Global Market Comments April 13, 2022 Fiat Lux Featured Trade: (JOIN ME ON CUNARD’S MS QUEEN VICTORIA FOR MY JULY 9, 2022 SEMINAR AT SEA) (SOME BASIC TRICKS FOR TRADING OPTIONS)

With Covid cases down 70% in two weeks and headed much lower, it's time for me to re-introduce you to the Mad Hedge Seminar at Sea. I firmly believe that the pandemic will be over by the summer, and what better way to celebrate than with an elegant Norwegian Fjord cruise. Come join me on

Global Market Comments April 12, 2022 Fiat Lux Featured Trade: (A DAY IN THE LIFE OF THE MAD HEDGE FUND TRADER), (SPY), (SPX), (QQQ), (FSLR), (SCTY), (TLT), (TBT), (FXE), (GLD), (GDX), (USO)

Diary Entry for Thursday, April 7, 2022 Dear Diary, 4:30 PM - the day before- Thought I’d check my Bloomberg to see how the Asian markets were opening. Yikes! They’re hammering bonds again. About damn time. It looks like it is going to be a ‘RISK OFF” day. Better fasten my seat belt, put on

Global Market Comments April 11, 2022 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or WATCH OUT FOR THE RECESSION WARNINGS) (TLT), (TSLA), (FB), (CRSP), (TDOC), (GILD), (EDIT), (SQ), (INDU), (NVDA), (GS)

The drumbeat of a coming recession is getting louder and louder. There is no doubt that the traditional signals of a slowing economy are already flashing yellow, if not bright red. Rocketing interest rates are the most obvious one, with ten-year US Treasury bonds yield soaring from 1.33% to 2.71% in a mere four months.

“By 2027, 75% of the companies in the Fortune 500 will not be there unless they make bold changes and digitally transform their companies. It’s do or die,” said Bill McDermott, CEO of ServiceNow (NOW), which offers cloud computing platforms for companies. I couldn’t agree more.

Global Market Comments April 8, 2022 Fiat Lux Featured Trade: (WEDNESDAY, JUNE 29, 2022 LONDON STRATEGY LUNCHEON) (APRIL 6 BIWEEKLY STRATEGY WEBINAR Q&A), (SPY), (TSLA), (TLT), (TBT), (AAPL), (IBB), (GOOGL), (ADBE), (NVDA), (FXE), ($BTCUSD)

Below please find subscribers’ Q&A for the April 6 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley. Q: The iShares Biotechnology ETF (IBB) is down quite a bit—do I wait a bit longer to put on a debit call spread LEAPS for the end of this year and possibly the end of

Global Market Comments April 7, 2022 Fiat Lux Featured Trade: (HOW THE COST OF ENERGY IS GOING TO ZERO), (SPWR), (TSLA)

Global Market Comments April 6, 2022 Fiat Lux SPECIAL CRISPR TECHNOLOGY ISSUE Featured Trade: (HOW CRISPR TECHNOLOGY MAY SAVE YOUR LIFE), (TMO), (OVAS), (CLLS), (SGMO)

Global Market Comments April 5, 2022 Fiat Lux Featured Trade: (DEMOGRAPHICS AS DESTINY), (EIS)

If demographics is destiny, then America’s future looks bleak. At least, that is the inevitable conclusion if demographics is your only consideration. Suddenly, Biden’s decision to allow 100,000 Ukrainian refugees into the US makes all the sense in the world. I have long been a fan of demographic investing, which creates opportunities for traders to

Global Market Comments April 4, 2022 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or WELCOME TO THE ROUND TRIP MARKET) (SPY), (TLT), (VIX)

If you had followed my advice and taken a cruise around the world in December, you would be getting home about now. A review of your portfolio would review that most of your positions were either unchanged or down slightly. And if you had chunky positions in bond shorts, as I pleaded, begged, and cajoled

“I didn’t wait until the age of 80 to engage in such an obviously fraudulent transaction,” said Barry Diller, currently under investigation for insider trading on Microsoft’s takeover of Activision.

Global Market Comments April 1, 2022 Fiat Lux Featured Trade: (WHY I AM GOING TO LIVE FOREVER)

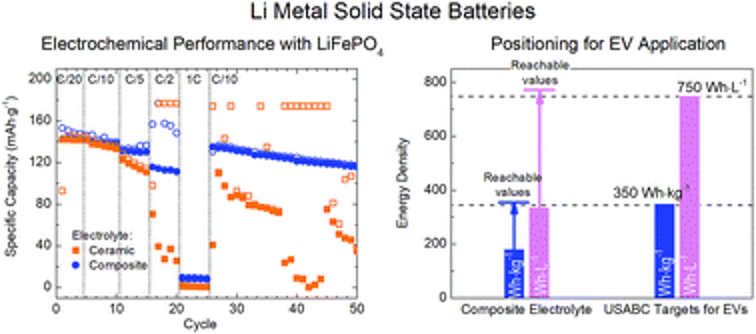

Global Market Comments March 31, 2022 Fiat Lux Featured Trade: (WHY SOLID-STATE BATTERIES ARE THE “NEXT BIG THING”) (TSLA), (QS)

Tesla shares have recently gotten their mojo back, exploding by an incredible 60% in the past month, and that can only mean one thing: mass production of solid-state batteries is fast approaching. For the last 30 years, the cutting edge of battery design has been trapped in lithium-ion liquid or gel states. This originally Japanese

Global Market Comments March 30, 2022 Fiat Lux Featured Trade: (TESTIMONIAL), (SHOPPING FOR FIRE INSURANCE IN A HURRICANE), (VIX), (VXX), (XIV), (THE ABCs OF THE VIX), (VIX), (VXX), (SVXY)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.