Mad Hedge Technology Alerts!

One hundred years from now, historians will probably date the beginning of the fall of the American Empire to 1986.

That is the year President Ronald Reagan ordered Jimmy Carter's solar panels torn down from the White House roof, and when Chinese Premier Deng Xiaoping launched his top secret 863 program to make his country a global technology leader.

Is the End is Near for the US?

Is the End is Near for the US?

The big question today is who will win one of the biggest opportunities of our generation?

Some 32 years later, the evidence that China is winning this final battle is everywhere. China dominates in windmill power, controls 97% of the world's rare earth supplies essential for modern electronics, is plunging ahead with clean coal, and boasts the world's most ambitious nuclear power program.

It is a dominant player in high-speed rail and is making serious moves into commercial and military aviation. It is also cleaning our clock in electric cars, with more than 30 low cost, emission free models coming to the market by the end of 2013.

Looking from a distance, one could conclude that China has already won the technology war.

And the Winner Is...

General Motors (GM) pitiful entrant in this sweepstakes, the Chevy Bolt, has utterly failed to reach the firm's sales targets. Still, I receive constant emails from drivers who say they absolute love the cars, and at $36,620, with dealer discounts it IS cheap.

This is all far more than a race to bring commercial products to the marketplace. At stake is nothing less than the viability of our two economic systems.

By setting national goals, providing unlimited funding, focusing scarce resources, and letting engineers run it all, China can orchestrate assaults on technical barriers and markets that planners here can only dream about.

And let's face it, economies of scale are possible in the Middle Kingdom that would be unimaginable in America.

Nissan Leaf

Nissan Leaf

The laissez faire, libertarian approach now in vogue in the US creates a lot of noise, but little progress. The Dotcom bust dried up substantial research and development funding for technology for a decade.

While China was ramping up clean coal research, president Bush was closing down ours.

Toyota Plug-In Prius

Mention government involvement in anything these days and you get a sour, skeptical look. But this ignores the indisputable verdict of history.

Most of the great leaps forward in US economic history were the product of massive government involvement. I'm thinking of the transcontinental railroad, the Panama Canal, Hoover Dam, the atomic bomb, and the interstate highway system.

All of these were far too big for a private company ever to consider. If the government had not funneled billions in today's dollars into early computer research, your laptop today would run on vacuum tubes, be as big as a skyscraper, and cost $100 million.

I mention all of this not because I have a fascination with obscure automotive technologies or inorganic chemistry (even though I do).

Long time readers of this letter have already made some serious money in the battery space. This is not pie in the sky stuff; this is where money is being made now.

I caught a 500% gain by hanging on to Warren Buffet's coat tails with an investment in the Middle Kingdom's Build Your Dreams (BYDFF).

I followed with a 250% profit in Chile's Sociedad Qimica Y Minera (SQM), the world's largest lithium producer. Tesla's own shares have been the top performer in the US market in 2014, up from $16.50 to $392.

These are not small numbers. I have been an advocate and an enabler of this technology for 40 years, and my obsession has only recently started to pay off big time.

We're not talking about a few niche products here.

The research boutique, HIS Insights, predicts that electric cars will take over 15% of the global car market, or 7.5 million units by 2025. Even with costs falling, that means the market will then be worth $225 billion.

Electric cars and their multitude of spin off technologies will become a dominant investment theme for the rest of our lives. Think of the auto industry in the 1920's. (TSLA), (BYDDF), and (SQM) are just the appetizers.

All of this effort is being expended to bring battery technology out of the 19th century and into the 21st.

The first crude electrical cell was invented by Italian Alessandro Volta in 1759, and Benjamin Franklin came up with the term battery after his experiments with brass keys and lightning. In 1859, Gaston Plant discovered the formula that powers the Energizer bunny today.

Further progress was not made until none other than Exxon developed the first lithium-ion battery in 1977. Then, oil prices crashed, and the company scrapped the program, a strategy misstep that was to become a familiar refrain.

Sony (SNE) took over the lead with nickel metal hydride technology, and owns the industry today, along with Chinese and South Korean competitors.

Expect to hear a lot about the number 1,600 in coming years. That is the amount of electrical energy in a liter (0.26 gallons), or kilogram of gasoline expressed in kilowatt-hours.

