Markets live on fads. Once a certain investment theme takes hold, the imitators start coming out of the woodwork in droves. In 1989, all of the largest Japanese banks stampeded to issue naked short put options on the Nikkei Average by the billions of dollars when the index was at an all-time high. It then

Global Market Comments October 20, 2020 Fiat Lux Featured Trade: (WHY SPAC’S ARE A SCAM) (PSTH), (SPAK)

“Nobody knew it was August 1982 until it was August 1984,” said Christopher Verrone, head of technical analysis at research boutique Strategas.

Global Market Comments October 19, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, OR WHY THE NEXT TWO WEEKS ARE A WRITE-OFF) (V), (SPY)

You can pretty much write off trading for the next two weeks. The election has been decided. It’s going to be a scandal a day in the media, but everyone has already made up their minds. All attention will be devoted to politics at the expense of trading, investment, and research. In the end, the

Global Market Comments October 16, 2020 Fiat Lux Featured Trade: (HOW TO GAIN AN ADVANTAGE WITH PARALLEL TRADING), (GM), (F), (TM), (NSANY), (DDAIF), BMW (BMWYY), (VWAPY), (PALL), (GS), (RSX), (EZA), (CAT), (CMI), (KMTUY), (KODK), (SLV), (AAPL)

Global Market Comments October 15, 2020 Fiat Lux Featured Trade: (OCTOBER 14 BIWEEKLY STRATEGY WEBINAR Q&A), (VXX), (INDU), (TLT), (GLD), (IB), (XPEV), (TSLA), (MRNA), (AMD), (SDS), (ITB)

Below please find subscribers’ Q&A for the October 14 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: Do you think Interactive Brokers (IB) will give better executions? A: No, these executions are all done by identical computers with

Global Market Comments October 14, 2020 Fiat Lux Featured Trade: (GOOGLE’S MAJOR BREAKTHROUGH IN QUANTUM COMPUTING), (GOOGL), (IBM)

“The stock market is very much a mood ring,” said Josh Brown, of Ritholtz Wealth Management.

Global Market Comments October 13, 2020 Fiat Lux Featured Trade: (COFFEE WITH RAY KURZWEIL), (GOOG)

Global Market Comments October 12, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or BACK TO THE NIFTY FIFTY), (CAT), (JPM), (BAC), (NSC), (UNP), (V), (MA), (FDX), (UPS), (IP), (AAPL), (TSLA)

My daughter needed a desk so she could go to high school from her bedroom. So, I drove around Northern Nevada to get the perfect piece, visiting Reno, Sparks, Carson City, and Minden. It is one of the most conservative parts of the country, probably 90% republican. What I saw was amazing. There were Biden/Harris

Global Market Comments October 9, 2020 Fiat Lux Featured Trade: (THE NEW AI BOOK THAT INVESTORS ARE SCRAMBLING FOR), (GOOG), (FB), (AMZN), MSFT), (BABA), (BIDU), (TENCENT), (TSLA), (NVDA), (AMD), (MU), (LRCX)

Global Market Comments October 8, 2020 Fiat Lux Featured Trade: (IF BONDS CAN’T GO DOWN, STOCKS CAN’T EITHER), ($NIKK), (TLT), (TBT), ($TNX) (TESTIMONIAL)

The U.S. Treasury bond market has suddenly ground to a halt, puzzling traders, investors, and hedge fund managers alike. Today, the yield on the 10-year Treasury bond (TLT), (TBT) traded as low as 0.77%. This is despite the U.S. economy delivering a horrific negative GDP growth during Q2. Growth is expected to rebound to 2-5%

Don't worry, John. Your posts are probably the least boring of any mentor(s) out there. Please keep up the good work. By the way, I may have flown in that Tiger Moth back in the early 70s. My dad learned to fly on Tiger Moths right after the war in south England and we used

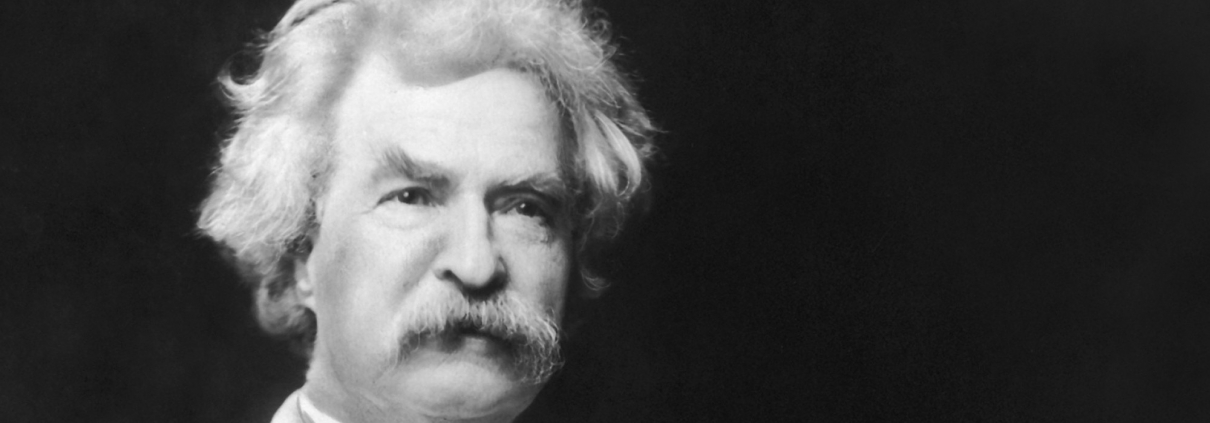

“October is one of the most peculiarly dangerous months to trade in stocks. The other are July, January, April, November, May, March, June, December, August, and February,” said American writer and humorist Mark Twain.

Global Market Comments October 7, 2020 Fiat Lux Featured Trade: (THE ROARING TWENTIES HAVE JUST BEGUN), (SPY), (TLT), (TBT), (VIX)

I just about fell out of my chair when the national election poll numbers were released over the weekend. After remaining stuck at a 49% to 41% lead for the past year, Joe Biden picked up 5% to reach a commanding 54% to 39% lead. These are the most decisive polling numbers since the 1972

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.