Mad Hedge Technology Alerts!

Students hoping to become bankers shouldn’t study finance, they should dive into AI programming.

This is the big takeaway from how investment banks are run these days.

Gone are the moments when finance degrees were the hottest commodity, now it is all about generative AI.

Artificial intelligence (AI) could replace the equivalent of 300 million full-time jobs, a report by investment bank Goldman Sachs says.

It could replace a quarter of work tasks in the US and Europe but may also mean new jobs and a productivity boom.

And it could eventually increase the total annual value of goods and services produced globally by 7%.

Generative AI, able to create content indistinguishable from human work, is "a major advancement", the report says.

Silicon Valley is keen to promote investment in AI not only in the United States but in a way that will ultimately drive productivity gains across the global economy.

The report notes AI's impact will vary across different sectors - 46% of tasks in administrative and 44% in legal professions could be automated but only 6% in construction and 4% in maintenance, it says.

Journalists will therefore face more competition, which would drive down wages unless we see a very significant increase in the demand for such work.

Consider the introduction of GPS technology and platforms like Uber (UBER). Suddenly, knowing all the streets in London had much less value - and so incumbent drivers experienced large wage cuts in response, of around 10% according to our research.

The result was lower wages, not fewer drivers.

Over the next few years, generative AI is likely to have similar effects on a broader set of creative tasks.

According to research cited by the report, 60% of workers are in occupations that did not exist in 1940.

However, other research suggests technological change since the 1980s has displaced workers faster than it has created jobs.

Nobody understands how the technology will evolve or how firms will integrate it into how they work.

Lower wages and higher output are a perfect recipe for higher technology share prices and that is exactly what we will get.

Currently, we are experiencing a mild pullback from the AI mania, but that is simply because it got too far ahead of its skis.

