I am no longer able to breathe. The pandemic demands that I wear a mask. The wildfires prevent me from going outside, as the air is so heavy from smoke.

So, I decided to flee the San Francisco Bay Area south to Big Sir for a couple of days to catch up on my writing. On the way, I passed dozens of sadly abandoned schools as the pandemic has moved all of California to online distance learning.

By the second day, I was surrounded by fire. At an afternoon wine tasting, I tipped the waiter to hurry up as my glass was filling with ash and fire trucks were passing every five minutes.

By the next morning, I was surrounded by out-of-control wildfires and there was only one open road out of town. What really lit a fire under my behind was a text message from Tesla stating they would shut down charging at the Monterey station after 3:00 PM to help head off rolling blackouts.

The Golden State was not the only place on fire last week. Stocks were en flagrante as well, led by Tesla, Amazon, and Apple. The S&P 500 hit a new high for the year. It is the most concentrated market in history, with only 12 technology names accounting for 85% of the 2020 gains. Yet, 57% of shares are showing losses for 2020.

With a 33X multiple, Apple is pricing in only a 3% annual gain in the coming years. The price of Tesla at $2,100 a share is assuming the 2040 earnings have already arrived. We are firmly in bubble territory.

Having been in many bubbles over my half-century of trading, I can tell you they all have one thing in common. They run a lot longer than anyone imagines possible. In the meantime, traders, analysts, and investors are tearing their hair out wondering why they are so underweight stocks.

So trade if you must. But understand that the risk/reward here is terrible. You are better off here buying gold and banks and selling short US Treasury bonds and the US dollar.

Much has been made about share splits, which were the primary drivers of markets last week. However, the history of these things as that share prices fade shortly after the splits are completed. That was last Friday for Tesla and this Friday for Apple.

Apple may run a little longer, as it typically sees shares peak right after new generational cell phone launches, due in October.

Weekly Jobless Claims topped 1.1 million, ending a four-month downtrend. New Jersey, New York, and Texas were worst hit. Without further stimulus, they should continue to rise from here. These are Great Depression levels, and now massive layoffs from state and local governments are starting to kick in.

Apple topped $2 trillion in market cap. It is hard for those of us to believe it who bought the stock under $1 in 1998. It looks like more gains are to come. The coming 5G iPhone is going to market the peak in the shares this year, as new generational phones always do.

Uber and Lyft received a stay of execution, for 60 days, over whether they must treat drivers as full-time employees with benefits. Looks like I won’t have to take BART until October.

The U.S. Economy is falling back into the abyss. Last week’s total for new claims was well above the pre-pandemic Great Recession high of 665,000. Over 57.4 million Americans have now filed new unemployment insurance claims.

The airline industry is about to implode. With six months of operating at 20% capacity, how can they not? At least 75,000 in layoffs are imminent. Avoid the sector at all costs. You won’t recognize what comes out the other end. The next administration won’t be so generous to shareholders.

US Corona cases are slowing, even though we’ve just seen five consecutive days above 1,000 deaths. It’s the temporary ebb in the epidemic I was expecting that would rally the “recovery” stocks and sink the bond market. It’s sad, but we are celebrating suffering another 9/11 every three days instead of two.

Warren Buffet hates gold (GLD), but loves gold miners (GDX), loading the boat on Barrick Gold (GOLD) in Q2. It’s a rare move for the Oracle of Omaha into precious metals and the only way the cash flow king can collect a dividend in the sector. Warren seems to share my own long-term view on rising inflation caused by massive government bond issuance and spending.

U.S. Housing Starts mushroomed, surging 22.6% on the month to a seasonally adjusted annual rate of 1.496 million. Building permits also came in ahead of expectations, up 18.8% to 1.495m. Migration to the suburbs may explain some of the increase in activity but record-low mortgage rates and tight existing home inventory are the primary drivers. Soaring lumber prices mean growth in single-family starts will slow over the remainder of the year, not to mention the extra 0.50% fee on refinances.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old.

My Global Trading Dispatch suffered one of the worst weeks of the year, giving up most of its substantial August performance. If you trade for 50 years, occasionally you get a week like this. The good news is that it only takes us back to unchanged on the month.

Longs in banks (JPM) and gold (GLD) and shorts in Facebook (FB) and bonds (TLT) held up fine, but we paid through the nose with shorts in Apple (AAPL), Amazon (AMZN), and Tesla (TSLA).

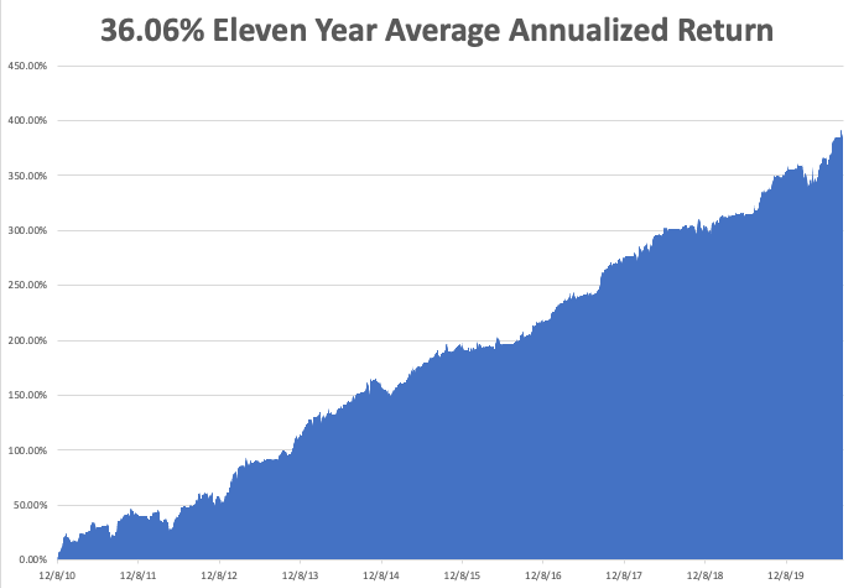

That takes our 2020 year to date down to 28.88%, versus -2.00% for the Dow Average. That takes my eleven-year average annualized performance back to 36.06%. My 11-year total return retreated to 384.79%.

It's a relatively low rent week on the data front. The only numbers that count for the market are the number of US Corona virus cases and deaths, which you can find here.

On Monday, August 24 at 8:30 AM EST, the Chicago Fed National Activity Index is out.

On Tuesday, August 25 at 9:00 AM EST, the S&P Case Shiller National Home Price Index for June is released.

On Wednesday, August 26, at 8:30 AM EST, Durable Goods for July are printed. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out.

On Thursday, August 27 at 8:30 AM EST, the Weekly Jobless Claims are announced. We also get the second estimate for Q2 GDP.

On Friday, August 28, at 8:30 AM EST, US Personal Spending is announced. At 2:00 PM, the Bakers Hughes Rig Count is released.

As for me, I am reading up on bios and generally preparing for my upcoming Mad Hedge Traders & Investors Summit, which I will be hosting for three days and starts on Monday morning at 9:00 AM EST. The attend please click here.

See you there.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader