Hey! You there, staring at this monitor. This is your PC talking to you. No, not you over there standing in the background. I?m talking to the guy sitting in front of me poking at my keys. Ouch! That one hurt! So you thought no one was watching, did you? Let me straighten you out.

Global Market Comments May 6, 2013 Fiat Lux Featured Trade: (MAY 8 LAS VEGAS STRATEGY LUNCHEON), (BEN?S NEW LEG FOR THE BULL MARKET), (SPY), (IWM), (AAPL), (GLD), (SLV), (CU), (TLT), (YCS), (FXY) (PLEASE USE MY FREE DATA BASE SEARCH) SPDR S&P 500 (SPY) iShares Russell 2000 Index (IWM) Apple Inc. (AAPL) SPDR Gold Shares (GLD)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on

I just returned from my round of monthly wine club pick-ups in California?s lush and fertile Napa Valley. I invested a half hour soaking up the breathtaking views at the hilltop Silverado winery. Duckhorn offered a lavish lunch event, which I ducked out on. The Wagner family is prospering as always, recently opening a tasting

The original purpose of this letter was to build a database of ideas to draw on in the management of my hedge fund. When a certain trade comes into play, I merely type in the symbol, name, currency, or commodity into the search box, and the entire fundamental argument in favor of that position pops

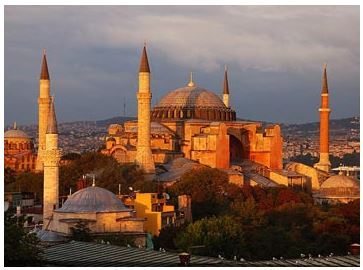

Global Market Comments May 3, 2013 Fiat Lux Featured Trade: (SO I LIED), (TURKEY IS ON THE MENU), (TUR), (TKC) (THE NEW CALIFORNIA GOLD RUSH), (GLD) iShares MSCI Turkey Invest Mkt Index (TUR) Turkcell Iletisim Hizmetleri AS (TKC) SPDR Gold Shares (GLD)

I sit here with my fingertips battered, bruised, and bleeding. My lower back aches, and my shoulders are as tight as a drum. After promising to take it easy for a while because the risk/reward in the market so badly sucks, I knocked out six Trade Alerts in one day. That is on top of

On my way back from Lake Tahoe last weekend I saw that every bend of the American river was dotted with hopeful miners, looking to make a windfall fortune. Weekend hobbyists were there panning away from the banks, while the hardcore pros stood in hip waders balancing portable pumps on truck inner tubes, pouring sand

I am building lists of emerging market ETF?s to snap up during any summer sell off, and Turkey popped up on the menu. The country is only one of two Islamic countries that I consider investment grade, (Indonesia is the other one). The 82 million people of Turkey rank 15th in the world population, and

Global Market Comments May 2, 2013 Fiat Lux Featured Trade: (SELLING GOLD AGAIN), (GLD), (IS USA, INC. A ?SELL?), (COLUMBIA IS POPPING UP ON MY RADAR), (GXG), (EEM) SPDR Gold Shares (GLD) Global X FTSE Colombia 20 ETF (GXG) iShares MSCI Emerging Markets Index (EEM)

The real shocker today in the Fed?s announcement is that it may increase monetary easing from here. As if we haven?t had enough already, with the US and Japan throwing in a combined $170 billion a month worth of monetary stimulus! More easing means that the America?s central bank thinks the global economy is even

What would happen if I recommended a stock that had no profits, was cash flow negative, and had a net worth of negative $44 trillion? Chances are, you would cancel your subscription, demand a refund, de-friend me from you Facebook account, and delete my email address from your address book. Yet that is precisely what

My current scenario for global equities has them selling off over the summer, then a rebounding led by emerging markets starting sometime in the fall. In that case, you want to start building short lists of high growth countries to pile into, once the turn comes. I would be including Columbia on any such list.

Global Market Comments May 1, 2013 Fiat Lux Featured Trade: (MAY 1 GLOBAL STRATEGY WEBINAR), (OLD TECH?S BIG COMEBACK), (AAPL), (MSFT), (INTC), (HPQ), (XLK), (AMAT), (GET READY FOR YOUR NEXT BIG TAX HIT) Apple Inc. (AAPL) Microsoft Corporation (MSFT) Intel Corporation (INTC) Hewlett-Packard Company (HPQ) Technology Select Sector SPDR (XLK) Applied Materials, Inc. (AMAT)

Apple blew away the bears today with the issuance of $17 billion in bonds, the largest such corporate debt issue in history. Spread over two, five, ten, and 30 years, the deal was oversubscribed by more than 3:1, with $40 billion in demand left unfilled. Foreign investors took down a major part of the deal,

No matter what anyone promises you today, this week, or this year, your taxes are going up. I don?t care if you are still licking your wounds from the January 1 payroll tax rise, or the federal tax hike for millionaires, which in my case took my rate up from 35% to 39.6%. At least

Global Market Comments April 30, 2013 Fiat Lux Featured Trade: (TRADE ALERT SERVICE POSTS TWO YEAR 90% PROFIT), (MAY 8 LAS VEGAS STRATEGY LUNCHEON), (IT?S OFFICIAL: THERE?S NOTHING TO DO), ?(SPY), (TLT), (JNK), (DINNER WITH ELIOT SPITZER) SPDR S&P 500 (SPY) iShares Barclays 20+ Year Treas Bond (TLT) SPDR Barclays High Yield Bond (JNK)

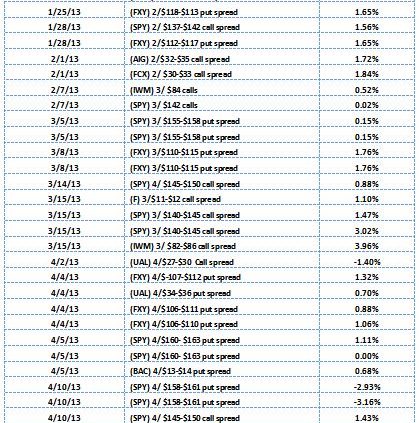

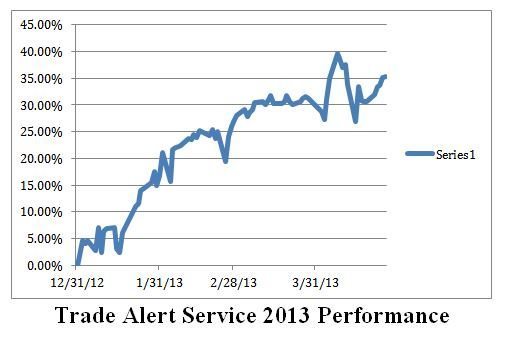

The Trade Alert Service of the Mad Hedge Fund Trader has posted a 90.6% profit since the inception of the service 30 months ago. That compares to a modest 21% return for the Dow average during the same period. This raises the average annualized return for the service to 36.2%, elevating it to the absolute

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on

You may have noticed that I am a man who is never short of words. I also rarely am for wont of things to do. This is one of those times. Every morning, I drag myself out of bed early, throw cold water on my face, and drag my sorry ass to my computers, where

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.