No Landing Outcome For Tech Stocks

NO LANDING!

That’s where we are at and that’s what we face as tech stocks need to overcome the “no landing” scenario to see better days in valuation.

There has been much chit-chat about what sort of recession the US economy will face in 2023.

Well, hold your horses there mister.

The smattering of positive labor data means there might not be a recession at all, which translates into neither a soft landing nor a hand landing for the economy.

Why does that matter for tech stocks?

The lack of light or deep recession has absolutely everything to do with inflation. High inflation kills growth stocks!

The logic behind this goes that if there is no recession, US workers will by and large keep their jobs.

From a societal point of view, this is great for Americans who can bank their salaries and spend, spend, spend.

However, this doesn’t work out so great if the stock market needs lower inflation for tech shares to go higher.

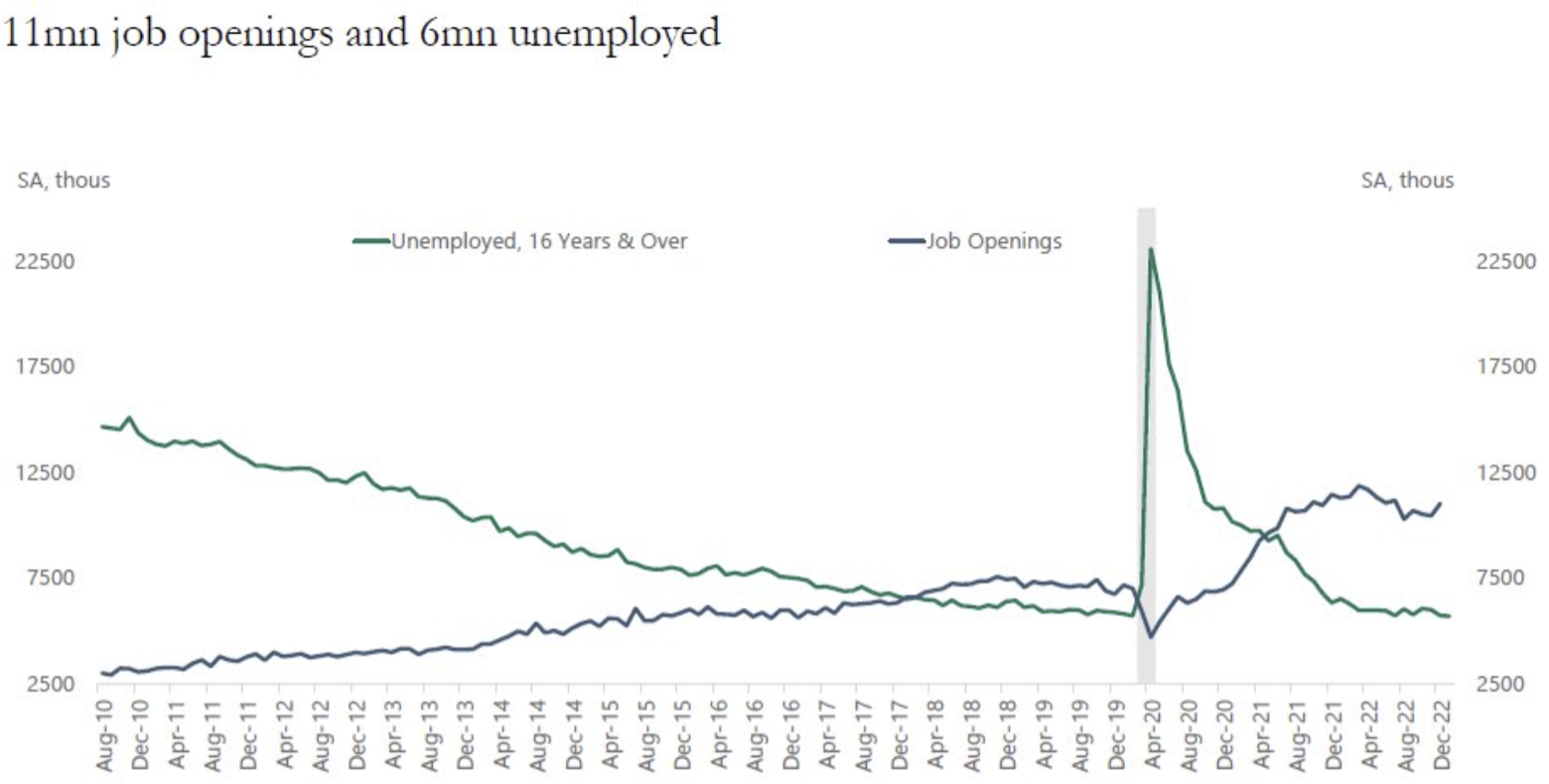

Let me just insert here that I am totally aware of all the tech job losses and they have topped around 200,000 so far and it’s a drop in the bucket to overall hiring and firing.

Interestingly enough, tech layoffs haven’t always resulted in the fired getting better jobs.

The jobs report shows a massive uptick in hiring particularly for restaurant jobs, retail, and hospitality.

Many of these are also part-time jobs which means the median US job is decreasing in quality and stability.

The result of more hiring for longer is that the US Central Bank might be forced to jack up rates again past the 5% that is priced in.

This is horrible news for the tech sector as the Nasdaq got off to a blistering start in January because of the clear path to lower inflation. This path is starting to close.

Last Friday’s January employment report saw the economy add a much stronger-than-expected 517,000 jobs, while the unemployment rate fell to 3.4%, its lowest level since 1969.

And if the services sector needs to fill hundreds of thousands of jobs, wage gains will threaten to make inflation spike yet again.

The reopening of China’s economy as reverses lockdowns could push commodity prices back to the upside, also contributing to price pressures after several months of slowing inflation readings.

The Fed has always pinpointed strong wage growth and full employment as an impediment to lowering rates.

I have banged on constantly that the Fed hasn’t done enough with lifting rates even though the pace of rate hikes has been historic.

Readers should remember that the amount of stimulus and handouts during the lockdowns were also historic as well.

Demand destruction simply will not occur if real rates are negative and that’s been the case for quite a while I might add.

Now there is a real risk of inflation reaccelerating because the Fed never raised rates high enough for companies to feel pain and fire employees.

This is why tech stocks have been swooning the last few days and the trading environment is still highly complex.

Expect whipsaws for the foreseeable future and if inflation does come back reincarnated, expect a page out of the 2022 playbook with stocks and bonds going decisively lower.