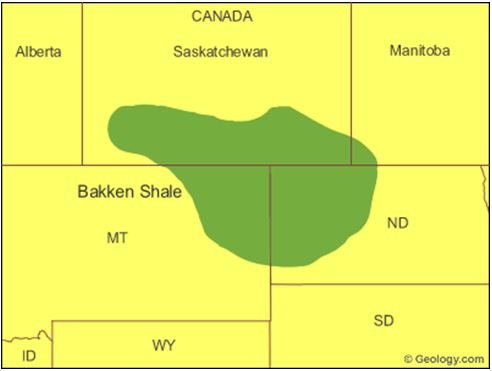

My inbox was clogged with responses to my ?Golden Age? for the 2020?s piece, particularly my forecast that the US was moving towards complete energy independence. This will be the most important change to the global economy for the next 20 years. So I shall go into more depth. The energy research house, Raymond James,

Global Market Comments January 7, 2014 Fiat Lux 2014 Annual Asset Class Review FOR PAID SUBSCRIBERS ONLY Featured Trades: (SPX), (QQQ), (XLF), (XLE), (XLI), (XLY), (EEM), (TLT), (TBT), (JNK), (PHB), (HYG), (PCY), (MUB), (HCP) (FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB) (FCX), (VALE), (MOO), (DBA), (MOS), (MON), (AGU), (POT), (PHO), (FIW), (CORN), (WEAT), (SOYB), (JJG)

Global Market Comments January 6, 2014 Fiat Lux Featured Trades: MY 20 RULES FOR TRADING

Nothing like starting the New Year with going back to basics and reviewing the rules that worked so well for us in 2013. Call this the refresher course for Trading 101. I usually try to catch three or four trend changes a year, which might generate 50-100 trades, and often come in frenzied bursts. Since

Global Market Comments January 3, 2014 Fiat Lux Featured Trade: (REPORT FROM THE MATTERHORN SUMMIT)

From where I stand, the rolling foothills of Northern Italy spread out below me to the south. On my left lie the distinctive peaks of the Dolomite Alps. On my right I can see the massive expanse of Mont Blanc, at 15,781 feet the highest mountain in Europe. I am standing at the summit of

Global Market Comments January 2, 2014 Fiat Lux Featured Trade: (AN EVENING WITH GENERAL DOUGLAS FRASER), (EWZ), (ECH), (GXG), (CU), (CORN), (SOYB), (WEAT), (A COW BASED ECONOMICS LESSON) iShares MSCI Brazil Capped (EWZ) iShares MSCI Chile Capped (ECH) Global X FTSE Colombia 20 ETF (GXG) First Trust ISE Global Copper Index (CU) Teucrium Corn (CORN)

I never cease to be amazed by the intelligence provided me by the US Defense Department, which after the CIA, has the world?s most impressive and insightful economic research team. There are few places a global strategist like me can go to get intelligent, thoughtful forty-year views, and this is one. Wall Street, eat your

SOCIALISM -You have 2 cows. You give one to your neighbor. COMMUNISM -You have 2 cows. The State takes both and gives you some milk. FASCISM -You have 2 cows. The State takes both and sells you some milk. NAZISM -You have 2 cows. The State takes both and shoots you. BUREAUCRATISM -You have 2

Global Market Comments December 31, 2013 Fiat Lux Featured Trade: (THE LONG VIEW ON EMERGING MARKETS), (HOW TO AVOID THE PONZI SCHEME TRAP), (MURRAY SAYLE: THE PASSING OF A GIANT IN JOURNALISM), (TESTIMONIAL)

Global Market Comments December 30, 2013 Fiat Lux Featured Trades: (BE CAREFUL WHO YOU SNITCH ON), (A CONVERSATION WITH THE BOOTS ON THE GROUND), (DINNER WITH JOSEPH STIGLITZ)

Buried in the recently passed Dodd-Frank financial reform bill are massive financial rewards for turning in your crooked boss. The SEC is hoping that multimillion dollar rewards amounting to 10%-30% of sanction amounts will drive a stampede of whistleblowers to their doors with evidence of malfeasance and fraud by their employers. If such rules were

Global Market Comments December 26, 2013 Fiat Lux Featured Trade: (INDIA IS CATCHING UP WITH CHINA), (PIN), (FXI), (WHO SAYS HEDGE FUNDS AREN?T ADDING VALUE?) (PETER F. DRUCKER ON MANAGEMENT) PowerShares India (PIN) iShares China Large-Cap (FXI)

When I first visited Calcutta in 1976, more than 800,000 people were sleeping on the sidewalks, I was hauled everywhere by a very lean, barefoot rickshaw driver, and drinking the water out of a tap was tantamount to committing suicide. Some 36 years later, and the subcontinent is poised to overtake China's white hot growth

Global Market Comments December 24, 2013 Fiat Lux Featured Trades: (A CHRISTMAS STORY), (THE U-HAUL INDICATOR)

It is the end of the school year at the University of California at Berkeley, and the unenviable task of moving my son, a senior, out of his hovel for the holidays fell to me. When I arrived, I was stunned to find nothing less than a war zone. Both sides of every street were

Global Market Comments December 23, 2013 Fiat Lux Featured Trade: (THE ONE BRIGHT SPOT IN REAL ESTATE), (A SHORT HISTORY OF HEDGE FUNDS), (THE POPULATION BOMB ECHOES), (POT), (MOS), (AGU), (THANK GOODNESS I DON?T LIVE IN SWEDEN), (EWD) Potash Corp. of Saskatchewan, Inc. (POT) The Mosaic Company (MOS) Agrium Inc. (AGU) iShares MSCI Sweden (EWD)

Global Market Comments December 20, 2013 Fiat Lux SPECIAL END OF YEAR ISSUE Featured Trades: (GO LONG CHRISTMAS CHEER AND HOT BUTTERED RUM), (A SPECIAL NOTE ON EXERCISED OPTIONS)

Global Market Comments December 19, 2013 Fiat Lux Featured Trade: (MAD HEDGE FUND TRADER PROFIT HITS 63%), (SPY), (TLT), (FXY), (SFTBY), (AAPL), (XLF), (I WAS WRONG?.BUT IT DIDN?T MATTER) (A DIFFERENT VIEW OF THE US) (THE STRUCTURAL BEAR CASE FOR TREASURY BONDS), (TLT), (TBT) SPDR S&P 500 (SPY) iShares 20+ Year Treasury Bond (TLT) CurrencyShares

The performance of the Mad Hedge Fund Trader?s Trade Alert Service is still going ballistic, reaching the heady height of 63.08% for the year. Including both open and closed trades, 24 out of the last 26 consecutive Trade Alerts have been profitable. The results so far in December are up a stunning +7.04. The three-year

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.