Mad Hedge Technology Alerts!

The post-election trade is absolute fire now, and readers need to pay attention.

Silicon Valley has delivered what could amount to the mother of tech rallies into the end of 2024.

Look at the examples that have turned heads.

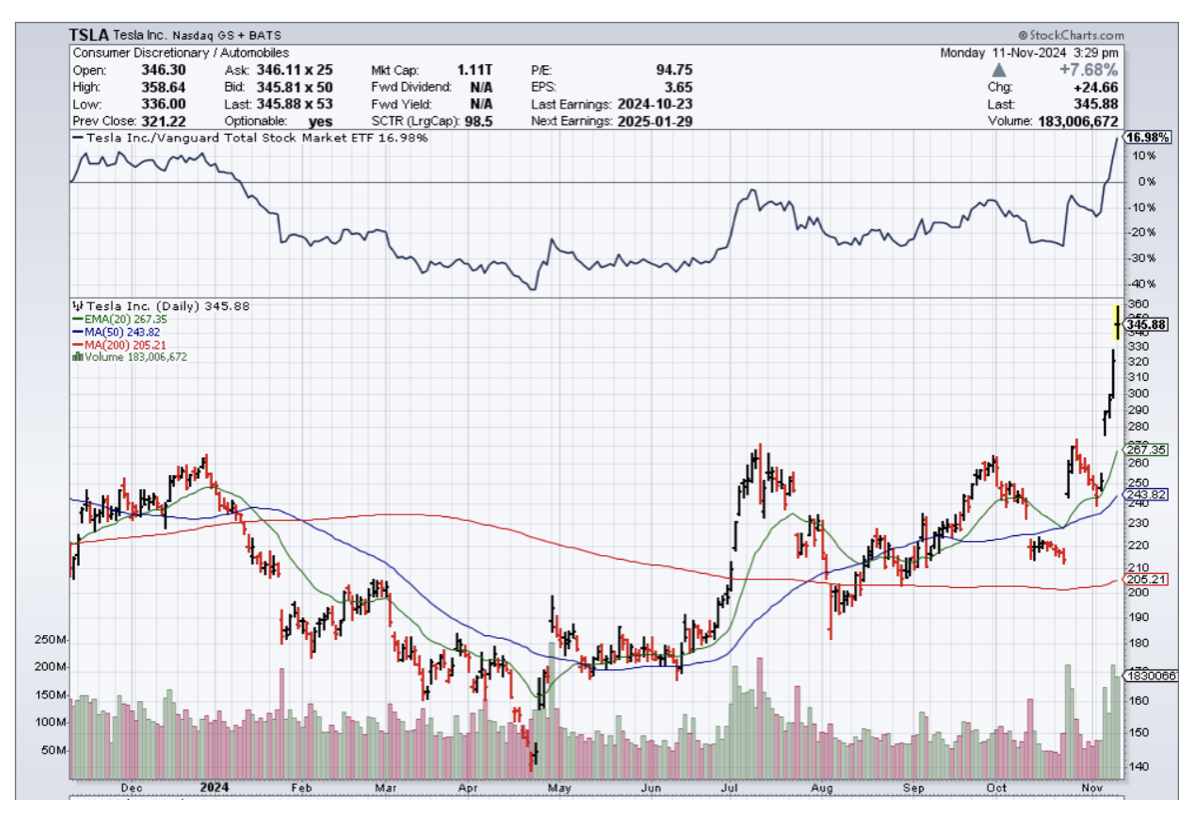

Electric vehicle (EV) company Tesla stock has gone absolutely parabolic with Elon Musk securing deep influence in the U.S. government for the next 4 years.

Part of the rally is also due to the increase in scarcity value from his social media platform X, which body-slammed traditional media avenues and convinced 75 million U.S. citizens to vote.

Musk could be tasked with “making recommendations for drastic reforms” aimed at the efficiency and performance of “the entire federal government”, Trump has said. This could grant Musk huge power over the agencies that regulate his and other tech companies.

Musk could be in charge with regulating – Apple, Google, Meta, Microsoft, and Amazon – which wield the data and processing power that shapes the social and economic lives of billions of people.

It was under Trump’s first presidency that the Justice Department began an investigation into Google, resulting in a case against the firm for suppressing competition.

Trump will probably take office with cases under way challenging the market power of several big tech firms, spearheaded by the anti-monopoly chair of the Federal Trade Commission, Lina Khan.

Many expect she will be fired. Yet Trump’s vice-president pick, JD Vance, has voiced support for aspects of her monopoly-busting approach.

