So, what am I talking about here?

Blue chip growth stocks? Diamonds? Residential real estate? Gold?

No, I am talking about grand pianos manufactured by Steinway & Sons of Queens, New York.

Did you say pianos?

Yup, the kind with which you sit down and play “As Time Goes By.” (Casablanca).

During the 19th century, there were over 1,200 US piano makers manufacturing a product which can include more than 12,000 parts. It was the technological Boeing 474 of its day.

Today, there are only five American piano makers, and just one, Steinway, is considered investment grade.

That’s because when Carnegie Hall, London’s Royal Albert Hall, or Beijing’s Concert Hall National Grand Theater is in the market for a new concert grand piano, they only consider Steinways.

You can start with an entry level 5’1” Steinway Model M baby grand piano, or ostentatiously splurge with an opera house filling nine-foot-long concert grand Model D.

I received the bad news from my kids’ piano teacher a few months ago. After six years of lessons, they had outgrown their piano, a modest entry level 1966 Wurlitzer spinet.

I approached the matter as I do everything, with exhaustive, no stone unturned research. What I learned was fascinating.

Given the available space in my home and the kids’ commitment to the enterprise, I decided that a seven-foot Steinway Model B would do.

My first visit was to the local Steinway dealer. For a mere $100,000, and $110,000 with tax I could buy a brand new 6’11” Model B.

For an extra $15,000 I could buy a model B with the Spirio technology that enabled the piano to play itself to incredible symphony standard.

Financing was available at a hefty 10%, compared to only 2% for my Tesla. Banks are not allowed to accept pianos as collateral.

Steinway also sells used pianos, but will only go back 15 years, getting me down to the $70,000 range. I thought I’d look around more.

So I plunged into my favorite source of incredible, once-in-a-lifetime deals, eBay (EBAY).

The offerings were vast.

They included everything from a $13,500 1897 Model B in desperate need of a complete $30,000 rebuild to a 2013 Model B in showroom condition for $87,500.

Obviously, I had my work cut out for me especially since I am not a musician myself. Coming from a family of seven kids, there was never enough money for music lessons.

Thus, I have been a lifetime consumer of music rather than a producer.

It turns out that, like Rolls Royce’s (that other great unknown inflation hedge), no one ever throws a Steinway away. A fully restored 130-year-old model can almost cost as much as a new one.

And there is your inflation play.

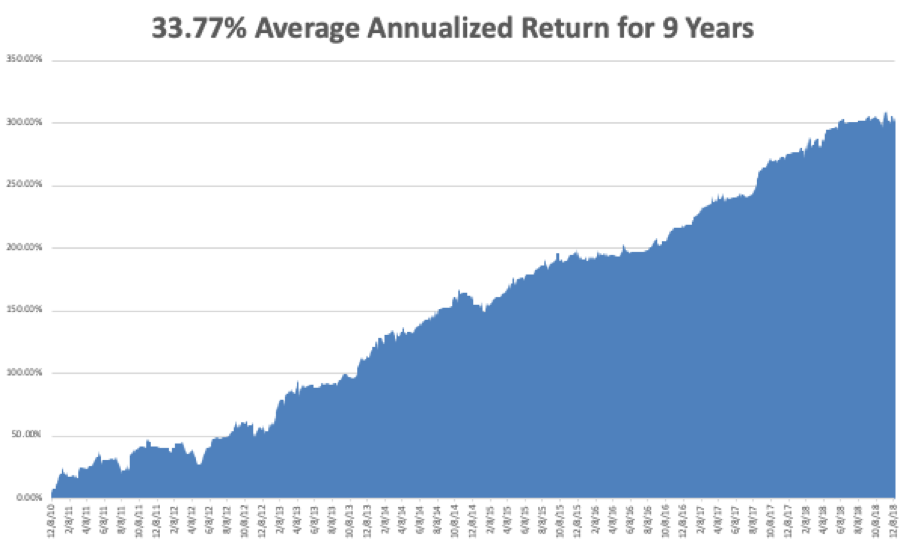

The list price for a Steinway Model B in 1900 was $1,050. Some 117 years later, it is up 100-fold, giving you a compound annual growth rate of 3.97% a year.