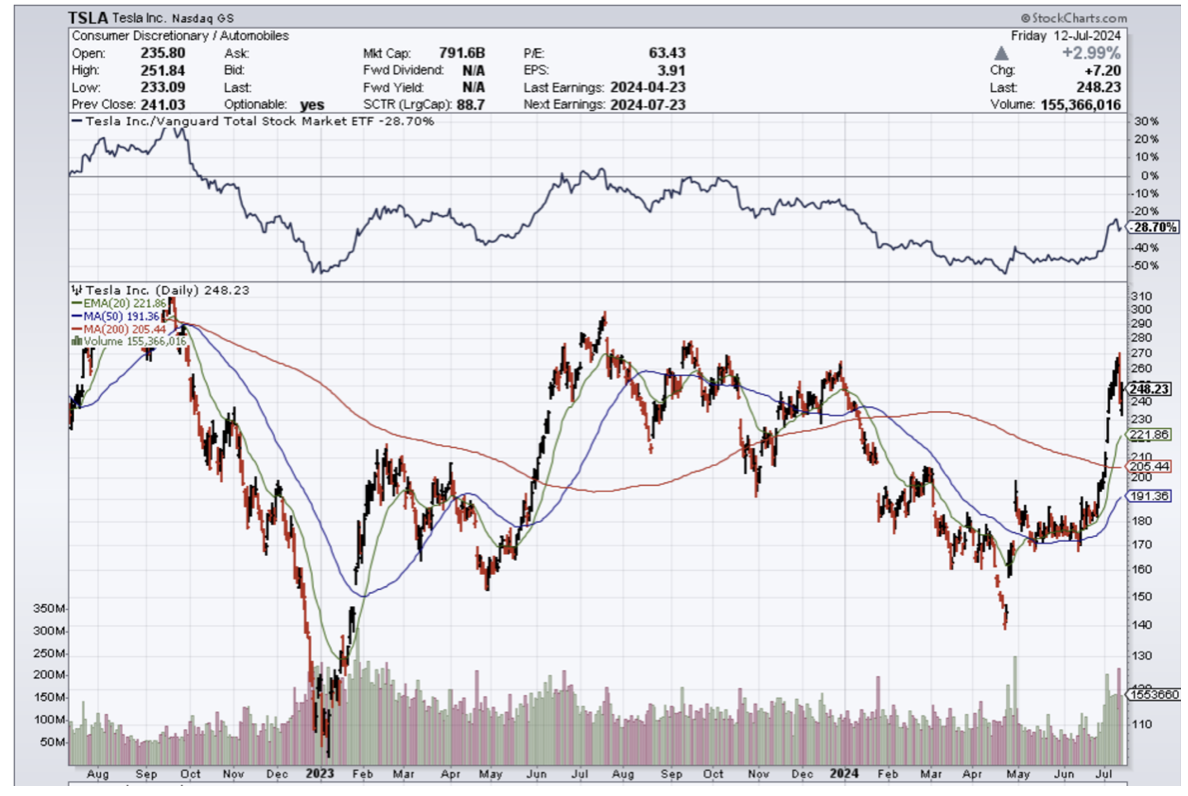

I am quite impressed by the price action in a stock like Tesla (TSLA) which executed a major cut to their global workforce to trim costs.

The staff cut of 10% could result in exactly what I mentioned in more output for less pay, but in terms of hiring more workers, they have decided to force less workers to do more.

This type of management decision increases efficiency because it forces workers to work smarter.

It’s certain they will be a major investor in AI chips to outfit their EV cars, and much of this corporate tech business is a feedback loops involving synergies with businesses overlapping.

Tech as a whole is not in trouble, but individual companies will find an imbalanced treatment of their stock.

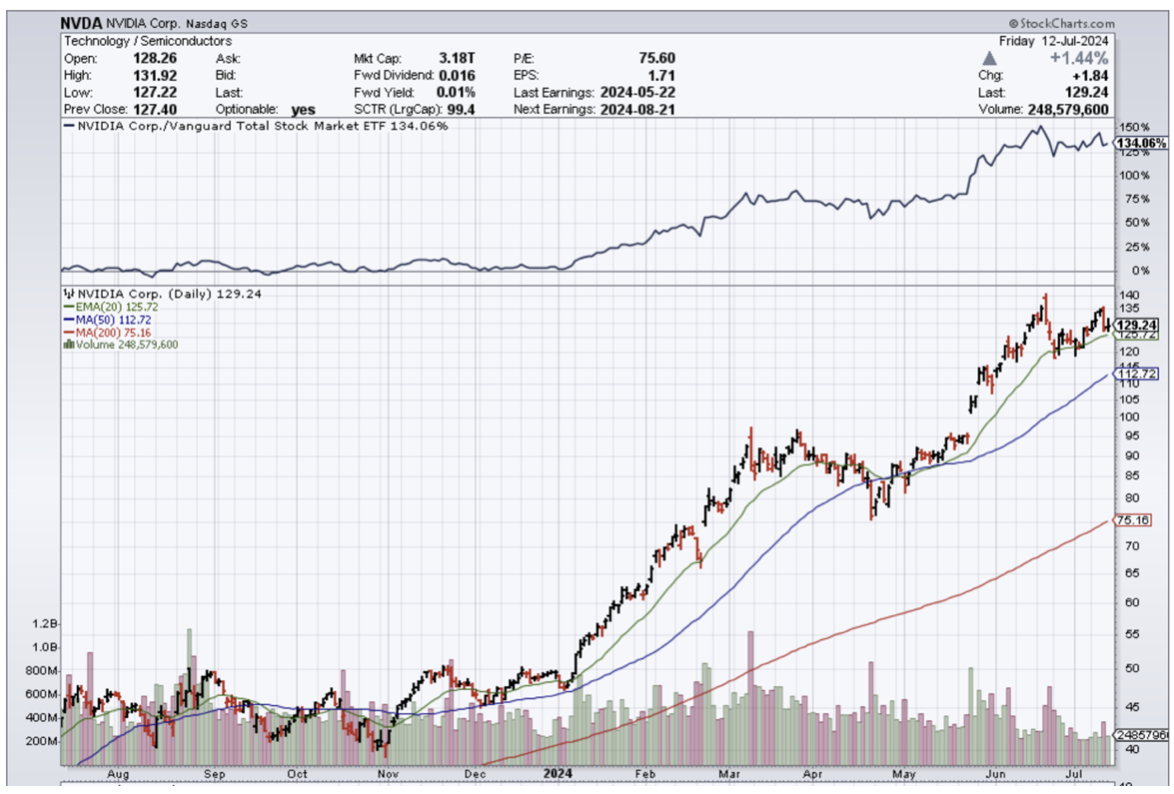

The AI pixie dust is still strong as many readers bought the shallow dip in Nvidia.

