When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

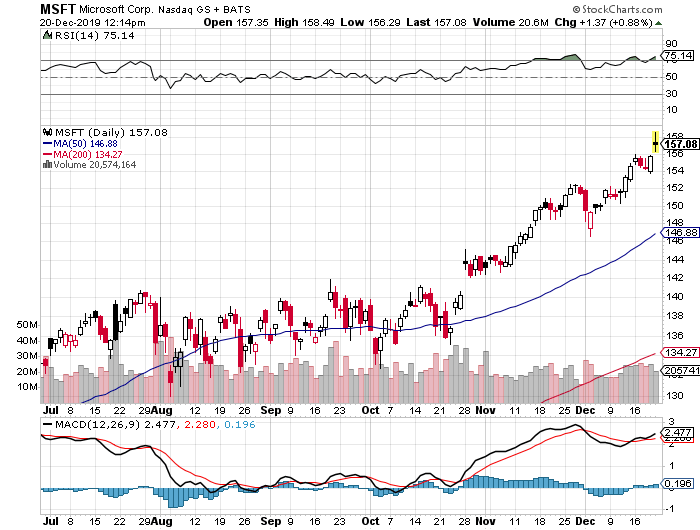

Trade Alert - (MSFT) - EXPIRATION

EXPIRATION of the Microsoft (MSFT) December 2019 $134-$137 in-the-money vertical BULL CALL spread at $3.00

Closing Trade

12-20-2019

expiration date: December 20, 2019

Portfolio weighting: 10%

Number of Contracts = 38 contracts

Provided that (MSFT) does not fall $20.08, or 12.73% by the close today, our position in the Microsoft (MSFT) December 2019 $134-$137 in-the-money vertical BULL CALL spread will expire at its maximum profit at $3.00.

As a result, you have earned $1,520, or 15.38% in 22 trading days. If you bought the shares instead, keep them. They are going much higher.

You don’t get any better quality than Microsoft (MSFT) in the tech world. It is the safest stock in which to invest today. This is a stock that you want to hide behind the radiator and keep forever. It is also one of the great turnaround stories of the decade.

In addition, this particular combination of strikes prices gave you huge support at the 50-day moving average at $140.67. Please note this option spread will be profitable whether the market goes up, sideways, or down small over the next four weeks.

This was a bet that Microsoft shares would NOT fall below $137.00 by the December 20 option expiration date in 22 trading days.

This was also a bet that we are not already in a recession, which I believe is still at least 12 months off.

You don’t need to do anything, as the expiration process is now fully automated. The profit will be deposited into your account and the margin freed up on Monday morning.

Well done, and on to the next trade!

EXPIRATION 38 December 2019 (MSFT) $134 calls at…….……$23.08

EXPIRATION short 38 December 2019 (MSFT) $137 calls at…….$20.08

Net Cost:………………………….…………..…..….….....$3.00

Profit: $3.00 - $2.60 = $0.40

(38 X 100 X $0.40) = $1,520 or 15.38% in 22 trading days.

The optics today look utterly different from when Bill Gates was roaming around the corridors in the Redmond, Washington headquarter, and that is a good thing in 2018.

Current CEO Satya Nadella has turned this former legacy company into the 2nd largest cloud competitor to Amazon and then some.

Microsoft Azure is rapidly catching up to Amazon in the cloud space because of the Amazon-effect working in reverse. Companies don’t want to store proprietary data to Amazon’s server farm when they could possible destroy them down the road. Microsoft is mainly a software company and gained the trust of many big companies especially retailers.

Microsoft is also on the vanguard of the gaming industry taking advantage of the young generation’s fear of outside activity. Xbox related revenue is up 36% YOY, and its gaming division is a $10.3 billion per year business. Microsoft Azure grew 87% YOY last quarter.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here at

http://www.madhedgefundtrader.com/ltt-vbpds/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

Not a day goes by when someone doesn’t ask me about what to do about trading Apple (AAPL).

