Summit Videos from the June 8-10 confab are up. Listen to 27 speakers opine on the best strategies, tactics, and instruments to use in these volatile markets. It is a true smorgasbord of investment strategies. Find the best one to suit your own goals. The product discounts offered last week are still valid. Start, stop,

Here is the game-changer that everyone is missing. Everyone knows that the pandemic pulled forward demand on a monumental scale. What they don’t know is that adoption has also been pulled forward, of new products and services, apps, technology, business organization by years, if not a decade. And while the pull forward in demand is

Global Market Comments July 9, 2021 Fiat Lux Featured Trade: (SOME BASIC TRICKS FOR TRADING OPTIONS)

“It’s not always the troops that storm the beaches who are the right ones to set up the government,” said Steve Vassallo from Foundation Capital about the resignation of founder Travis Kalanick from Uber.

Global Market Comments July 8, 2021 Fiat Lux Featured Trade: (TESTIMONIAL) (A BUY-WRITE PRIMER), (AAPL)

John, I couldn’t be happier with your service, and the way you operate your business. I love it! And I recommend you to my relatives and my good friends when appropriate. I feel very grateful and blessed to have been introduced to your information and your person even though not in person. I’m in Tesla

Global Market Comments July 7, 2021 Fiat Lux Featured Trade: (JUNE 30 BIWEEKLY STRATEGY WEBINAR Q&A), (QQQ), (BRKB), (GOOG), (NVDA), (FB), (TSLA), (JPM), (BAC), (C), (GS), (MS), (NASD), ((X), (FCX), (AMZN), (MSFT), (AAPL), (FCX)

Below please find subscribers’ Q&A for the June 30 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Lake Tahoe, NV. Q: How long will the tech rally last (QQQ)? A: Short term we are overheated, but long term it’s still a buy. I think tech will lead for the next several years. Look for the next

“At the tail end of a momentum-driven melt-up, weird things start to happen,” said Chris Harvey, chief equity strategist at Wells Fargo.

Global Market Comments July 6, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or ALL EYES ON THE FANGS) (FB), (AAPL), (AMZN), (MSFT), (NFLX), (NVDA), (AMD), (MU)

If you are a believer in the FANGS (FB), (AAPL), (AMZN), (MSFT), (NFLX), with NVIDIA (NVDA) as an add-on, last week was definitely your week. They rose every day, ending the week with a melt-up of epic proportions. After eight months in the penalty box, tech came back with a vengeance and is now two

Global Market Comments July 4, 2021 Fiat Lux SPECIAL FOURTH OF JULY ISSUE Featured Trade: (COULD YOU QUALIFY TO BECOME A U.S. CITIZEN?)

Today’s Fourth of July celebration brings back memories of my late wife’s campaign to become an American citizen 25 years ago. Kyoko originally came from Japan. Part of the process required a verbal quiz about U.S. history and government. Our family spent a year energetically prepping her, with nightly grillings over dinner about the most

Global Market Comments July 2, 2021 Fiat Lux SPECIAL EARLY RETIREMENT ISSUE Featured Trade: (HOW TO JOIN THE EARLY RETIREMENT STAMPEDE)

Global Market Comments July 1, 2021 Fiat Lux Featured Trade: (A VERY BRIGHT SPOT IN REAL ESTATE)

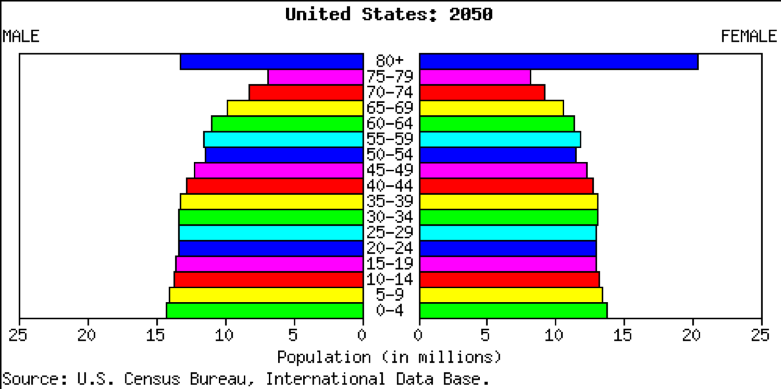

I feel obliged to reveal one corner of this bubbling market that might actually make sense. By 2050, the population of California will soar from 39 million to 50 million, and that of the US from 330 million to 400 million, according to data released by the US Census Bureau and the CIA Fact Book

"The difference between a Tesla and all of its competitors is the difference between an iPod and a cassette player," said Harvard Law fellow Vivek Wadhwa.

Global Market Comments

J

Global Market Comments June 29, 2021 Fiat Lux Featured Trade: (RIGHTSIZING YOUR TRADING)

“The last few years have been periods of high returns and relatively low volatility. I think with the yield curve inversion and the economy slowing, PMI is in contraction in much of the world ... we’re entering a period that’s the opposite of that. We’re going to have lower returns and substantially higher volatility,” said

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.