(MSFT), (AMZN), (GOOGL), (BIDU), (NVDA), (IBM)

I've been around the block a few times, and I've seen my fair share of tech revolutions - from the rise of the personal computer to the dawn of the internet. But nothing, and I mean nothing, has gotten me as fired up as the AI boom.

It all started back in the early 2010s. I was at a conference in Silicon Valley, rubbing elbows with some of the biggest brains in tech.

That's when I first heard rumblings about this thing called "machine learning." At first, I brushed it off as just another buzzword - something for the eggheads to geek out over.

But then I met this young hotshot named Andrew Ng. He was talking about how machines could learn to recognize patterns, how they could make predictions, and how they could even teach themselves to play complex games like chess and Go.

And it hit me like a ton of bricks - this wasn't just some passing fad. This was the future.

Fast forward to today, and that future is here. AI is no longer a niche academic pursuit - it's a trillion-dollar industry that's reshaping every facet of our lives.

Now, I know what you're thinking. "John, isn't this just another tech bubble waiting to burst?" And sure, I get it. We've all been burned before. But let me tell you something - AI is different.

This isn't just about some fancy new gadget or app. This is about a fundamental shift in the way we live, work, and do business.

Just look at the numbers. Global AI funding hit a staggering $93.5 billion in 2021, up from just $36 billion in 2020. That's a 160% increase in just one year.

And it's not just the Silicon Valley giants getting in on the action. Countries like China and France are pouring billions into AI research and development, racing to gain an edge in this new digital frontier.

Let’s focus on France for now. They've got homegrown heroes like Mistral AI and H turning heads and attracting big-name investors faster than you can say "bonjour."

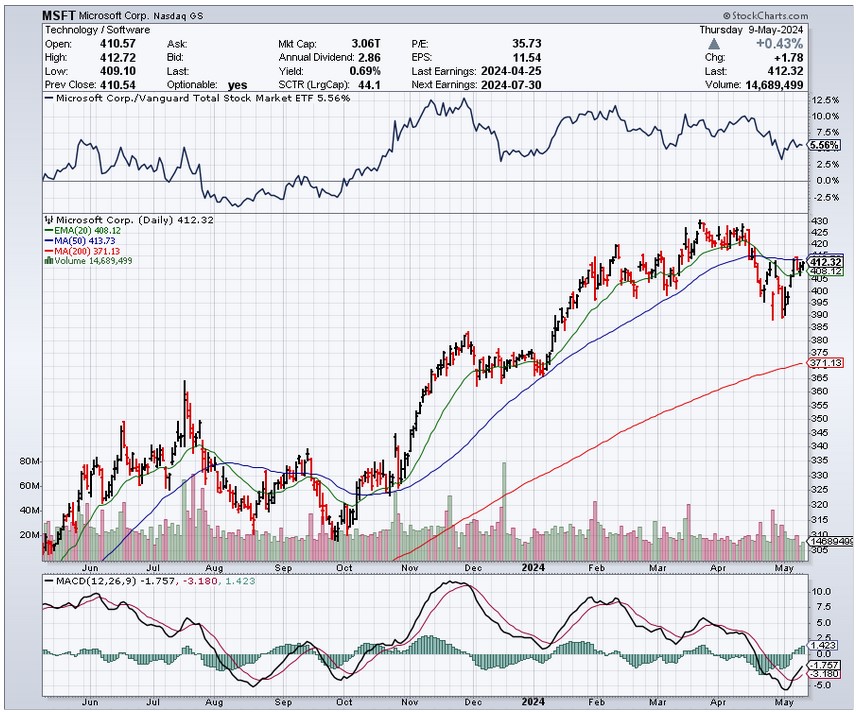

Mistral AI, backed by Microsoft (MSFT), is already flirting with a $6 billion valuation just a year after setting up shop.

And H? They've raised a staggering $220 million from the likes of luxury kingpin Bernard Arnault (aka the richest man in the world).

Even President Macron is getting in on the action, vowing to make France the undisputed king of the AI hill. He's throwing cash at research centers and promising to open "AI cafes" nationwide.

Can you imagine discussing the finer points of machine learning over a croissant? Sacrebleu!

But it's not just the French République making waves. US giants like Google (GOOGL), Amazon (AMZN), and China's Baidu (BIDU) are all in on the AI game.

And don't even get me started on NVIDIA (NVDA) and IBM (IBM). These companies are building the picks and shovels of the AI gold rush, and they're poised to make a killing.

So, what does this mean for us? It means we've got a once-in-a-generation opportunity on our hands.

The AI market is set to hit $1.8 trillion by 2030, growing at a mind-boggling 38.1% annually.

To put that in perspective, that's like the entire GDP of Canada, but just for AI. And it's not just one industry - AI is seeping into every nook and cranny of the economy, from healthcare to finance to transportation.

A recent survey by McKinsey found that 56% of companies are already using AI in at least one function, and that number is only going to grow.

And get this - by 2025, AI could be driving a whopping $15.7 trillion in global economic growth. That's more than the current output of China and India combined.

On top of all these, though, here's something else to consider: as the AI race heats up, governments are scrambling to figure out how to regulate this brave new world.

Some want to slam on the brakes, while others, like ex-Google boss Eric Schmidt, are urging Europe to step on the gas and invest like crazy.

In fact, the EU has already pledged to invest $21.758 billion per year in AI over the next decade.

So, here's my advice to you. Don't sit on the sidelines and watch this opportunity pass you by. Add those companies I talked about to your watchlist.

As for me? I may be an old dog, but I've still got a few new tricks up my sleeve. And you can bet your bottom dollar that I'll be right there in the thick of things, riding this AI wave all the way to the top.

See you on the other side.