Global Market Comments

July 16, 2018

Fiat Lux

Featured Trade:

(THE BEST FINANCIAL BOOK EVER),

(A DAY WITH TOM FRIEDMAN OF THE NEW YORK TIMES),

(THOUGHTS AT SEA ABOARD THE QUEEN MARY 2, PART I)

Location: 48 degrees, 02.12 minutes North, 043 degrees, 42.08 minutes East, or 1,421 nautical miles ENE of New York.

The Queen Mary 2 is currently plowing its way through a massive fog bank a thousand miles thick, sounding the foghorn every two minutes. Visibility is less than 100 yards, and the waves are a rough 12 feet high.

The captain has closed the outside decks for fear of losing a passenger overboard. The weather has disrupted our satellite link, and our Internet is down. So here I write.

One hour out of New York, and a passenger suffered a heart attack. So, the captain turned the ship around and headed back to the harbor, where the New Jersey Search and Rescue sent out a launch to pick up the unfortunate man and his spouse.

That meant we could pass under the Verrazano-Narrows Bridge three times, on each occasion deftly clearing the span by a mere 10 feet. Talk about inauspicious beginnings.

The ship is truly gigantic. You must allow 20 minutes to get anywhere, 5 minutes to walk there and 15 minutes to get lost. When launched in 2003, it was the largest cruise ship ever built at 148,900 tons, nearly double the size of the now decommissioned Queen Elizabeth II.

It whisks up to 3,000 passengers and 1,325 crew across the seas in the utmost luxury at a steady 21.5 knots. You could water ski behind this leviathan of a vessel, if only the crew permitted it.

As a 40-year guest of Cunard and the highest paying customer on the ship, I managed to bag the Sandringham Suite, possibly the most luxurious publicly available oceangoing accommodation ever created.

The 2,200-square-foot, two-floor, two-bedroom, three-bathroom, Q1 class apartment on decks nine and 10 includes a formal dining room, kitchen, his-and-her closets, a small gym, and 1,000 square feet of rear-facing teak deck.

All of this was a bargain for $56,000, or about the same as renting the presidential suite at the San Francisco Ritz for a week at $10,000 a night, except at the end you wake up in England five pounds heavier.

Not that I noticed, though. By the afternoon, the two complimentary bottles of Dom Perignon Champagne were already headed for the recycling bin.

The suite came staffed with two full-time butlers, Peter and Henry, who were an endless font of fascinating information about the ship. During one unfortunate cruise, eight senior citizens passed away.

The morgue held only six, so the extra two were stashed in the meat locker for the duration of the voyage. No comments were every made about the seasoning of the steaks that week.

I asked if Cunard ever performed burials at sea in these circumstances. They said they used to. But a few years back an elderly billionaire "Mr. Smith" checked into a deluxe Q1 cabin with a hot young "Mrs. Smith," and then promptly expired. The grieving widow requested he be buried mid-Atlantic with the traditional yard of sail and a cannonball.

When the ship docked at Southampton, a much older, actual "Mrs. Smith" appeared to claim the body and sued the company when informed of his current disposition.

So, no more burials at sea.

Yes, the ship did hit a whale once, which struck the bulbous bow. It next landed in Lisbon, Portugal, with the whale still attached. Cunard was fined for commercial fishing without a license. The unlucky cetacean's skeleton is now in a Lisbon maritime museum. Apparently, this company gets sued a lot because of its deep pockets.

Of course, the memory of the sinking of the Titanic is ever present. There is a history display down on deck 2, and you can even have your photo taken in front of a backdrop of the grand staircase of the ill-fated ship.

When we passed 10,000 feet over the wreck at 48 degrees, 38.50 minutes North, 50 degrees, 00.11 minutes West one day out of New York, the Queen Mary 2 let out three long blasts of its horn in memory of the lost. Cunard took over the Titanic's White Star Line during the Great Depression and is therefore the inheritor of this legacy.

Peter is now at the door with my dinner, so I will continue on another post.

Global Market Comments

July 13, 2018

Fiat Lux

Featured Trade:

(FRIDAY, AUGUST 3, 2018, AMSTERDAM, THE NETHERLANDS GLOBAL STRATEGY DINNER),

(NOTICE TO MILITARY SUBSCRIBERS),

(CHINA'S COMING DEMOGRAPHIC NIGHTMARE)

Global Market Comments

July 12, 2018

Fiat Lux

Featured Trade:

(FRIDAY, JULY 27, 2018, ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR),

(AMERICA'S NATIVE INDIAN ECONOMY)

When I was remodeling my 160-year-old London house, the chimney was in desperate need of attention. After the bricklayer crawled up the fireplace, he found a yellowed and somewhat singed envelope addressed to Santa Claus.

