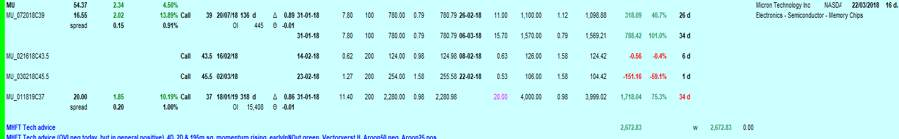

Dear John, I hope you remember me. We once met at a luncheon in Paris a number of summers ago. Thank you for the suggestion you made during the January 31 webinar about the launch of the Mad Hedge Technology Letter. After the first issue, I bought Micron Technology (MU). I bought two July $39

Global Market Comments September 1, 2022 Fiat Lux Featured Trade: (LOOKING AT THE LARGE NUMBERS) (TLT), (TBT) (BITCOIN), (MSTR), (BLOK), (HUT)

Global Market Comments August 31, 2022 Fiat Lux Featured Trade: (THE LAZY MAN’S GUIDE TO TRADING), (ROM), (UXI), (BIB), (UYG), (TESTIMONIAL)

Global Market Comments August 30, 2022 Fiat Lux Featured Trade: (REPORT FROM THE AUGUST 4 TESLA SHAREHOLDERS MEETING), (TSLA), (F), (GM)

I have to admit, listening in on the August 4 Tesla (TSLA) shareholder’s meeting was something like going to a rock concert. There was plenty of loud music, shouting fans, flashing lights, and cool videos, and it definitely had its own rock star dancing on the stage in a black suit. Yet, there was something

Global Market Comments August 29, 2022 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or IT’S TIME FOR PAIN) (SPY), (QQQ), (TLT), (VIX), (TSLA)

Please don’t call me anymore. I don’t want to hear from you, not even for a second! I’ve deleted your email from my address book, unfriended you from Facebook, and already forgotten your telephone number. For you have committed the ultimate sin. You have asked me if the market is going to crash in September

Global Market Comments August 26, 2022 Fiat Lux Featured Trade: (AUGUST 24 BIWEEKLY STRATEGY WEBINAR Q&A), (UNG), (AAPL), (MU), (AMD), (NVDA), (META), (VIX), (MCD), (UBER)

Below please find subscribers’ Q&A for the August 24 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California. Q: I’ve heard another speaker say that we are not heading for a Roaring Twenties; instead, we are heading for a Great Depression. Who is right? A: There are many different possible comments

Global Market Comments August 25, 2022 Fiat Lux Featured Trade: (ABOUT MY TRIP TO SPACE) (TSLA)

Last month, I thrilled you with my aerobatics flying a WWII Spitfire over the White Cliffs of Dover (click here if you missed it). This month, I one-upped myself. In appreciation to the early buyers of Model S-1’s, Tesla invited me to submit a photo to be etched on the side of a satellite launch

Global Market Comments August 24, 2022 Fiat Lux Featured Trade: (THE MAD HEDGE TRADERS & INVESTORS SUMMIT IS ON FOR SEPTEMBER 13-15)

Global Market Comments August 23, 2022 Fiat Lux Featured Trade: (BETTER BATTERIES HAVE BECOME BIG DISRUPTERS) (TSLA), (XOM), (USO)

We are on the verge of seeing the greatest advancement in technology this century, the mass production of solid-state batteries. The only question is whether Tesla (TSLA) will do it, which is remaining extremely secretive, or whether one of the recent spates of startups pulls it off. When it happens, battery efficiencies will improve 20-fold,

“Rational people don’t risk what they have and need for what they don’t have and don’t need,” said Oracle of Omaha Warren Buffet.

Global Market Comments August 22, 2022 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE PARTY IS OVER) (SPY), (QQQ), (TLT), (VIX)

It’s been one heck of a party for the last two months. We’ve been wearing lampshades on our heads, dancing the Lindyhop, and drinking hopium by the barrel. But even the best of parties must come to an end. It's time to put the empty bottles into the recycling bin. I’ve called Uber for the

In Silicon Valley, you’re either a unicorn or a dinosaur, and if you are the latter, you are investable,” said a venture capital friend of mine.

"Nobody knew it was August 1982 until it was August 1984," said Chris Verone, head of technical analysis at research boutique Strategas.

Global Market Comments August 18, 2022 Fiat Lux Featured Trade: (I STILL HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE) (TESTIMONIAL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.