applies. Even so, the collapse of the dollar is a mathematical certainty resulting from current US government reflationary policies in the extreme, and may be the trigger for the world?s next big financial crisis. Expect more action in the second half.

4) Real Estate: Down

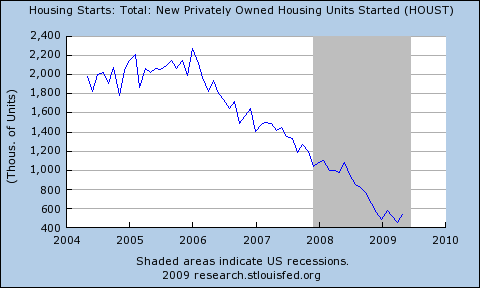

With markets still deleveraging, and the son of subprime, the Alt-A loans on our doorstep, real estate is dead money at best. Although the cost of carry for home ownership is rapidly approaching equivalent rental costs on an after tax basis, fewer and fewer buyers are qualifying for loans. Add 1.2 million unsold homes from builders, to three million existing homes already on the market, and you have a staggering 4.2 million homes for sale in the US. There are at least another two million homes being held off the market waiting to smack down any recovery in prices. This is 7% of the total American housing stock. Probably 20% of US homeowners are underwater on their mortgages, and they?re not buying anything anytime soon. We also have an impending crisis in commercial real estate to deal with, generating lots of mall bankruptcies and empty retail space. Remember, ?debt? is a four letter word. I don?t see a meaningful recovery in residential real estate for five years, and then it will be a slow claw back at best.

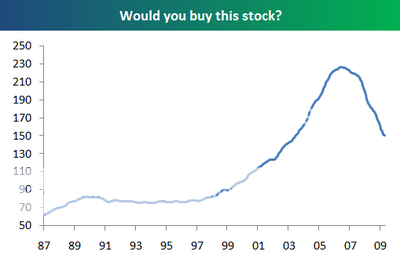

Grade: A+. There is so much inventory out there it is unbelievable, yet the relentless tide of foreclosures keeps dumping more properties on the market. The sickness has metastasized to commercial real estate, which may be the next big shoe to fall. Look at the chart of the Case-Shiller Real Estate Price Index, which shows us back at 2003 price levels. If this were a stock, would you want to buy it? It is starting to take on the flavor of an all out capitulation. Only the 1990-1997 bottom looks safe. Stay away. Rent, don?t buy.

Final Grade: A. OK, so my self grading is biased. But I am sticking to my guns on all of my core trades for 2009. The big question is, do you sell your doubles? All of the good trades are now overextended on the upside and begging for a pullback. What do you do here? It all boils down to your time frame, your risk tolerance, and your propensity to trade. Short term traders should get out (see ?Sell in May and Go Away?), but look to get back in on serious dips. Long term investors should sit back and hang on, even if the next few months grow violent, scary, or just plain tedious. The wind is at your back.

Call me what you want. You can even call me ?Mad?. Does anyone have a billion dollar hedge fund they want me to run? E-mail me.

The Mad Hedge Fund Trader

June 30, 2009 Featured Trades: (SPX), (SNE), (CGW), (PHO), (FIW), (TTEK), (VE), (PNR), (AMZN)

1) As much as I like to open beer bottles with my teeth, do my own tattoos, and roll around in the snow naked and beat myself with birch branches, when it comes to pain in my investment portfolio, I am definitely a wimp. So I have to take notice when a ?Golden Cross? occurs on one of the major indexes, as happened with the S&P 500 on June 23 when it hit 888. For the initiated, a ?Golden Cross? occurs when the 50 day moving average moves up through the 200 day moving average. Historically, this means that the index will rise 7% in the next three months, 8% in the next six, and 19% over the coming year. The trouble is that if technical analysts were always right, they would only wear Jon Green or Anderson & Sheppard suits, drive Bentley Turbo RT?s, and certainly wouldn?t deign to talk to you. The harsh reality is that most shop at Men?s Warehouse, drive Hyundai?s, and work on salary for brokers. If they were paid based on performance, there would be no need for Jenny Craig or Weightwatchers. Not that they are to be ignored. They are right at least half the time. But their opinions are just one more thing to throw into the decision making soup.

2) I spent the evening with Dr. Robert Frank, professor at the Cornell University School of Management, and author of The Economic Naturalist?s Field Guide. US consumer spending?? peaked at $10 trillion, or 73% of GDP in 2000, and in the new world of falling incomes and enforced savings rates, it will take many years to come back. The current disaster was a guaranteed outcome, because while incomes stagnated over the last 30 years, the median home size jumped 50% to 2,600 square feet. Deregulation poured gasoline on the fire, enabling an unsustainable culture of leverage. California is in a real pickle, because governor Arnold Schwarzenegger is forced to act as Herbert Hoover did by balancing a budget while falling into a Depression. Dr. Frank argues that we should use this economic crisis to fundamentally remake the US tax system. The current system taxes savings on multiple levels, but spending is tax free. We need to scrap the income tax (three cheers), and implement a steeply progressive consumption tax. We need to tax pollution the same way. Dr. Frank, who co-authored a previous book with Fed governor Ben Bernanke, offers radical solutions. It seems that desperate times require desperate measures.

