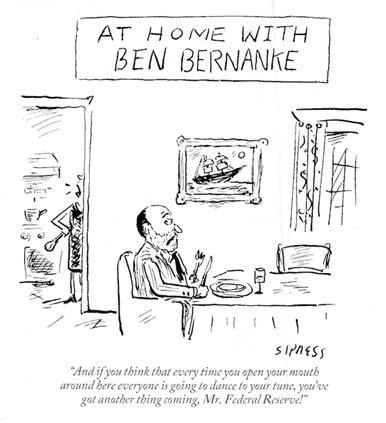

Ben Bernanke finally did the deed. He tapered his quantitative easing program, from $85 to $75 billion a month. I thought he would wait until next month for incoming Fed governor Janet Yellen to take the helm, and the responsibility. It was not to be. The good news for followers of my Trade Alert Service

Global Market Comments December 18, 2013 Fiat Lux Featured Trade: (THE RECEPTION THAT THE STARS FELL UPON), (NLR), (CCJ), (CORN), (WEAT), (SOYB), (DBA), (OIL ISN?T WHAT IT USED TO BE), (USO), (TAKING A BITE OUT OF STEALTH INFLATION), (SGG), (WEAT) Market Vectors Uranium+Nuclear Enrgy ETF (NLR) Cameco Corporation (CCJ) Teucrium Corn (CORN) Teucrium Wheat (WEAT)

Virtually every analyst has been puzzled by the seeming immunity of stock markets to high oil prices this year. In fact, stocks and crude have been tracking almost one to one on the upside. The charts below a friend at JP Morgan sent me go a long way towards explaining this apparent dichotomy. The first

Global Market Comments December 17, 2013 Fiat Lux Featured Trade: (THE RISING DRUMBEAT FOR ALIBABA), (SFTBY), (S), (TMUS), (T), (RAMPANT WAGE INFLATION STRIKES CHINA), (FXI) (CHECK OUT OBAMA?S LATEST STIMULUS PLAN), (TESTIMONIAL) SoftBank Corp. (SFTBY) Sprint Corporation (S) T-Mobile US, Inc. (TMUS) AT&T, Inc. (T) iShares China Large-Cap (FXI)

Rumors hit the market Friday that Sprint (S) will mount a $20 billion takeover bid for T-Mobile (TMUS) in early January. The news caused a late day kerfluffle on what would otherwise have been a slow December pre holiday Friday. The Shares of both companies immediately jumped 10%, which left many analysts scratching their heads.

I rely on hundreds of 'moles' around the world whose job it is to watch a single, but important indicator for the world economy. One of them checks for me the want ads in the manufacturing mega city of Shenzhen, China, and what he told me last week was alarming. Wage demands by Chinese workers

Was there is no limit to how far President Obama was willing to go to stimulate the economy and reassure his election? So I had to be amused when a friend sent me a link to his proposal. Warning: the source is a college humor website, so I would take it with so many grains

Global Market Comments December 16, 2013 Fiat Lux Featured Trade: (REPORT FROM THE FROZEN WASTELANDS OF THE WEST)

Global Market Comments December 13, 2013 Fiat Lux Featured Trade: (DECEMBER 18 GLOBAL STRATEGY WEBINAR), (MY MARKET TAKE FOR THE REST OF 2013), (DOUBLING UP ON SOFTBANK), (SFTBY) (SPY), (XLF), (TLT), (FXY), (SFTBY), (AAPL), (TESTIMONIAL) SoftBank Corp. (SFTBY) SPDR S&P 500 (SPY) Financial Select Sector SPDR (XLF) iShares 20+ Year Treasury Bond (TLT) CurrencyShares Japanese

I can?t believe how fast the year has gone by. It seems like only yesterday that I was riding the transcontinental railroad from Chicago to San Francisco, writing my 2013 All Asset Class Review. Now 2014 is at our doorstep. As usual, the market has got it all wrong. There is not going to be

I have always been a big fan of buying a dollar for 30 cents. That appears to be the opportunity now presented by the Japanese software giant, Softbank (SFTBY). This gorilla of the Internet space was founded and run by my old friend, Masayoshi Son, who many refer to as a combination of the Jeff

Global Market Comments December 12, 2013 Fiat Lux Featured Trade: (IS THIS THE BIG TRADE OF 2014?), (GLD), (SLV), ($SSEC), (EEM), (FXI), (JJC), (DBA), (CORN), (CU), (USO), (KOL), (A CHRISTMAS DONATION FOR THE WORTHIEST OF CAUSES) SPDR Gold Shares (GLD) iShares Silver Trust (SLV) Shanghai Stock Exchange Composite Index ($SSEC) iShares MSCI Emerging Markets (EEM)

I follow a broad range of unconventional, but highly useful leading economic indicators that gives me a decisive edge when predicting the future direction of global financial markets. One of them has started flashing a warning sign. I fund an orphanage in remote Zhanjiang, in China?s southern Guangdong province, near Hainan Island called The Zhanjiang

Global Market Comments December 11, 2013 Fiat Lux Featured Trade: (THE BIPOLAR ECONOMY), (SAY GOODBYE TO YOUR FAVORITE TEACHER), (RAILROADS ARE BREAKING OUT ALL OVER), (UNP), (CSX), (NSC), (CP), (ACI) Union Pacific Corporation (UNP) CSX Corp. (CSX) Norfolk Southern Corp. (NSC) Canadian Pacific Railway Limited (CP) Arch Coal Inc. (ACI)

Corporate earnings are up big! Great! Buy! No wait! The economy is going down the toilet! Sell! Buy! Sell! Buy! Sell! Help! Anyone would be forgiven for thinking that the stock market has become bipolar. There is, in fact, an explanation for this madness. According to the Commerce Department?s Bureau of Economic Analysis, the answer

Don?t bother taking an apple to school to give your favorite teacher, unless you want to leave it in front of a machine. The schoolteacher is about to join the sorry ranks of the service station attendant, the elevator operator, and the telephone operators whose professions have been rendered useless by technology. The next big

Global Market Comments December 10, 2013 Fiat Lux Featured Trade: (GOTTA LOVE THAT NOVEMBER NONFARM PAYROLL), (MAD HEDGE FUND TRADER PROFIT SPURTS TO 59%), (SPY), (SFTBY), (AAPL), (TLT), (FXY) SPDR S&P 500 (SPY) SoftBank Corp. (SFTBY) Apple Inc. (AAPL) iShares 20+ Year Treasury Bond (TLT) CurrencyShares Japanese Yen Trust (FXY)

The November nonfarm payroll blew out to the upside once again, with 203,000 souls landing jobs for the month. Previous months were substantially revised up. The headline unemployment rate made a whopping great fall from 7.3% to 7.0%, the sharpest drop in years. The much feared collapse in the jobs market triggered by the October

The performance of the Mad Hedge Fund Trader?s Trade Alert Service is still going ballistic, reaching the heady height of 59% for the year. I know some of your saw your faith challenged when, at one point, the stock market was looking at five consecutive down days last week. The red ink all disappeared when

Global Market Comments December 9, 2013 Fiat Lux Featured Trade: (LESSONS FROM THE AUSTRALIAN DOLLAR), (FXA), (EWA), (HANGING OUT WITH THE WOZ), (AAPL), (TESTIMONIAL) CurrencyShares Australian Dollar Trust (FXA) iShares MSCI Australia (EWA) Apple Inc. (AAPL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.