In a move that could revitalize its growth strategy, Apple is reportedly developing its own line of dedicated artificial intelligence (AI) chips. This strategic shift comes amidst a broader slowdown in the tech sector and aims to enhance Apple products and services in a future dominated by AI-powered innovation.

The AI Imperative

Apple's interest in developing in-house AI chips reflects the growing recognition that AI is becoming essential for competitive technology products and services. AI fuels features like photo and image classification, voice assistants, personalized recommendations, and advanced computational photography. Currently, Apple relies on chips from suppliers like Qualcomm and Nvidia to power the AI capabilities of its devices. However, by developing its custom AI silicon, Apple could gain significant advantages:

- Performance and Power Efficiency: Apple could tailor its AI chips specifically for the workloads and computational needs of its devices, potentially leading to significant gains in AI performance while optimizing power usage.

- Tighter Integration: In-house AI chips would allow Apple to have deeper integration across its hardware and software, enabling seamless and more sophisticated AI-driven experiences.

- Cost Savings: Reducing reliance on third-party chip suppliers could potentially lead to cost savings over time, strengthening Apple's profit margins.

- Competitive Differentiation: Proprietary AI chips would allow Apple to differentiate its products with unique AI capabilities not found in competing devices.

A History of Chip Innovation

Apple has a proven record of developing its own custom chips, particularly its A-series and M-series chips that power iPhones, iPads, and Macs. These chips have consistently demonstrated superiority in performance and energy efficiency compared to off-the-shelf solutions. Building on this success, Apple appears poised to apply its chip-design expertise to the burgeoning realm of AI acceleration.

The Market Context

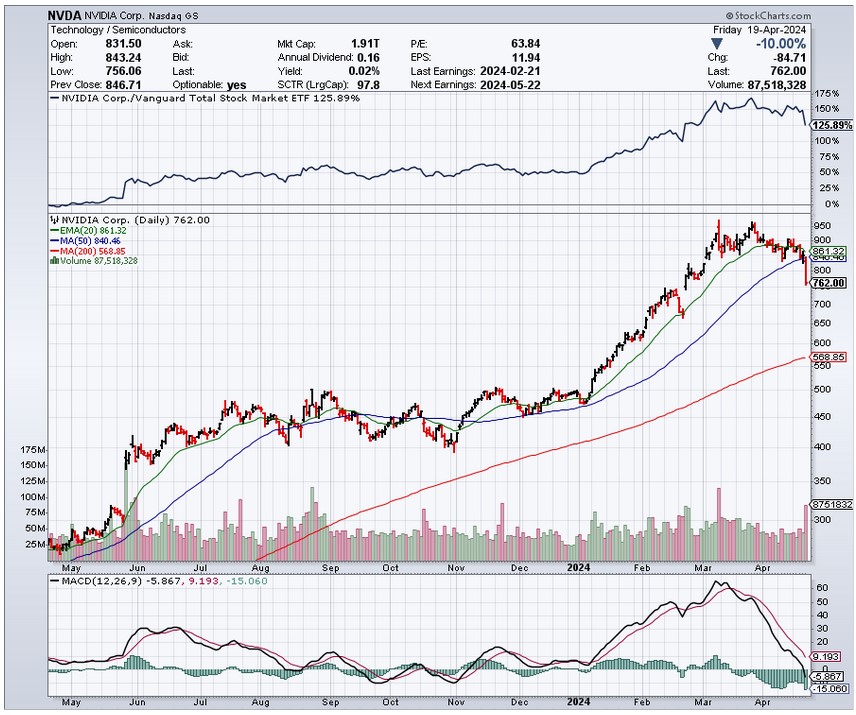

News of Apple's AI chip development emerges during a challenging time for the tech industry. The global economic slowdown, rising inflation, and supply chain disruptions have contributed to a market slump, with major tech companies experiencing slowing growth and declining stock prices. In response, many companies, including Apple, are scrutinizing their costs and investments focusing on high-potential areas.

Investing in AI represents a strategic bet for Apple. The global AI chip market is expected to witness explosive growth in the coming years, fueled by applications across various industries, including autonomous vehicles, healthcare, and smart manufacturing. By establishing a significant presence in AI hardware, Apple would position itself to capture a substantial portion of this burgeoning market.

