When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

December 30, 2016

Fiat Lux

Featured Trade:

(JANUARY 4TH LIVE GLOBAL STRATEGY WEBINAR),

(WILL SPACE X BE YOUR NEXT TEN BAGGER?)

(EBAY), (TSLA), (SCTY), (BA), (LMT)

eBay Inc. (EBAY)

Tesla Motors, Inc. (TSLA)

SolarCity Corporation (SCTY)

The Boeing Company (BA)

Lockheed Martin Corporation (LMT)

I am constantly on the lookout for ten baggers, stocks that have the potential to rise tenfold over the long term.

Look at the great long-term track records compiled by the most outstanding money managers, and they always have a handful of these that account for the bulk of their out performance, or alpha, as it is known in the industry.

I?ve found another live one for you.

Elon Musk?s Space X is so forcefully pushing forward rocket technology that he is setting up one of the great investment opportunities of the century.

In the past decade, his start up has accomplished more breakthroughs in advanced rocket technology than have been seen in the last half century, since the golden age of the Apollo space program.

As a result, we are now on the threshold of another great leap forward into space. Musk?s ultimate goal is to make mankind an ?interplanetary species?.

There is only one catch.

Space X is not yet a public company, being owned by a handful of fortunate insiders and venture capital firms. But you should get a shot at the brass ring someday.

The rocket launch and satellite industry is the biggest business you have never heard of, accounting for $200 billion a year in global sales. This is probably because there are no pure stock market plays.

Only two major companies are public, Boeing (BA) and Lockheed Martin (LMT), and their rocket businesses are overwhelmed by other aerospace lines.

The high-value-added product here is satellite design and construction, with rocket launches completing the job.

Once dominated by the US, the market for launches has long since been ceded to foreign competitors. The business is now captured by Europe (the Ariane 5), China (the Long March 5), and Russia (the Angara A5).

Until recently, American rocket makers were unable to compete because decades of generous government contracts enabled costs to spiral wildly out of control.

Whenever I move from the private to the governmental sphere, I am always horrified by the gross indifference to costs. This is the world of the $10,000 coffee maker and the $20,000 toilet seat.

Until 2010, there was only a single US company building rockets, the United Launch Alliance (ULA), a joint venture of Boeing and Lockheed Martin. ULA builds the aging Delta IV and Atlas V rockets.

The vehicles are launched from Cape Canaveral, Florida and Vandenberg Air Force Base in California.? I had the privilege of witnessing one such launch. They look like huge roman candles that just keep on going until they disappear into the blackness of space.

Enter Space X.

Extreme entrepreneur Elon Musk has shown a keen interest in space travel throughout his life. The sale of his interest in PayPal, his invention, to Ebay (EBAY) in 2002 for $165 million, gave him the means to do something about it.

He then discovered Tom Mueller, a childhood rocket genius from remote Idaho, who built the largest ever amateur liquid fueled vehicle, with 13,000 pounds of thrust. Musk teamed up with Mueller to found Space X in 2002.

A decade of grinding hard work, bold experimentation, and heart rending testing ensued, made vastly more difficult by the 2008 Great Recession.

Space X?s Falcon 9 first flew in June, 2010 and successfully orbited earth. In December, 2010, it launched the Dragon space capsule and recovered it at sea. It was the first private company ever to accomplish this feat.

Dragon successfully docked with the International Space Station (ISS) in May, 2012. NASA has since provided $440 million to Space X for further Dragon development.

The result was the launch of the Dragon V2 (no doubt another historical reference) in May, 2014. It was large enough to carry seven astronauts.

Space X conducted the first successful flight test of the new Dragon capsule on May 6 of that year.

Then Musk really upped his game by successfully pulling off the first ever landing of a booster rocket on a platform at sea in April, 2016. This is crucial for his plan to dramatically cut the cost of space travel.

Commit all these names to memory. You are going to hear a lot more about them.

Musk?s spectacular success with Space X can be traced to several different innovations.

He has taken the Silicon Valley hyper competitive ethos and financial model and applied it to the aerospace industry:? the home of the bloated bureaucracy, the no bid contract, and the agonizingly long time frame.

For example, his initial avionics budget for the early Falcon 1 rocket was $10,000, and was spent on off-the-shelf consumer electronics. It turns out that their quality had improved so much in recent years they met military standards.

But no one ever bothered to test them. $10,000 wouldn?t have covered the food at the design meetings at Boeing or Lockheed-Martin which would have stretched over years.

