Not a day goes by without me hearing from a reader about the competition.

They previously subscribed to a newsletter that promised a top drawer education, an insider’s insights, and spectacular returns, sometimes 100% or more a month.

“Doubled in a day” is a frequently heard term.

The entry-level costs are only a few bucks, but they are ever teased onward by the “trade of the century”, a certain 100X winner that they will reveal to you only after another upgrade to their service.

Customers eventually spend outrageous amounts of money, $5,000, $10,000, or even $100,000 a year for the service.

They then lose their shirts.

I hear from readers who have gone through as many as ten of these scams before they find me. Some have lost millions of dollars. Others have been wiped out.

The sob stories are legion.

Then, they find the Diary of a Mad Hedge Fund Trader.

This is the source of all those effusive testimonials you find on my website (click here). Believe me, they come in every day. I don’t make this stuff up.

Here is the problem. I work in an industry where 99% of the participants are frauds. They are giant Internet marketing firms with hundreds or thousands of employees.

They spend millions to buy your email address. They then spend millions more on copywriters and programmers to pen and distribute top rate invitations to you to get rich.

Some of these pitches are so compelling, that even I take a look from time to time. These guys are slick, really slick.

None of these people have ever worked on Wall Street. They have never been employed as traders. They have not even traded for their own account.

They would not know which end of a stock to hold upward if you handed one to them.

For the most part, they are twenty-something kids who got an “A” in creative writing, if they ever went to school. Many haven’t.

So by putting your faith and your wealth in these newsletters and “trade-mentoring” services, you are placing them in the hands of kids without any experience whatsoever.

Hence, the disastrous results. You’d have a better outcome tossing a coin or throwing darts at a dartboard.

Some of the larger services hire washed out has been investment professionals who become the “face” of the company and lend it some bogus credibility.

They know the lingo, can quote you statistics all day long, and may even boast of proprietary models and hidden indicators. But chances are they have never made a trading dollar in their life.

Without exception, they are lightweights, have-beens, and wannabees who failed in the big show. None have ever traded for a living. If they did, they would be broke.

Better to sell the shovels to the gold miners than to try it themselves.

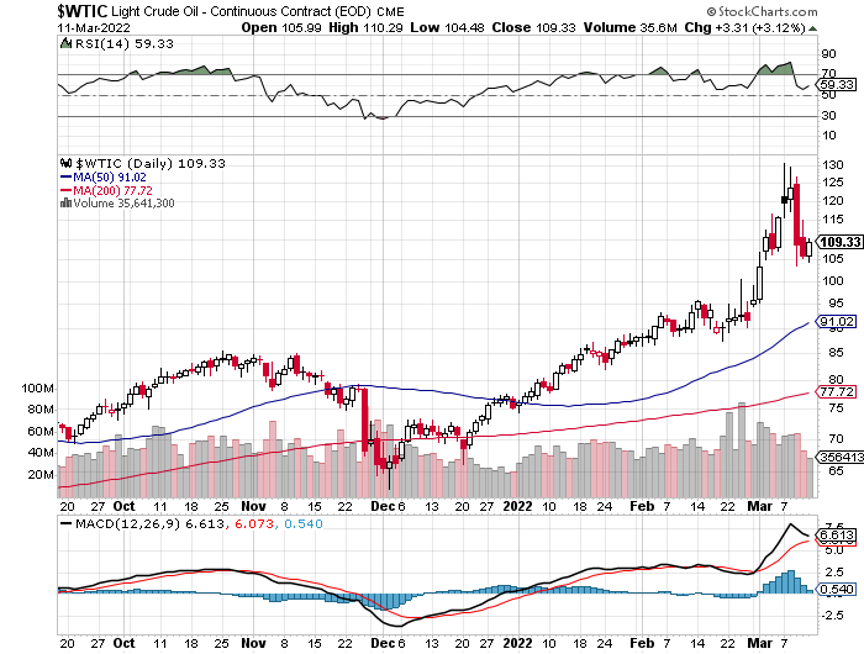

They include the oil newsletter that never saw the crash coming, the fixed income service that is always predicting the return of hyperinflation and a crash, and the perennial prediction that the Dow Average is about to plunge to 3,000.

And because these guys are lousy at their jobs, they always tell you to do THE EXACT OPPOSITE of the right thing to do at market extremes.

