Trade Alert - (OXY) – BUY BUY the Occidental Petroleum (OXY) January 2026 $60-$62.50 out-of-the-money vertical Bull Call spread LEAPS at $0.80 or best Opening Trade 10-8-2024 expiration date: January 16, 2026 Number of Contracts = 1 contract China certainly brought out a big bazooka with its massive stimulus package last week. If this

Global Market Comments October 7, 2024 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or GOLDILOCKS ON STEROIDS, plus A KERFFUFLE IN PARIS), (SPY), (FXI), ($COMPQ), (CCJ), (SLB), (OXY), (TSLA), (TLT), (DHI), (NEM), (GLD), (TSLA)

The 6,000 targets for the S&P 500 are starting to go mainstream. That was my forecast on January 1, back when everyone said I was nuts. The inflation rate is 2.2%, GDP growth is 3.0%, and interest rates are falling sharply, on their way to 3.0% by next summer. Goldilocks is back, but this time

"The market always gets it right," said Jim O'Neill, the chairman of Goldman Sachs International, who coined the term "BRIC".

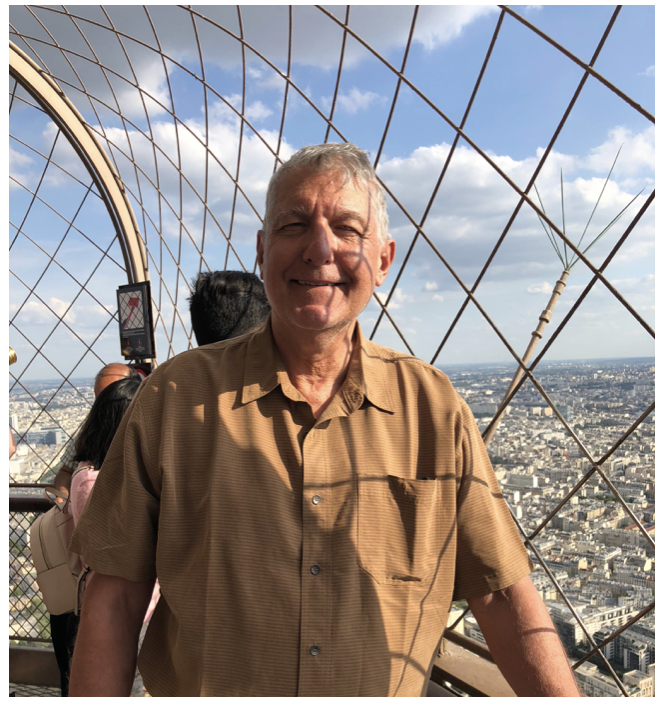

Global Market Comments October 4, 2024 Fiat Lux Featured Trade: (JOIN ME ON CUNARDS QUEEN MARY 2 FOR MY JULY 11 TRANSATLANTIC SEMINAR AT SEA LUNCHEON), (EUROPEAN STYLE HOMELAND SECURITY)

The English are feeling the pinch in relation to recent geopolitical events and have therefore raised their security level from "Miffed" to "Peeved." Soon, though, security levels may be raised yet again to "Irritated" or even "A Bit Cross." The English have not been "A Bit Cross" since the blitz in 1940 when tea supplies

“Bonds are priced artificially because you’ve got some guy buying tens of billions of dollars’ worth a month. That will change at some point, and when it does, people are going to lose a lot of money,” said the Oracle of Omaha, Warren Buffett.

Global Market Comments October 3, 2024 Fiat Lux Featured Trade: (THE MAD HEDGE SEPTEMBER 17-19 SUMMIT REPLAYS ARE UP), (HOW TO EXECUTE A MAD HEDGE TRADE ALERT)

From time to time, I receive an email from a subscriber telling me that they are unable to get executions on trade alerts that are as good as the ones I get. There are several possible reasons for this: 1) Markets move, sometimes quite dramatically so. 2) Your Trade Alert email was hung up on

Global Market Comments October 2, 2024 Fiat Lux Featured Trade: (FRIDAY OCTOBER 25 SALT LAKE CITY UTAH STRATEGY LUNCHEON) (TRADING DEVOID OF THE THOUGHT PROCESS), (SPY), (INDU), (TLT), (USO)

It seems that all anyone has to do is blow their nose these days, and high-frequency trading will amplify the movement, a multiple of what we would have seen in past years. It's like the butterfly flapping its wings in the Amazon. The exit of institutional money to trading in in-house dark pools, the concentration

Global Market Comments October 1, 2024 Fiat Lux Featured Trade: (HOW TO AVOID THE PONZI SCHEME TRAP) (TESTIMONIAL)

In Silicon Valley, you’re either a unicorn or a dinosaur, and if you are the latter, you are uninvestable,” said a venture capital friend of mine.

Global Market Comments September 30, 2024 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or CHINA IS BACK! plus MY ENCOUNTER WITH ALIENS), (GLD), (CCJ), (NEM), (TSLA), TLT), (DHI), (FXI), (BIDU), (TNE) (USO), (BTU), (UNG), (CORN), (WEAT), (SOYB), (LVS), (WYNN) (LVUY) (HESAF)

There are always many unintended consequences to any Fed move, such as the 50-basis point interest rate cut on September 18. This time, a big one is that China would match and then exceed our own central bank’s move with a blockbuster stimulus package of their own. China has finally reached the “whatever it takes”

Global Market Comments September 27, 2024 Fiat Lux Featured Trade: (THE MAD HEDGE SEPTEMBER 17-19 SUMMIT REPLAYS ARE UP), (SEPTEMBER 25 BIWEEKLY STRATEGY WEBINAR Q&A), (TSLA), (NVDA), (GLD), (SLV), (AGQ), (URA), (X), (PGE), (FDX), (V), (CEG), (NEE), (CCJ), (FSLR), (TLT), (WMT), (FCX), (UBER), (LYFT), (FXB), (T)

Below please find subscribers’ Q&A for the September 25 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe Nevada. Q: The iShares 20+ Year Treasury Bond ETF (TLT) is not advancing like I had hoped. I’m not sure why the interest rate cuts have not impacted the 20-year maturity—is it too far out?

“There’s a 70% chance you could lose it all,” said Jeff Bezos to his parents when asking for a $100,000 investment to start Amazon. “I want you to know the risks because I want to be able to come home for Thanksgiving.”

Global Market Comments September 26, 2024 Fiat Lux Featured Trade: (AN INSIDER’S GUIDE TO THE NEXT DECADE OF TECH INVESTMENT), (AMZN), (AAPL), (NFLX), (AMD), (INTC), (TSLA), (GOOG), (META)

Global Market Comments September 25, 2024 Fiat Lux Featured Trade: (THE NEXT COMMODITY SUPER CYCLE HAS JUST BEGUN), (COPX), (GLD), (FCX), (BHP), (RIO), (SIL), (CCJ), (PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.