I have just finished reading the best financial book ever, and I have read most of them. It is The Ascent of Money: A Financial History of the World by Harvard professor Niall Ferguson. It gives you a great explanation of how the broad sweep of history delivered us to the doorstep of today?s crisis.

I took a day off to attend the New York Times Global Forum at San Francisco?s Sony Metreon Center. Their goal was to put together 400 of the most forward thinking and influential minds in the Bay Area, stand back, and see what happened. It was organized by my old friend, fellow traveler, and veteran

Global Market Comments June 21, 2013 Fiat Lux Featured Trade: (UPDATED 2013 STRATEGY LUNCHEON SCHEDULE), (THE PROBLEM WITH GM), (GM) (WHY I LOVE/HATE THE OIL COMPANIES), (XOM), (USO), (THE WORST TRADE IN HISTORY), (AAPL) General Motors Company (GM) Exxon Mobil Corporation (XOM) United States Oil (USO) Apple Inc. (AAPL)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Updates, which I will be conducting throughout Europe during the summer of 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks, bonds,

Like a heroin addict who just can?t wean himself off of the good stuff, General Motors is going back into subprime lending to finance new auto sales. Although the much-diminished company has made great strides at reforming its errant ways, they still do not understand their fundamental problem. My dad was a lifetime GM customer,

The first thing I do when I get up every morning is to curse the oil companies as the blood sucking scourges of modern civilization. I then fall down on my knees and thank God that we have oil companies. This is why petroleum engineers are getting $100,000 straight out of college, while English and

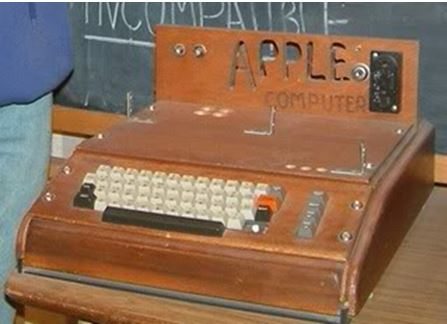

Say you owned 10% of Apple (AAPL) and you sold it for $800 in 1976. What would that stake be worth today? Try $22 billion. That is the harsh reality that Ron Wayne, 76, faces every morning when he wakes up, one of the three original founders of the consumer electronics giant. Ron first met

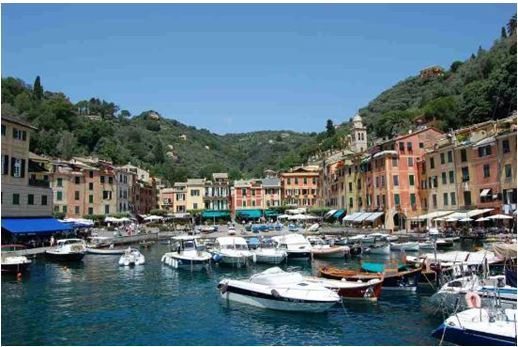

Global Market Comments June 20, 2013 Fiat Lux Featured Trade: (JULY 25 PORTOFINO, ITALY STRATEGY LUNCHEON), (MORE OF THE SAME FROM UNCLE BEN), (SPY), (FXY), (YCS), (GLD), (TLT), (TBT), (THE NEW COLD WAR) SPDR S&P 500 (SPY) CurrencyShares Japanese Yen Trust (FXY) ProShares UltraShort Yen (YCS) SPDR Gold Shares (GLD) iShares Barclays 20+ Year Treas

You may have noticed that our website has been down for the past day. We are undertaking a major upgrade to our infrastructure, and I thought completing this while you are all on vacation would be timely. This means that our store is down as well, so you may need to wait until the weekend

Come join John Thomas for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting near Portofino, Italy on the Italian Riviera, on Thursday, July 25, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I'll be giving you my up

Ben Bernanke delivered exactly what I expected today, continuing his massively simulative monetary policy as is. The taper went missing in action, and search parties have been already sent out by the bears. In the past this move would have triggered a massive move up in risk assets, and a collapse of the bond market,

My friend, Ian Bremmer of the Eurasia Group, a global risk analyst who I regularly follow, has published an outstanding book entitled The End of the Free Markets: Who Wins the War Between States and Corporations. I find this highly depressing, as it takes me as long to read one of Ian's books as it