Thinking it was placed there by my kids, he handed it over to me. In it was a letter penned in a childlike scrawl, written with a quill and ink, dated Christmas, 1910, asking for a Red Indian suit.

Europeans have long had a fascination with our Native Americans. So, in preparation for my upcoming European strategy luncheon tour, I thought I would get myself up to date about our earliest North American residents.

Business is booming these days on Indian reservations, or it isn't, depending on where they live.Of the country's 565 reservations, some 239 have moved into the casino business and the cash flow has followed.

In 2010, Indian gaming reaped some $26.7 billion in revenues, or some $9,275 per indigenous native. That is a stunning 44% of America's total casino revenues.

Some, like the Pequot tribe's massive Foxwoods operation just two hours from New York City, now the world's largest casino, once had money raining down upon it.

But the casino grew so large that it entirely occupied the diminutive Connecticut reservation allocated to it by an obscure 17th century treaty.

During the salad days, the profits were so enormous that an annual $250,000 stipend was paid to each officially registered tribal member.A poker boom helped.

No surprise that the tribe grew from 167 to 665 members during the past 30 years.Today, the operation is burdened with $2.5 billion in debt, thanks to some bad investments and an ill-timed expansion.

Casinos in more rural locations in the far west, distant from population centers, have fared less well.Those that contracted out for professional management from Las Vegas and Atlantic City firms, such as Harrah's, MGM and Caesars, earn a modest living.

But the reservations attempting local management on their own fall victim to inefficiencies, incompetence, corruption, nepotism, over hiring of locals and outright theft.

Believe it or not, it is possible to lose money in the casino business, and some have had to shut down.

Overbuilding is another problem. In northern New Mexico you can find several casinos within five miles of each other competing for the same customers. Most of their clients (read losers) are in fact local tribal members, the same individuals these houses are intended to help.

The 326 tribes that avoided the casino industry do so at the cost of a big hit to their standard of living.

That explains why Native American median household income reaches only $35,062, compared to $50,046 for the U.S. as a whole. Many, such as the numerous Hopi, shun it because of their religion.

Without gambling there are few economic opportunities on the reservations, which is why they were given the land in the first place.

The parched conditions of the west limit farming. Unemployment runs as high as 80% on some reservations, such as the White Mountain Apaches.

As a result, a high proportion of the country's 2.9 million Native Americans are wards of the federal government, living on food stamps and other government handouts.

That's not how it was supposed to be. The first modern reservation was set up for the Navajo tribe in 1851 at a baking hellhole on the Pecos River, with the intention of enforcing a primitive form of apartheid to ensure their survival.The legendary scout Kit Carson was hired to herd the hapless Indians to their new home.

He did it by burning all the crops in their homelands and cutting down every tree.Because they surrendered early rather than fight, today they are the most populous tribe, with 160,000, owning the largest reservation, at 24,000 square miles, mostly in Arizona.

Those who signed treaties early survived, which gave them status as an independent nation but ceded all matters regarding defense to the federal government.In fact the Iroquois, Sioux, and the Chippewa separately declared war on Germany during WWII.

Some even issued their own passports to attend the last Olympics. Those who didn't had to settle for much smaller reservations, or got wiped out.

In 1975, Congress passed the Indian Self-Determination and Education Assistance Act, which devolved power from the government to the tribes.

Florida's Seminole tribe won the right in court to open a casino in 1981, which was confirmed by the Supreme Court in 1987. After that, it was off to the races, with Indian bingo parlors sprouting across the country.

During the 19th century Indian wars when hundreds of thousands died, the practice was to attack a wagon train, kill all the men, marry the women and adopt the children.

As a result, I am descended from three different tribes, the Delaware, Sioux, and the Cherokee, as are about a quarter of native Californians my age. So I tried to cash in on government largess by applying for tribal scholarships to go to college.

It was to no avail. Only those who can trace their lineage to a 1941 Bureau of Indian Affairs census and are one-eighth Native American can qualify.When whites married Indians 150 years ago, the common practice was to baptize them and give them western names, obliterating their true heritage.

They were also pretty casual with marriage records in the Wild West. Jumping over a broom doesn't exactly make it into the county records. But we still have many of the wedding photos, and it's clear who they are.

I never did find out if that little boy got his Red Indian suit for Christmas, but I hope he did.

So, Should I Double Down?

So, Should I Double Down?

"There's a lot of performance anxiety out there right now. There's nothing worse than sitting on cash watching a market go up double digits," said Tom Lee, former chief U.S. equity strategist of J.P. Morgan.

Global Market Comments

July 11, 2018

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE MONDAY, JULY 16, 2018, PARIS, FRANCE GLOBAL STRATEGY LUNCHEON),

(THE PASSING OF A GREAT MAN)

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Luncheon, which I will be conducting in Paris, France, on Monday, July 16, 2018. A three-course lunch will be followed by an extended question-and-answer period.

