Will the person who bought Tesla shares (TSLA) on my recommendation last year at $30 please email me? I have been traveling a lot recently and lost your email address. I would like to get a testimonial from you. The stock hit $250 earlier this year and is up 833% from your cost, making it

Global Market Comments June 9, 2014 Fiat Lux Featured Trade: (LAST CHANCE TO ATTEND THE JUNE 13-14 INVEST LIKE A MONSTER LAS VEGAS CONFERENCE) (JULY 18 BARCELONA, SPAIN STRATEGY LUNCHEON) (THE SOLAR ROAD REVISTED), (AAPL), (GOOG), (TSLA), (FB), (TWTR) Apple Inc. (AAPL) Google Inc. (GOOG) Tesla Motors, Inc. (TSLA) Facebook, Inc. (FB) Twitter, Inc. (TWTR)

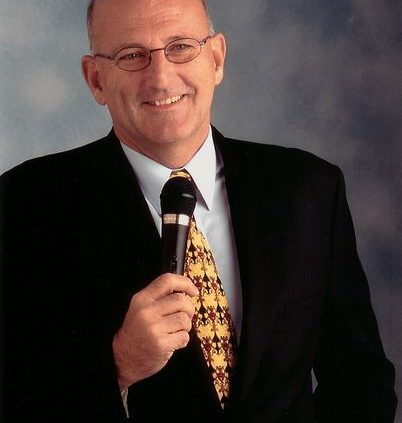

Please come to hear me, Mad Hedge Fund Trader John Thomas, as the keynote speaker at the Invest Like a Monster Las Vegas Conference on June 13-14. I will be joined by many old friends from across the investment spectrum. Jon and Pete Najarian will teach you the tricks of the trade for navigating the

Global Market Comments June 6, 2014 Fiat Lux Featured Trade: (JULY 11 SARDINIA, ITALY STRATEGY LUNCHEON) (THE ECB?S DRAGHI FINALLY USES HIS BAZOOKA), (FXE), (EUO), (EZU), (EEM), (SPY), (A COW BASED ECONOMICS LESSON) CurrencyShares Euro Trust (FXE) ProShares UltraShort Euro (EUO) iShares MSCI EMU Index (EZU) iShares MSCI Emerging Markets (EEM) SPDR S&P 500 (SPY)

After remaining woefully behind the curve on European monetary policy, European Central Bank president, Mario Draghi, has finally leapt to the forefront. Specifically, he has announced a package of measures designed to stimulate the beleaguered continental economy that includes generous doses of interest rate cuts and quantitative easing. In short, his has finally pulled that

Global Market Comments June 5, 2014 Fiat Lux Featured Trade: (JULY 7 ROME, ITALY STRATEGY LUNCHEON) (IS CYTRX (CYTR) ANOTHER TEN BAGGER?), (CYTR), (TSLA), (BIDU), (MCP), (LNG), (DNA), (AN EVENING WITH ?GOVERNMENT MOTORS?), (GM) CytRx Corporation (CYTR) Tesla Motors, Inc. (TSLA) Baidu, Inc. (BIDU) Molycorp, Inc. (MCP) Cheniere Energy, Inc. (LNG) Genentech, Inc (DNA) General

If there is one complaint about the Diary of a Mad Hedge Fund Trader, it is that I am too short term in my orientation. My response is that this is the only way you can obtain a 138% trading return in 3 ? years. I can skim off the cream when others can?t. There

Global Market Comments June 3, 2014 Fiat Lux Featured Trade: (JUNE 4 GLOBAL STRATEGY WEBINAR), (JUNE 23 LONDON STRATEGY LUNCHEON), (THERE ARE NO GURUS), (THE COST OF CLEAN COAL), (KOL), (UNG), (PCE), (BTU), (JOY) Market Vectors Coal ETF (KOL) United States Natural Gas (UNG) PG&E Corporation (PCG) Peabody Energy Corp. (BTU) Joy Global, Inc. (JOY)

