Archive

Hot Tips

Nonfarm Payroll Comes in at a Weak 175,000,

in April, the slowest in six months. The headline Unemployment Rate ticked up to 3.9% while wage gains slowed. Friday’s report signaled further evidence that demand for workers is moderating, but the data likely don’t amount to “an unexpected weakening” that Federal Reserve Chair Jerome Powell said iwould warrant a policy response.

Apple Announced the Worst Earnings in Years,

but also delivered a record $110 billion share buyback, sending shares soaring. Though revenue fell 4.3% to $90.8 billion in the March quarter, that was better than the $90.3 billion predicted by analysts. Avoid (AAPL) as reality will catch up with the share price soon enough.

Sony and Apollo Mount $26 Billion Bid for Paramount.

Paramount, which is controlled by Shari Redstone, has been weighing a merger proposal from David Ellison, the head of Skydance Media and son of Oracle’s co-founder Larry Ellison. A period of exclusive talks between Paramount’s board and Ellison is scheduled to end Friday. The apple doesn’t fall from the tree. Observe from a great distance.

Commodity Takeover Wars Heat UP,

as Swiss-based commodity giant Glencore also considers a bid for Anglo-American. Anglo is attractive to its competitors for its prized copper assets in Chile and Peru, a metal used in everything from electric vehicles and power grids to construction, whose demand is expected to rise as the world moves to cleaner energy and wider use of AI. Follow the big money. Buy (FCX) and (COPX) on dips.

Oil Sees Biggest Drop in Three Months,

as tensions in the Middle East fade. Both benchmarks are set for weekly losses as investors are concerned higher-for-longer interest rates will curb economic growth in the U.S., the world's leading oil consumer, as well as in other parts of the world. Buy (XOM) and (OXY) on dips.

Fed Says No Hikes, but no Cuts Either,

triggering a 500-point rally in the market. Federal Reserve Chair Jerome Powell said it was unlikely that the central bank’s next move will be a rate hike. The comment spurred a rally for the three major averages, with the Dow surging more than 500 points in its session high. Central bank policymakers kept rates steady at the conclusion of their May meeting, holding at a range of 5.25% to 5.5%. Expect the same next month.

JOLTS Report for Job Openings Hit Three-Year Low.

US job openings trailed behind estimates for the month of March, the US Bureau of Labor Statistics reported 8.5 million job openings against expectations of 8.7 million. Additionally, the ISM Manufacturing PMI (Purchasing Managers' Index) fell to 49.2 in April; ISM's prices paid index jumped to 60.9. It presages a cool Nonfarm Payroll Report on Friday.

Demand for Adjustable Rate Loans Soar,

as the 7.25% 30-year fixed sends borrowers fleeing. The share of ARM applications rose to 7.8% of mortgage demand last week, according to the Mortgage Bankers Association. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 7.29% last week from 7.24% the previous week. The average contract interest rate for 5/1 ARMs decreased to 6.60% from 6.64%. The plan is to pray for lower rates before the first rate reset happens.

Exxon Cuts Deal with the FTC,

allowing the pioneer deal to go through. Exxon first announced the deal for Pioneer in October, in an all-stock transaction valued at $59.5 billion. Exxon said the acquisition would more than double its production in the Permian Basin. Follow the big money. Buy (XOM) on dips.

The US Treasury Announced a Bond Buyback Program,

with the first scheduled on May 29. The Treasury's last regular buyback program began in the early 2000s and ended in April 2002. Under the buyback program, the Treasury said it plans to hold weekly "liquidity support" buybacks of up to $2 billion per operation in nominal coupon securities, and up to $500 million per operation in TIPS. Bond bulls don’t get your hopes up. The plan is to simply smooth out what is expected to be very large debt issues throughout 2024.

ADP Comes in at a Strong at 192,000,

in April in private job hires. The wage measure showed annual pay gains up 5% from a year ago, the smallest gain since August 2021. Job gains were strongest in leisure and hospitality, which posted an increase of 56,000. Other industries showing gains included construction (35,000) and sectors covering trade, transportation, and utilities as well as education and health services, both of which saw increases of 26,000.