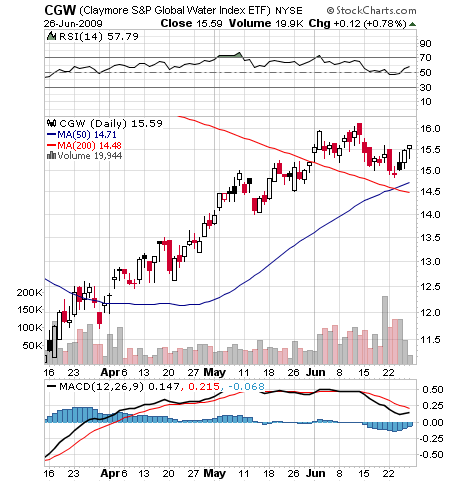

3) If you think that the upcoming energy shortage is going to be bad, it will pale in comparison to the next water crisis, so investment in fresh water infrastructure is going to be a recurring long term investment theme. (See my earlier efforts to get you into the water space). One theory about the endless wars in the Middle East since 1918 is that they have really been over water rights. Although Earth is often referred to as the water planet, only 2.5% is fresh, and three quarters of that is locked up in ice at the North and South poles. In places like China, with a quarter of the world?s population, up to 90% of the fresh water is already polluted, some irretrievably so. Some 18% of the world population lacks access to potable water, and demand is expected to rise by 40% in the next 20 years. Aquifers in the US, which took nature millennia to create, are approaching exhaustion. While membrane osmosis technologies exist to convert sea water into fresh, they use ten times more energy than current treatment processes, a real problem if you don?t have any, and will easily double the end cost to consumers. While it may take 16 pounds of grain to produce a pound of beef, it takes a staggering 2,416 gallons of water to do the same. The UN says that $11 billion a year is needed for water infrastructure investment, and $15 billion of the US stimulus package will be similarly spent. It says a lot that when I went to the UC Berkeley School of Engineering to research this piece, most of the experts in the field had already been retained by major hedge funds! At the top of the shopping list to participate here should be the Claymore S&P Global Water Index ETF (CGW), which has appreciated by 32% since I first brought it up. You can also visit the PowerShares Water Resource Portfolio (PHO), the First Trust ISE Water Index Fund (FIW), or the individual stocks Veolia Environment (VE), Tetra-Tech (TTEK), and Pentair (PNR). Who has the world?s greatest per capita water resources? Siberia, which could become a major exporter to China in the decades to come.

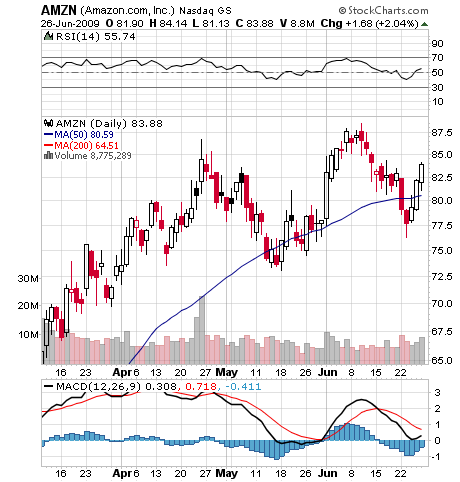

4) It appears that my website was one of the few that did not crash on news of the death of Michael Jackson. I wonder why? Twitter survived its first serious crash threat when traffic spiked to 65,000 tweets a second. AT & T?s network did less well, and almost came down. That?s better than Google?s search engine, which temporarily froze. Yahoo says they got the greatest number of clicks on a news story in its history. The Internet was built to survive a nuclear war, but was taken down by the passage of a drug addicted musician. You would think that the copyright holder on the Jackson titles, Sony (SNE), would do well, but not so. Instead, Amazon (AMZN) stock took off, offering for sale the top ten selling Jackson CD?s by the King of Pop. Most of them sold out in a day. I guess it?s a new world out there. Those with the best selling machine, win. Our local winner? Butler Amusements bought four carnival rides at a Neverland Ranch auction last year, and these can be ridden today at the Alameda County Fair. Talk about a windfall!

QUOTE OF THE DAY

?If 1.4 billion people suddenly decide to spend an extra dollar a day, it will have a massive impact on what?s going on in the world,? said Andy Brough, a fund managers at Schroeder?s, about Chinese efforts to stimulate domestic consumption.