A one-kilogram lithium-ion battery using today's most advanced designs produces 200 KwH. Stretching the envelope, scientists might get that to 400 KwH in the near future.

But any freshman physics student can tell you that since electrical motors are four times more efficient than internal combustion ones, that is effective parity with gasoline.

Since no one has done any serious research on inorganic chemistry since the Manhattan project, until Elon Musk came along, the prospects for rapid advances are good.

A good rule of thumb is that costs will drop my half every four years. So Tesla S-1 battery that costs $30,000 four years ago, will run $15,000 today, and only $7,500 in 2022.

Per Kilowatt battery costs are dropping like a stone, from $1,000 a kWh in the Nissan Leaf I bought eight years ago to $200 kWh in my new Tesla S-1.

In fact, the Tesla, it is such a revolutionary product that the battery is only the eighth most important thing.

The additional savings that no one talks about is that an electric motor with only eleven moving parts requires no tune-ups for the life of the vehicle.

This compares to over 1,000 parts for a standard gas engine. You only rotate tires every 6,000 miles. That's because the motor runs at room temperature, compared to 500 degrees for a conventional engine, so the parts last forever.

Visit the Tesla factory, and you are struck by the fact that there are almost no people, just an army of German robots. Few parts mean fewer workers, and lower costs.

All of the parts are made at the Fremont, CA plant, eliminating logistical headaches, and more cost. By only selling the vehicle online, the expense of a huge dealer network is dispatched.

The US government rates the S-1 as the safest car every built, a fact that I personally tested with my own crash. Consumer Reports argues that it is the highest quality vehicle every manufactured.

My Personal Crash Test

Indeed, the Tesla S-1 is already the most registered car in America's highest earning zip codes. Oh, and did I tell you that the car is totally cool?

The New Tesla 3

Hence, the need for government subsidies to get private industry over the cost/production hump.

Nissan, Toyota, Tesla, and others are all betting their companies that further progress and economies of scale will drive that cost down to below $100 per kWh.

That will make electric cars cheaper than conventional hydrocarbon powered ones by a large margin. The global conversion to electric happens much faster than anyone thinks.

In a desperate attempt to play catch up, President Obama lavished money on alternative energy, virtually, since the day he arrived in office.

His original 2010 stimulus package included $167 billion for the industry, enough to move hundreds of projects out of college labs and into production.

However, in the ultimate irony, much of this money is going to foreign companies, since it is they who are closest to bringing commercially viable products to market. Look no further than South Korea's LG, which received $160 million to build batteries for the GM Volt.

Since then, all subsidies for electric cars have been eliminated by the tax bill passed in December.

Fortunately, the US, with its massively broad and deep basic research infrastructure, a large military research establishment (remember the old DARPA Net?), and dozens of still top rate universities, is in the best position to discover a breakthrough technology.

The Energy Department has financed the greatest burst in inorganic chemistry research in history, with top rate scientists pouring out of leading defense labs at Los Alamos, Lawrence Livermore, and Argonne National Labs.

There are newly funded teams around the country exploring opportunities in zinc-bromide, magnesium, and lithium sulfur batteries. A lot of excitement has been generated by lithium-air technology, as well as much controversy.

In the end, it may come down to whether our Chinese professors are smarter than their Chinese professors.

In 2007, the People's Republic took the unprecedented step of appointing Dr. Wan Gan as its Minister of Science and Technology, a brilliant Shanghai engineer and university president, without the benefit of membership in the communist party.

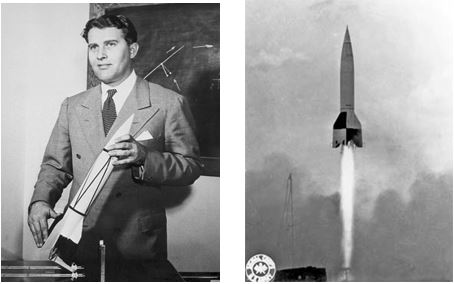

Battery development has been named a top national priority in China. It is all reminiscent of the 1960's missile race, when a huge NASA organization led by Dr. Werner Von Braun beat the Russians to the moon, proving our Germans were better than their Germans.

Consumers were the ultimate winners of that face off as the profusion of technologies the space program fathered pushed standards of living up everywhere.