I do believe in the AI hype, and a lot of the price action is skewed toward just a handful of AI stocks.

My advice is to buy AI stocks on the dip and this increased efficiency will certainly filter down into the top and bottom lines.

Mad Hedge Technology Letter

July 12, 2024

Fiat Lux

Featured Trade:

(ROTATION HITS THE TECH SECTOR)

($COMPQ), ($TNX), (IWM)

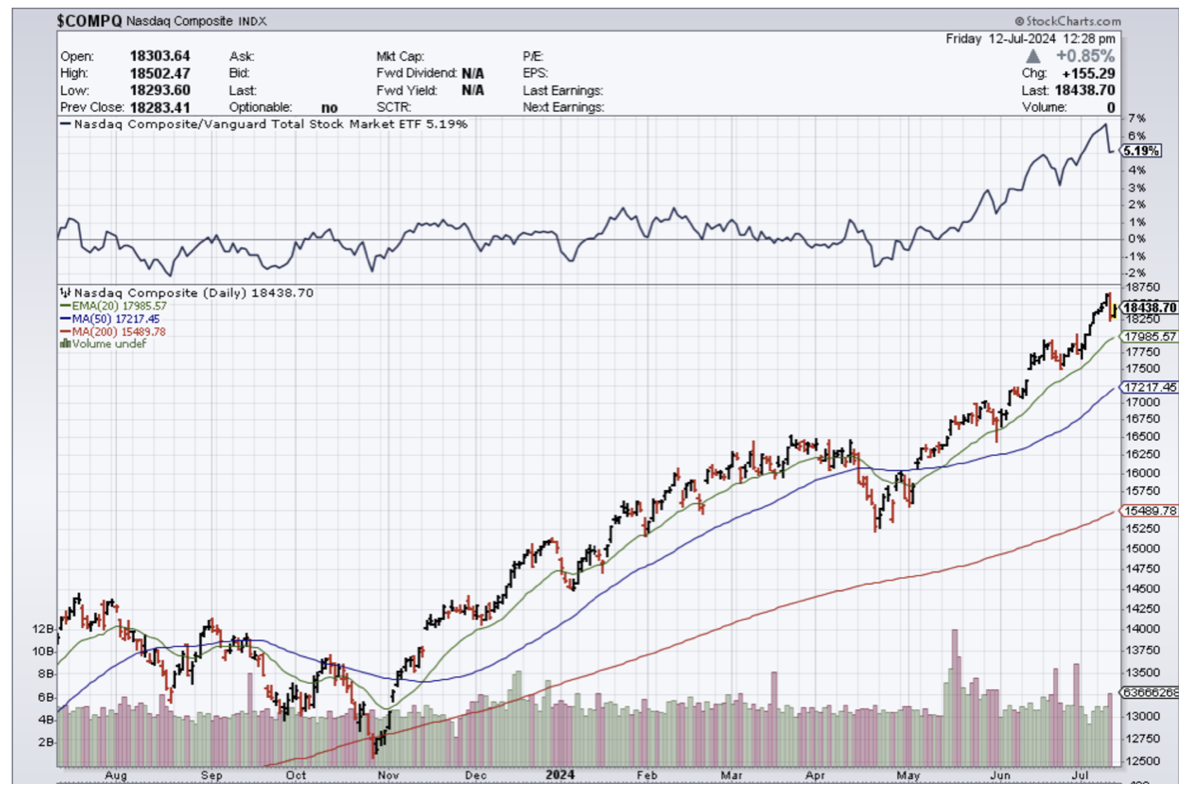

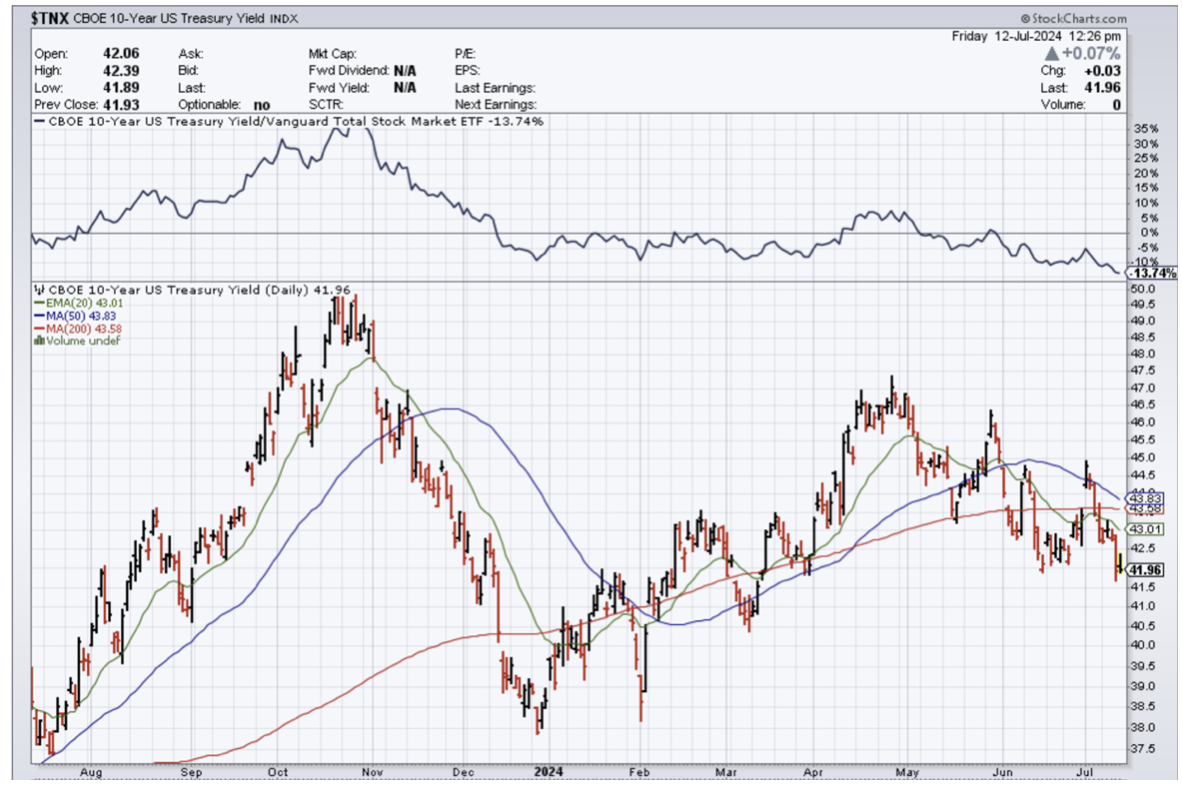

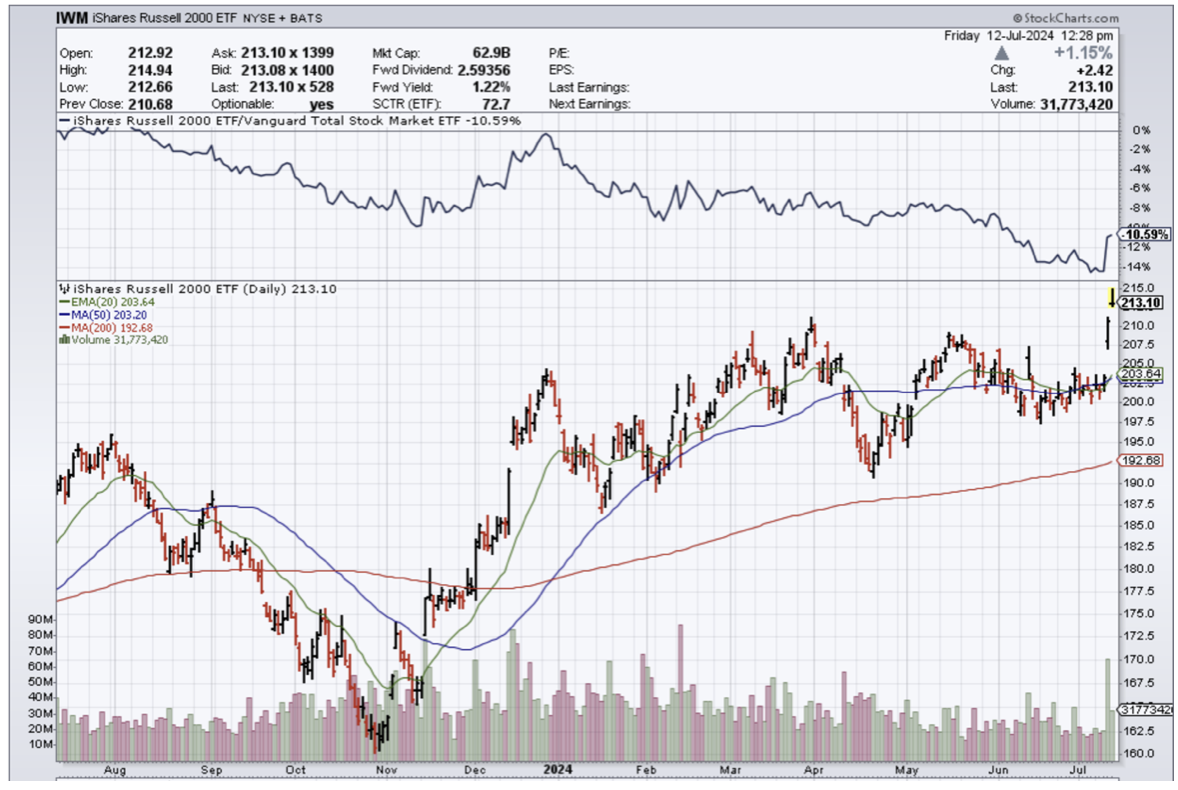

Bond yields ($TNX) diving and the market pricing in a 25 basis point rate cut in September surely translates into another swift leg up in tech stocks ($COMPQ), right?

Hold your horses.

The price action resulted in the exact opposite with big names like Tesla down over 4%.

It was ugly but orderly which is a victory and not of the pyrrhic sort.

The sharp selloff stemmed from a lower-than-expected CPI number.

Decreasing CPI is a strong signal that price inflation is coming down and that is highly conducive to higher stock prices.

However, every inflation report reflecting lower inflation doesn’t guarantee tech stocks in unison will go up.

