Mad Hedge Technology Alerts!

“Price is what you pay, value is what you get.” – Said Warren Buffett

Mad Hedge Technology Letter

October 21, 2024

Fiat Lux

Featured Trade:

(BITCOIN PRICE ACTION IS GOOD FOR TECH STOCKS)

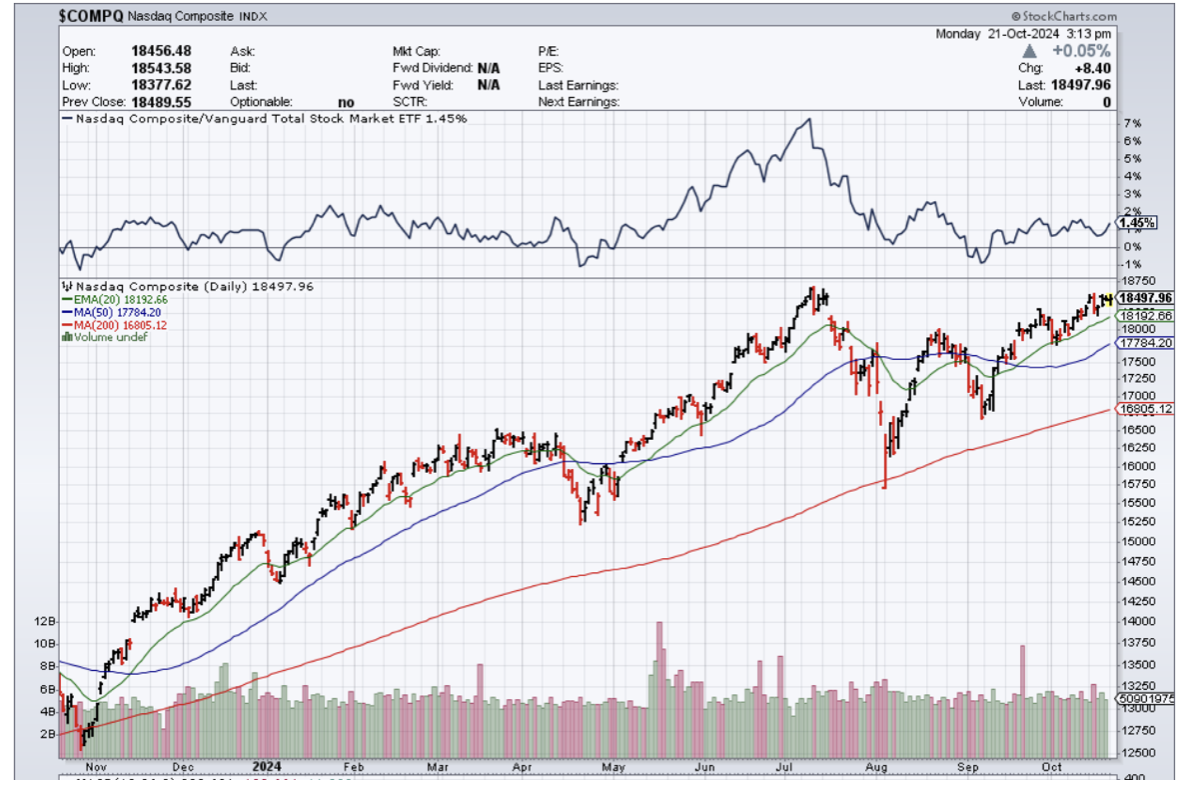

($COMPQ), (BTCUSD)

When I see Bitcoin coming back from the doldrums, it highly suggests to me that there is a great deal of liquidity sloshing around in the markets.

Bitcoin doesn’t pay your mortgage or buy food at the grocery.

Fiat currencies do.

Therefore, users still need to convert their crypto holdings into whatever it may be, whether it is Turkish Lira or Euro, to transact with most retailers.

So when we have a roaring economy of 3% GDP powered by $3 trillion in annual deficit spending, it seems that many investors are focused on the large deficit spending, which infuses a heavy dose of asset appreciation into the economy and other asset classes like crypto and tech stocks. That is why tech stocks, houses, Bitcoin, and groceries are all expensive and rarely go down in price.

Bitcoin approaching $70,000 per coin is a highly bullish sign to the rest of the tech stocks that this rally will power on until year-end.

Tech stocks are denominated in US dollars, which makes them a huge beneficiary of increasing global liquidity, which is on the rise again, with central banks across the world injecting cheap capital into their economies.

When global liquidity has exceeded its moving average in the past, it has often coincided with significant upward movements in the price of Bitcoin and tech stocks.

Compounding the positive fortunes of Bitcoin and tech stocks are the presidential candidates saying they are very pro-crypto.

Republican candidate Donald Trump is avowedly pro-crypto, so much so that Bitcoin is viewed as a so-called Trump trade. Democratic rival Vice President Kamala Harris has vowed to support a regulatory framework for the industry.

I do believe that this synchronized trade of higher-tech stocks, higher bitcoin, a weaker yen, and stronger gold continues until there is a paradigm shift.

The one outsized risk that is a “known known” is the Aha moment when investors realize the federal debt is a now problem.

We have kicked the can down the road for decades, but even Elon Musk has repeated a warning that the U.S. is hurtling toward the brink of "bankruptcy."

U.S. national debt has skyrocketed in recent years, crossing the $34 trillion mark at the beginning of 2024, largely due to lockdown stimulus measures that sent inflation spiraling out of control and forced the Federal Reserve to hike interest rates at a historical clip.

Earlier this year, Bank of America warned the U.S. debt load is about to ramp up to add $1 trillion every 100 days, headed towards $36 trillion by the end of 2024. This will also trigger a surge in Bitcoin prices.

I do believe if the federal government limits its debt spending to $3 trillion per year, tech stocks and bitcoin will continue to increase in price in tandem.

However, if we ever do get a recession, yes, the one that was supposed to happen since 2019, then it could trigger a $15 trillion federal debt response to limit the contagion, destroying more purchasing power.

A massive fiscal event like that would careen the US economy into a dangerous path while disrupt the tech and bitcoin trade into the only bitcoin and gold trade.

We still have time to get the situation under control, but neither party has even talked about it during their campaign. Only Musk has said he wants to create a department of efficiencies to trim the fat and reduce government spending.

As it stands now, goldilocks continues, and readers should buy the dip in tech stocks.