S&P Case Shiller National Home Price Index Soars.

Home prices in February jumped 6.4% year over year, marking another increase after the prior month’s annual gain of 6%, and the fastest rate of price growth since November 2022. Prices in San Diego saw the biggest rise among the 20 cities in the index, up 11.4% from February of 2023. Both Chicago and Detroit reported 8.9% annual increases. Portland, Oregon, saw the smallest gain in the index of just 2.2%. Strong demand and tight supply continue to push home values higher, even though mortgage rates are now moving higher again.

Chicago PMI Fades,

at a very low 37.9 versus an expected 45 in April. It’s the lowest level in two years and a serious stagflationary number. The Chicago PMI assesses the business conditions and the economic health of the manufacturing sector in the Chicago region. A value above 50.0 indicates expanding manufacturing activity, while a value below 50.0 indicates contracting manufacturing activity.

Consumer Confidence Dives,

to 97 versus an expected 103.5, a three-year low. Expectations drop to 66, a two-year low. Earlier months were revised down. It’s yet another stagflation number. Confidence now stands at the lower end of its recent range as consumers contend with elevated inflation, high borrowing costs, and a gradually cooling labor market.

Amazon Blows Out Earnings,

taking the shares up $6. In its first-quarter earnings report on Tuesday, Amazon’s operating margin reached double digits for the first time on record. The company’s margin climbed to 10.7% in the period, up from 7.8% in the fourth quarter and topping a previous high of 8.2% in the first quarter of 2021. Buy (AMZN) on dips.

Musk Cuts China Deal,

sending stock soaring by 12%. Tesla can now use full self-driving in China, an ideal test bed for future US deployment. The carmaker will partner with tech giant Baidu on maps and navigation. It’s a blockbuster deal that will immediately add to (TSLA) earnings. The company charges $8,000 for FSD in the US, or $99 a month for a subscription. Elon kills the shorts again.

Stock Trading is Getting More Concentrated,

with a third taking place in the last ten minutes of each 390-minute session. Now fresh evidence emerging from Europe — where the pattern is similar — suggests the trend may be hurting liquidity and distorting prices. It’s new ammo for critics of index trading because index funds drive the phenomenon. These products typically buy and sell shares at the close, since the last prices of the day are used to set the benchmarks they aim to replicate.

Copper Tops $10,000 per Metric Tonne,

a new two-year high and higher prices beckon. The takeover battles continue with BHP trying to buy Anglo American. BHP is trying to buy copper supplies in the stock market it can’t get from mining. The problem is that miners just aren’t building enough mines, with the Pandemic making a major dent in the pipeline. Production from existing mines is set to fall sharply in the coming years, and miners would need to spend more than $150 billion between 2025 and 2032 in order to fulfill the industry’s supply needs. Buy (FCX) and (COPX) on dips.

Yen Crashed Below ¥160,

a new 40-year low. Higher for longer rates in the US means lower for longer for the Japanese yen. A brief Bank of Japan intervention caused a snapback rally to 156. Did the BOJ just draw its line in the sand? Avoid (FXY) while the turmoil persists. Japan is so cheap now I might have to move back to Tokyo. Bikrishita!

Viking Goes Public at High $1.33 Billion IPO,

valuing the company at $10.8 billion, taking advantage of the current boom in cruise line bookings. Viking, founded in 1997, started out with four river vessels and now owns a fleet of 92, allowing customers to book voyages to destinations including Antarctica and the Arctic. The company will list its shares on the New York Stock Exchange under the symbol (VIK). Buy (RCB) on dips.

Personal Consumption Expenditures Come in Warm

for March, up 2.8% YOY, the same as for February. Service prices led. But the numbers were not as hot as feared so both bonds and stocks rose.

