June 15, 2009

June 15, 2009Featured Trades: (CVX), (CRUDE), (NLR), (CCJ), (EDF SA), (GOLD), (CRUDE)

1)I heard a little tidbit yesterday that makes me feel like I just ate a bad fish taco. Frontline, the world?s largest tanker company, says that it has 100 million barrels in storage, the equivalent of five days of US consumption, the result of the spectacular contango situation that exists in the crude futures market. Traders have been buying front month crude, storing it, and reselling it one year out for non leveraged profits of up to 75%. With spot now at $72.12, and futures for December delivery selling at $75.56, that spread has narrowed to an annualized 9.53%. The last crude top was made by the filling of the Strategic Petroleum Reserve. Could this intermediate top be put in by the filling of the world?s excess tanker fleet? This makes me worried not just about crude, but all of my longs in commodities and their producing stocks, the S&P 500, the BRICK?s, and everything else that has enjoyed a torrid doubling since the beginning of the year. Could gold?s poor performance this week, which dropped from $990 to $935, be the canary in the coal mine? And by extension, is it time to take profits on my short Treasury positions by selling the TBT, which has also doubled? There are just too many charts hanging around their 200 day moving averages to dismiss this lightly. I hate to sound redundant, but selling in May is looking more clever by the minute. Cash is King.

2)After spending time with the Sierra Club last week, I thought I?d pop next door to San Ramon and get the other side of the story from Dave O?Reilly, CEO of Chevron (CVX). The original Standard Oil of California and one of the Seven Sisters, Chevron has a storied history. It discovered the Ghawar field in Saudi Arabia in the thirties, the world?s largest, and later took over Gulf Oil (from Paul Getty), and Texaco. It is now the largest company in California.?? David says the world needs 245 million barrels/day to function. The problem for the US is that over the last 20 years demand has increased by 4 million b/d, while depletion has cut domestic production by 4 million b/d. The 8 million b/d gap can only be met with imports, which is why Chevron now earns 75% of its earnings from overseas, doing battle with Nigerian rebels and uncooperative foreign governments. The net net is that oil prices are going up. All alternative sources will need to be developed to deal with this widening gap, be it wind, solar, biofuel, or nuclear. Chevron is in fact the world?s largest producer of geothermal energy, accounting for 2% of its total supplies, is also the state?s largest installer of solar panels, and has invested $300 million in biofuel research. This is more than just ?feel good? money. The real impediment is that capital turnover in the energy industry is extremely slow. Coal fired power plants can last a century, and our 245 million cars last 15-18 years. Some of today?s low mileage clunkers will still be on the road in 2030. Even with the best efforts, Chevron will get three quarters of its revenues from oil in 2050. There is 100 years worth of investment in our current energy infrastructure and it won?t be replaced overnight. We will be lucky if we can cut CO2 emissions by 25% by 2050, a far cry from the Sierra Club?s 90% goal. The quickest way to cut emissions is to convert our coal fired power plants to natural gas. When Chevron took over Texaco in 2001, it inherited its legal headache in a $27 billion lawsuit over clean up of the Lago Agrio field in Ecuador, a hot button with environmentalists. Now David, a modest Irish engineer who came up through the research side of the company, has to be escorted by bodyguards at public events.

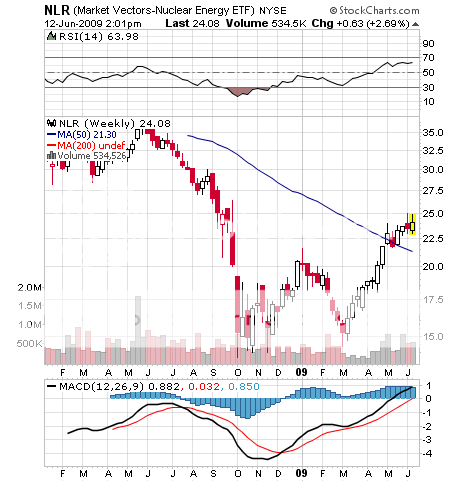

3) The seventies are about to make a comeback. No, don?t drag your leisure suits, bell bottoms, and Bee Gee?s records out of your storage facility. I mean the nuclear industry, which has been in hibernation since the accident at Three Mile Island in 1979. There is absolutely no way we can deal with our energy crunch without a huge expansion of our nuclear capacity, which sits at a lowly 20% of our power generation. France has already achieved this, getting 85% of its electric power from nuclear, followed by Sweden at 60%, and Belgium at 54%. Unless you?re a nuclear engineer, you are probably unaware that the technology has moved ahead four generations. The first one produced the aging behemoths we now see on coasts and rivers, which used high grade fuel that would melt down if someone forgot to flip a switch. Generations two, three, and four never got off the drawing board. Generation five is not your father?s nuclear power plant, relying on a new form of fuel embedded in graphite tennis balls that is just strong enough to generate electricity, but too weak to risk a disaster. This eliminates the need for four foot thick reinforced concrete containment structures, which accounted for 50% of the old design?s cost. Low grade waste can be stored on site, not shipped to Nevada or France. The permitting process is being shortened from 15 years to four by confining new construction to existing facilities instead of green fields, urged on by a less fearful public and even some CO2 conscious environmentalists. At least 30 new reactors are expected to start construction in the US over the next five years, and over 90 in China. There has got to be an equity play here. The Market Vectors Nuclear Energy ETF (NLR), which has jumped an impressive 78% to $25 since March, is the easiest way in. You can also buy its largest components, like Cameco (CCJ), the world?s largest uranium producer, or ??lectrict?? de France (EDF SA) which has the monopoly in France and is developing a major export business.

4) I can tell you right now that cap and trade is going to win the political battle over a carbon tax, hands down. Don?t waste a nanosecond of your time even thinking about it. Nobody wants to be tarred with pushing a new tax, and Wall Street is gearing up to make a fortune in the new trading vehicle. Europe has already adopted the system, and a Paris based exchange called Bluenext, partnered with NYSE Euronext, trades Certified Emission Reduction credits (CERS?s). Some 4-6 million CER?s trade each day worth $50-$75 million. After peaking last year at ???30, CER?s crashed to ???7.5 in February and then bounced to ???12.72 today. They are traded in 1,000 unit lots, and are backed up with far month futures contracts. Check out their cool website at http://www.bluenext.eu/. Morgan Stanley and Goldman Sachs have already set up trading operations in the instrument. The EC government grants CER?s to green companies, which them sell them to big polluters, which must buy them to expand thei

r business. The costs are passed on to consumers. The system contributed to a 3.8% reduction in CO2 emissions in Europe last year. The current world market for carbon credits is $126 billion, but if the US joins the system that will jump by $1 trillion. I was involved in the creation of the Japanese equity warrant market in the early eighties, and I can tell you that new, poorly understood markets with spreads wide enough to drive a truck through are a license to print money for the early players. Perhaps there is hope after all for the legions of traders, market makers, brokers and analysts left unemployed by last year?s collapse.

QUOTE OF THE DAY

?Le laisser-faire, c?est fini,? said French President Nicolas Sarkozy, as only he can say it.