Just saw a flash crash? Sell everything! The next crash is here! Just hit a new all-time high? Load the boat! The market is about to double! For them, markets are always about to zero, or to infinity.

Here’s another problem. Negativity outsells a positive outlook hugely, sometimes by 10:1. It makes people look smarter. That’s the source of all of these Armageddon scenarios. They make a ton of money for their purveyors.

It’s not about being right or dispensing sage advice and proper guidance. It’s only about making a dollar, nothing else. There is no guilt or responsibility involved whatsoever.

All of this is done at your expense. I get emails for victims who sold their house at the market bottom and want to know what to do now that the house has doubled in value and rents are rising.

There are a lot of people out there who drank the Master Limited Partnership Kool-Aid and put all of their assets there to get the double-digit yields. If they are lucky, they are down only 90%.

The precious metal area is a favorite of Internet marketers. Readers who bought this sector on margin, as they were urged to do with great urgency, lost everything.

I know this all sounds like sour grapes coming from me. The sad reality is that out of hundreds of competing investment and trading newsletters in the industry, I can count on one hand those run by true professionals, and I know most of them.

The rest are all crooks.

Yes, I know who these people are. But I am not going to name any names. No time to sling mud here. I can hear the collective sighs of relief already.

This is why I strive to provide the opposite of the con-men. To me, it is more important to be right than to be rich. I will give you my unvarnished, undiluted views, even if it is bad for my business, which it often is.

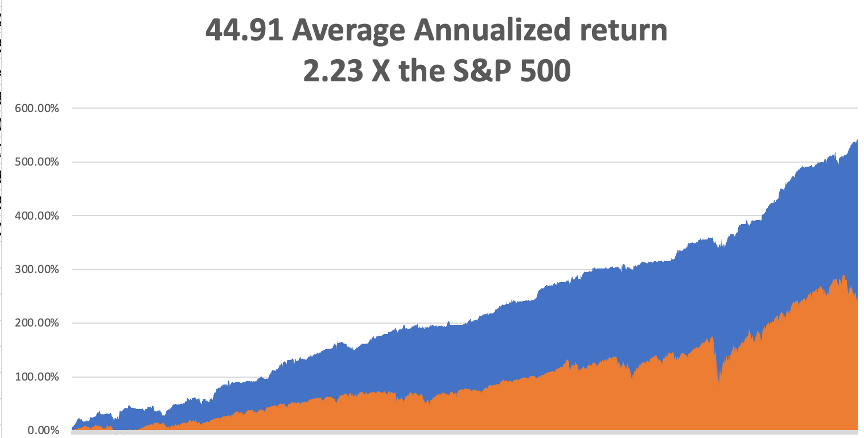

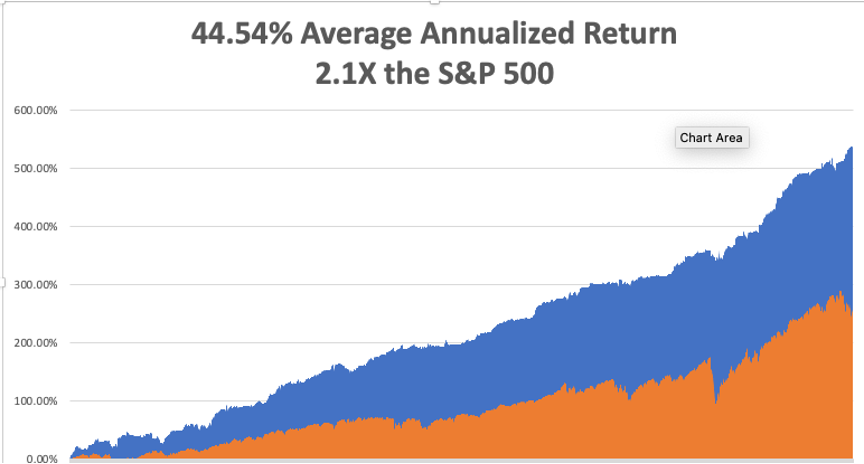

This is why we publish our model trading performance on a daily basis, warts and all.

Notice that no other newsletter does this. If they did, they would only show huge losses, which don’t sell well. It’s all about making tons of incredible claims without a shred of documentation.

So please continue trolling the web for new investment insights and trading opportunities. After all, that’s how you found me all those years ago. But I will give you a piece of advice:

Caveat emptor!

Buyer beware!

I Think I’ll Recommend This One