June 29, 2009 Featured Trades: (TBT), (JAPAN), (CALIFORNIA), (UNG), (WHEAT)

1) For those who missed the 70% move in the TBT this year, the double short Treasury bond ETF, another window is setting up for you to get in. After running up from $35 to a meteoric $60, we have backed off to $50. Similarly, the bond futures, which plunged from 142 to 112, have bounced back up to 118.5. The yield on the ten year has backed off from 3.99% to under 3.50% in just a few weeks. I think the prospect of a retest of this year?s stock market lows triggered a lot of flight to safety buying of government paper in the last few weeks. If we don?t get that retest, which I think is unlikely, then it?s back to the races for the TBT. End of month, end of quarter, and end of half window dressing has also been goosing prices. Things certainly aren?t getting any better on the fiscal front. According to the Congressional Budget Office, the national debt is now growing so fast, that it will reach 100% of GDP by 2023, seven years earlier than was predicted only 18 months ago. Some 90% of the increase came from burgeoning Medicare and Medicaid spending. It seems that hardly a week goes by without Congress passing another humongously expensive package that has wonderful long term benefits for the economy and society, but has to be paid for with hard cash dollars up front. Watch the TBT.

2) It?s sad to see a once great country fall on hard times. It?s like watching a formerly leading hedge fund manager apply for food stamps. I?m talking about Japan, which in 1989 boasted the world?s most valuable stocks, largest banks, and strongest currency. Oh, how the mighty have fallen. This week the Ministry of Finance published the trade figures for May showing a 42% YOY drop, and that the cataclysmic fall in exports continues unabated, as foreigners keep their money in their pockets instead of buying high quality cars and electronics. Even exports to China fell 29.7%. I?m sure the chart below will be found in business school textbooks for decades to come as proof of the risks of running an overly export dependent economy. Although a giant fiscal stimulus package will start to hit in the second half of this year, most economists have GDP forecasts for the year of minus 6.8% or worse. This would take GDP back to the 2004 level, and make our economy look positively bubbliscious by comparison. This is all happening when the numbers of those retiring is going through the roof, causing welfare payments to skyrocket. Taking a page out of Obama?s playbook, the government is borrowing to meet these costs, so the national debt is expected to reach the certifiable nosebleed territory of 197% by next year! Prime Minister Taro Aso has so far fought off increased consumption taxes, but it is just a matter of time before those efforts are tossed out the window. Continued deflation is a no brainer. Real estate prices are still stuck at 30% of their 1990 levels. This is what an ?L? shaped recovery looks like up close and ugly. In the meantime, the yen strengthens, making exports ever more expensive and uncompetitive. Better to stand aside from the Land of the Rising Sun and watch with tears. Is the US next?

3) The Wall Street Journal made some prescient comments yesterday about how the flood of hedge fund capital into commodities is fundamentally changing the nature of those markets, confounding the old timers. The Northeast is experiencing the coldest summer in 27 years, and you would expect Natural Gas to crater (see my June 2, 2009 Newsletter). But chart buying by the proliferation of new NG ETF?s out there has been holding it up. Excessive rain has delayed wheat plantings, normally a very positive development for wheat prices. But traders are obsessing over weather Chinese stockpiling of food is leveling off, knocking prices for a loop (see my June 16, 2009 Newsletter). I avoided trading the soft commodities for most of my life, because, basically, making a bet on the weather always seemed like a loser to me. Better to bet on two flies crawling up a wall.?? The pros relied on Cray supercomputers processing complex algorithms and historical data to come up with forecasts that were wrong half the time. I actually prefer the new order. I rather place bets on what the Chinese are up to than Mother Nature any day.

4) As the California budget battle reaches white hot temperatures, Fitches has cut the rating on the state?s debt to A-, and placed it on ?credit watch?, a warning of further downgrades. The move is a delayed recognition of reality, as is the rating agency industry?s practice. The legislature tried, but failed to pass $12 billion in budget cuts, which governor Arnold Schwarzenegger said he would veto anyway, because they didn?t meet the full $24 billion tab (see my previous dispairing piece here). In the package were increases in motor vehicle registration fees, $1.50 a pack in additional tobacco taxes, cancellation of health insurance for one million children, a production tax of 9.9% for in-state pumped crude oil, the firing of thousands of teachers, firefighters, policemen, and probation officers, and more smoke and mirrors accounting shenanigans that kick the can into the future. Some of the changes were only possible through a redefinition of the English language that turned ?taxes? into ?fees.?As California goes, so goes the nation, as many states will follow the Golden State into financial Armageddon. In a new era of soaring unemployment, restrained consumption, high savings, and crashing stock and property prices, states dependant on taxes on incomes, sales, capital gains, and property appraisals don?t do well. Make sure those muni bonds are insured. Why do I get the sickening feeling that I am watching a rerun of Thelma and Louis?

