Mad Hedge Technology Alerts!

In our never-ending quest to upgrade our customer service we will be changing our telephone numbers. Effective today, you can reach us at 201-858-8051, or 888-520-8616.

If Nancy is not in, the call will automatically roll over to any of a half dozen other Mad Hedge Fund Trader staff. We do get overwhelmed sometimes when the market is moving, so be sure to leave a voice mail if you can't get through. Your call will be returned shortly.

With our year-to-date performance up to 19.30%, our trailing one-year return at an eye-popping 56.34%, and our eight-year record to a new all-time high of 295.77%, business is booming.

That works out to an average annualized report of 35.14%. It doesn't get any better than that.

The Mad Hedge Technology Letter has been a spectacular success, with a 90% success rate on Trade Alerts. Having access to an extra 60 hours a week of technology research is also boosting our overall performance.

Many thanks for your support.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Let Me Do the Heavy Lifting for You

Penetrating the home is the holy grail for tech companies, and soon the smart home will be full of gizmos and gadgets that will accompany Alexa.

Not so fast.

Before we enter the abode, there is a war taking place right before our eyes.

The last mile.

This industry focuses on monetizing the transportation route to people's doorsteps whether its food delivery, ride-shares, or a dog-walking app.

The intense obsession with this last mile stems from the shift in consumers' behavior because of online commerce.

People just aren't going out and buying stuff anymore like they used to do.

Particularly, Millennials have a pension for binge-watching Netflix while gorging on food deliveries.

In the current climate, brick-and-mortar's future prospects look bleak as foot traffic disappears and mega-malls shutter at an accelerating rate.

As a last resort, companies have no choice but to evolve, reinvent themselves, and execute a digital strategy based on fast fulfillment through a smartphone app to attract new transactions.

Enter the food delivery industry.

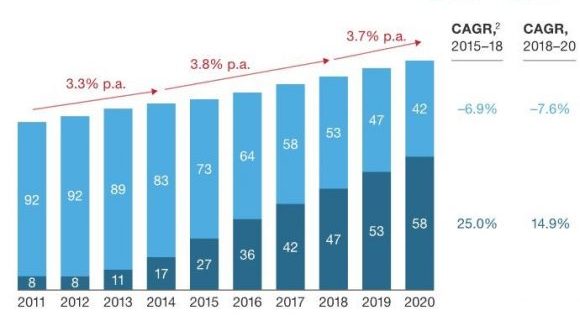

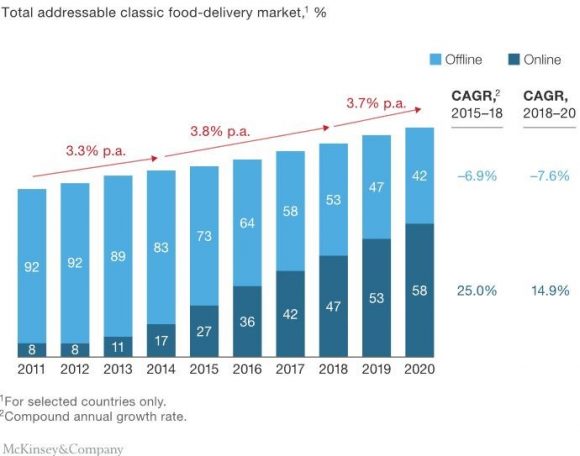

China's food delivery industry has matured faster than America's food delivery industry. And precious pearls of wisdom can be gleaned by the developments in China.

The Chinese food delivery industry is a $32 billion industry compared to a $5 billion industry in America.

Consolidation ran rampant in the early days while the migration to mobile was more pronounced in China. The multiple players burning cash faster than Elon Musk were subsidized by private funds.

Then Tencent and Alibaba (BABA) snapped up the last two remaining combatants resulting in a blossoming of a new duopoly.

Alibaba's Ele.me commands about half the market share in China while Tencent's Meituan-Dianping has a 43% share.

Meituan-Dianping is valued at $30 billion at the last stage of fundraising making it the fourth biggest unicorn in the world.

The food delivery industry could gradually mirror the situation in China, but America is still in its nascent stage, and the industry still offers viable growth chances for the participants.

The industry leader is Grubhub and it has been able to avoid the insane cash burn with which Chinese food deliverers grappled.

Shockingly, Grubhub turns a profit showing how last mile delivery in China has been reduced to a data grab.

The margins are juicier stateside.

On March 1, 2017, Grubhub's shares were trading at $33. Fast-forward to today and the shares are doing extraordinarily well, topping $102 giving investors more than a 300% return on capital in more than a year.

Grubhub was able to perform this feat in the face of harsh downgrades caused by Amazon's epic rise as the No. 4 player.

Numerous Amazon induced sell-offs could not hold back the stock with each stock dump being an attractive entry point.

