Microsoft Takes a Giant Leap Forward

CEO of Microsoft (MSFT), Satya Nadella, and his management team have made an aggressive step towards making inroads to the metaverse.

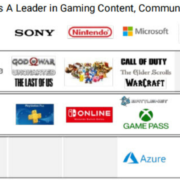

Gaming will be the launching pad to the metaverse that will first start as digital communities and later evolve into interoperable and integrated digital worlds.

The rest of the metaverse will germinate via these gaming communities and Microsoft knows that which is why they purchased Activision (ATVI) in cash for $68 billion and change.

The price was 3X higher than what they paid for LinkedIn but equally as strategic as many tech behemoths look forward to the next “big thing.”

The deal will mean MSFT will be one of the biggest gaming companies in the world just nudging out China’s Tencent and Japan’s Sony.

In the U.S., they will be by far the biggest gaming company and Nadella has made it a point of emphasis to navigate the gaming world by tapping M&A.

Remember, it was Nadella who built the MSFT cloud from scratch and Microsoft possessing its own stand-alone cloud asset dovetails nicely with their deep dive into gaming.

There are intrinsic synergies resulting from owning both.

The lack of native cloud infrastructure was a critical reason why ATVI gave up, as Chief Executive Officer Bobby Kotick said in an interview, “You look at companies like Facebook and Google and Amazon and Apple, and especially companies like Tencent — they're enormous and we realized that we needed a partner in order to be able to realize the dreams and aspirations we have,” he said.

This was the best Kotick could have wished for and I’ve mentioned this overarching trend of the best Silicon Valley companies getting stronger and now it’s even more pronounced as we are on the verge of exiting this pandemic this year.

In a higher interest rate environment, cash hoarders like Microsoft, Apple (AAPL), and Amazon (AMZN) simply have more ammunition than these smaller outfits who get penalized because of a harder route to access cheap capital making future cash flows costlier.

Now many of these smaller companies are realizing that they need to stand on their own two feet and that’s a scary thought for many CEOs who have been accustomed to tapping the capital markets to paper over the cracks.

What’s good about ATVI?

Activision owns mobile-gaming studio King, maker of Candy Crush, one of the most popular mobile games of all time.

Microsoft has almost zero presence in mobile gaming.

Nadella wants his gaming empire to facilitate direct payment like Apple’s App Store.

That’s effectively the holy grail of today’s gaming.

Microsoft has been at war with Apple and Google, over the fees the app stores charge for games.

It’s no surprise that Microsoft wants complete control over its ability to distribute games and content.

The deal also allows Microsoft an access point to secure an influential pool of gamers creating their own gaming content and worlds.

After adding Minecraft, LinkedIn, and GitHub, Nadella has been on the hunt for a game-changing asset that will drive the bottom line of MSFT via a large community of creators.

He failed to land social video service TikTok, while negotiations with Pinterest (PINS) and Discord were rebuffed.

ATVI is really a feather in the cap for Nadella, who won’t stop there and knows it’s just one battle of a greater war for tech supremacy.

These high-quality assets don’t get cheaper over time either.

Simply put, Microsoft loves subscription businesses, and gaming is among the best of them, and they are the stickiest around with recurring revenue that makes predicting future cash flows that much easier.

The ATVI pickup will raise the price of buying gaming assets across the board as I foresee a rush into these types of assets where not only can a company purchase the content, licenses, and gaming platform, but they can also add top-notch gaming developers which are equally as important as Microsoft tries to outmuscle Apple and Google.

This move is highly bullish for MSFT, so much so, that anti-trust regulators might cast a suspicious eye on this deal.