Similarly, Musk sent out the specs for a third party valve actuator no more complicated than a garage door opener, and a $120,000, one-year bid came back. He ended up building it in house for $3,000. Musk now tries to build as many parts in house as possible, giving it additional design and competitive advantages.

This tightwad, full speed ahead and damn the torpedoes philosophy overrides every part that goes into Space X rockets.

Amazingly, the company is using 3-D printers to make rocket parts, instead of having them custom made.

Machines guided by computers carve rocket engines out of a single block of inconel nickel-chromium super alloy, foregoing the need for conventional welding, a frequent cause of engine failures.

Space X is using every launch to simultaneously test dozens of new parts on every flight, a huge cost saver that involves extra risks that NASA would never take. It also uses parts that are interchangeable on all its rocket types which is another substantial cost saver.

Space X has effectively combined three nine engine Falcon 9 rockets to create the 27 engine Falcon Heavy, the world?s largest operational rocket. It has a load capacity of a staggering 53 metric tons, the same as a fully loaded Boeing 737. It has half the thrust of the gargantuan Saturn V moon rocket that last flew in 1973.

Musk is able to capture synergies among his three companies not available to any competitor. Space X gets the manufacturing efficiencies of a mass production car maker. Tesla Motors has access to the futuristic space age technology of a rocket maker. Solar City (SCTY) provides cheap solar energy to all of the above.

And herein lies the play.

As a result of all these efforts, Space X today can deliver what ULA does for 76% less money with vastly superior technology and capability. Specifically, its Falcon Heavy can deliver a 116,600 pound payload into low earth orbit for only $90 million, compared to the $380 million price tag for a ULA Delta IV 57, 156 pound launch.

In other words, Space X can deliver cargo to space for $772 a pound, compared to the $7,515 a pound UAL charges the US government. That?s a hell of a price advantage.

You would wonder when the free enterprise system is going to kick in and why Space X doesn?t already own this market.

But selling rockets are not the same as shifting iPhones, laptops, watches, or cars. There is a large overlap with the national defense of every country involved.

Many of the satellite launches are military in nature and top secret. As the cargoes are so valuable, costing tens of millions of dollars each, reliability and long track records are big issues

.

Enter the wonderful world of Washington DC politics. UAL constructs its Delta IV rocket in Decatur, Alabama, the home state of Senator Richard Shelby, the powerful head of the Banking, Finance and Urban Affairs Committee.

The first Delta rocket was launched in 1960, and much of its original ancient designs persist in the modern variants. It is a major job creator in the state.

Shelby has criticized President Obama?s attempt to privatize and modernize the rocket business as ?a faith based initiative.? ULA is a major contributor to Shelby?s campaigns.

ULA has no rocket engine of its own. So it buys engines from Russia, complete with blue prints, hardly a reliable supplier. Magically, the engines have so far been exempted from the economic and trade sanctions enforced by the US against Russia for its invasion of the Ukraine.

ULA has since signed a contract with Amazon?s Jeff Bezos owned Blue Origin, which is also attempting to develop a private rocket business, but is miles behind Space X.

Musk testified in front of Congress in 2014 about the viability of Space X rockets as a financially attractive, cost saving option. His goal is to break the ULA monopoly and get the US government to buy American. You wouldn?t think this would be such a tough job, but it is.

Musk has since sued the US Air Force to open up the bidding.

Elon became a US citizen in 2002 primarily to qualify for bidding on government rocket contracts. This move was to address national security concerns.

NASA did hold open bidding to build a space capsule to ferry astronauts to the International Space Station. Boeing won a $4.2 billion contract while Space X received only $2.6 billion, despite superior technology and a lower price.

It is all part of a 50-year plan that Musk confidently outlined to a venture capital friend of mine two decades ago. So far, everything has played out as predicted.

The Holy Grail for the space industry has long been the building of reusable rockets, thought by many industry veterans to be impossible.

Imagine what the economics of the airline business would be if you threw away the airplane after every flight? It would cost $1 million for one person to fly from San Francisco to Los Angeles.

This is how the launch business has been conducted since the inception of the industry in the 1950s.

Space X is on the verge of accomplishing exactly that. It will do so by using its Super Draco engines and thrusters to land rockets on a platform at sea. Then you just reload propellant and relaunch.