QUOTE OF THE DAY

?Recession-Plagued Nation Demands New Bubble to Invest In,? says The Onion in a headline, a satirical publication.

June 26, 2009

Featured Trades: (BYDDF), (GMX), (TM), (AMSC), (CVA)

Would you like to receive each post from The Mad Hedge Fund Trader 24 hours earlier than anyone else? Is so, please subscribe to our client newsletter at our store at www.madhedgefundtrader.com. For $29 a month you can get the head start that can make a crucial difference in your trading and investment decisions. In a world when indexes move 10% a day, and individual stocks move 25%, a day can seem like a lifetime. Global research is getting more expensive, especially with a falling dollar. Thanks for your support.

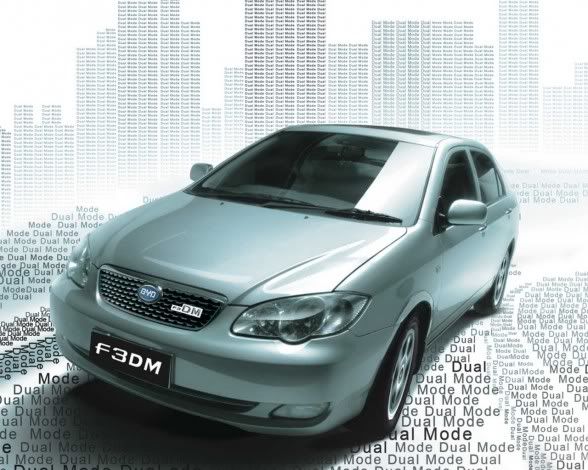

1)Like Paul Revere on his midnight ride, I feel a patriotic duty to warn you of the foreign invasion that is headed our way. No I?m not talking about the British, but redcoats of a more Eastern origin. I?m referring to the Chinese electric car company ?Build Your Dreams? (BYDDF) (see http://www.byd.com/company.php) . CEO Wang Chuan-Fu, who Charlie Munger describes as a combination of General Electric?s (GE) legendary manager, Jack Welch, and inventor Thomas Edison, scraped up $300,000 from relatives to start a knock off cell phone battery company in Shenzen in 1995. He grew the company into a massive, vertically integrated conglomerate, employing 130,000 workaholics at 11 factories, including those in Hungary, Romania, and India (interesting choices). BYD bought a defunct car company in 2003 and re-engineered it to launch the $22,000 F3DM sedan last year, an old technology ferrous oxide based plug-in hybrid that gets 62 miles on a charge. General Motors (GMX) Volt and Toyota?s (TM) plug in Prius, which won?t come out until next year, will only get 40 miles per charge and cost more. All-electric models are coming out this year. Warren Buffet was so impressed, he made a rare foreign investment last year, asking for a 25% stake and settling for 10% for $230 million. Wang, who has already earned himself a place on the Forbes 400 list, intends to build BYD into the world?s largest automaker, and quickly. Why do I feel like this war is over before the first shots were even fired?

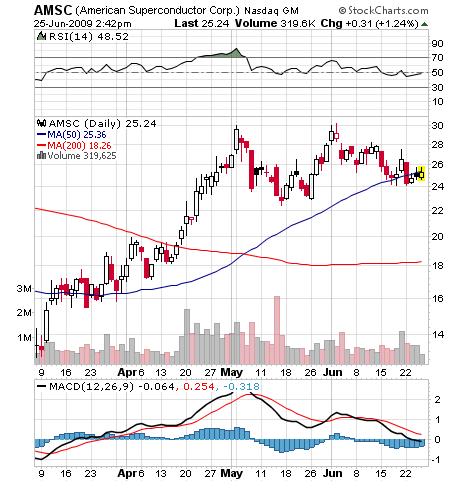

2) If the 2009 Clean Energy Bill passes, it is going to pave the way for major structural changes to the US economy, which few of the non-engineering types voting for it in Congress understand. The bill encourages electric power utilities to switch to renewables, upgrade the electric power grid, and put in place a cap and trade system which places an enormous burden on the power industry to go green (see my June 15,2009 Newsletter). The bill is expected to sail through the House, but faces a major fight in the Senate, where the administration is going to have to get all of their ducks in a row for it to pass. The bill provides the legal structure to spend that $100 billion for alternative energy already passed in the stimulus bill. In his cheerleading press conference for the bill, Obama correctly declared that dependence on hydrocarbons was jeopardizing our national security. He also cleverly described this as a massive creator of high tech jobs that can?t be exported.? I?m not highlighting this because I live in California, wear sandals all year, drive a Prius, or have a refrigerator stuffed as if a giant gerbil does my shopping. Since this economic crisis started, the key has been to buy whatever the government is buying, and since they are going into alternatives in a big way, you want to be right ahead of them (see my solar piece). Time to add more alternative energy names to your list to buy on dips. Look at American Superconductor (AMSC), which is involved in advanced wind turbine designs and electric power grid upgrades. Also take a peek at Covanta (CVA), an established business that profitably burns trash to create electricity.