Tech stocks have done exceptionally well during a backdrop of high rates and high inflation which is extremely unusual.

The market took this opportunity to rotate out of tech and into cheaper stocks that look to benefit more from lower rates.

That’s not saying that tech stocks don’t benefit from lower rates, they certainly do, but the best of the rest has been so beaten down behind the woodshed during this higher rate story that many companies have been on life support and are due for a quick bounce.

The bounce, however, could be short-lived and the bounce could also be given back swiftly.

I suspect a temporary slowdown of tech stocks for the moment will take place while beaten-down sectors get their 15 minutes of fame before they disappear into the background.

I do believe once this short event has worked itself through the system, tech will be off to the races again.

It’s hard to keep tech stocks down because nothing of note has and looks like toppling them.

Presiding over iron-clad balance sheets with Teflon business models and wielding cash cows is the secret recipe to success.

The worst-performing sector in 2024 — real estate — had its best day this year. The Russell 2000 (IWM) climbed 3.6% — the most since November.

US inflation cooled broadly in June to the slowest pace since 2021 on the back of a long-awaited slowdown in housing costs, sending the strongest signal yet that the Fed can cut interest rates soon.

I find this rotation highly beneficial for the overall health of the stock market and it is honestly about time.

Higher rates were starting to turn the screws on many smaller companies.

Many have been in survival mode forcing management into maneuvers like cutting staff, doubling up workloads, trimming expenses, and reducing prices for products.

I do believe that this scarcity mentality will come to an end and this does give more room for other tech companies other than the Magnificent 7 to overperform.

To be honest, the over-reliance on 7 tech stocks to power the tech market is getting a little long in the tooth, and the narrow concentration of alpha is highly irregular and negative for the long-term sustainability of the tech sector.

I would tell readers to get your gunpowder ready because we are setting up for an optimal entry point into tech stocks for the next leg up.

Just be patient.