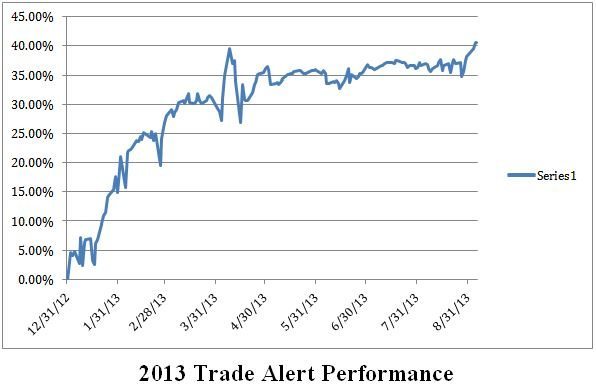

The Trade Alert service of the Mad Hedge Fund Trader has posted a year-to-date gain of 40.53%, a new all time high. Performance since inception 33 months ago soared to 95.58%. This pegs the average annualized return at 34.75%. Some 71% of all Trade Alerts since the beginning have been profitable. Carving out the closed

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

When anyone starts lecturing you that the US has the highest tax rate in the industrialized world, just turn around, walk away, and pretend you never heard them. This person is either ignorant about this country?s taxation system, or is deliberately trying to deceive or mislead you. According to a report released by the Internal

To prove that The Diary of a Mad hedge Fund Trader only deals with the highest quality, top drawer clientele, I want to share the picture below sent in by a subscriber.

Global Market Comments September 5, 2013 Fiat Lux Featured Trade: (OCTOBER 18 SAN FRANCISCO STRATEGY LUNCHEON) (TAKING PROFITS ON MY EURO SHORT), ?(FXE), (EURO), (POPULATION BOMB ECHOES), (POT), (MOS), (AGU), (WEAT), (CORN), (SOYB), (RJA) CurrencyShares Euro Trust (FXE) Potash Corp. of Saskatchewan, Inc. (POT) The Mosaic Company (MOS) Agrium Inc. (AGU) Teucrium Wheat (WEAT) Teucrium

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

It looks like the (FXE) gave us the double top at $133 which I predicted in my August 28 webinar, which very conveniently, was the lower strike of my Currency Shares Euro Trust (FXE) September, 2013 $133-$135 bear put spread. We have since backed off $3, and lower levels beckon. I originally wrote this Trade

Global Market Comments September 4, 2013 Fiat Lux Featured Trade: (WHY I?M KEEPING MY OIL SHORT), (USO), (SCO), (A COW BASED ECONOMICS LESSON), (ON THAT TESLA RECOMMENDATION), (TSLA) United States Oil (USO) ProShares UltraShort DJ-UBS Crude Oil (SCO) Tesla Motors, Inc. (TSLA)

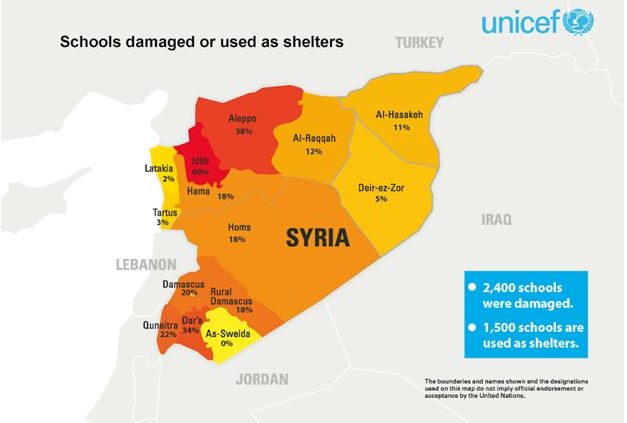

Let?s call this the weekend of love. On Friday morning, we were looking forward to a long weekend of missiles raining down on Syria and the regional conflagration that would follow. The price of oil reflected as much, with west Texas intermediate trading all the way up to $112.50. Then the British Parliament voted against

SOCIALISM -You have 2 cows. You give one to your neighbor. COMMUNISM -You have 2 cows. The State takes both and gives you some milk. FASCISM -You have 2 cows. The State takes both and sells you some milk. NAZISM -You have 2 cows. The State takes both and shoots you. BUREAUCRATISM -You have 2

Will the person who bought Tesla shares (TSLA) on my recommendation last year at $30 please email me? I was traveling in Europe over the summer and lost your email address. I would like to get a testimonial from you. The stock hit $173.70 today, and is up 580% from your cost, making it the

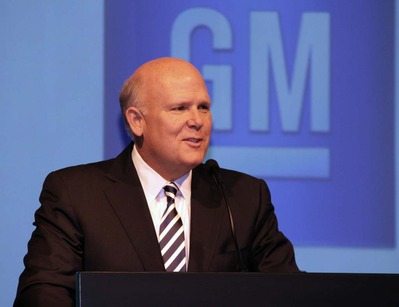

Long-term readers of this letter are well aware of my antipathy towards General Motors (GM). For decades, the company turned a deaf ear to customer complaints about shoddy, uncompetitive products, arcane management practices, entitled dealers, and a totally inward looking view of the world that was rapidly globalizing. It was like watching a close friend

Global Market Comments September 3, 2013 Fiat Lux Featured Trade: (AN EVENING WITH ?GOVERNMENT MOTORS?), (GM), (WHY BEN BERNANKE HATES ME) General Motors Company (GM)

I don?t just think he hates me. He truly despises me. In fact, he does everything he can to put me out of business. Take the taper, for example. If I am right and he doesn?t end quantitative easing, then my model-trading portfolio goes through the roof. If he does, it will crater. Many other

Global Market Comments August 30, 2013 Fiat Lux Featured Trade: (WHY I?M DOUBLING MY YEN SHORT), (FXY), (YCS), (GET READY FOR THE NEXT GOLDEN AGE) CurrencyShares Japanese Yen Trust (FXY) ProShares UltraShort Yen (YCS)

The summer us coming to a close this weekend, and the longer term, fundamentally driven trends that have been sunning themselves at the beach are about to reassert themselves. The sideways churning moves on low volume that started as early as March are about to come to an end. Therefore, it is time to bulk

I believe that the global economy is setting up for a new golden age reminiscent of the one the United States enjoyed during the 1950?s, and which I still remember fondly. This is not some pie in the sky prediction. It simply assumes a continuation of existing trends in demographics, technology, politics, and economics. The

Global Market Comments August 29, 2013 Fiat Lux Featured Trade: (BATTLE TESTING YOUR PORTFOLIO), (SPY), (USO), (FXE), (FXY), (YCS), (GLD), (SLV), (TLT), (THE COST OF CLEAN COAL), (KOL), (WHO IS BEN BERNANKE?) SPDR S&P 500 (SPY) United States Oil (USO) CurrencyShares Euro Trust (FXE) CurrencyShares Japanese Yen Trust (FXY) ProShares UltraShort Yen (YCS) SPDR Gold

The great thing about the sudden $5 pop is the price of oil since Monday is that it battle tests your portfolio. You really don't know what you own and the risks it entails until something like this comes along. I'll explain why. For a start, you get a very clear idea of which of

I wanted to get the low down on clean coal (KOL) to see how clean it really is, so I visited some friends at Lawrence Livermore National Laboratory. The modern day descendent of the Atomic Energy Commission, where I had a student job in the seventies, the leading researcher on laser induced nuclear fission, and

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.