Activist Elliot Takes a Run at Mining Giant Anglo American,

accumulating a $1 billion stake. BHP is also making a takeover bid here on the coattails which Elliot is clearly trying to ride. It just highlights global interest in mining shares. Anglo American plc is a British multinational mining company that is the world's largest producer of platinum, with around 40% of world output, as well as being a major producer of diamonds, copper, nickel, iron ore, polyhalite, and steelmaking coal. On a side note, copper hit an all-time of $10,000 per metric tonne in the London Market this morning. Buy (FCX) and (COPX) on dips.

Alphabet Earnings Beat Delivers Monster 10% Move,

recovering a $2 trillion market cap. It also announced its first ever dividend and a $70 billion share buyback, the second largest after Apple.

Global Equity Funds Face Fourth Week of Outflows,

at $2.7 billion, far less than the $23 billion last week. Hopes of a Fed rate cut are fading beyond the horizon. U.S. equity funds experienced outflows of $1.2 billion, while European equity funds saw $6.3 billion leave during the week. Conversely, Asian markets, primarily driven by Japanese equity funds, recorded inflows of $5.1 billion.

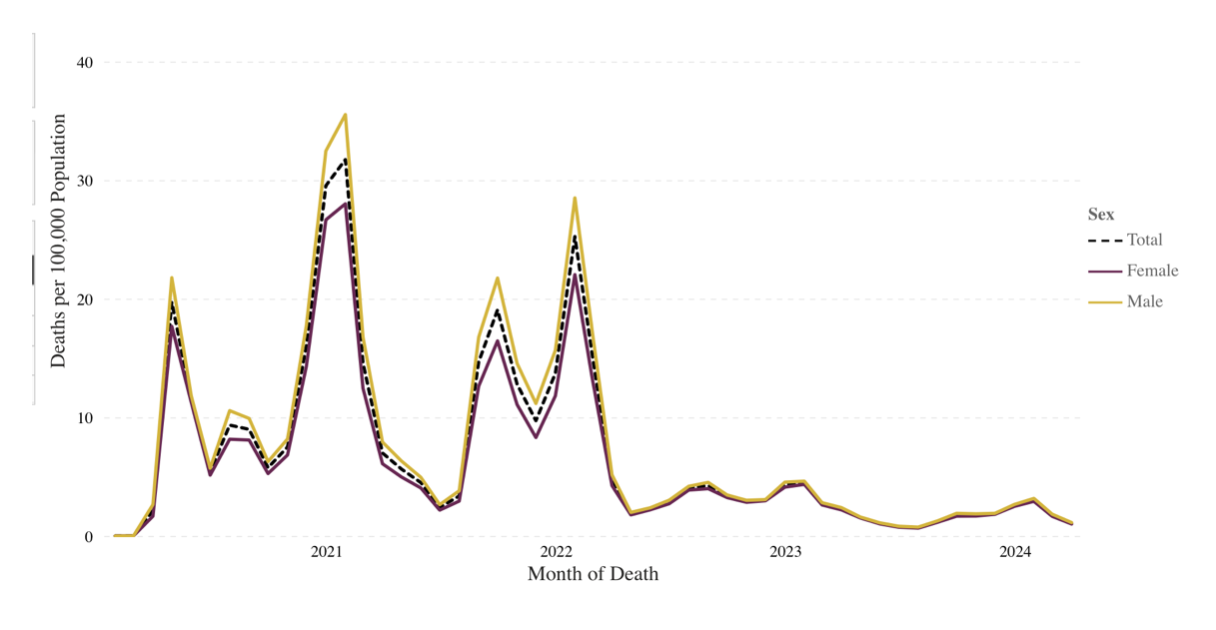

CDC Birth Data Fall to Lowest Level Since the Great Depression,

1.1 births per 1,000 people. That is well below the Great Depression levels. Only 3,664,292 new Americans were born in 2021. It means there will be a shortage of consumers in 20 years so be out of stocks by then. The good news is that Covid deaths have fallen from 4,000 per day to only 19 since January of 2020.