This compares to 5.18% for ten-year US Treasury bonds, and 9.71% for the S&P 500 over the same time period. But then you can’t play a stock certificate, let alone make your kids practice on it.

A Steinway is, in fact, the perfect instrument with which to make these long-term inflation calculations.

Vintage cars, diamonds, and homes are all unique, have varying quality, and are all susceptible to overvaluation and hype from aggressive salesmen and dealers. Even gold coins can have huge differences in valued based on grade and rarity.

Save for a few patents issued in the 1930s covering keyboard and soundboard manufacturing, Steinways are built almost identically to the way they were made 117 years ago. Tour their factory and you find workshops filled with primitive 100-year-old iron and wooden tools.

Every other manufactured product has seen massive productivity and technology improvements over a century that have caused real prices to completely collapse.

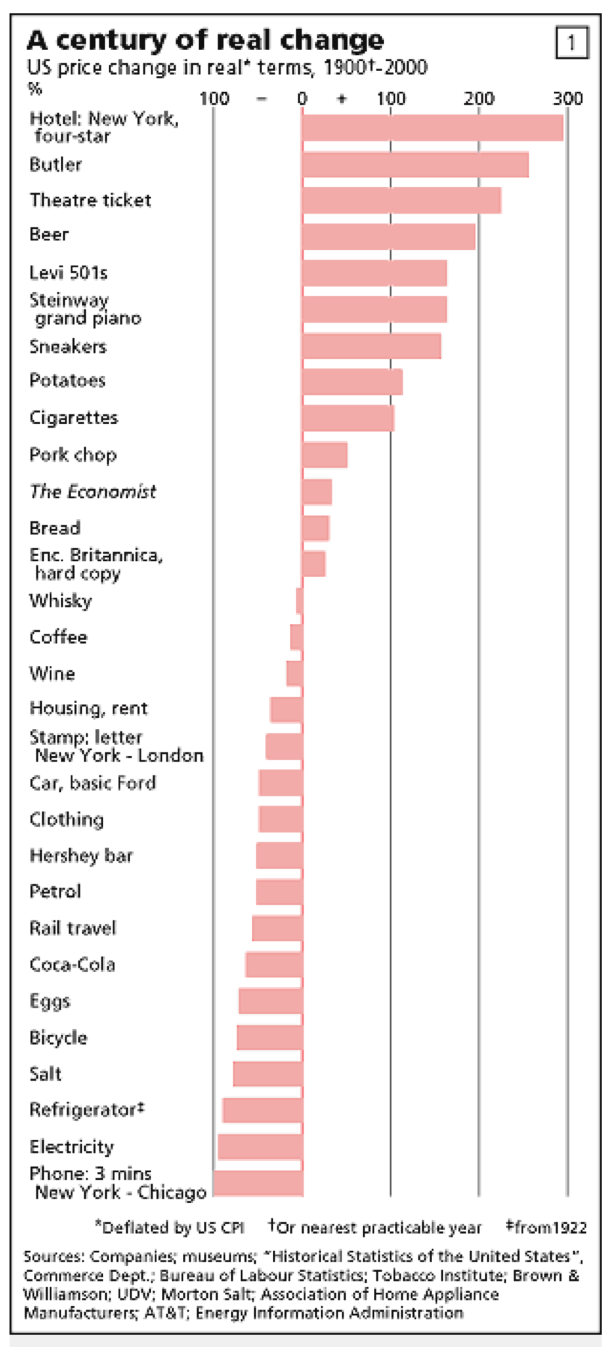

Take computers, for instance, which have suffered an average annual price decline of 30% since 1950. The cost of telephone calls has fallen by almost 100% in real terms since 1900 (see table below which I lifted from my former employers at The Economist)

That is the source of the rise in our standard of living.

It gets better. The prices of Steinways are rising fairly dramatically in real terms relative to almost everything else, thanks to a host of geopolitical reasons.