Trump also thinks the tech giants give the US global clout at a time when AI is becoming a matter of national security.

“China is afraid of Google,” Trump said last month when he questioned whether a corporate split of Google could “destroy the company”.

Trump said he would “save TikTok” after a ruling that its Chinese owners must sell it if it is to continue in the US, but the trade-offs are everywhere.

In other areas, any Trump plan to cut incentives for EV manufacturers would be “an overall negative for the EV industry.

This would probably help Musk’s Tesla because its existing competitive advantage would be exaggerated if its rivals were hobbled. There are reports Trump may only tweak the subsidies rather than scrap them. If Trump’s trade tariffs limit imports of cheaper Chinese EVs, that would further help Musk.

Crypto-linked stocks in Coinbase, MicroStrategy, Riot Platforms, and MARA Holdings have jumped between 11% and 21%, participating in what is known as the post-election Trump trade.

I certainly expect a follow-through on the post-election trade, with money from the sidelines opting into the rally.

Not only that, retail traders have signaled they are participating in this broad rally as well.

The paradigm shift cannot be understated, and many changes will start to be visible as the new administration comes closer to taking over.

The high inflation of the last few years was painful for the bottom segment of the American population, and it will be interesting to see if the new government will discount them or start to redirect policy to them.

Either way, the more important policy decisions as it relates to big tech are regulation, corporate tax policy, tariffs, and the ease of doing business in the U.S.

Clearly, Trump has made it known he does value strong American tech companies, but I don’t believe they will be left untouched to do whatever they want.

In the short term, ride the rally to higher highs. Since the summer dip, I had a hunch that we would reverse to all-time high’s, and that is exactly where we find ourselves in the Nasdaq index.

Mad Hedge Technology Letter

November 8, 2024

Fiat Lux

Featured Trade:

(AIRBNB IS IN THE DOG HOUSE)

(ABNB)

Revenue increased 10% from $3.4 billion a year earlier, and that is where the problem lies for Airbnb (ABNB).

Growth rates of 10% are a problem in technology.

The mantra of scaling out and monetizing is all but expected for growing tech companies.

Something in the ballpark of 30% and higher is something that shareholders would prefer to see.

Just look at the top tech company right now, Nvidia and the breathtaking 126% revenue growth year over year is an example of what I am talking about.

A measly 10% won’t cut it, and it explains the hard sell-off in shares in the travel platform this morning.

It’s true that the company isn’t a cash burner, and the company noted a $2.8 billion tax benefit during the third quarter of 2023, but to really fetch that premium on the stock market, investors will need to see demonstrably higher growth rates and better profitability.

Average daily rates increased 1% from a year ago to $164 in the third quarter, signaling a cooling down of revenue opportunity.

If per-night revenue isn’t growing fast, then Airbnb will need to make that up on the volume.

This is starting to look and feel like a company that won’t be able to scale their product.

Remember that acquiring a listing on Airbnb is an intensive process for the property owner, and the 12% in commission Airbnb requires is probably at the upper limit of what they can ask.

Airbnb said adjusted EBITDA for the third quarter was $2 billion, up 7% year over year.

Gross booking value, used by Airbnb to track host earnings, service fees, cleaning fees, and taxes, totaled $20.1 billion in the third quarter. The company reported 123 million nights and experiences booked, up 8% from a year ago.

Airbnb said it saw hosting growth across all regions and market types during the third quarter. The company said in its shareholder letter that it has more than 8 million active listings and has worked to improve listing quality. Airbnb has removed more than 300,000 listings since last year.

In 2021, the stock was priced at over $200, and fast forward to today, it is languishing at $135 after another 8% selloff.

Even more prevalent, the stock has also been punished as non-AI stocks and AI stocks have bifurcated into two separate paths.

Airbnb has been talking up getting into other businesses like experiences, and I don’t believe that will move the needle in terms of revenue growth.

Property management is another sub-sector they are talking about to expand, but again, I don’t see that as a solution, and that type of work is incredibly labor intensive, which tech companies should stay away from.

At a time when tech companies are looking to automate to look to go on auto-pilot, Airbnb is going the other way and will need more human labor.

Labor costs have been trending higher, and property management will never be an industry where a tech company can just substitute with an algorithm.

Many of times, when tech and real estate intertwine, the Frankenstein company loses its way and doesn’t succeed.

Airbnb will just need to settle for a lower premium than most other tech stocks. I would stay away from this stock for now and head to higher ground to ride the bandwagon of AI.