Mad Hedge Technology Alerts!

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Said American Investor Warren Buffett

Mad Hedge Technology Letter

September 6, 2024

Fiat Lux

Featured Trade:

(BROADCOM A LONG-TERM WINNER)

(AI), (NVDA), (AVGO),

The chip trade isn’t in the dumps, but traders are taking a fine tooth comb to earnings guidance to see if the numbers are stacking up with the hype.

Today we got yet another data point that suggests chip stocks are great, but they aren’t living up to the lofty expectations of growth that tech companies are used to.

In short, they are too expensive and investors want a cheaper multiple for chip stocks right here and now.

So be prepared for a little bit of a selloff in the immediate short term.

One of the best second-tier chip stocks and one of Apple's biggest customers gave us a glimpse into operations behind the scenes at one of Silicon Valley’s robust silicon makers.

Broadcom (AVGO) delivered a disappointing sales forecast, hurt by the parts of its business that aren’t tied to artificial intelligence.

The company projected sales of roughly $14 billion in the fourth quarter while they expect $12 billion of revenue from AI-related products for the full year, beating the average estimate of $11.8 billion.

The forecast showed that Broadcom’s non-AI operations are growing more slowly than anticipated. Though the company has benefited from a surge in artificial intelligence spending, not all of its wide-ranging divisions are significantly profiting.

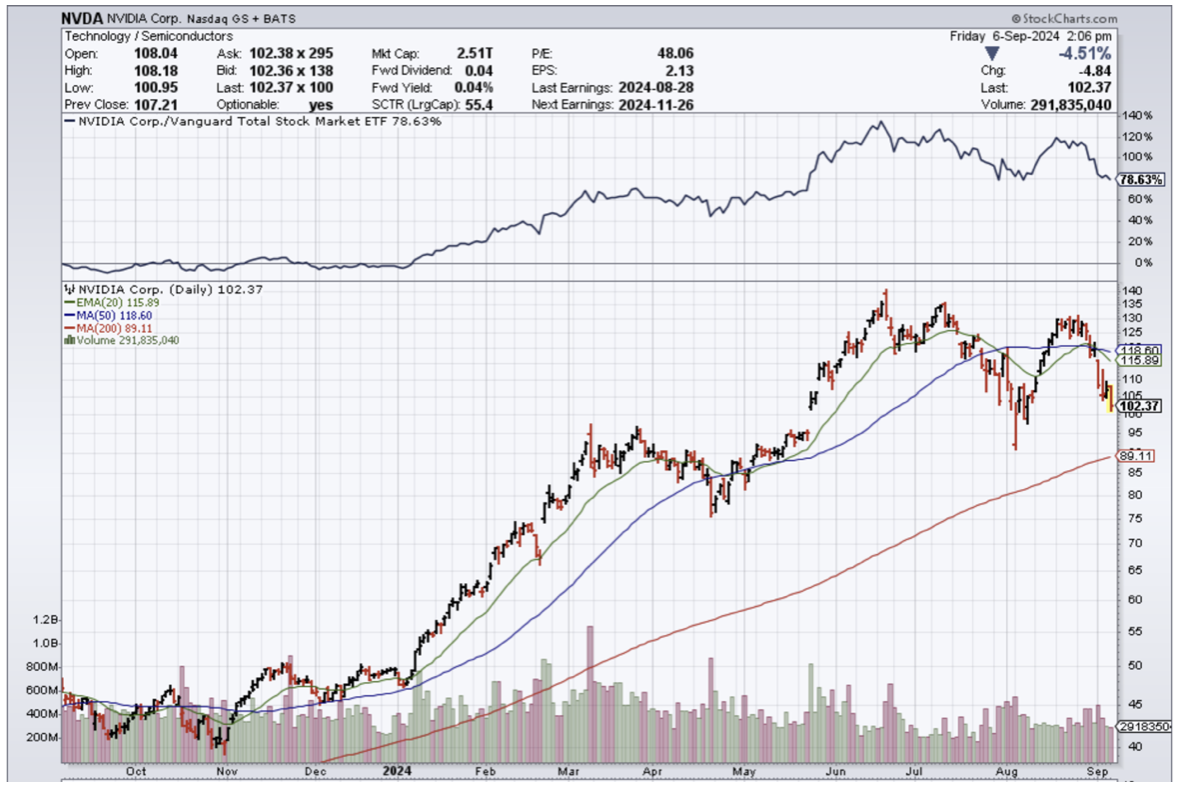

The AI spending boom has turned Broadcom’s rival Nvidia (NVDA) into the richest, most valuable company in the industry. Nvidia sells so-called AI accelerators that help develop tools such as ChatGPT. Broadcom has benefited as well by supplying related components and software.

Datacenter providers rely on Broadcom’s custom-chip design and networking semiconductors to build their AI systems. The company also sells components for cars, smartphones, and internet access gear. Its push into software, meanwhile, includes products for mainframe computers, cybersecurity, and data center optimization.

Over the long term, the AVGOs CEO believes that the AI chip market will move to custom, in-house designs. That would mean shifting away from Nvidia components — a change that could benefit Broadcom since it helps customers produce their chips.

Apple is a top customer as well: Broadcom provides key components for the iPhone.

Chip stocks were hovering at an all-time high just a few weeks ago.

The scandal that spurred a selloff in chips was the accounting issues at SuperMicro.

The initial event opened up a can of worms and signaled to traders to take profits while conditions were still favorable.

Now chip stocks are telling traders that they cannot keep up with the high expectations and investors will need to taper back the whole idea that AI is about to overtake the world.

Even if AVGOs AI business is doing exceptionally well, they have a legacy business that is bringing up the rear and could be a drag on the overall business for years to come.

AVGO is still a stalwart in the chip business with interests in the right verticals and I do believe it is still a long-term buy especially considering they still haven’t successfully integrated VMware.