How Softbank is Taking Over the US Venture Capital Business

One of the few people who can magnify pressure on the venture capitalists of Silicon Valley is none other than Masayoshi Son.

What a ride it has been so far. At least for him.

His $100 billion SoftBank Vision Fund has put the Sand Hill Road faithful in a tizzy – utterly revolutionizing an industry and showing who the true power broker is in Silicon Valley.

He has even gone so far as doubling down his prospects by claiming that he will raise a $100 billion fund every few years and spend $50 billion per year.

This capital logically would flow into what he knows best – technology and the best technology money can buy.

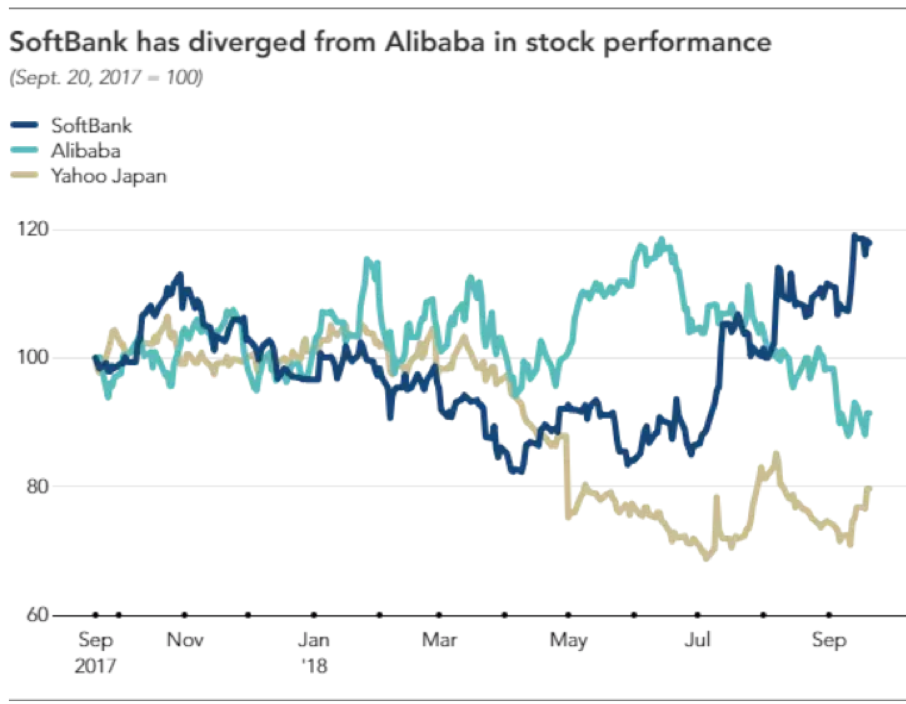

As Yahoo Japan and Alibaba (BABA) shares have floundered, SoftBank’s stock has decoupled from the duo displaying explosive brawn.

SoftBank’s stock is up 30% in the past few months and I can tell you it’s not because of his Japanese telecommunications business which has served him well until now as his cash cow.

Yahoo Japan, in which SoftBank owns a 48.17% stake, has existing synergies with SoftBank’s Japanese business, but has experienced a tumble in share price as Son turns his laser-like focus to his epic Vision Fund.

His tech investments are bearing fruit and not only that, Son revealed his Alibaba investment is about to clean up shop to the tune of $11.7 billion next year shooting SoftBank shares into orbit.

A good portion of the lucrative windfall will arrive from derivatives connected to the sale of Alibaba, and the other 60% comes from the paper profits finally realized in this shrewd piece of business.

Equally paramount, SoftBank’s Vision Fund hauled in $2.13 billion in operating profits from the April-June quarter underscoring the effectiveness of Masayoshi Son’s tech ardor.

Son said it best of the performance of the Vision Fund saying, “Results have actually been too good.”

So good that after this June, Son changed his schedule to spend 3% of his time on his telecom business down from 97% before June.

His telecommunications business in Japan has turned into a footnote.

It was the first quarter that Son’s tech investments eclipsed his legacy communications company.

Son vies to rinse and repeat this strategy to the horror of other venture capitalists.

The bottomless pit of capital he brings to the table predictably raises the prices for everyone in the tech investment world.

Son’s capital warfare strategy revolves around one main trope – Artificial Intelligence.

He also strictly selects industry leaders which have a high chance of dominating their field of expertise.

