Tech Deserves What It Deserves

A bear market rally in tech would be an overwhelmingly healthy signal that the financial system is working in an orderly fashion.

Yet, as I say that, a looming recession inches closer.

How do I know that?

That was my first reaction when my eyes were stung by the headline of 8.3% inflation.

Sure, not a 10, but it is emblematic of the ongoing inflation concerns with items such as airplane tickets up 18% year over year in price.

Remember the consensus was that inflation pressures are trending towards peaking, potentially setting up for a nice bear market rally.

That narrative hit another catch-22, not as bad as it could have been, but clearly not great and prices biting at the backs of consumers.

The hope that inflation will be crammed back into the genie bottle is not going to happen until later this year and not for the right reasons.

Simply because comparables become easier to beat year over year.

Like I have mentioned in past tech letters, high-growth tech stocks are most sensitive to the fluctuation in rates and investors should be nowhere near growth funds like Cathy Wood’s ARK Innovation ETF (ARKK).

Another head-scratching move was ARK’s Cathy Wood selling Tesla (TSLA) shares and rolling them into GM (GM).

This is for the lady who likes to tell us that we aren’t “doing the research.”

Betting against Elon Musk is a fool’s game.

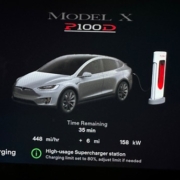

When it comes to EVs, I would put money on Musk to defy any odds.

Tesla will outperform GM, especially amid a backdrop of lithium prices spiking and supply chain issues going haywire.

Musk is simply the anointed guy that knows how to work miracles.

He only developed the EV industry as he saw fit, invented reusable space rockets, cut the price of space exploration by 10, and reimagined tunneling construction technology.

And by the way, his Neuralink brain interface company is working on implanting chips in human brains so we don’t need to use our fingers on keyboard anymore.

I wouldn’t want to compete with this man and to believe that GM will be able to nimbly outmaneuver Musk who has the audacity to aggressively solve anything no matter how many people he pisses off is not an incremental bet on “innovation” that Wood likes to tout she is participating in.

Neither is the purchase of Roku (ROKU), Zoom (ZM), or Roblox (RBLX) which have all tanked since she put new money to work in them in late April.

Inflation at 8.3% means that the real rate of inflation is still -7.55% and until that’s addressed, any bear market rally will be viciously sold breaching further levels down below.

The carnage in the tech world is indicative at the dregs of the barrel.

Tech IPOs are toxic.

Market for new issues has been bereft throughout the first four-plus months of this year, and nothing that would move the needle is on the tech IPO radar for the duration of the second quarter.

Companies that were aiming to go out in the first half of 2022 have no appetite to continue down that path because there simply won’t be a bid.

Going public today would require a complete revaluation of their business and leave many late-stage investors and employees with out-of-money stock.

Grocery deliverer Instacart is the only company in that class that’s been forthright with its slowing valuation. In March, the company said it cut its valuation by about 40% to $24 billion.

That’s how bad it is out there at the bush league end of the tech sector and many of these stocks that are public such as Teladoc are down 80%.

I do believe that many of these loss-making growth techs are rightfully down 80%.

They had time to show a profit and they failed in the allotted amount of time they were given.

Every window closes and the market moves forward with or without them.

In the near term, I am bearish on the market but I do believe we are oversold which could feed into a dead cat bounce to sell on.