Global Market Comments June 2, 2014 Fiat Lux Featured Trade: (MAD HEDGE FUND TRADER PUNCHES THROUGH TO NEW ALL TIME HIGH), (AAPL), (GOOG), (TLT), (FXY), (JUNE 17 NEW YORK STRATEGY LUNCHEON), (TESTIMONIAL) Apple Inc. (AAPL) Google Inc. (GOOG) iShares 20+ Year Treasury Bond (TLT) CurrencyShares Japanese Yen Trust (FXY)

The industry beating performance of the Mad Hedge Fund Trader?s Trade Alert Service has finally punched through to a new all time high for the first time in seven weeks. The total return for my followers so far in 2014 has reached 15.50%, compared to a feeble 1.3% for the Dow Average during the same

Come join Mad Day Trader Jim Parker and I for lunch at the Mad Hedge Fund Trader?s Global Strategy Luncheon, which we will be conducting in New York, NY on Tuesday, June 17, 2014. An excellent three course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period.

Global Market Comments May 30, 2014 Fiat Lux Featured Trade: (JUNE 4 GLOBAL STRATEGY WEBINAR), (JULY 18 BARCELONA, SPAIN STRATEGY LUNCHEON) (WHY I?M SELLING SHORT TREASURY BONDS), (TLT), (TBT), (SPY), (VIX), (VXX) iShares 20+ Year Treasury Bond (TLT) ProShares UltraShort 20+ Year Treasury (TBT) SPDR S&P 500 (SPY) VOLATILITY S&P 500 (^VIX) iPath S&P 500

This has really been one of those incredible, jaw dropping, knock your socks off kind of years. It seems like every asset class is doing exactly the opposite of what it should do. A slowing economy delivered a huge move up in bonds, which is fine. The extent of the damage the harsh winter wrought

Global Market Comments May 29, 2014 Fiat Lux Featured Trade: (JUNE 23 LONDON STRATEGY LUNCHEON) (JOHN THOMAS AND ALAN PATCHING ON HEDGE FUND RADIO), (UUP), (FXI), (FXA), (EWA), (AAPL), (GOOG), (GLD), (SLV), (MON), (POT), (MOS), (AND MY PREDICTION IS?.), (TESTIMONIAL) PowerShares DB US Dollar Index Bullish (UUP) iShares China Large-Cap (FXI) CurrencyShares Australian Dollar Trust

During my recent trip to Australia, I had the privilege to be interviewed by Alan Patching, one of the leaders of the country?s vibrant business community, on his show, Transforming Business Minds. Alan was the chief organizer of the 2000 Sydney Olympics. He is the author of several business books. He is also a professor

Global Market Comments May 28, 2014 Fiat Lux Featured Trade: (JULY 25 ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR) (THE 60-40 CORRECTION), (SPY), (QQQ), (IWM), (TLT), (FXY), (GLD), (IBB), (COME TO THE JUNE 13-14 INVEST LIKE A MONSTER LAS VEGAS CONFERENCE) SPDR S&P 500 (SPY) PowerShares QQQ (QQQ) iShares Russell 2000 (IWM) iShares 20+ Year Treasury Bond

Traders have been tearing their hair out this year, if they have any left. The indecisive, flip flopping, ?RISK ON?/?RISK OFF? state of play has been devoid of any direction clues for the past three months. Gold (GLD), the yen (FXY), and bonds (TLT) have been even worse, flat lining inside of narrow ranges. Hedge

Please come to hear me, Mad Hedge Fund Trader John Thomas, as the keynote speaker at the Invest Like a Monster Las Vegas Conference on June 13-14. I will be joined by many old friends from across the investment spectrum. Jon and Pete Najarian will teach you the tricks of the trade for navigating the

Global Market Comments May 27, 2014 Fiat Lux Featured Trade: (JUNE 17 NEW YORK STRATEGY LUNCHEON) (INTRODUCING ?THE OPENING BELL WITH JIM PARKER?), (BUY NOW TO BEAT THE PRICE INCREASE), (ORDER EXECUTION 101)

Come join Mad Day Trader Jim Parker and me for lunch at the Mad Hedge Fund Trader?s Global Strategy Luncheon, which we will be conducting in New York, NY on Tuesday, June 17, 2014. An excellent three course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.