Morgan Stanley's (MS) Brian Nowak went neutral on the stock in June 2017 and issued a price target between a range of $43 and $47 because of enhanced competition.

The analysts were all wrong again.

Grubhub has secured 34% of the market share followed by Uber Eats at 20% and Amazon at 11%. The third player was Eat24, which was recently acquired by Grubhub bolstering its market position an additional 16% to 50%.

The key metric for Grubhub is DAG - Daily Active Grubs.

This number was up 35% YOY to 437,000. Management has highlighted Tier 2 and Tier 3 cities as noticeable growth levers, and the Tier 1 cities such as New York and Chicago remain solid.

The rampant growth resulted in $233 million for the quarter, which is up 49% YOY. The integration of Eat24 will result in cost efficiencies and synergies across its operation.

Grubhub also entered into a partnership with online restaurant review platform Yelp (YELP) integrating the Grubhub platform onto the Yelp platform.

Actions speak volumes and aggressive tactics securing further market share gains are required to stave off Amazon whose rapid ascent has management's nerves hanging by a thread.

Despite being defensive in nature, the Yelp and Eat24 deals should give Grubhub a wider digital footprint stimulating business.

Grubhub also agreed to a deal with Yum! Brands (YUM) to lure premium restaurant assets such as KFC and Taco Bell into the Grubhub ecosphere.

The company has many irons in the fire and will not rest on its laurels.

After last quarter, Grubhub tallied up 15.1 million active diners, which is up 72% YOY. Annual guidance came in at between $930 million to $965 million.

To put the diminutive size in perspective, Grubhub liaises with 80,000 restaurants while Ele.me in China served 1.2 million restaurants.

Rough estimates show that 11% of Americans will use food delivery apps by 2020.

The nascent industry in America has a long runway ahead as the American consumer has been slower than the Chinese to adopt a thoroughly digital life.

This will all change.

Amazon is swiftly ramping up its food delivery business in conjunction with food ordering platform Olo based in New York. Outsourcing back-end support and partnering with Olo is a sign that Amazon sees this as a side job.

Amazon is still in the process of blending in Whole Foods within the existing framework of the company. Last mile food delivery is not a pure Amazon type of business.

Any potential business Amazon hopes to disrupt is leveraged by advantages in execution of volume (using state-of-the-art fulfillment centers) and low margins.

Thus, groceries fit these criteria to a T. However, value-added food meals delivered to the home cannot take advantage of the expensive fulfillment centers because the products' main point of transport is the restaurant's kitchen.

The analysts' bearish calls revolve around the grim margin prospects.

They could be correct, but the timing of the call is too early.

Yes, the opportunity to ruin margins is there for the taking in this industry.

Grubhub earned $99 million off of a miniscule $683 million of revenue in 2017, and technological innovations will devour margins to the bone.

After the mythical run-up in the face of the Amazon threat, the stock is expensive, but the company is still healthy and expects another record year.

Any sniff of margin headwinds will cripple the stock trajectory. It's not a matter of if but when.

Any big data play is ripe for competition because of the appreciation of the value of the data itself. Buy low and sell high.

At the height of competition in China, consumers were eating for free along with free deliveries because of the massive subsidies with companies seeking to gain market share any way possible.

Any similar repeat would put Grubhub's stock in the doldrums.

There are alternatives in the last mile food space.

Domino's Pizza (DPZ) is not a food delivery business nor is it a tech company.

However, it is a restaurant that fuels growth with one of the best digital strategies in the food business.

Domino's Pizza is an A.I. play.

The stock's epic rise is directly correlated with a smorgasbord of tech enhancements.

In 2014, Domino's launched DOM, a virtual ordering assistant created by A.I. voice recognition technology.

The heavy investments into the tech side have borne fruit with 65% of Domino's sales resulting from a myriad of digital platforms.

CEO J. Patrick Doyle has chimed in promulgating the desire for 100% digital sales.

Doyle believes voice is the future and implementing voice into Domino's structure will free up workers' time to focus on producing the pizzas instead of manning the phone lines thus reducing operating costs.

Domino's has been investing in its A.I. capabilities for the past five years and would be a better way to play the food space with a few extra degrees of separation with Amazon than Grubhub.

The digital strategy is about five years in, and during that time, Domino's has seen its stock rise from $46.57 to $245 today and most analysts attribute the success to its excellent digital strategy.

Would I take a flyer on Grubhub? Yes.

Would I rather buy Microsoft? Yes.

_________________________________________________________________________________________________

Quote of the Day

" 'User' is the word used by the computer professional when they mean 'idiot.' " - said Pulitzer Prize-winning American author Dave Barry.

Mad Hedge Technology Letter

May 9, 2018

Fiat Lux

Featured Trade:

(HERE'S THE TOP STOCK IN THE MARKET TO BUY TODAY),

(MSFT), (AMZN), (AAPL), (APTV), (QCOM), (FB)