January 22, 2010

January 22, 2010

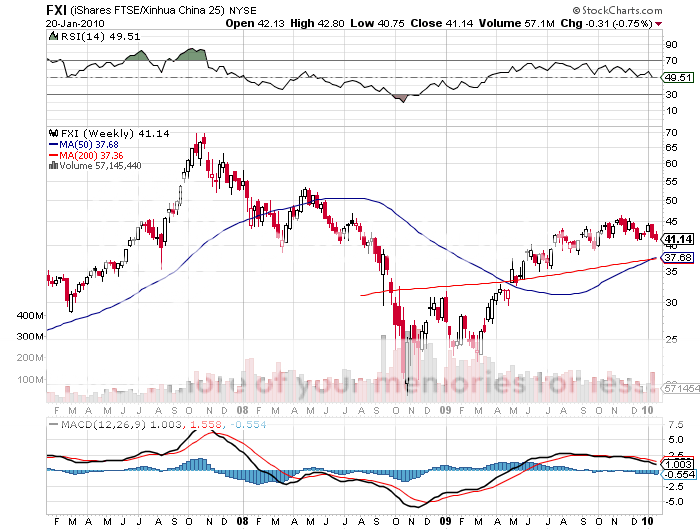

Featured Trades: (FXI), (GOOG), (WFC), (EL NINO)

?

?

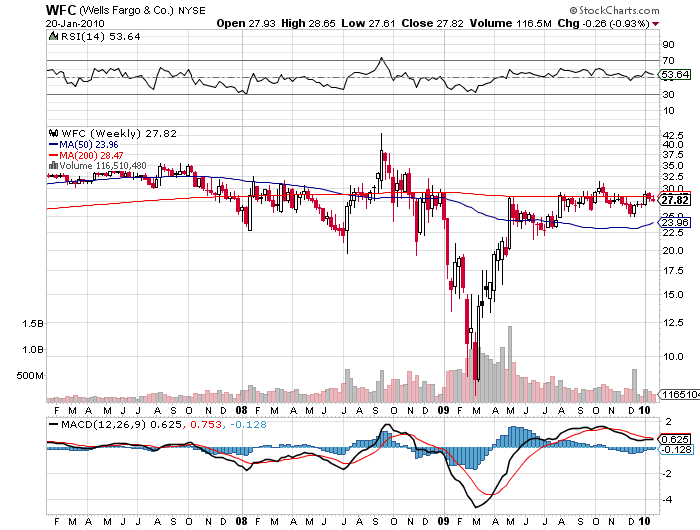

2)I caught an interesting interview with Howard Atkins yesterday, the CFO of Wells Fargo (WFC), gaining some insight into what is probably the best run big bank in the US. Profits soared to a record $12.9 billion in 2009, thanks to top line? revenue growth across the board in an incredibly well diversified portfolio of businesses, including insurance, brokerage, investment banking asset management, credit cards, consumer lending, and of course, home mortgages. The bank originated a breathtaking $94 billion in mortgages in Q4 alone, giving it a 25% share of the total US market. It basically stole Wachovia Bank at the height of the financial crisis, and immediately wrote down its loan book to a fraction of its face value. Loan losses in Q4 jumped from $2.9 billon to $5.4 billion, and that number will taper in 2010. But the bank is fortunately making money fast enough across all its businesses to healthily write off future losses. That eliminates the need for any further capital raises in the foreseeable future, with key ratios stronger that pre crisis levels. I am avoiding the financial sector for all of the abundantly obvious reasons. But if I had to own one big American bank, WFC would be it. I also like the cute little stage coaches they have on their checks, and a TV add program that rides out of a Louis L?Amour novel.

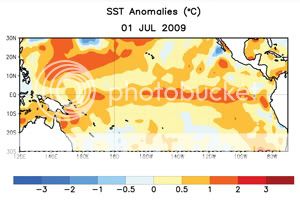

3) You?ll have to excuse me, but I?m sending my letter out early today so I can go over to my kids? elementary school and help fill sandbags to keep at bay the flooding brought on by California?s torrential rains this week. This morning I checked in with some old friends at the National Oceanic and Atmospheric Administration (NOAA) in Tiburon, California, located at the abandoned Navy base that was home to the Golden Gate Bridge?s antisubmarine net during WWII.? They warned me that our El Ni??o winter (check their site ) could deliver a drenching 10 inches of rain this week, in a state that normally sees 20 inches a year. So named because all of the fish disappeared off the coast of Chile one Christmas years ago, El Ni??o?s are caused by a sudden warming of ocean temperatures in the Central and Eastern Pacific, which lead to unusual weather patterns here. During the last El Ni??o in 1998, the rainfall in San Francisco soared from 20 inches to 100 inches, the American River dykes broke, railroads were destroyed beyond repair, the Sierras got pelted with 40 feet of snow, and species of fish like mahi mahi normally found in Hawaii suddenly hit the hooks of delirious fishermen in San Francisco Bay. Australia endured a terrible drought. This could all be great for wheat prices and bad for insurance companies, and no doubt this is one of the painful dividends of global warming.

?Easy money is the mother?s milk of speculation,? said ?Trader Mark,? publisher of the hugely successful investment website www.fundmymutualfund.com