3) There is an easier, cheaper, and faster way to solve the banking crisis which no one is talking about on Capitol Hill.?? If collateralized debt obligations (CDO?s) are the problem, just get rid of them! Desecuritize them! Just convert them back into the underlying loans. There are $1.4 trillion in CDO?s outstanding, backed by Alt-A and subprime loans in the form of 3,700 individual securitizations of perhaps 3.7 million loans. Over 68% of the loans backing these bonds are current.?? Mark to market rules are forcing the banks to carry this paper on their balance sheets at 50%-80% discounts. The problem is that mark to market is a meaningless accounting fiction when there is no market. If you break up these securities and place the underlying loans back on the banks? balance sheets, the good mortgages can be valued at 100% of face, and those behind in their payments, or in default, can be discounted to maybe 70% of face because they are still secured by the value of the homes. This would boost the entire asset class from the current 20-50 cents up to 90 cents on the dollar. Restored balance sheets would enable banks to resume lending. Of course it would be a massive admin job unwinding the rats? nests behind some of these securities, but Heaven knows there is abundant subprime and Alt-A expertise available for hire these days. Just sift through the ashes of Lehman Brothers and Bear Stearns. Why aren?t people talking about this?

4) Another green shoot bites the dust as weekly jobless figures jumped 12,000 back up to 627,000. They started offshoring hedge fund managers years ago.?? And now South Carolina governor Sanford tells us that his state has started offshoring mistresses. Where will it all end? Is there no shame? Please pray for me, Argentina.

QUOTE OF THE DAY

?You can?t produce a baby by getting nine women pregnant for one month,? said Oracle of Omaha, Warren Buffet, revering to Obama?s multifaceted attempts to revive the economy.

June 25, 2009 Featured Trades: (SPX), (F), (NSANY), (GMX), (PCG), (FSLR), (STP), (SPWRB)

1) Now that we are solidly into a correction, I have been flooded with requests from readers to call the next bottom in the S&P 500. Well here it is. Brace yourself. Put it on a Post-it-Note on your computer. It is without a doubt and unquestionably going to be 880, 850, 830, 800, 750, 666, or 320. That last number works out to be 90% of the book value of the S&P 500, which was the low seen in the 1930s depression. Yes, that depression, not this one. You are really asking me to solve a one billion variable equation, because that is the number of direct and indirect participants in global stock markets. If the few green shoots out there start to die off, the meltdown in commercial real estate accelerates, the Fed missteps by draining liquidity too soon, or there is another unforeseen shock to the system, then you can go with the lower of these numbers. If we are distracted by the health care debate, emerging market economies continue to perk up, and this strength helps our technology stocks stay alive, then sleepy narrow trading ranges will dominate, and the higher support levels will hold. But no matter what happens, I will be able to come back to you in three months and claim that I was right.

2) What is the new normal? This is the debate that is raging in hedge fund research departments around the world. I?m afraid that today?s equity investors are not taking into account some unpleasant new realities. The last thirty years have seen an average PE multiple of 15 times, and peaked at 20 times during the really great years. Unfortunately, this multiple expansion was fueled by an explosion in leverage. Even companies that hated debt had to drink the Kool-Aid to compete. Now we are moving in reverse on the leverage front double time. Debt/EBIDTA has shrunk from three times to two times in just two years. Even if corporations want to leverage now, they can?t, because the lenders have gone missing. If you wean the patient off of steroids, shouldn?t this mean that the range of PE multiples is permanently downsized? Should the new normal of 1-2% economic growth and an ?L? shaped recovery demand an average of only 12 times, 10 times, or Heaven forbid, the eight times low we endured in the seventies? Logic like this makes today?s 13.4 multiple look frightening rich, and the stock market insanely expensive.

3) There is something that really irks me today about the government?s announcement of the first of the loan guarantees promised by its $25 billion Advanced Technology Vehicles Manufacturing Incentive Program. Ford (F) will get $5.9 billion, Nissan (NSANY) $1.6 billion, and Tesla Motors $465 million. The money will be used to boost fuel efficiency through the development of battery power systems that can be competitive with those coming out of China (see my piece on BYD.) Have the Feds got this ass backwards or what? Imagine what Tesla could do with $5.9 billion? They could take advantage of economies of scale to build an entire new, all electric auto industry from scratch in California, creating tens of thousands of manufacturing jobs. Droves of auto engineers would happily vacate the frozen industrial wasteland that is Michigan for the sunny climes of California, and might even take up eating bean sprouts. This would accelerate the creative destruction that has to happen before the US auto industry can move forward. The money in question is equivalent to the two months worth of negative cash flow that General Motors (GMX) is currently burning. Why not invest in the future, instead of bailing out the buggy whip makers? The Chinese must think we?re nuts, but will happily clean out our pockets, as long are we are in this diminished condition.