After all, it is the world largest publicly-traded company at a $1.2 trillion market capitalization. It is the planet’s most widely owned stock. Almost everyone uses their products in some form or another. It buys back more of its own stock than any other company on the planet. Oh yes, it is also one of Warren Buffet’s favorite picks.

So, the widespread adulation is totally understandable.

Apple is a company with which I have a very long relationship. During the early 1980s, I was ordered by Morgan Stanley to take Steve Jobs around to the big New York Institutional Investors to pitch a secondary share offering for the sole reason that I was one of three people who worked for the firm who was then from California.

They thought one West Coast hippy would easily get along with another. Boy, were they wrong, me in my three-piece navy blue pinstripe suit and Steve in his work Levi’s. It was the worst day of my life. Steve was not a guy who palled around with anyone. He especially hated investment bankers.

I got into Apple with my personal account when the company only had four weeks of cash flow remaining and was on the verge of bankruptcy. I got in at $7 which, on a split-adjusted basis today, is 50 cents. I still have them. In fact, my cost basis in Apple is less than the 77-cent quarterly dividend now.

Today, some 200 Apple employees subscribe to the Diary of a Mad Hedge Fund Trader looking to diversify their substantial holdings. Many own Apple stock with an adjusted cost basis of under $5. Suffice it to say, they all drive really nice Priuses.

So I get a lot of information about the firm far above and beyond the normal effluent of the media and stock analysts. That’s why Apple has become a favorite target of my Trade Alerts over the years.

And here is the great irony: Nobody would touch the stock with a ten-foot pole at the end of 2018. Since then, Apple has rallied 71%, creating more market cap in a year than any company in history.

Here’s why. Apple was all about the iPhone which then accounted for 75% of its total earnings. The TV, the watch, the car, the iPod, the iMac, and Apple Pay were all a waste of time and consumed far more coverage than they are collectively worth.

The good news is that iPhone sales are subject to a fairly predictable cycle. Apple launches a major new iPhone every other fall. The share price peaks shortly after that. The odd years see minor upgrades, not generational changes.

Just like you see a big pullback in the tide before a tsunami hits, iPhone sales are flattening out between major upgrades. This is because consumers start delaying purchases in expectation of the introduction of the new iPhones 7 more power, gadgets, and gizmos.

So during those in-between years, the stock performance was disappointing. 2018 certainly followed this script with Apple down a horrific 30.13% at the lows. Maybe it’s a coincidence, but the previous generation in Apple shares in 2015 brought a decline of, you guessed it, exactly 29.33%.

The coming quarter could bring quite the opposite.

After March, things will start to get interesting, especially post the Q1 earnings report in April. That’s when investors will start to discount the rollout of the new 5G iPhone seven months later. Everyone and their brother is waiting for 5G to purchase their next iPhone, unless it gets lost or stolen first.

The last time this happened, in 2018, Apple stock rocketed by $86, or 55.33%. This time, I expect a minimum rally to $400 high, or much higher. After all, I am such a conservative guy with my predictions (Dow 120,000 by 2030?).

Even at that price, it will still be one of the cheaper stocks in the market on a valuation basis which currently trades at a 20X earnings multiple. This is up from a subterranean multiple of 14X a year ago. The value players will have no choice to join in, if they’re not already there.

But Apple is a much bigger company this time around, and well-established cycles tend to bring in diminishing returns. It’s like watching the declining peaks of a bouncing rubber ball.

This is not your father’s Apple anymore. Services like iTunes and the new Apple+ streaming service are accounting for an even larger share of the company’s profits. And guess what? Services companies command much higher multiples than boring old hardware ones. It’s the old questions of linear versus exponential growth.

A China trade deal will bring a new spring to Apple’s step, where sales have recently been in free fall. Their new membership lease program promises to deliver a faster upgrade cycle that will allow higher premium prices for their products. That will bring larger profits.

It all adds up to keeping Apple as a core to any long term portfolio.

Just thought you’d like to know.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.