American oil imports from the Middle East are in free fall, down 35% in two years. They are quickly being replaced by tar sands imports from Canada, which are ballooning to 2 million barrels a day and at all time highs. American energy production is surging, thanks to new finds of natural gas showing up

If you want to impress your friends with your vast knowledge of financial matters, then here are the Latin translations of the script on the backside of a US dollar bill. ?ANNUIT COEPTIS? means ?God has favored our undertaking.? ?NOVUS ORDO SECLORUM? translates into ?A new order has begun.? The Roman numerals at the base

Having trouble raising capital for your new hedge fund? Just list Warren Buffet as your ?Honorary Chairman.? That?s what California prison guard, Ottoniel Medrano, did. To help his marketing efforts, he also claimed that he had $4.8 billion in assets under management as well as massive real estate holdings in Asia. With this scam, Medrano?s

Global Market Comments June 17, 2013 Fiat Lux Featured Trade: (JULY 12 AMSTERDAM STRATEGY LUNCHEON) (AN ENVIRONMENTAL ACTIVISTS TAKE ON THE MARKETS), (DBA), (MOO), (PHO), (FIW). (BUSINESS IS BOOMING AT THE MONEY PRINTERS), (ON EXECUTING TRADE ALERTS) PowerShares DB Agriculture (DBA) Market Vectors Agribusiness ETF (MOO) PowerShares Water Resources (PHO) First Trust ISE Water Idx

Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Amsterdam, The Netherlands, on Friday, July 12, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view

I spent an evening with Lester Brown, president of the Earth Policy Institute and a winner of the coveted MacArthur Prize, for some long-term thinking about the environment and its investment implications. Global warming is causing the melting of ice sheets in Greenland and Antarctica, glaciers in the Himalayas, and the Sierra snowpack. Water tables

All of the high-grade paper used by the US Treasury to print money is bought by one firm, Crane & Co., which has been in the same family for seven generations. Last year, the Feds printed 38 million banknotes worth $639 million. Although they have seen the recession cause the velocity of money to decline,

Global Market Comments June 14, 2013 Fiat Lux Featured Trade: (UPDATED 2013 SUMMER STRATEGY LUNCHEON SCHEDULE), (THE YEN CARRY TRADE BLOW UP), (FXY), (YCS), (DXJ), (SNE), (HMC), (TM), (THE SERVICE JOB IN YOUR FUTURE), (MCD) CurrencyShares Japanese Yen Trust (FXY) ProShares UltraShort Yen (YCS) WisdomTree Japan Hedged Equity (DXJ) Sony Corporation (SNE) Honda Motor Co.,

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Updates, which I will be conducting throughout Europe during the summer of 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks, bonds,

When I staggered downstairs at 11:00 PM to check the close for the Tokyo stock market, my eyes just about popped out of my head. Yikes! Down 6.3%! The yen was up another 2% to ?94 against the US dollar as well!! It looked like the world was in for another round of ?RISK OFF?

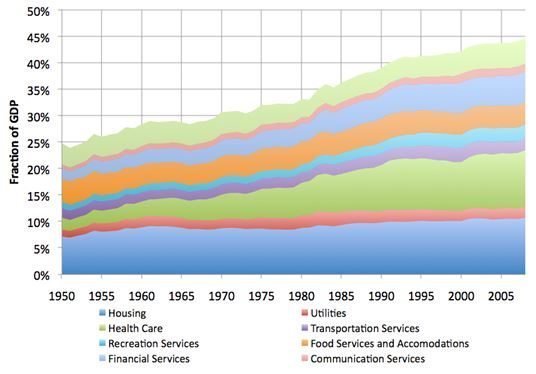

Anyone wondering about the long term future of the US economy should take a look at the chart below. It shows the unrelenting growth of services? share of American GDP growing from 25% to 45% over the last sixty years. Far and away the fastest growth area has been in health care, and with the

Global Market Comments June 13, 2013 Fiat Lux Featured Trade: (JULY 16 BERLIN STRATEGY LUNCHEON), (ANOTHER NAIL IN THE NUCLEAR COFFIN), (SCE-PF), (NLR), (CCJ) (THE CHINA VIEW FROM 30,000 FEET) (FXI), (DBC), (DYY), (DBA), (PHO) Southern California Edison Trus (SCE-PF) Market Vectors Uranium+Nuclear Enrgy ETF (NLR) Cameco Corporation (CCJ) iShares FTSE China 25 Index Fund

Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Berlin, Germany, at 12:00 noon on Tuesday, July 16, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to

Southern California Edison (SCE/PF) has announced that it is permanently closing its controversial nuclear power plant at San Onofre. The move is only the latest in a series of closures implemented by utilities around the country, and could well spell the end of this flagging industry. This is further dismal news for holders of ETF?s

I have long sat beside the table of McKinsey & Co., the best management consulting company in Asia, hoping to catch some crumbs of wisdom. So, I jumped at the chance to have breakfast with Shanghai based Worldwide Managing Director, Dominic Barton, when he passed through San Francisco visiting clients. These are usually sedentary affairs,

Global Market Comments June 12, 2013 Fiat Lux Featured Trade: (JULY 8 LONDON STRATEGY LUNCHEON), (TESLA GETS AGGRESSIVE ON MARKETING), ?(TSLA), (GM), (F), (WATCH OUT FOR THE CHIHUAHUA GLUT) Tesla Motors, Inc. (TSLA) General Motors Company (GM) Ford Motor Co. (F)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in London on Monday, July 8, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks, bonds,

Tesla (TSLA) CEO, Elon Musk, has taken off the gloves and is offering an innovative new hybrid lease that promises to bring in thousands of new buyers of his revolutionary, all electric S-1 sedan. The package eliminates the downside risk that concerned prospective customers about the resale value of their cars down the road. Under

You never know what the third, fourth, or fifth derivative impacts a major economic trend can cause. That is how the collapse of the housing market has created a Chihuahua glut in California, where evicted homeowners are handing over their pets to animal shelters. The diminutive Mexican canine enjoyed a boom in popularity in recent

Global Market Comments June 11, 2013 Fiat Lux Featured Trade: (JULY 2 NEW YORK STRATEGY LUNCHEON), (MY BIG MISS IN SWITZERLAND), (FXF), (EWL), (TESTIMONIAL) CurrencyShares Swiss Franc Trust (FXF) iShares MSCI Switzerland Capped Index (EWL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.