More Term LEAPS to Buy at the Bottom

The final bottom in this bear market is fast approaching. It may come in weeks or months. After the cataclysmic meltdown in March, markets are becoming more orderly and tradable. What does this mean for LEAPs?

It means the next bid dip in share prices is the one you want to buy.

Readers have been besieging me with more ideas on long term LEAPS to buy at the next bottom. So, here is another generous serving of red meat.

I am often asked how professional hedge fund traders invest their personal money. They all do the exact same thing. They wait for a market crash like we are seeing now and buy the longest-term LEAPS (Long Term Equity Participation Securities) possible for their favorite names.

The reasons are very simple. The risk on LEAPS is limited. You can’t lose any more than you put in. At the same time, they permit enormous amounts of leverage.

Two years out, the longest maturity available for most LEAPS, allow plenty of time for the world and the markets to get back on an even keel. Recessions, pandemics, hurricanes, oil shocks, interest rate spikes, and political instability all go away within two years and pave the way for dramatic stock market recoveries.

You just put them away and forget about them. Wake me up when it is 2022.

I put together this new portfolio using the following parameters. I set the strike prices just above the all-time highs set in February. I went for the maximum maturity. I used today’s prices. And of course, I picked the names that have the best long-term outlooks based on our own intensive in-house research.

You should only buy LEAPS of the best quality companies with the rosiest growth prospects and rock-solid balance sheets to be certain they will still be around in two years. I’m talking about picking up Cadillacs, Rolls Royces, and even Ferraris at fire-sale prices. Don’t waste your money on speculative low-quality stocks that may never come back.

If you buy LEAPS at these prices and the stocks all go to new highs, then you should earn an average 400% profit from an average stock price increase of only 75%.

That is a staggering return 5.3 times greater than the underlying stock gain. And let’s face it. None of the companies below are going to zero, ever. Now you know why clever hedge fund traders only employ this strategy.

There is a smarter way to execute this portfolio. Put in throw-away crash bids at levels so low they will only get executed on the next cataclysmic 1,000-point down day in the Dow Average.

You can play around with the strike prices all you want. Going farther out of the money increases your returns, but raises your risk as well. Going closer to the money reduces risk and returns, but the gains are still a multiple of the underlying stock.

Buying when everyone else is throwing up on their shoes is always the best policy. That way your return will rise to ten times the move in the underlying stock.

If you are unable or unwilling to trade options, then you will do well buying the underlying shares outright. I expect the list below to rise by 50% or more over the next two years.

Enjoy.

Tesla (TSLA) - June 17 2022 $1,080-$1,100 vertical bull call spread at $4.00 delivers a 400% gain with the stock at $1,100, up 51% from the current level. The pandemic is vastly accelerating all trends. One big one is the migration from internal combustion engines to electric power where Tesla has a ten-year and expanding head start. Sales at its new Shanghai factory in the first country to recover from the Coronavirus are blowing away its most optimistic view. The Model Y small SUV at the end of this year is expected to be the company’s biggest-selling model ever.

CRISPR Therapeutics (CRSP) - January 15 2021 $85-$90 vertical bull call spread at $1.00 delivers a 400% gain with the stock at $85, up 77% from the current level. It’s shorter-dated than the others, but this was the longest maturity posted on my trading platform. CRISPR Therapeutics is the dominant player in gene-editing technology, which is key to many biotech developments going forward. That includes beating the Coronavirus. The stock is an incredible bargain at this level, off 36% from its all-time high.

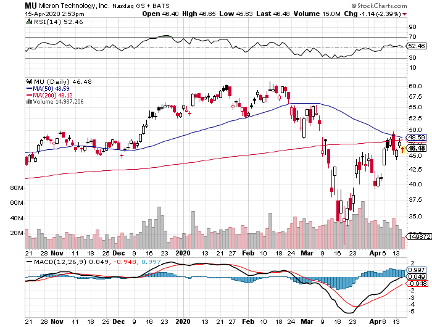

Micron Technology (MU) – January 21 2021 $85-$90 vertical bull call spread at $1.00 delivers a 400% gain with the stock at $90, up 96% from the current level. Coming out on the other side of the pandemic, there will be a massive global shortage of the computer chips that Micron Technology makes with already huge profit margins. A total no-brainer and I love visiting their Boise, Idaho headquarters.

To review my last list of Ten Long-Term LEAPS to Buy at the Market Bottom, please click here.

Yup, I Think I See Another Great LEAPS Opportunity