My Favorite Stock to Short

Troubled Bank of America (BAC) certainly earned its title as the premier Dog of the Dow last year. It managed an appalling 58% decline in 2011, the worst of any of the 30 Index stocks. It only managed to stay above the crucial $5 level by a hair?s breadth, below which many pension funds are barred from owning shares.

Since the beginning of this year, it has been the best performer, soaring 48% from $5.60 to $8.30. Will this eye-popping turnaround continue?

I think it is more likely that the enormous Lake Tahoe outside my window freezes into a gigantic mango smoothie.? Its credentials as a ?zombie? bank are as good as ever, and it will continue to play a leading role in the horror story our financial system has become.

(BAC) has become the poster boy for ?too big to manage?. The bank is still, by many measures, the largest in the US, with $2.3 trillion in assets, 288,000 employees, 5,900 branches, and 18,000 ATM?s. One out of two Americans are said to have an account at the North Carolina based institution. The $84 billion market cap company earned a penny a share last year, giving a price earnings multiple of a mind blowing 802.

The problem is that the company is so gargantuan that by the time information filters up to the top, it has become old, irrelevant, or even dangerous. It seems to want to plunge into every ?flavor of the day? strategy, which is always fatal for any organization that turns with the speed of a supertanker.

It plunged into proprietary trading in the early 2000?s, despite a woeful lack of talent to execute. Its 2007 purchase of Countrywide for $2 billion saddled it with a loan book so toxic that it still may not survive. It paid $50 billion for Merrill Lynch, when, if the positions were marked to market, it would have been worth only $1 or less.

Bank of America is a deer that can?t stay out of the headlights. Any online search about the company reveals a litany of problems, including mortgage fraud, robo signing, SEC sanctions and fines, municipal bond fraud, an ill-fated $5 debit card fee, and litigation up the wazoo. Oh, to be their outside counsel. Kaching!

The company recently announced disappointing earnings driven by falling revenues and rising costs. Their financial statement offered a panoply of special items, with prominent distressed assets sales used to cover losses. It is literally eating its seed corn to keep from starving to death. (BAC) attempted to pay a dividend in 2011, but that was nixed by the Federal Reserve due to its TARP obligations.

The size of the market that can meet their rising credit standards is shrinking dramatically, thanks to a 30 year long squeeze on the middle class. They might as well be a buggy whip manufacturer. The cost of regulation is skyrocketing. This is why I went on national TV last May and pounded the table to get viewers to sell it short at $13.50.

Despite the whopping great rally in the share price, they are trading at a big discount to book value, meaning that investors think the bank is still carrying large, unrealized loan losses on its books. Now Moody?s has threatened to downgrade the bank?s credit rating a couple of notches, which would increase its borrowing costs substantially. They are truly caught between a rock and a hard place.

I am not one of these glum guys who think that Bank of America will go bankrupt. That was a 2008 story. Don?t worry, your deposits are safe. It is far more likely to get broken up. First on the block will be Merrill Lynch, which is worth more today than in the dark days of four years ago. Think of it as (BAC)?s General Motors. Management is also making noises about withdrawing from Texas and other major markets.

There may be a time for a true national bank in the US, but that time is not now. Not when they play at being hedge funds on the side without the slightest idea of how to do so, and then blow up with your money inside, requiring taxpayer assistance. But there is a trade here for the nimble.

This is the really interesting part. Bank of America has become the favorite whipping boy of the high frequency traders. Because of them, its shares frequently accounted for 10% or more of NYSE volume last year. They have increased the volatility of these shares dramatically.? As a result, (BAC) is one of the highest beta large caps in the market.

What does this mean for the average punter working behind a PC (or Mac) at home? That a rapid 50% jump in shares is likely to be followed by a sudden 25% plunge. At this level, it has become the classic ?heads you win, tails I win 5X? situation if positioned appropriately.

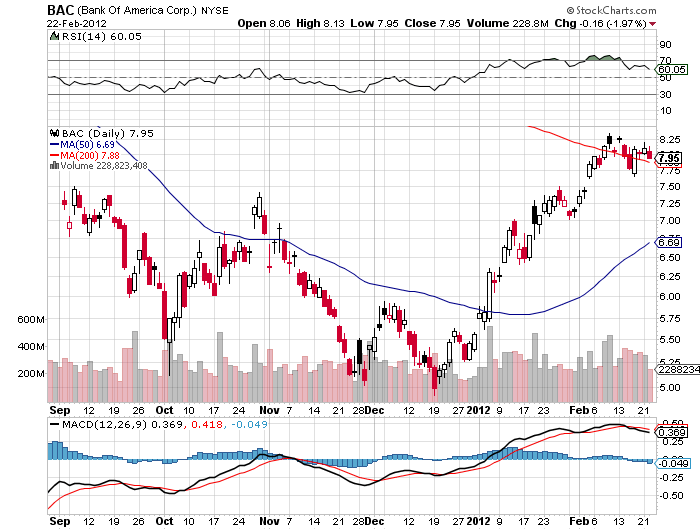

The algorithms are lurking out there just waiting to pounce on this pitiful stock like a hungry leopard. Take a look at the chart below, and the setup is as clear as day. Despite an (SPX) that ground up to new highs nearly every day last week, (BAC) stock has begun rolling over like the Bismarck. Get a serious ?RISK OFF? day in global assets, and this thing could dive like a kamikaze.

No surprise then that (BAC) has become my favorite stock to sell short.