June 25, 2009

June 25, 2009 Featured Trades: (SPX), (F), (NSANY), (GMX), (PCG), (FSLR), (STP), (SPWRB)

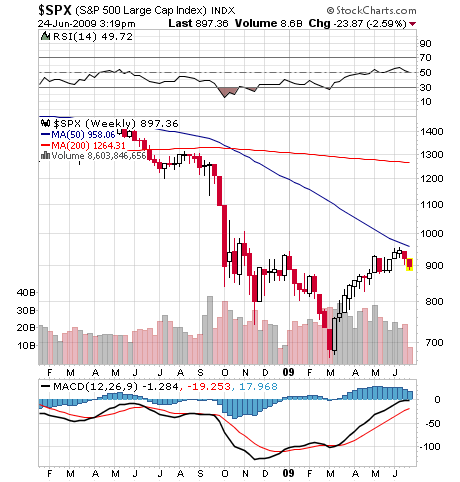

1) Now that we are solidly into a correction, I have been flooded with requests from readers to call the next bottom in the S&P 500. Well here it is. Brace yourself. Put it on a Post-it-Note on your computer. It is without a doubt and unquestionably going to be 880, 850, 830, 800, 750, 666, or 320. That last number works out to be 90% of the book value of the S&P 500, which was the low seen in the 1930s depression. Yes, that depression, not this one. You are really asking me to solve a one billion variable equation, because that is the number of direct and indirect participants in global stock markets. If the few green shoots out there start to die off, the meltdown in commercial real estate accelerates, the Fed missteps by draining liquidity too soon, or there is another unforeseen shock to the system, then you can go with the lower of these numbers. If we are distracted by the health care debate, emerging market economies continue to perk up, and this strength helps our technology stocks stay alive, then sleepy narrow trading ranges will dominate, and the higher support levels will hold. But no matter what happens, I will be able to come back to you in three months and claim that I was right.

2) What is the new normal? This is the debate that is raging in hedge fund research departments around the world. I?m afraid that today?s equity investors are not taking into account some unpleasant new realities. The last thirty years have seen an average PE multiple of 15 times, and peaked at 20 times during the really great years. Unfortunately, this multiple expansion was fueled by an explosion in leverage. Even companies that hated debt had to drink the Kool-Aid to compete. Now we are moving in reverse on the leverage front double time. Debt/EBIDTA has shrunk from three times to two times in just two years. Even if corporations want to leverage now, they can?t, because the lenders have gone missing. If you wean the patient off of steroids, shouldn?t this mean that the range of PE multiples is permanently downsized? Should the new normal of 1-2% economic growth and an ?L? shaped recovery demand an average of only 12 times, 10 times, or Heaven forbid, the eight times low we endured in the seventies? Logic like this makes today?s 13.4 multiple look frightening rich, and the stock market insanely expensive.

3) There is something that really irks me today about the government?s announcement of the first of the loan guarantees promised by its $25 billion Advanced Technology Vehicles Manufacturing Incentive Program. Ford (F) will get $5.9 billion, Nissan (NSANY) $1.6 billion, and Tesla Motors $465 million. The money will be used to boost fuel efficiency through the development of battery power systems that can be competitive with those coming out of China (see my piece on BYD.) Have the Feds got this ass backwards or what? Imagine what Tesla could do with $5.9 billion? They could take advantage of economies of scale to build an entire new, all electric auto industry from scratch in California, creating tens of thousands of manufacturing jobs. Droves of auto engineers would happily vacate the frozen industrial wasteland that is Michigan for the sunny climes of California, and might even take up eating bean sprouts. This would accelerate the creative destruction that has to happen before the US auto industry can move forward. The money in question is equivalent to the two months worth of negative cash flow that General Motors (GMX) is currently burning. Why not invest in the future, instead of bailing out the buggy whip makers? The Chinese must think we?re nuts, but will happily clean out our pockets, as long are we are in this diminished condition.

4) I have been covering the solar industry for nearly 40 years now, and for most of this time it has only been economic in space stations. But times are changing. If you look carefully at your electric bill and calculate the cost per kilowatt hours each month as I do, you will notice that the price has been going up for the last ten years. This is partly because of ineptly handled deregulation, but also because our utility, Pacific Gas & Electric (PCG) is mandated by state law to reduce greenhouse gas emissions. Last year, the collapse of the economy and crude prices drove the cost of thin film solar?s primary raw material, polysilicon, down dramatically. The cost curve is falling, the demand curve is rising, and it is only a matter of time before they cross. The gap now is only a few cents per kilowatt, and that can easily be bridged with government subsidies. This industry is on the verge of becoming truly profitable. All it might take is another rise in crude prices, something you can count on. Watch behemoth First solar (FSLR) position itself to cash in, as well as Suntech Power (STP) and SunPower (SPWRB). But also watch the volatility, as this is definitely an ?E? ticket ride.

QUOTE OF THE DAY

?When we declared war in 1941 there were not 8,000 earmarks attached,? said Warren Buffet, in chiding congress in its handling of the economic crisis.