It turns out that the Chinese are taking over the global market.

While 200,000 pianos a year are sold in the US, the figure is over 1 million in China.

Many Chinese parents hope their children will achieve the international prominence of 35-year-old Lang Lang who commands millions of dollars a year in global performance and licensing fees. Many aspiring parents drive their kids to practice eight hours a day.

As a result, the Chinese have been buying up all the used premium pianos in the world including Steinways in the US, Bechsteins and Bosendorfers in Germany, Faziolis in Italy, and Yamahas and Kawais in Japan.

Whenever Chinese buy a luxury apartment in San Francisco, the first thing they do is outfit it with a Steinway grand piano even if they don’t play. It is the ultimate status symbol not only because of the price they pay but the space it takes up.

As a result, Steinways not only sell at a large premium to other pianos but are dear relative to ALL manufactured products over the expanse of time.

Researching the history of Steinway, you find a storied company that has undergone the sad but familiar travails of American manufacturing over the last century.

In short, it’s a miracle that this company still exists.

The first pianos were sold by a German immigrant from Hamburg in 1856. By 1972, a lengthy strike and competition from Japanese imports forced the original Steinway family to sell out to CBS after five generations.

Then there was a brief but disastrous experiment with Teflon parts in the 1970s. Suddenly Steinways didn’t sound like Steinways.

A private equity deal followed in 1985. From 1996 to 2013 it traded on the New York Stocks exchange under its own ticker symbol (LVB) (for Ludwig von Beethoven).

Steinway was then bought by my friend and newsletter client, hedge fund legend John Paulsen for $500 million. It produced its 600,000th piano in 2015.

If you want to watch a film about old-fashioned American manufacturing, vanishing skills, the pride of craftsmanship and working with your hands, watch the highly entertaining documentary movie “Note by Note: The making of Steinway L1037.”

It has won several awards.

It is wonderful to watch with the kids in that it shows what work was like in the old United States I remember, and can be streamed online for $4.99 by clicking here. https://www.amazon.com/Note-Harry-Connick-Jr/dp/B002ZS0R5I/ref=tmm_aiv_swatch_0?_encoding=UTF8&qid=&sr=

As for my own Steinway search, it had a very happy ending.

eBay enabled me to find a local Craigslist listing in Jackson, Mississippi for a 1951 Model B that was originally purchased by the University of Mississippi Music Department. It had been played by every noted pianist touring the South for a half century.

Some 20 years ago, a local doctor then purchased it right off the stage at a university surplus equipment sale.

This year the doctor retired, sold his mansion but had no room for a grand piano in his rapidly downsizing lifestyle.

He listed the piano for a low-ball price of $18,000, the cost of his 1997 ground up restoration. After I had a professional musician visit the house to check the condition and tone, I was the only bidder.

I figure if the kids ever get sick of practicing, I can always flip it to the Chinese for double. That’s me, always the trader.

I am totally comfortable buying big-ticket items off of eBay as I have been trading there for 20 years. I have bought five cars there for assorted family members.

If you aren’t comfortable with eBay, there is always Bruno.

Dallas, Texas-based Maestro Bruno Santo is a Julliard graduate, former Steinway dealer, and the most knowledgeable individual I ran into during my far-ranging research. He is also quite the salesman.

He runs a high-volume, low-margin business model which I admire and can probably get you a very nice Steinway in the mid $30,000s.

You can reach him through his website at http://redbirdllc.com/home

To learn more about the interesting and beautiful world of Steinway pianos, please visit the company’s website at http://www.steinway.com

Getting an 800-pound finely tuned musical instrument from Jackson, Mississippi to San Francisco, California is a whole new story on its own.

What I learned about the national trucking industry was amazing, and boy, did I get a deal!

Watch for my future research piece on “What I learned Moving My Steinway Grand Piano.”

As for the old Wurlitzer, it is now happily ensconced in my Lake Tahoe beachfront estate. Neighbor Michael Milliken has already completed the quality of the play.