Global Market Comments February 3, 2014 Fiat Lux Featured Trade: (FEBRUARY 5 GLOBAL STRATEGY WEBINAR), (NOW WE?RE COOKING WITH GAS), (AMERICA?S DEMOGRAPHIC TIME BOMB), (TESTIMONIAL)

Now We?re Cooking With Gas (UNG) Those who followed my advice to buy the United States Natural Gas Fund (UNG) July, 2014 $23 puts at $1.68 yesterday are now in the enviable position of owning a security that is running away to the upside. At this morning?s high the puts traded at $2.40, a one

Global Market Comments January 31, 2014 Fiat Lux Featured Trade: (TIME TO SELL NATURL GAS), (UNG), (USO), (MAD HEDGE FUND TRADER 2014 GLOBAL STRATEGY LUNCHEON SCHEDULE) United States Natural Gas (UNG) United States Oil (USO)

Time to Sell Natural Gas I received a crackly, hard to understand call late last night from one of my old natural gas buddies in the Barnet shale in Texas. Chances are that CH4 peaked in price last night with the expiration of the front month contract. It was time to sell. I spent five

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Luncheons, which I will be conducting around the world throughout 2014. Please find the schedule for the next six months below. To warm you up, I?ll email you a PowerPoint presentation covering the broad range of topics we may cover, which is

Global Market Comments January 30, 2014 Fiat Lux Featured Trade: (SATURDAY FEBRUARY 22 BRISBANE AUSTRALIA STRATEGY LUNCH) (PULLING THE RIPCORD ON SOFTBANK), (SFTBY), (HAPPY BIRTHDAY IRS!), (THE TECHNOLOGY NIGHTMARE COMING TO YOUR CITY) SoftBank Corp. (SFTBY)

The day I bought my second lot of shares in the internet giant on December 12 was the exact point where a year of upward momentum in this stock came to a juddering halt. The shares have since been like an errant teenaged child who you keep giving the benefit of a doubt until he

Global Market Comments January 29, 2014 Fiat Lux Featured Trade: (THURSDAY FEBRUARY 20 MELBOURNE, AUSTRALIA STRATEGY LUNCH) (AAPLE STRIKES AGAIN), (AAPL). (AN EVENING WITH TRAVEL GURU ARTHUR FROMMER) Apple Inc. (AAPL)

Let me tell you my thinking here. More than 51 million iPhones sold is good enough for me, 3.2 million more than they moved a year ago, and they are more expensive devices. IPads leapt from 22.9 million to 26 million, including the five high end ones I bought. The earnings announcement wasn?t that bad,

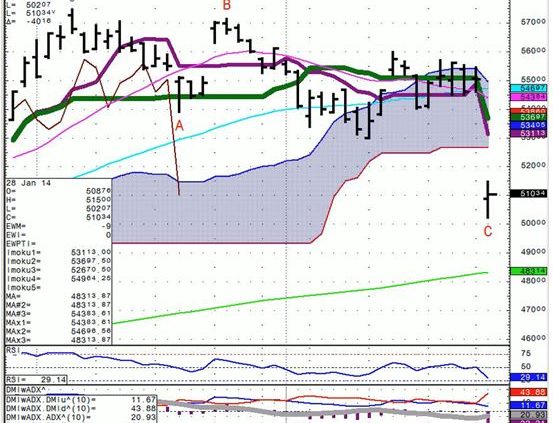

Global Market Comments January 28, 2014 Fiat Lux Featured Trade: (FRIDAY FEBRUARY 14 SYDNEY, AUSTRALIA STRATEGY LUNCH), (WHAT THE MARKETS ARE DOING FROM HERE), (SPY), (QQQ), (IWM), (FXY), (TLT), (TBT), (XLF), (XLY), (TURKEY IS ON THE MENU), ?(TUR), (TKC) SPDR S&P 500 (SPY) PowerShares QQQ (QQQ) iShares Russell 2000 (IWM) CurrencyShares Japanese Yen Trust (FXY)

For the last couple of nights, I have left my iPhone logged into the Argentina peso market, one of several troubled currencies igniting the emerging market contagion. Whenever the peso losses another handle to the US dollar, an alarm goes off. That gives me a head start on how American markets will behave the next

I am building lists of emerging market ETF?s to snap up during the current sell off, and Turkey popped up on the menu. The country is only one of two Islamic countries that I consider investment grade, (Indonesia is the other one). The 82 million people of Turkey rank 15th in the world population, and

Global Market Comments January 27, 2014 Fiat Lux Featured Trade: (FEBRUARY 12 AUCKLAND NEW ZEALND STRATEGY LUNCH) (THE PRICE OF STARDOM AT DAVOS), (WILL GOLD COINS SUFFER THE FATE OF THE $10,000 BILL), (GLD), (SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS) SPDR Gold Shares (GLD)

Global Market Comments January 24, 2014 Fiat Lux Featured Trade: (SATURDAY FEBRUARY 22 BRISBANE AUSTRALIA STRATEGY LUNCH) (A FEW THOUGHTS ON TRADING STRATEGY), (SPY), (QQQ), (IWM), (GLD), (GDX), (ABX), (TLT), (TBT), (ANOTHER DINNER WITH ROBERT REICH) SPDR S&P 500 (SPY) PowerShares QQQ (QQQ) iShares Russell 2000 (IWM) SPDR Gold Shares (GLD) Market Vectors Gold Miners

After one of the wildest rides in recent memory, the stock market has ground to a complete halt. So have virtually all other asset classes as well. You can see this in the activity of my Trade Alert service as well. After sending out Alerts as fast as I could write them for the past

I never tire of listening to economics guru, Robert Reich, speak about the economy. He was former Labor Secretary under Bill Clinton, and ran against Mitt Romney for governor of Massachusetts (he lost). He has published 13 books. Oh, and he dated our recent Secretary of State, Hillary Rodham, when they were in law school

Global Market Comments January 23, 2014 Fiat Lux Featured Trade: (THURSDAY FEBRUARY 20 MELBOURNE, AUSTRALIA STRATEGY LUNCH), (AIRLINE STOCKS ARE CLEARED FOR TAKEOFF), (AAL) (UAL), (DAL), (LUV), (TESTIMONIAL) American Airlines Group Inc. (AAL) United Continental Holdings, Inc. (UAL) Delta Air Lines Inc. (DAL) Southwest Airlines Co. (LUV)

When I was a young, clueless investment banker at Morgan Stanley 30 years ago, the head of equity sales took me aside to give me some fatherly advice. Never touch the airlines. The profitability of this industry was totally dependent on fuel costs, interest rates and the state of the economy and management hadn't the

Global Market Comments January 22, 2014 Fiat Lux Featured Trade: (FRIDAY FEBRUARY 14 SYDNEY, AUSTRALIA STRATEGY LUNCH), (WHY THE WORLD HATES THE AUSSIE), (FXA), (EWA), (EWZ), (FXI), (REVISITING CHENIERE ENERGY), (LNG), (USO), (UNG) CurrencyShares Australian Dollar Trust (FXA) iShares MSCI Australia (EWA) iShares MSCI Brazil Capped (EWZ) iShares China Large-Cap (FXI) Cheniere Energy, Inc. (LNG)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Sydney, Australia at 12:00 noon on Friday, February 14, 2014. An excellent meal will be followed by a wide ranging discussion and a minute question and answer period. I?ll be giving you my up to

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.