4) I have been covering the solar industry for nearly 40 years now, and for most of this time it has only been economic in space stations. But times are changing. If you look carefully at your electric bill and calculate the cost per kilowatt hours each month as I do, you will notice that the price has been going up for the last ten years. This is partly because of ineptly handled deregulation, but also because our utility, Pacific Gas & Electric (PCG) is mandated by state law to reduce greenhouse gas emissions. Last year, the collapse of the economy and crude prices drove the cost of thin film solar?s primary raw material, polysilicon, down dramatically. The cost curve is falling, the demand curve is rising, and it is only a matter of time before they cross. The gap now is only a few cents per kilowatt, and that can easily be bridged with government subsidies. This industry is on the verge of becoming truly profitable. All it might take is another rise in crude prices, something you can count on. Watch behemoth First solar (FSLR) position itself to cash in, as well as Suntech Power (STP) and SunPower (SPWRB). But also watch the volatility, as this is definitely an ?E? ticket ride.

QUOTE OF THE DAY

?When we declared war in 1941 there were not 8,000 earmarks attached,? said Warren Buffet, in chiding congress in its handling of the economic crisis.

June 24, 2009 Featured Trades: (SPX), (EURO/YEN CROSS), (VENTURE CAPITAL)

1) All eyes will be on the Fed interest rate decision today, but your time will be better spent watching the NBA finals, the US Open, or Wimbledon, which you have wisely Tivo?d for days like this.?? US industrial capacity utilization is terrible, and still falling, while unemployment is still rising at a record pace. Sure, commodity prices have doubled this year, but the give back there has already started. The buying that did occur happened because investors were looking for an alternative to the sick dollar, not because there is huge underlying demand by end users. This is one of the reasons why I became cautious about all of my long positions last month. So I can say with complete confidence that the chances of an interest rate hike are less than zero for the foreseeable future.

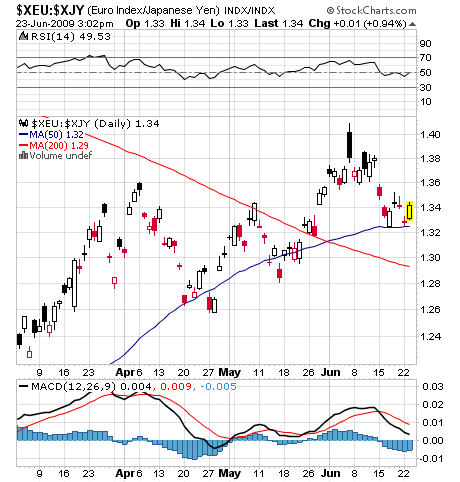

2) I warned readers that pain was on the way eight days ago, and one of the big reasons was a major reversal in the euro/yen cross rate, a great barometer of global risk taking by hedge funds. After trading as high as ??170 in 2007, it plummeted to a low of ??114 earlier this year. It then took off like a scalded chip three weeks before the S&P 500 made its prophetic 666 low on March 9. Look at the charts for the euro/yen and the SPX and you?ll see the correlation has been huge. This is a valuable and highly predictive cross rate to track, because the big boys can finance positions for free by borrowing in yen and investing in other high yielding, commodity producing currencies, like the Australian, New Zealand, and Canadian dollars. After a spike up to ??141 on June 8, euro/yen reversed all the way back to ??132 warning that a tempestuous round of deleveraging and risk reduction was on the way. For mere mortals, this translates into selling of everything across the board and is why trades as diverse as copper, crude, stocks, and BRICS have suffered vicious sell offs. Watch the euro/yen cross as a wizened old sailor keeps a weather eye on his barometer.

3) If you want to impress your friends with your vast knowledge of financial matters, then here are the Latin translations of the script on the backside of a US dollar bill. ?ANNUIT COEPTIS? means ?God has favored our undertaking.? ?NOVUS ORDO SECLORUM? translates into ?A new order has begun.? The Roman numerals at the base of the pyramid are ?1776.? The better known ?E PLURIBUS UNUM? is ?One nation from many people.? The basic design for the cotton and linen currency with red and blue silk fibers, which has been in circulation since 1957, carries enough symbolism to drive conspiracy theorists to distraction. An all seeing eye? The darkened Western face of the pyramid? And of course, the number ?13? abounds. Thank Benjamin Franklin for these cryptic symbols, and watch Nicholas Cage?s movie National Treasure. The balanced scales in the seal are certainly wishful thinking and a bit quaint. Study the buck closely, because there are going to be a lot more of them around.

