July 15, 2010 - Why the World's Worst Economy Has the Strongest Currency

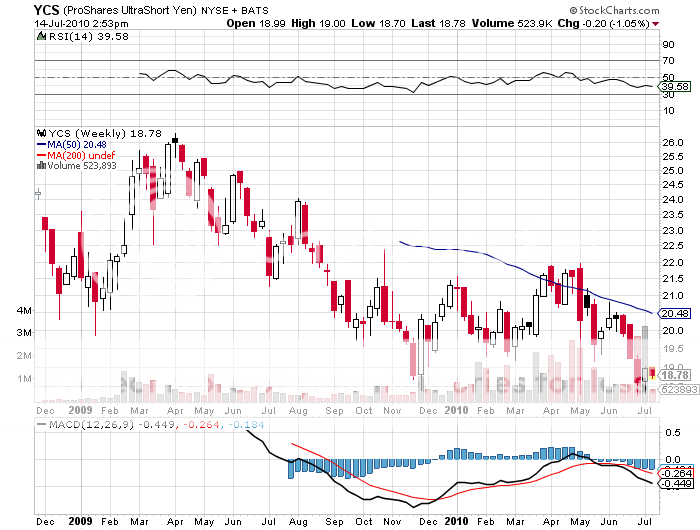

Featured Trades: (FXJ), (YCS)

Currency Shares Japanese Yen Trust ETF

ProSharesUltraShort Yen ETF

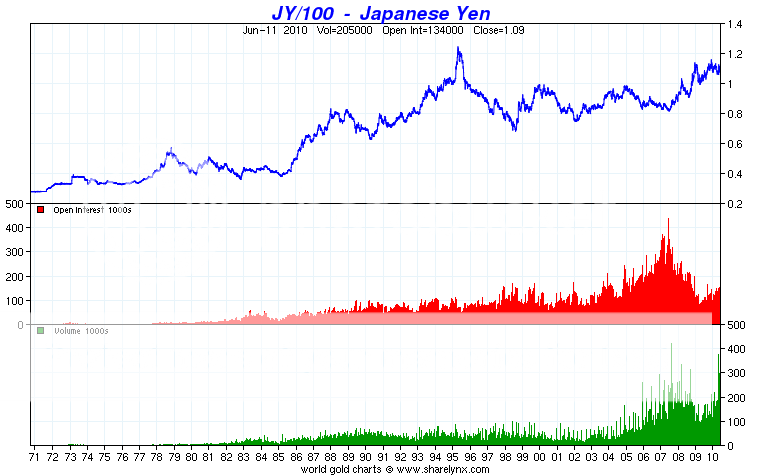

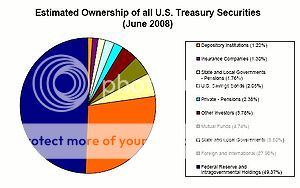

2) Why the World's Worst Economy Has the Strongest Currency. Global currency traders remain puzzled by the continuing strength of the yen (FXY), (YCS), which broke out of a ?90- ?95 range a few weeks ago and insists on levitating around the ?87-?89 area. Looking at the fundamentals, you would not pick Japan to possess one of the world's most virile currencies. It runs one of the planet's largest and most rapidly climbing budget deficits, suffers a demographic nightmare of epic proportions, and lives in the shadow of China, which surpassed it in GDP this year to become number two. It produces a tenth of the Middle Kingdom's new per capita GDP. And the ruling Democratic Party of Japan (DPJ), which promised to weaken the yen, just took an absolute pasting at the polls. The reason is simple: the fundamentals are so poor, that no one owns the yen, and therefore, can't sell it. Central bank holdings of the Japanese currency have been plummeting for years, and are now thought to be around 10% of the total. Japan's 15 year old zero interest rate policy made it unattractive when the others were yielding 5%-6%. Now that all the major currencies yield close to nothing, the playing field is level. While the government has been a massive issuer of debt, thanks to the country's high savings rate some 95% is held domestically, unlike the US, where more than 28% is owned by foreigners. You don't hear rumors of China threatening to dump its JGB holdings, because they own virtually none. Japan's notoriously anemic long term growth rate of a minuscule% hasn't exactly seduced managers to pack their portfolio with yen assets. Risk reducing hedge funds buying yen to unwind carry trades has been another dynamic at work (click here for an explanation). But it doesn't look so bad if you think that the US growth rate is about to double dip into negative numbers. Yen bulls, and yes, there are such people out there, are hoping for a run to the 1996 high of ?85, and even an overshoot to the all time high of ?79.5. If that happens, you can kiss the Nikkei goodbye, and watch 10 year Japanese bond yield touch 0.45% once again. This is one slugfest that I prefer to watch from the sidelines. I think the long term trend of the Japanese currency is down from here, and won't own it here on pain of death.