I bet that's how this contest ends as well. The only question is whether the operating instructions will come in English or Mandarin.

Its Easy, Just Read the Manual

And in With the New Wheels

Mad Hedge Technology Letter

February 13, 2018

Fiat Lux

Featured Trade:

(CHASING NVIDIA),

(NVDA)

Long term readers of this letter know too well that after tripling from my initial forecast of $68 a share, that the shares of NVIDIA would double again.

After listening to their Q4 earnings call, I now have to confess that I was wrong my in assessment.

It now looks like NVIDIA shares will triple off of the recent $180 low.

From what I heard, the call was nothing less than amazing.

When considering companies limited by imagination, the last one I would anoint is Nvidia (NVDA).

I have been pounding the table for years, pleading with readers to drop everything and get into this battering ram of a stock.

If you didn't, well, you aren't buying at the bottom, but the future potential for Nvidia cannot be understated. Nvidia stands atop a parapet, scoffing at its enemies who simply cannot compare.

Its superior strategic position in GPU (graphics processing units) chips has forced the tech community to adopt its platform as the building blocks of A.I., machine learning, data center, and autonomous car technology.

In fact, Nvidia has only scratched the surface of its potential. The sustained growth story is not only intact but accelerating at a rapid clip.

The first chapter of Nvdia's rise to glory was on the back of e-gaming and the subsequent demand for their GPUs. The most talented gamers require the superior GPU's for faster processing speeds and crisper visuals that aid playing levels.

Casual gamers seem to upgrade their GPU's as well, since many of these participants cut their teeth jostling with their online counterparts 10 hours/day.

The main beneficiary of the GPU gaming upgrade boom is the model NVIDIA Pascal. This chip has the world's most advanced gaming GPU architecture, delivering truly game-changing performance, innovative technologies, and immersive, next-gen virtual reality.

Offering scintillating gameplay, it's a rung up in the gaming world. Additionally, the companies that manufacture gaming consoles are part and parcel in this GPU game of thrones. Sales of the Nintendo Switch provided a boost to Nvidia's Tegra processor revenue, tallying up to $450 million, up 75% YOY.

On a stand-alone basis, Nvidia is knocking the ball out of the park in terms of a pure gaming stock, but it is so much more than that. Nvidia IS the future. This was all apparent in last week's earnings call, which I shall outline below.

Data Centers

Revenue of $606 million was up a staggering 105% YOY, and up 20% QOQ. This over performance reflected strong adoption of Tesla V100 GPUs based on the Volta architecture, which began shipping in Q2 and continued to solidify in Q3 and Q4 2017.

V100's are present in every mainstream computer made by every major company, and have been chosen by every major cloud provider to deliver A.I. and high-performance computing.

Cloud customers adopting the V100 include Alibaba, Amazon Web Services, Baidu, Google, IBM, Microsoft Azure, Oracle and Samsung.

Nvidia perpetuates leadership in the AI training markets where their GPU's remain the platform of choice for training and machine learning networks. Any well-known company looking to A.I. functionality in the data center space relies on Nvidia to carry the load.

Nvidia posted a growing traction in the A.I. inference market where NVIDIA's platform can improve performance and efficiency by many degrees of magnitude over CPU's.

"Inference?" is the technology that puts sophisticated neural networks, trained on powerful GPUs, into use, solving problems for everyday users. Nvidia considers A.I. inference as a cogent new opportunity for the data center GPUs.

Nvidia is also gaining influence for A.I. in a growing number of vertical industries such as transportation, energy, manufacturing, smart cities, and healthcare.

The most poignant data center technology innovation was Tensor Core, a unique feature of the new Volta GPU Architecture. This technology alone can successfully complete rapid deep learning, and it officially increases the throughput of deep learning by 800%.

Autonomous Driving

Nvidia flaunted their leading position in autonomous vehicles with several salient landmarks and new partnerships. A.I. self-driving cars are trending towards moving from deployment to production.

Jensen Huang, the genius who is the CEO of Nvidia, announced that DRIVE Xavier, the world's first autonomous machine processor, will be available for the first time this quarter with more than 9 billion transistors.

DRIVE Xavier is the most complicated system Nvidia has ever delivered to customers. Recently trotted out, NVIDIA Drive is the world's first functional A.I. self-driving platform, enabling automakers to create autonomous vehicles they can operate safely.