I'll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, precious metals, energy, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there, too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $259.

I'll be arriving early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and discuss the financial markets.

The lunch will be held at a restaurant in a four-star hotel in the City of Light's central Opera district that was a favorite of Ernest Hemingway's, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for the luncheon, please click here.

It was with a heavy heart that I boarded a plane for Los Angeles a few years ago to attend a funeral for Bob, the former scoutmaster of Boy Scout Troop 108.

The event brought a convocation of ex-scouts from up and down the West Coast and said much about our age.

Bob, 85, called me two weeks prior to tell me his CAT scan had just revealed advanced metastatic lung cancer. I said "Congratulations Bob, you just made your life span."

It was our last conversation.

He spent only a week in bed, and then was gone. As a samurai warrior might have said, it was a good death. Some thought it was the smoking that he quit 20 years before.

Others speculated that it was his close work with uranium during WWII. I chalked it up to a half century of breathing the air in Los Angeles.

Bob originally hailed from Bloomfield, New Jersey. After WWII, every East Coast college was jammed with returning vets on the GI Bill. So, he enrolled in a small, well-regarded engineering school in New Mexico in a remote place called Alamogordo.

His first job after graduation was testing V2 rockets newly captured from the Germans at the White Sands Missile Range. He graduated to design ignition systems for atomic bombs. A boom in defense spending during the 50s swept him up to the Greater Los Angeles area.

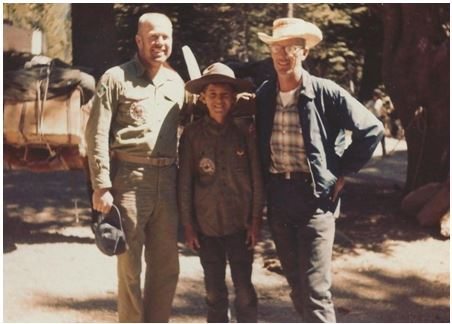

Scouts I last saw at age 13 or 14 were 60 at the time of the gathering, while the surviving dads were well into their 80s. Everyone was in great shape, those endless miles lugging heavy packs over High Sierra passes obviously yielding lifetime benefits.

Hybrid cars lined both sides of the street. A tagalong guest called out for a cigarette and a hush came over a crowd numbering more than 100.

Apparently, some things stuck. It was a real cycle of life weekend. While the elders spoke about blood pressure and golf handicaps, the next generation of scouts played in the backyard or picked lemons off a ripening tree.

Bob was the guy who taught me how to ski, cast for rainbow trout in mountain lakes, transmit Morse code, and survive in the wilderness. He used to scrawl schematic diagrams for simple radios and binary computers on a piece of paper, usually built around a single tube or transistor.

I would run off to Radio Shack to buy WWII surplus parts for pennies on the pound, and spend long nights attempting to decode impossibly fast Navy ship-to-ship transmissions. He was also the man who pinned an Eagle Scout badge on my uniform in front of beaming parents when I turned 15.

While in the neighborhood, I thought I would drive by the house in which I grew up, once a modest 1,800-square-foot ranch style home to a happy family of nine. I was horrified to find that it had been torn down, and the majestic maple tree that I planted 40 years ago had been removed.

In its place was a giant, 6,000-square-foot marble and granite monstrosity under construction for a wealthy family from China.

Profits from the enormous China-America trade have been pouring into my hometown from the Middle Kingdom for the past decade, and mine was one of the last houses to go.

When I was class president of the high school here, there were 3,000 white kids, and one Chinese. Today those numbers are reversed. Such is the price of globalization.

I guess you really can't go home again.

At the request of the family, I assisted in the liquidation of his investment portfolio. Bob had been an avid reader of the Diary of a Mad Hedge Fund Trader since its inception, and he had attended my Los Angeles lunches.

It seems he listened well. There was Apple (AAPL) in all its glory at a cost of $21. I laughed to myself. The master had become the student and the student had become the master.

Like I said, it was a real circle of life weekend.

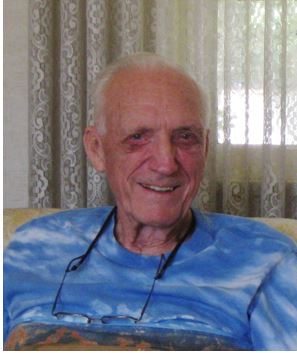

Scoutmaster Bob

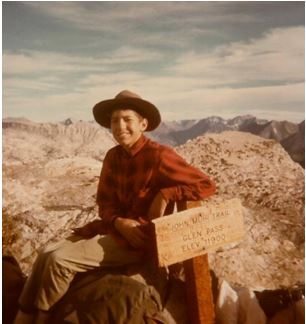

The Mad Hedge Fund Trader at Age 11 in 1963

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.