July 20, 2009

July 20, 2009 Featured Trades: (GE), (GS), (SPX), (FXI), (EEM), (TBT), (USO), (DBA)

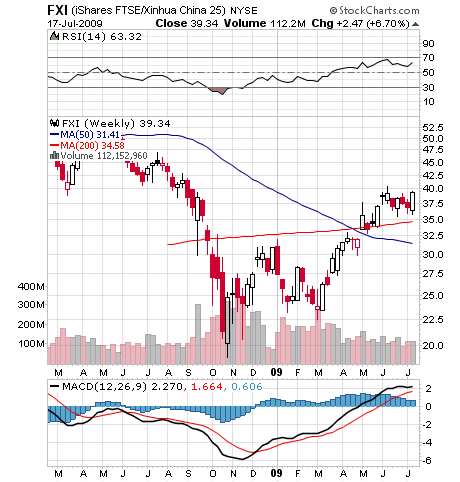

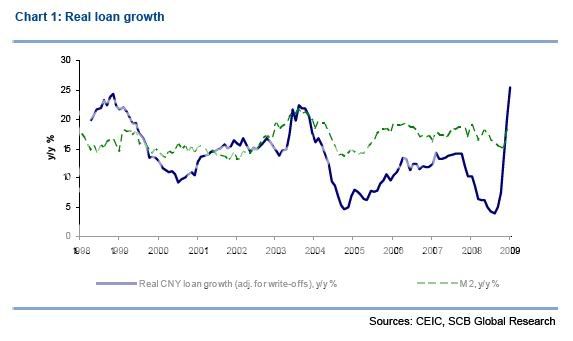

1) China?s National Bureau of Statistics announced the data for the only country that matters right now, showing that Q2 GDP growth came in at 7.9%, much better than expected. The Middle Kingdom?s gold and foreign currency reserves soared to a new record of $2.13 trillion. The main impetus has been the country?s $586 billion stimulus program announced earlier this year, which unlike our own, seems to be delivering immediate and impressive results. New bank lending in China is through the roof, thanks to aggressive government prodding. The China ETF (FXI) had a great week, and is now up 74% from my New Year recommendation. Potentially, of far greater importance, is China?s decision this week to liberalize foreign capital outflows, a development that went virtually unreported in the Western press. This will make billions of dollars available for direct investment in foreign advanced technology and crucial natural resources. It also means that less cash will be available for investment in US Treasuries, an asset class the Chinese are clearly tiring of. For an in depth discussion of this important reform, please read Keith Fitz-Gerald?s excellent piece .

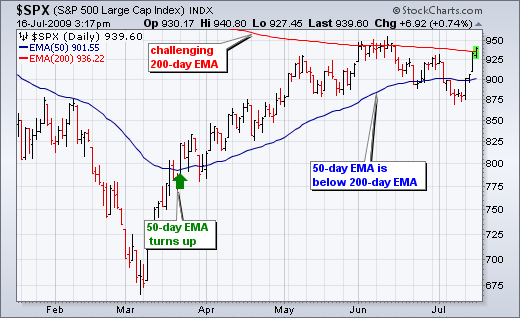

2) ?Please ignore everything I told you a week ago? was the sorry message I received from multiple technical analysts over the weekend, as they updated their weekly charts. Last week they told you it was going down, and now they are telling you they don?t know. Unfortunately, these days markets are so interlinked that if you get one wrong, you get them all wrong. So the short squeeze in the S&P 500 (SPX) last week triggered a big sell off in the dollar and Treasury bonds (TBT), and healthy rallies in emerging markets (EEM), commodities (DBA), crude (USO) and other reflation instruments. This kind of bipolar, manic-depressive type of trading may be a feature of capital markets for years, if not decades to come. Technical analysts and day traders rule when nobody else cares and volumes are low. I watched the Nikkei trade a 14,000-21,000 range for ten years, with dozens of furious short covering rallies followed dependably by slow bleeds, until it finally broke down to the high 6,000s, off 85% from the top. Keep those stop loss orders permanently in place, and fasten your seat belts, or stay away.

3) I was sad to hear that Walter Cronkite passed away, but who?s to argue with going short at 92? Sounds like a great trade to me. I had the rare pleasure of spending time with Cronkite during one of his many trips to the Foreign Correspondents Club of Japan in the seventies. He was then considered a God in the journalism fraternity, one of the founders of the broadcast industry, a co-worker with Edgar R. Morrow, and one of the few surviving war correspondents from WWII. Yet, he still had the generosity to take the time to give me some good advice on how to move my struggling career as a writer forward, while I was still unknown, starving, and clueless about the realities of this hard ball business. He was much more fun off screen, always carried this impish smile, and seemed to view life as one great long night out with the boys. Later in life, he bemoaned the perversion of his industry from news to entertainment for profit, and despised the shouting, uninformed talking heads that cable TV foisted upon us. Cronkite only expressed one opinion on air during his career, and that was that the US should get out of Vietnam. The world will be more opinionated, shrill, and poorly informed without Cronkite.

4) I am frequently asked where I find my best sources of market data. Well here they are: Saturday Night Live, David Letterman, and the Jon Stewart Show. Unfortunately, Jay Leno retired and won?t be back until his new show starts in September. I?ve found my investment returns are much better when I keep the Comedy Channel on all day, instead of CNBC, which is basically a giant fan club for its owner, General Electric (GE). How else would I know that Jim Cramer argued vociferously that Bear Stearns wouldn?t go under, or that Dora the Explorer had been appointed to the Supreme Court? For a perfect example of this, take a look at this video clip outlining John Stewart?s take on the Goldman Sachs (GS) earnings.

QUOTE OF THE DAY

?The rate of profit is always highest in the countries that are going fastest to ruin,? said Adam Smith, on the dangers of ?overtrading? in The Wealth of Nations.