4) These are indeed dark days for Silicon Valley?s venture capital industry. With the exit door slammed shut for years to come, new money is staying away, avoiding the high risk multiyear lock up. Angel investors have gone back to heaven. The deterioration of the economy has been so rapid that the rationale for many start ups is no longer there. Countless web 2.0, next generation models for social networking sites, video sharing sites, wikis, blogs, and folksonomies never made it to profitability, and will be swept away. Unfortunately, this means there will be an untold number of great ideas that will never see the light of day. Alternative energy is one of the few areas where business plans are getting any traction. Many investors are bracing themselves for reports of losses on their existing holdings, once the industry?s arcane accounting makes that possible. Expect a lot of once hard to get office space on Palo Alto?s Sand Hill Road to become available for cheap soon.

QUOTE OF THE DAY

?While there?s an energy shortage, we have no shortage of energy,? said John Hofmeister, former CEO of the US operations of Shell Oil.

June 23, 2009

Featured Trades: (SPX), (GXM)

1) Ok, people, the sucker's rally is now over. If you had any doubt, take a look at the insider selling figures for April and May. Corporate selling of stock has soared from $10 billion in April to $63 billion in May.?? Insider selling jumped from $1.9 billion to $2.2 billion, an enormous amount. Who were the suckers? Inflows to mutual funds and ETF's ballooned from $7.0 billion to $10.3 billion. Retail investors are always the ones who ring the bell at the top of a move. That explains why dozens of technical indicators are rolling over. They're are not signaling a crash, but they are not saying we are going up any time soon, either. If for whatever reason you can't get out, sell short dated calls against all of your positions.

2) Paul Krugman made an insightful point on his New York Times blog (see http://krugman.blogs.nytimes.com/). The surprise 17% improvement in new housing starts for May, which many heralded as a bonafide green shoot, is not what it seems. Sure, 17% is a nice number, but we're coming off such a low base the number is meaningless. 17% ain't what it used to be. It's like General Motors (GXM) (note new ticker symbol) going from $2 to $3. Sure, it's a 50% move, but it doesn't mean the bankrupt company is back in the pink of health. You could use the same argument for the 40% move in the S&P500. Since virtually all of our economic data is recovering from once a century extremes, they will have to be viewed with many grains of salt. When you meet Paul in person he is a pussycat, but in print is he Freddy Kruger meets Jack the Ripper.

3) One of the joys of having small children is that you get to know the guy at the local plumbing supply shop really well. It's amazing what will fit down a toilet these days. He once told me that when Troll Dolls hit the market, every plumber in the country was guaranteed a job for life. When I went there yesterday I thought I'd pick up some leading economic indicators as well. After a deadly winter, business is picking up a bit. Sure, it is still down a third from two years ago, but there is a definite improvement going on. The Eureka moment! His comments confirm the sort of 'L' shaped recovery I have been expecting. We aren't going to zero anymore, but it is not exactly off to the races either. Throughout the nineties, a salesman at Circuit City (RIP) walked me through every generation of technology, and he was worth his weight in gold. All I had to do was buy a new TV from him every year, and they kept getting bigger and more expensive. Sometimes figuring out the direction of the economy is as simple as going down to the local butcher, baker, or candlestick maker and asking. They are on the front lines of economic activity, and they will see any changes months before those of us glued to computer screens.

4) Since I have been pelted daily with predictions that residential real estate has bottomed for the last 18 months, like hail in a Midwestern summer thunderstorm, I feel a public duty to tell you that is just not the case. Now that the state and federal moratoriums are off, foreclosures are accelerating. There are over a million Option ARM and Alt-A loan resets about to hit the fan. Since many owners will not see positive equity in their homes in their lifetimes, banks are seeing more walk always. The run up in mortgage rates from 4.5% to 5.5% has yet to hit the market. Some 18 million homeowners divert 50% of their incomes to pay for housing, double the 25% that is considered healthy, and many of them are losing jobs. While the volume of units sold has rebounded, the action is dominated by speculators, flippers, and bottom feeders bidding for properties at 10-40 cents on the dollar, not exactly a sign of health. Call me when Ozzie & Harriet Nelson come back to the market. I listen to industry insiders call the bottom of the Japanese real estate market for 15 years, until they finally died, and the market is still a fraction of its 1990 high. I thing we are closer to the bottom than the top in terms of price, but closer to the top than the bottom in terms of time. You can take that to the bank.

QUOTE OF THE DAY

'We won't see a 'V' shaped recovery, but a recovery nonetheless,' Said Abbey Joseph Cohen, senior strategist at Goldman Sachs.