The Competitive Landscape

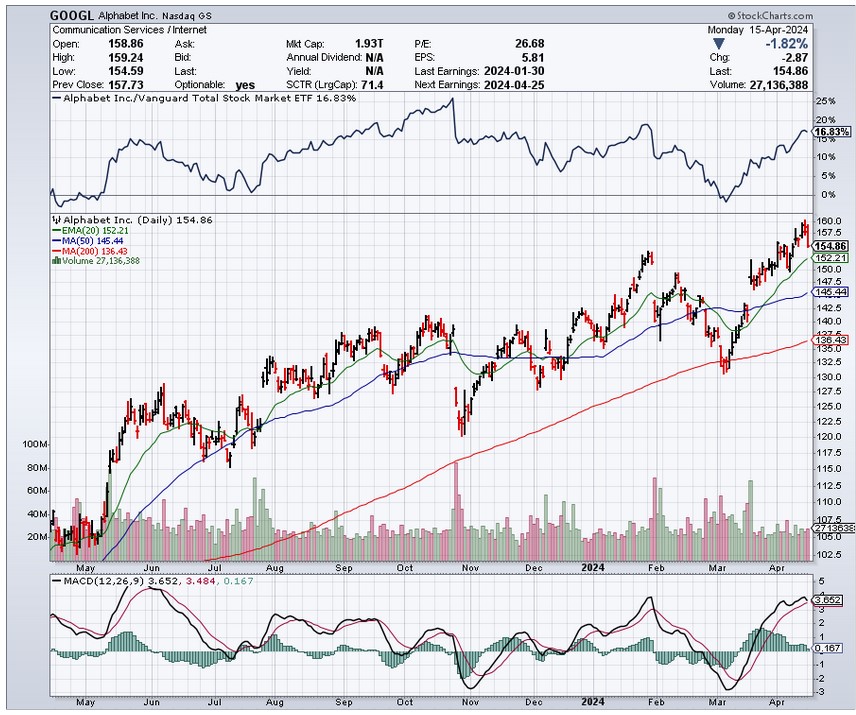

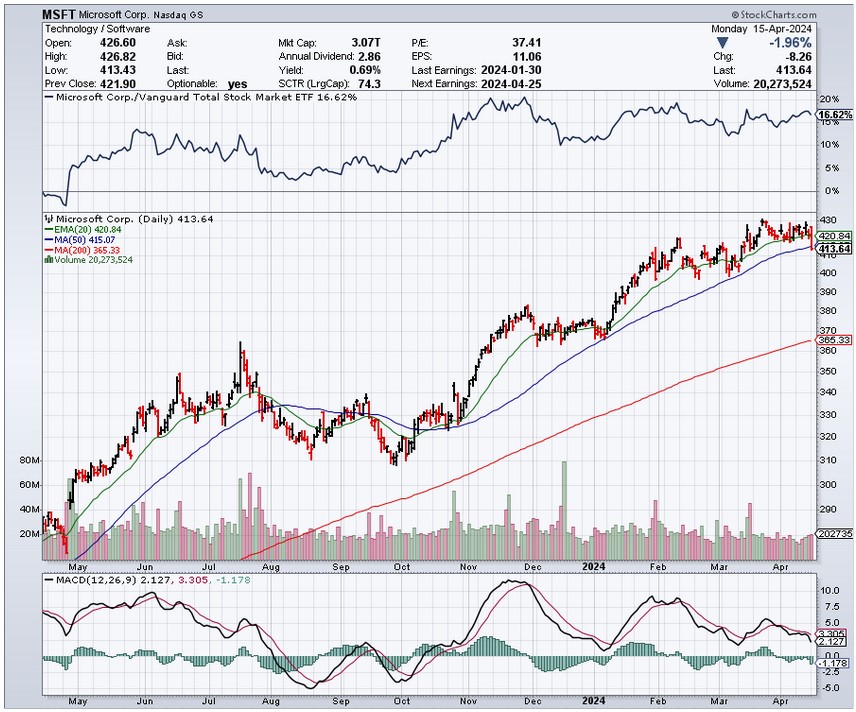

Apple's foray into AI chips intensifies competition in an increasingly crowded field. Tech giants like Google and Amazon have already developed custom AI chips for their cloud computing services and devices. Meta (formerly Facebook) is also heavily invested in the development of AI chips aimed at powering its Metaverse ambitions. Traditional chipmakers like Nvidia and Intel are equally committed to maintaining their dominance in AI hardware development.

Potential Impact on Apple's Ecosystem

Should Apple successfully develop its AI chips, the implications for its products and services would be notable:

- Enhanced Siri and AI-powered features: More powerful AI capabilities could supercharge Siri, making the voice assistant more intelligent and responsive, and unlock new AI-driven features across Apple's devices.

- Computational Photography and Videography: AI-powered cameras on future iPhones and iPads could take mobile photography and videography to new heights through image processing and computational effects.

- Augmented Reality (AR) Breakthroughs: On-device AI could enable new possibilities in AR, facilitating the development of more immersive and intelligent AR experiences.

Challenges and Considerations

Apple's path to becoming a leader in AI hardware won't be without challenges:

- The complexity of AI Chip Design: Designing high-performance AI chips requires specialized expertise and significant research and development expenditure.

- Talent Acquisition: Apple will need to attract and retain top engineers in the highly competitive field of AI chip design.

- Execution Risk: Successful execution is vital. Even with the right resources, there's always the risk that new chip projects may face delays or fail to achieve their desired performance targets.

Getting in on the AI market might be more important than ever for Apple, given the recent lackluster stock performance issues the company has seen.