Mad Day Trader, Jim Parker, thinks that the next three to six months will be a tough time for the financial markets. They won?t crash, but won?t break out to new highs either. Instead, they will stay confined to technically driven, narrow, low volume ranges that will cause traders to tear their hair out. It

Global Market Comments March 24, 2014 Fiat Lux Featured Trade: (MARCH 26 GLOBAL STRATEGY WEBINAR), (READ OIL & ENERGY INSIDER FOR TRADING CLUES), (USO), (UNG), (APC), (NBL) (END OF THE COMMODITY SUPERCYCLE), (SLV), (PPLT), (PALL), (CU), (BHP), (USO), (CORN), (WEAT), (SOYB), (DBA), (RSX) United States Oil (USO) United States Natural Gas (UNG) Anadarko Petroleum Corporation

I am often asked to divulge my research sources that give me my unfair advantage in trading. I usually decline such requests, unwilling to part with the ?secret sauce? that enables me to beat the market, as well as most other hedge fund managers year after year. Why level the playing field for my competitors,

Global Market Comments March 21, 2014 Fiat Lux Featured Trade: (CHICAGO FRIDAY, MAY 23 GLOBAL STRAGEGY LUNCHEON) (THE RECEPTION THAT THE STARS FELL UPON), (NLR), (CCJ), (CORN), (WEAT), (SOYB), (DBA), (THE MOST FUNCTIONAL WORD IN THE ENGLISH LANGUAGE) Market Vectors Uranium+Nuclear Enrgy ETF (NLR) Cameco Corporation (CCJ) Teucrium Corn (CORN) Teucrium Wheat (WEAT) Teucrium Soybean

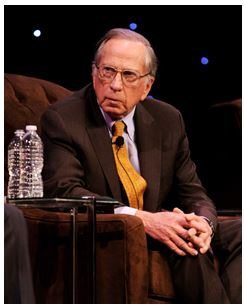

My friend was having a hard time finding someone to attend a reception who was knowledgeable about financial markets, White House intrigue, international politics, and nuclear weapons. I asked who was coming. She said Reagan?s Treasury Secretary, George Shultz, Clinton?s Defense Secretary, William Perry, and Senate Armed Services Chairman, Sam Nunn. I said I?d be

Global Market Comments March 20, 2014 Fiat Lux Featured Trade: (ORLANDO FLORIDA SATURDAY, MAY 17 GLOBAL STRAGEGY LUNCHEON), (MAKING HAY WITH THE EAGLEFORD SHALE), (USO), (UNG), (XOM), (CVX), (LNG), (CHK), (HAL) (THE PASSING OF A GREAT MAN) United States Oil (USO) United States Natural Gas (UNG) Exxon Mobil Corporation (XOM) Corporation (CVX) Chevron Cheniere Energy,

Global Market Comments March 19, 2014 Fiat Lux Featured Trade: (LAS VEGAS WEDNESDAY, MAY 14 GLOBAL STRAGEGY LUNCHEON), (THE MYSTERY OF THE MISSING $100 BILLION), (TLT), (AN EVENING WITH CONGRESS BARNEY FRANK) iShares 20+ Year Treasury Bond (TLT)

Global Market Comments March 18, 2014 Fiat Lux Featured Trade: (FRIDAY APRIL 25 SAN FRANCISCO STRATEGY LUNCHEON (ITS TIME FOR A STRATEGY CHANGE), (SPY), (DAL), (GE), (GS), (BAC), (TLT), ($DAX), (HOW TO TRADE CALL SPREADS IN AUSTRALIA), (MY FAVORITE SECRET ECONOMIC INDICATOR) SPDR S&P 500 (SPY) Delta Air Lines Inc. (DAL) General Electric Company (GE)

There is absolutely no doubt that both risk and volatility are rising in the financial markets. The higher the indexes rise, the sharper the intraday breaks. That is never a healthy sign for a bull market that has thrived for more than two years without a 10% correction. The Crimean referendum should have been a

For the many Australians who recently subscribed to Mad Hedge Fund Trader PRO, a temporary regulatory obstacle has emerged. There are two types of trading accounts permitted by Australian financial regulators: Cash Accounts ? opened by individuals Regulation ?T? accounts -? opened by corporations and trusts Reg ?T? accounts have no problems executing any of

Global Market Comments March 17, 2014 Fiat Lux Featured Trade: (FRIDAY APRIL 4 INCLINE VILLAGE, NEVADA STRATEGY LUNCHEON), (CHARTS TO WATCH FOR AN END TO THE CRISIS), (SPY), (TLT),(FXY), (RSX), (GLD), (CU), (CYB), (VIX), (VXX), (RUNNING THE SAN FRANCISCO BAY TO BREAKERS) SPDR S&P 500 (SPY) iShares 20+ Year Treasury Bond (TLT) CurrencyShares Japanese Yen

Bad China data?.Russia threatens the Ukraine?.more bad China data?.maneuvers at the Russia-Crimea border. The bull has been punched out with a market that was down every day last week, China and Russia both taking turns thrashing investors, like tag team wrestlers. When will it end? The canaries in the coal mine will be found in

Global Market Comments March 14, 2014 Fiat Lux Featured Trade: (ORLANDO FLORIDA SATURDAY, MAY 17 GLOBAL STRAGEGY LUNCHEON), (CASHING IN ON THE SAUDI ARABIA OF MILK), (ENZL), (TAKE A RIDE IN THE NEW SHORT JUNK ETF), (SJB), (JNK), (CORN) iShares MSCI New Zealand Capped (ENZL) ProShares Short High Yield (SJB) SPDR Barclays High Yield Bond

On of the scariest parts of driving around New Zealand a few weeks ago were these huge trucks and trailers that came barreling at you on tiny narrow roads. There couldn?t have been more than a few inches of clearance between us. This, I had to deal with while driving a rental stick shift on

?Global Market Comments March 13, 2014 Fiat Lux Featured Trade: (WHY THIS CHART IS UTTERLY MEANINGLESS), (THE REAL ESTATE MARKET IN 2030) (TESTIMONIAL)

Much has been made of the rising level of margin debt held by individuals. Cumulative NYSE margin debt, or the amount of money lent to buy stocks on credit, is rapidly approaching $2.3 trillion, an all time high. Historically, when this figure peaked, and no more money was available for mom and pop to buy

Global Market Comments March 12, 2014 Fiat Lux Featured Trade: (FRIDAY APRIL 25 SAN FRANCISCO STRATEGY LUNCHEON), (WHY COPPER IS CRASHING), (CU), (FCX), (BREAKFAST WITH FED GOVERNOR BOB MCTEER), Pulling the Ripcord on GM (BAC), (GS), (GM), (AIG) First Trust ISE Global Copper Index (CU) Freeport-McMoRan Copper & Gold Inc. (FCX) Bank of America Corporation

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 25, 2014. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

When Dr. Copper (CU), the only commodity with a PhD in economics, suddenly collapses from a heart attack, risk takers everywhere have to sit up and take notice. Since the 2011 top, the red metal has collapsed a shocking 38%. It has given back 10% just in the last two weeks. Will copper take down

No one can explain the most complex economic and monetary issues in a simpler, more homespun fashion than former governor of the Federal Reserve, Bob McTeer. He is known for carrying around two yardsticks, one slightly longer than the other, to demonstrate to your average guy the monthly changes in employment. Bob argues that the

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.