The concept has so far been successfully tested to an altitude of 1,000 meters (click link for the YouTube video: https://www.youtube.com/watch?v=SBUtlOnNc5E .

Attempts to do this from a live launch have had some setbacks (click links for that video where they almost made it: https://www.youtube.com/watch?v=PT0xCSJbt88 and https://www.youtube.com/watch?v=ycLKqRDjoZA), but it was successfully pulled off? (click here:? https://www.youtube.com/watch?v=3G8GJQumBFs

Consequently, launch costs will plummet to pennies on the dollar. If Space X can chop payload costs to under $100, compared to ULAs $7,515, that is a savings which even Richard Shelby can?t argue against.

Talk about disruptive innovation with a turbocharger!

The company is building its own spaceport in Brownsville, Texas that will be able to launch multiple rockets a day.

The Hawthorne, CA factory (where I charge my own Tesla S-1 when in LA) now has the capacity to build 20 rockets a year. This will eventually be ramped up to hundreds.

Space X is the only organization that offers a launch price list on its website, much as Amazon sells its books (http://www.spacex.com/about/capabilities). The Falcon 9 will carry 28,930 pounds of cargo into low earth orbit for only $60.2 million. Sounds like a bargain to me.

Space X currently has $5 billion in contracts to fly over 50 missions for a variety of private and governmental entities, making the company cash flow positive. This includes a $1.6 billion NASA contract to supply the (ISS).

This no doubt includes an assortment of tax breaks which Musk has proven adept at harvesting. Elon has been a quick learner about the ways of Washington.

Customers have included the Thai telecommunications firm, Rupert Murdock?s Sky News Japan, an Israeli telecommunications group, and the US Air Force.

So, when do we mere mortals get to buy the stock? Musk estimates at 12 flights a year the company will earn a 10% return on capital, making it worth $4-5 billion.

The current exponential growth in broadband will lead to a similar growth in satellite orders and therefore rocket launches. So, the commercial future of the company looks especially bright.

However, Musk is in no rush to go public. A permanent, viable, and sustainable colony on Mars has always been a fundamental goal of Space X. It would be a huge distraction for a publicly managed company. That makes it a tough sell to investors in the public markets.

You can well imagine that the next recession would bring cries from shareholders for cost cutting that would put the Mars program at the top of any list of projects to go on the chopping block. So Musk prefers to wait until the Mars project is well established before entertaining an IPO.

Musk expects to launch a trip to Mars by 2025 and establish a colony that will eventually grow to 80,000. Tickets will be sold for $500,000.

There are other considerations. Many employees and early venture capital investors wish to realize their gains and move on. Public ownership would also give the company extra ammunition for cutting through Washington red tape. These factors point to an IPO that is earlier than later.

On the other hand, Musk may not care. The last net worth estimate I saw for him was $13 billion. If his three companies increase in value by ten times over the next decade, as I expect, that would increase his wealth to $130 billion, making him the richest person in the world.

If an IPO does come, investors should jump in with both feet. While the value of the firm may have already increased tenfold by then, there may be another tenfold gain to come. Get on the Elon Musk train before it leaves the station.

To describe Elon as a larger than life figure would be something of an understatement. Musk is the person on which the fictional playboy/industrialist/technology genius, Tony Stark, in the Iron Man movies is based.

When the Disney movie, Tomorrowland,?was released,? a Tesla supercharging station featured prominently. Elon takes all of this in good humor. He loaned a Tesla roadster to the film producers.

Musk says he wishes to die on Mars, but not on impact. Perhaps, it would be the ideal retirement for him, say around 2045, when he will be 75.

To visit the Space X website, please click link: http://www.spacex.com . It offers very cool videos of rocket launches and a discussion with Elon Musk on the need for a Mars mission.

Catching a Dragon by the Ta

Catching a Dragon by the Ta

il

This Could Be the Stock Performance

This Could Be the Stock Performance

Is Mars the Next Hot Retirement Spot?

Is Mars the Next Hot Retirement Spot?

?The longer you wait to fire someone, the longer it has been since you should have fired them,? said Elon Musk, founder and CEO of Space X and Tesla Motors.

Global Market Comments

December 29, 2016

Fiat Lux

Featured Trade:

(MY OLD PAL, LEONARDO FIBONACCI),

(TESTIMONIAL)

I remember the 12th century like it was yesterday.

In those days, the leading intellectuals used to get together and drink wine by the gallon which at that time was really little more than rotten grape juice. The problem was that we all used to pass out before anybody came up with a great idea.

