My 2012 Report Card

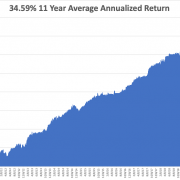

I?ll give myself a ?B? on this one. Sure, with the Trade Alert Service generating a 14.87% net profit for the year, I was able to bring in double the Dow average, and triple what most hedge funds delivered, including some of the biggest ones.

But for once, I did not achieve true greatness. I feel that, given the amount of work I did, I should have done much better. I issued 230 Trade Alerts in rapid-fire succession with a ?to die for? success rate of 70%.

I managed to capture these gains with half the market volatility of 2011. While the Volatility Index (VIX) reached the lofty height of 49% in 2011, in 2012 we managed to eke out a peak of only 27%, and that was only for a few nanoseconds. In fact, volatility was down for almost the entire year, save for a brief spike in May, and some yearend short covering.

In 2011, I had a much higher range in the market to work with, the high for the Dow coming in at 12,850 and the low at 10,400, for a total range of 2,450 points. In 2012, the range was only 1,630 points, making it a much more difficult market to work with. This meant shifting from outright call and put option positions to spreads, in order to keep the dosh reliably rolling in.

Nevertheless, I made some serious money in 2012. The best trade of the year was a call spread in the S&P 500, which nicely caught the yearend rally in equities, producing a 4.75% profit for the notional $100,000 portfolio. The worst was a short position in Boeing (BA), which cost me a gut wrenching 8.70%.

In terms of asset classes, foreign exchange trading was far and away my biggest earner, adding 11.85% in positive performance. This was because I shorted volatility in the Japanese yen (FXY), (YCS) for the first three quarters of the year when it flat lined, and then went aggressively short when the big break to the downside came. Thank you Mr. Shinzo Abe, Japan?s new prime minister, who championed the beleaguered country?s assertive weak yen policy during the December elections! Shorts in the Euro (FXE), (EUO) also chipped in.

Gold (GLD) was my second income producer, taking in 6.40%. I timed the summer rally in the barbarous relic perfectly, and shook it by the lapels until its gold teeth came chattering out. I would have made more, but the yellow metal then died on the announcement of Ben Bernanke?s QE3, much to everyone?s surprise.

My five years spent drilling for oil and gas in West Texas came in handy once again, netting 4.75% in gains. This was entirely made on the short side. Friends calling me from the Lone Star State with tales of endless oil gluts gushing forth from North Dakota encouraged me to be more bold in selling the (USO) than I might have otherwise.

I was also a fairly nimble bond trader in 2012 (TLT), (TBT), harvesting another 1.62% in profits. I correctly called the top in prices/bottom in yields in August, but failed to capitalize with bigger short positions. This could be a big trade in 2013.

Ah, now for the hard part. Not every trade was a winner in 2012, although many of the losers were hedges for long side plays that ultimately made money. Trading in the index ETF options for the S&P 500 (SPY) and the Russell 200 (IWM) lost -1.30%. An early long position in the volatility Index (VXX) eroded -3.42% from the performance. Fortunately, I bailed from that strategy quickly.

Options positions in individual equities bled me by another -9.54%. Almost the entire loss came from one stock, Apple (AAPL), which is still perplexing the street. I managed the first $150 decline in the stock admirably. After that, it was a bloodbath. Never have I seen a share price divorce itself so dramatically from the underlying fundamentals. Either something terrible is about to happen to Steve Jobs? creation, or the stock market has got it all wrong.

This was one tricky year to trade. I started off all right, clocking gains in January and February. I correctly anticipated another ?Sell in May, and go away? year. But I underestimated the extent that volatility would fall. Melting option premiums absolutely took me to the cleaners in March and April.

When I realized the problem, I switched from outright options to spreads, which included a short volatility element to every single position. That launched a white-hot run of 25 consecutive profitable trades from April to September.

Then Ben Bernanke caught me by surprise, launching QE3 sooner than expected, just before the presidential election. That forced me to stop out of positions that turned good only days later. I correctly called the outcome of the election in all 50 states. But the big Obama win caught many portfolio managers by surprise, who responded by dumping positions to realize capital gains and beat expected tax increases. That took the (SPX) down 10%, leaving the market unchanged on the year by mid November. This cost me more money.

I redeemed myself by accurately calling the yearend rally and going aggressively long. In the end, the ?Fiscal Cliff? that was supposed to crash the market was little more than a media invention. Stocks closed on their highs.

It was one of the tougher years in my career, so I was quite happy to deliver double-digit profits for my readers. It was also a learning experience. After slogging through 45 years in this business, I still occasionally commit the same blunders as a first year trainee. Don?t we all.

Hopefully, you learned something too from my outpouring of 400,000 words in the 250 daily letters that I penned during the year analyzing every investment theme under the sun. You should have also gained some insight from the 22 biweekly webinars I produced. You also had a chance to expand your horizons at by 26 strategy luncheons and speaking engagements held around the world.

2013 will be better, as our blistering gains so far testify.

Good Luck and Good Trading

John Thomas

The Mad Hedge Fund Trader