The Global Impact of the New Japanese IRA?s

Nearly two years ago, the Japanese government introduced the Individual Retirement Account for individual investors in Japan for the first time.

The move was part of Prime Minister Shinzo Abe?s multifaceted efforts to revive Japan?s economy, and could unleash as much as $690 billion in net buying into Japanese equities by 2018.

The move was inspired by American IRA?s, which were first introduced in 1981. After that, the Dow average soared by 25 times. It is amazing to what lengths people will go to avoid the taxman.

Starting October 1, 2013 individuals have been permitted to contribute up to ?1 million a year into Nippon Individual Savings Accounts (NISA) or some $8,000, while married couples can chip in ?2 million.

These funds are exempt from capital gains and dividend taxes for five years. At the same time, capital gains taxes will rise from 10% to 20%.

Thanks to a 22-year long bear market, only 7.9% of personal assets in Japan are currently invested in stocks, compared to 34% in the US. Individuals account for only 28% of the daily trading volume in Tokyo, while foreigners take up 63%. Still, that?s up from only 21% a year earlier.

Over the past 10 years, individuals sold a net $214 billion in equities, keeping their eyes firmly on the rear view mirror. Almost all of the funds were deposited into bank accounts yielding near zero.

Even 10 year Japanese Government Bonds are yielding only 0.41% as of today. That doesn?t buy you much sushi in your retirement.

Over the past three years, Japan has enjoyed having the world?s fastest growing industrialized economy. The latest data show that it is expanding at a white hot 3.5%, versus a far more modest 2% rate in the US, and only 0.5% in Europe.

Early indications are that the NISA?s are hugely popular. Japanese brokers have launched a massive advertising effort to promote the program, which promises to substantially boost their own earnings. Firms have had to lay on extra customer support staff to assist with online applications, where clueless investors have spent two decades in hiding. That certainly makes Japanese brokers, like Nomura (NMR), a buy. Another of my favorites is Sony (SNE).

To get some idea of the potential, take a look at how Merrill Lynch?s stock performed after 1981, which rose by many multiples. The bear market has lasted for so long that many applicants confess to investing in equities for the first time in their lives.

Since Shinzo Abe announced his candidacy for prime minister and his revolutionary economic and monetary program nearly four years ago, the Japanese stock market (DXJ) has soared by an amazing 176% in US dollar terms. The short Japanese yen 2X ETF (YCS) has similarly rocketed by a huge 232%.

Regular readers of the Mad Hedge Fund Trader have been mercilessly pounded to buy Japanese stocks and sell short the Japanese yen for the best of three years. I can almost hear ?Oh no, here comes another yen bashing piece!?

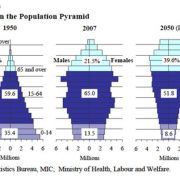

The need to bolster Japan?s retirement finances is overwhelming. It has the world?s oldest population, with some 26% of their 127.6 million over the age of 65.

The average life span in Japan is 82.6 years. That is a lot of people to support for a $6 trillion GDP. Thanks to plummeting fertility rates, the population is expected to decline to 106 million by 2055.

By yanking $690 billion out of the banks and moving out the risk spectrum, Abe?s new IRA?s provide additional means through which the economy can permanently return to health.

Higher stock prices will provide cheap equity financing for public companies, which can then reinvest in the domestic economy and create jobs.

I have written endlessly on the fundamental case for a strong Japanese stock market this year (to read my previous articles on yen, please click the following links: ??Rumblings in Tokyo?, ?New BOJ Governor Craters Yen??and ?New BOJ Governor Crushes the Yen?).