Today, we saw the largest point loss in market history, the first use of modern circuit breakers, and individual stocks down up to 40%. Ten-year US Treasury bond yields cratered to 0.39%. Virtually the entire energy and banking sectors vaporized. What did I do? I did what I always do during major stock market crashes.

"Legalize gay Marijuana," said a bumper sticker seen in Northern Nevada.

Global Market Comments March 9, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or SEARCHING FOR A BOTTOM), (SPX), (VIX), (VXX), (CCL), (UAL), (WYNN)

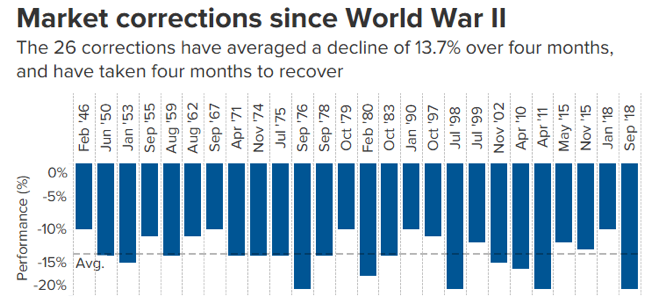

OK, I’ll give it to you straight. If the American Coronavirus epidemic stabilizes at current levels of infection, the double bottom in the S&P 500 (SPX) at 2,850 will hold, down 16% from the all-time high two weeks ago. If it gets worse, it won’t, possibly taking the index down another 8.8% to 2,600, the

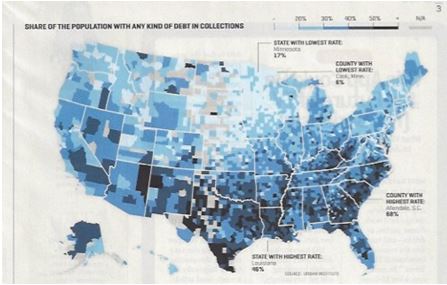

Global Market Comments March 6, 2020 Fiat Lux Featured Trade: (THE UNITED STATES OF DEBT), (TLT), (TBT), ($TNX)

With ten-year US Treasury yields falling below 0.90% today a borrowing rampage of epic proportions is about to ensue. This is not a new thing. We are, in fact, becoming the United States of Debt. That Washington is taking the lead in this frenzy of borrowing is undeniable. Since the new administration came into power

Global Market Comments March 5, 2020 Fiat Lux SPECIAL MARKET BOTTOM ISSUE Featured Trade: (FRIDAY, APRIL 17 SAN FRANCISCO STRATEGY LUNCHEON), (A LEAP PORTFOLIO TO BUY AT THE BOTTOM), (TEN LONG-TERM BIOTECH & HEALTHCARE LEAPS TO BUY AT THE BOTTOM) (UNH), (HUM), (AMGN), (BIIB), (JNJ), (PFE), (BMY)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update which I will be conducting in San Francisco on Friday, April 17, 2020. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period. I will also be bringing some artifacts from my recent trip to the

Joe Biden’s romp over Bernie Sanders in the Tuesday Democratic primary takes the lid off on the entire biotech and healthcare sector. Sanders has promised to dismantle the entire sector by promising Medicare for all and banning private coverage. Sanders was also about to take a cudgel to drug pricing. While Sanders was leading in

Global Market Comments March 4, 2020 Fiat Lux Featured Trade: (TEN LONG TERM LEAPS TO BUY AT THE BOTTOM) (MSFT), (AAPL), (GOOGL), (QCOM), (AMZN), (V), (AXP), (NVDA), (DIS), (TGT)

Global Market Comments March 3, 2020 Fiat Lux Featured Trade: (TEN STOCKS TO BUY BEFORE YOU DIE) (MSFT), (AAPL), (GOOGL), (QCOM), (AMZN), (V), (AXP), (NVDA), (DIS), (TGT)

A better headline for this piece might have been “Ten stocks to Buy at the Bottom”. At long last, we have a once-a-decade entry point for the ten best stock in America at bargain basement prices. Coming in here and betting the ranch is now a no-lose trade. If I’m right, the pandemic ends in

Global Market Comments March 2, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or TRADING THE CORONA MARKET), (SPX), (INDU), (AAPL), (VIX), (VXX), (AAPL), (MSFT), (AMZN)

It’s time to stockpile food, load up on ammo, and get ready to isolate yourself from the coming Corona Armageddon. If you rely on prescriptions to keep breathing, better lay in a three-month supply. Six months might be better. At least, that’s what the stock market thinks. That was some week! Thank goodness it wasn’t

"It is insane to risk what you have and need to obtain what you don't need," said Oracle of Omaha Warren Buffet about the extreme leverage found in many modern securities and trading strategies.

Global Market Comments February 28, 2020 Fiat Lux Featured Trade: (FEBRUARY 26 BIWEEKLY STRATEGY WEBINAR Q&A), (VIX), (VXX), (SPY), (TLT), (UAL), (DIS), (AAPL), (AMZN), (USO), (XLE), (KOL), (NVDA), (MU), (AMD), (QQQ), (MSFT), (INDU)

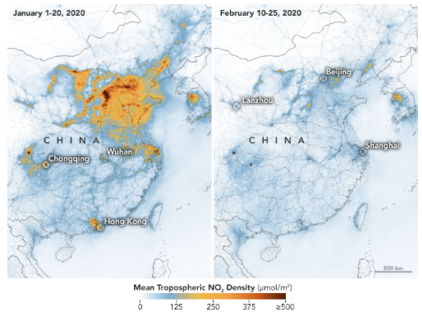

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader February 26 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: There’s been a moderation of new coronavirus cases in China. Is this what the market needs to find a bottom? A:

“The VIX right here is unsustainably low. I think China has more of a downside surprise. Analyst expectations for earnings are overly aggressive. There are just a few too many things that can go wrong out there,” said Vadim Zlotnikov, chief market strategist at Alliance Bernstein.

Global Market Comments February 27, 2020 Fiat Lux Featured Trade: (GET READY TO TAKE A LEAP BACK INTO LEAPS), (AAPL), (BA), (TESTIMONIAL)

Just as every cloud has a silver lining, every stock market crash offers generational opportunities. In a month or two, there will be spectacular trades to be had with LEAPS. What are LEAPS, you may ask? This is the best strategy with which to cash in on the gigantic market swoons, which have become a

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.