June 22, 2009

Featured Trades: (NATURAL GAS), (UNG), (FCEL), (BRK/A), (GS)

1) The Potential Gas Committee of the American Gas Association published a report that US reserves have jumped by 35% to 1,836 trillion cubic feet, thanks to the huge discoveries of new shale fields since 2006. Also contributing are the new fracturing technologies, which I had a hand in pioneering myself ten years ago. That means our natural gas reserves can now meet 100 years of current consumption, and are roughly equivalent to Saudi Arabia?s crude reserves on a BTU basis. Natural gas futures dove 26 cents to $4.23, and the ETF (UNG) gave back 4%. A buddy of mine close to the committee warned me that something like this was headed down the pike, which is why I sent readers a warning two weeks ago to cash out at $4.30. When you only see chart driven traders buying a commodity and the industry insiders selling the Hell out of it, you want to stay away. Bewildered technicians were last seen feverishly searching for Hainesville on Google. It was their models that sucked $3 billion into UNG over the last three months. This is great news for the big consumers of NG, like the utility industry and the petrochemical industry. It will also give a shot in the arm to Boone Pickens? plan to shift our transportation system to NG (see my March 30, 2009 Newsletter). Even the ratio, pairs, and mean reversion traders have been burned by NG this year. As cheap as NG is, a Saudi Arabia?s worth of supply hitting the market could easily knock the price down by half from here. As extreme as the move in the oil/gas ratio is at 18:1, we could be breaking new ground.

2) While searching for beneficiaries of lower natural gas prices, I stumbled across an interesting little company in Connecticut called FuelCell Energy (FCEL). It sells onsite power plants which are basically giant lithium ion batteries that run of NG as well as biomass, wastewater, propane, and landfills. Think of a cell phone battery that pumps out 50 megawatts of electricity, enough to power a small city. Since the NG is soundlessly electrochemically reacted and not burned, there are no greenhouse gases produced. I have been following this technology for 35 years, and you used to only find things like these at remote industrial sites well outside the power grid, like on Pacific islands or in Northern Canada, where the only alternative was a diesel generator expensively shipped in. While the technology created warm and fuzzy feelings with environmentalists, a cost of four times the market was usually buried in a footnote on page 247. Not true anymore. Their net cost is 16 cents a kilowatt hour, which looks good in high cost states like Hawaii and California. But if you throw in the abundance of state and Federal subsidies now available for alternative energy, that cost drops to 12 cents. Imagine what a halving of NG prices would do? The Golden State accounted for 40% of FCEL?s orders last year, you can find them at several Marriot Hotels in San Francisco, but a South Korean utility has become a large customer, boosting the stock by nearly triple from the March lows.? This is a classic example of why old fossils like myself have to more frequently clear out the cobwebs from our brains in order to root out the new trading opportunities.

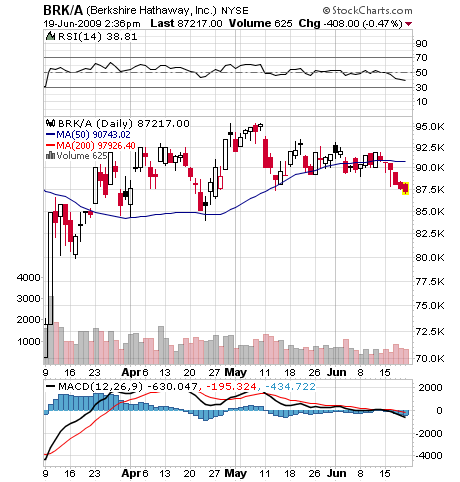

3) A lot of people like to follow Warren Buffet?s Berkshire Hathaway (BRK/A) as a leading indicator for the market. What better guide than a portfolio of the best of the best, run by the world?s great investor? Recently the news has not been good. If you wonder what a stock looks like when it is rolling over on diminishing volume, this is it. The only question is how big, how fast. As much as I worship the avuncular, chocolate milkshake loving, Sees Candy eating Oracle of Omaha, memorizing his annual letter to investors?? and hanging on his every spoken word, he hasn?t been doing that well lately. Since March, his main investing vehicle has only managed a 35% gain, compared to a 40% pop for the S&P 500; despite heavy weightings in such best of breed financials like Goldman Sachs (GS). Better keep his ticker on your desk top, because what BRK/A does, the world will follow.

4) I have really been avoiding financials for the last few months after they had their dead cat bounces. However, I had to listen to Midsouth Bank CEO Rusty Cloutier when he spoke on CNBC. His 24 branch bank, with a market cap of only $103 million, is based in Lafayette, LA, one of my old stomping grounds and home of the world?s greatest ??touff??e and shrimp gumbo. He says that ?Unless we break up the big banks and get back to sound banking principles we are going to relive this over and over again??.Free enterprise has to have the right to fail??.Allan Greenspan and his administration have some problems they have to ??fess up to.? With the current system of megabanks ?they get the gain and we get the pain??.I?m regulated now by 13 agencies of the US government and I don?t know that I need a 14th.? There?s no one who can read you a riot act like a Southern regional banker.

QUOTE OF THE DAY

?We?re trying to fix everything in four months that took place over 100 years, said Jack Welch, retired CEO of General Electric (GE).