This is a necessary component to prove its technology is ready for mass market. Several dynamic collaborations have begun with Uber, which has integrated A.I. video technology for its fleet of self-driving cars and freight trucks.

Production vehicles utilizing NVIDIA drive technology include vehicles from Chariot. Chariot is a privately-owned commuter shuttle service that is currently in the process of being acquired by Ford.

The company's mobile-phone application allows passengers to hop on a shuttle between home and work during commuting hours. Chariot currently operates in several neighborhoods in Silicon Valley and plans to swiftly expand to other locations around the United States. The Chariot fleet expects to be fully functional and possess automation capability by 2020.

Over 320 firms are now using the NVIDIA Drive platform, up 50% YOY, including almost every relevant car maker, truck maker, robo-taxi company, mapping company, car parts manufacturer and start-up in the autonomous vehicle ecosphere.

Nvidia has strategically placed itself on the front line hoping to expedite the roll out of this technology in the form of a massive fleet, servicing the individual. The obsolescence of human drivers is closer than you think.

Autonomous driving is the most significant paradigm shift in the history of the automotive industry. In total, transportation is a $10 trillion industry and I am not exaggerating when I say this will completely reshape our daily lives.

Vehicles will be fully or partly autonomous, depending on the entity. The potential of this market is massive.

The imminent monetization process will commence in 2019 and 2020, but if I had to bet money, I would say widespread profiteering will not occur until 2022.

The first goal is to train a network of autonomous driving capabilities, and this will be aided by creating a platform named NVIDIA GTX that grants everybody the chance to train a neural network promptly.

The inherent development of the A.I. requires top end GPU's, and Nvidia harvests a good portion of the spoils.

The second phase would be development platforms for the cars themselves and all these tasks will be executed by Nvidia Xavier SoC.

A system-on-a-chip (SoC) is a microchip with all the necessary electronic circuits and parts for a given system, such as a smartphone or wearable computer, on a single integrated circuit (IC).

Xavier is the most complex SoC that humankind has ever invented. All previous NVIDIA DRIVE software development carries over and runs with this consolidated architecture.

The prices for Nvidia GPU's split because the mix of solutions are unique. Autonomous vehicles that still have physical drivers will fetch a price between $500 to $1,000 per GPU.

Autonomous vehicles without drivers will command a price of $2,000-$3,000 per GPU. In general, the industry will see large-scale deployment starting FY 2018.

Practically every car produced in 2022 and beyond will have autonomous driving capabilities, requiring copious amounts of Nvidia GPU chips.

Huang repeatedly complains that Nvidia cannot keep up with the insane demand of these new technologies. There will be a persistent GPU shortage for the foreseeable future.

What does the future of AI behold aside from the imminent sensations of autonomous vehicles?

At a basic level, A.I. can be used for many things, such as improving images. For instance, you could reconstruct a photograph using A.I.. You could correct blemishes or parts of the image that haven't been rendered yet. A.I. would be used to fill in the holes, predict the future, and render results.

Let's take it one step further.

Extrapolating this concept to broader designs of everything, say cars, A.I. will be used to generate their designs in the future.

You could draw the first few preliminary scribbles of a car design and based on the inventory, safety, physics, consumer demands and other crucial inputs, the A.I. technology would complete the remaining 90% of the design.

This new type of design technology is called generative design and will revolutionize the way people do business.

My prognosis in the future of developing software is a world where computers can write their own software and this software will be so dense and complex that no human can replicate the task.

Essentially, we will be coaching up data to teach software how to write it's own software through machine learning. And imagine the new business applications introduced by this potential software!

Did I mention that Nvidia is also returning $1.25 billion to shareholders in FY 2019 and receiving another tailwind of high single digit growth in bitcoin mining?

Of course, all of that pales in comparison to the potential big picture profits Nvidia could realize. Jensen Huang has told investors that he expects A.I. to be a $10 billion/year business and autonomous technology to be a $40 billion/year business.

Remember that their most stable segment now is e-gaming GPUs which are only a paltry $3 billion/year in total revenue.

Nvidia could easily triple its business without fulfilling its revenue claims by just partially reaping the fruits of their labor from the A.I., data center, and autonomous vehicle industries. To visit their website please click here.