Global Market Comments June 19, 2013 Fiat Lux Featured Trade: (JULY 8 LONDON STRATEGY LUNCHEON), (TRADE ALERT SERVICE RANKS SIXTH AMONG HEDGE FUNDS) (THE HISTORY OF TECHNOLOGY), (THE FUTURE OF CONSUMER SPENDING), (EEM), (PIN), (IDX), (EWC) iShares MSCI Emerging Markets Index (EEM) PowerShares India (PIN) Market Vectors Indonesia Index ETF (IDX) iShares MSCI Canada Index

Come join me for lunch for the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in London on Monday, July 8, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I'll be giving you my up to date view on stocks, bonds,

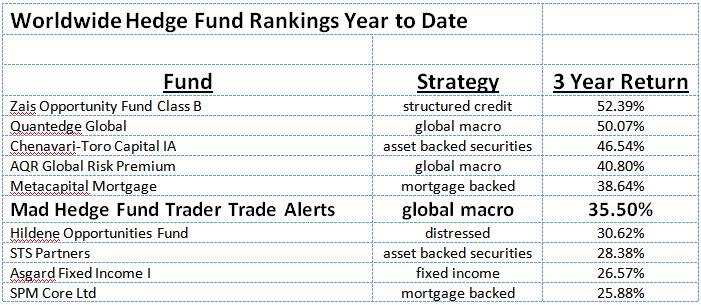

The Trade Alert service of the Mad Hedge Fund Trader ranked as the sixth top-performing hedge fund in the world, according to statistics compiled by Barron's. The Dow Jones subsidiary tallied results of the top 100 funds from a potential global universe of over 10,000. It then ranked results according to their three-year compound annual

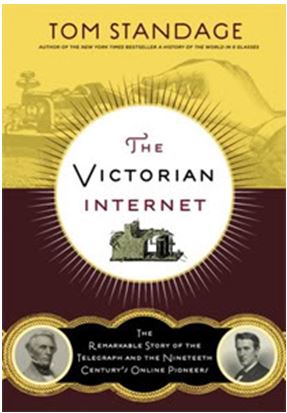

I have just finished leisurely reading Tom Standage's book The Victorian Internet: The Remarkable Story of the Telegraph and the Nineteenth Century On-Line Pioneers. Standage discusses the creation and development of the telegraph system and how it revolutionized communication in the nineteenth century. The book claims that Modern Internet users are in many ways the

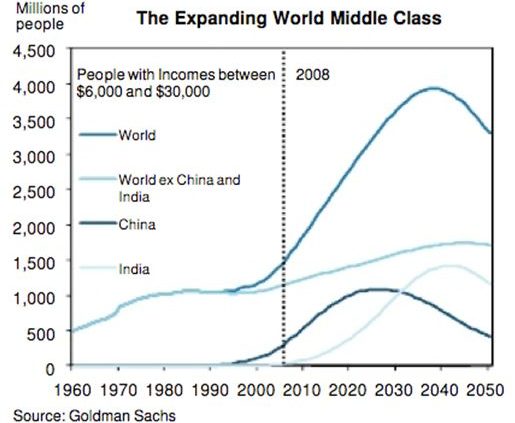

As part of my never ending campaign to get you to move more money into emerging markets, please take a look at the chart below from Goldman Sachs. It shows that the global middle class will rise from 1.8 billion today to 4 billion by 2040, with the overwhelming portion of the increase occurring in

Global Market Comments June 18, 2013 Fiat Lux Featured Trade: (JULY 2 NEW YORK STRATEGY LUNCHEON), (THE HIGH OIL MYSTERY), (USO), (UNG), (SCAM OF THE WEEK), (DECODING WHAT?S IN YOUR POCKET) United States Oil (USO) United States Natural Gas (UNG)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting in New York, NY on Tuesday, July 2, 2013. An excellent three course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period. I?ll be giving you my up

American oil imports from the Middle East are in free fall, down 35% in two years. They are quickly being replaced by tar sands imports from Canada, which are ballooning to 2 million barrels a day and at all time highs. American energy production is surging, thanks to new finds of natural gas showing up

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.