Geographically speaking, the fund has pinpointed America and China as the best sources of companies. India takes in the bronze medal.

Unsurprisingly, these two heavyweights are the unequivocal leaders in artificial intelligence spearheading this movement with the utmost zeal.

His eyes have been squarely set on Silicon Valley for quite some time and his record speaks for himself scooping up stakes in power players such as Uber, WeWork, Slack, and GM (GM) Cruise.

Other stakes in Chinese firms he’s picked up are China’s Uber Didi Chuxing, China’s GrubHub (GRUB) Ele.me and the first digital insurer in China named Zhongan International costing him $500 million.

Other notable deals done are its sale of Flipkart to Walmart (WMT) for $4 billion giving SoftBank a $1.5 billion or 60% profit on the $2.5 billion position.

In 2016, the entire venture capitalist industry registered $75.3 billion in capital allocation according to the National Venture Capital Association.

This one company is rivalling that same spending power by itself.

Its smallest deal isn’t even small at $100 million, baffling the local players forcing them to scurry back to the drawing board.

The reverberation has been intense and far-reaching in Silicon Valley with former stalwarts such as Kleiner Perkins Caufield & Byers breaking up, outmaneuvered by this fresh newcomer with unlimited capital.

Let me remind you that it was considered standard to cautiously wade into investment with several millions.

Venture capitalists would take stock of the progress and reassess if they wanted to delve in some more.

There was no bazooka strategy then.

SoftBank has thrown this tactic out the window by offering aspiring firms showing promise boatloads of capital up front even overpaying in some cases.

Conveniently, Son stations himself nearby at a nine-acre estate in Woodside, California complete with an Italianate mansion he bought for $117.5 million in 2012.

It was one of the most expensive properties ever purchased in the state of California even topping Hostess Brands owner Daren Metropoulos, who bought the Playboy Mansion from Hugh Hefner in 2016 for $100 million.

If you think Son is posh – he is not. He only fits himself out in the Japanese budget clothing brand Uniqlo. He just needed a comfortable place to stay and he hates hotels.

In August, SoftBank decided to top off the $4.4 billion investment in WeWork, an American office space-share company, with another $1 billion leading Son to proclaim that WeWork would be his “next Alibaba.”

Son continued to say that WeWork is “something completely new that uses technology to build and network communities.”

The rise of remote workers is taking the world by storm and this bet clearly follows this trend.

The unlimited coffee and beer found in the new Japanese Roppongi WeWork office that opened earlier this year was a nice touch.

WeWork plans to open 10-12 offices in Japan by the end of 2018.

Thus far, WeWork is operating in over 300 locations in over 20 countries.

Revenue is growing rapidly with the $900 million in 2017 a 12-fold improvement from 2014.

The newest addition to SoftBank’s dazzling array of unicorns is Bytedance, a start-up whose algorithms have fueled news-stream app Jinri Toutiao’s meteoric rise in China.

The deal values the company at $75 billion.

It also runs video sharing app Douyin, and overseas version TikTok.

Bytedance’s proprietary algorithm, serving to personalize streams for users, is the best in China.

They have been able to insulate themselves from local industry giants Tencent and Alibaba.

TikTok has piled up over 500 million users and brilliant investment like these is why Son revealed that the Vision Fund’s annual rate of return has been 44%.

SoftBank’s ceaseless ambition has them in the news again with whispers of investing in a Chinese online education space with a company called Zuoyebang.

China’s online education market is massive. In 2017, this industry pulled down over $33 billion in revenue, and 2018 is poised to break $55 billion.

Zuoyebang has lured in Goldman Sach’s (GS) as an investor.

This platform allows users to upload homework questions for third party assistance – the name of the app literally translates into “homework help.”

Cherry-picking off the top of the heap from the best artificial intelligence companies in the world is the secret recipe to outperforming your competitors.

At the same time, aggressively throwing money at these companies has effectively frozen out any resemblance of competition. Once the competition is frozen out, the value of these investments explodes, swiftly super-charged by rapidly expanding growth drivers.

How can you compete with a man who is willing to pay $300 million for a dog walking app?

Venture capitalist funds have been scrambling to reload and mimic a Vision Fund-like business of their own, but its not easy raising $100 billion quickly.

This genius strategy has made the founder of SoftBank the most powerful businessman in the world.

Son owns the future and will have the largest say on how the world and economies evolve going forward.