Then someone started importing coffee from the Middle East and thinkers stayed awake long enough to produce great thoughts.

Enter the Renaissance.

One of the guys I used to hang out with then was named Leonardo Fibonacci. Good old Leo was a man after my own heart, a world-class nerd and geek with a penchant for mathematics.

His dad was a diplomat from the Court at Pisa to the Algiers sultanate who had a nice little import/export business on the side. It is safe to say that there was probably as little action in Algiers then as there is now. I know because I?ve been there.

Instead of camping out in his dad?s basement and staying depressed like a lot of young men these days, Leo killed time trolling the local bazaars for interesting used books he could buy on the cheap.

Remember, this was before texting. That was not hard to do since most people couldn?t read. He took the trouble to learn Arabic and translated them back into Latin. Ancient math books were his specialty.

It didn?t take Leo long to figure out that the Arabs had developed a numbering system vastly superior to the Roman numerals then in use in Europe. Most importantly, they mastered the concept of zero and the placement of digits in addition and subtraction. The Arabs themselves, in fact, lifted these concepts from archaic Indian mathematicians as far back as the 6th century.

If you don?t believe me about the significance of this discovery, try multiplying CCVII by XXXIV. (The answer is VIIXXXVIII, or 7,038). Try designing a house, a bridge, or a computer software program with such a cumbersome numbering system.

Leo didn?t stop there. He also discovered a series of numbers, which seemed to have magical predictive powers. The formula is extremely simple. Start with zero, add the next number, and you have the next number in the series.

Continue the progression and you get 0,1,1,2,3,5,8,13,21,34,55?. and so on. It?s no surprise that the sequence became known as the ?Fibonacci Sequence?.

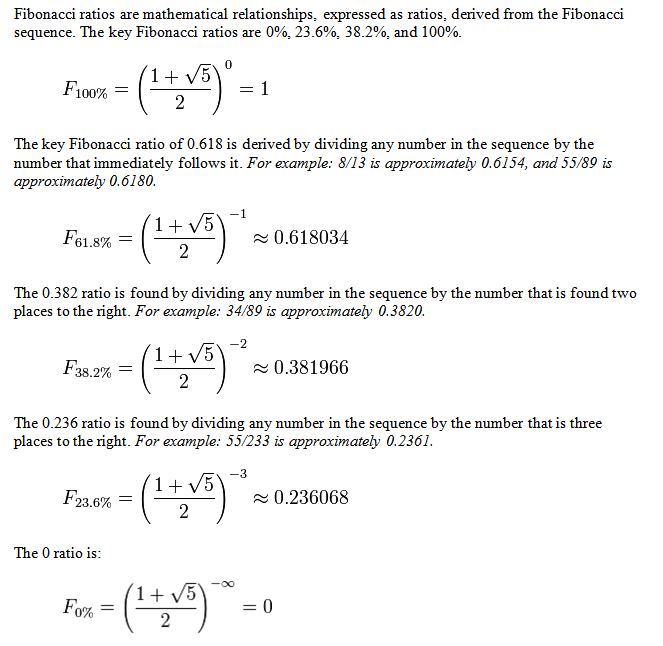

The great thing about this series is that if you divide any number in it by the next one, you get a product that has become known as the ?Golden Ratio?. This number is 1:1.618, or 0.618 to one.

Fibonacci?s original application for this number was to predict the growth rate of a population of breeding rabbits.

Then some other mathematicians started playing around with it. It turns out the Great Pyramid in Egypt was built to the specification of a Fibonacci ratio. So is the rate of change of the curvature of a seashell, or a human ear. So is the ratio of the length of your arms to your legs.

Upon closer inspection, the Fibonacci ratio turned out to be absolutely everywhere, from the structure of the tiniest cell to the swirl of the largest galaxies in the universe.

Fibonacci introduced his findings in a book entitled ?Liber Abaci?, or ?Free Abacus? in English which he published in 1202. In it he proposed the 0-9 numbering system, place values, lattice multiplication, fractions, bookkeeping, commercial weights and measures and the calculation of interest. It included everything we would recognize as modern mathematics.

The book launched the scientific revolution in Europe that led us to where we are today, and was a major bestseller. In fact, you can still buy it on Amazon, making it the longest continuously published book in history.

Enter the stock market. By the end of the 19th century, some observers noticed that share prices tended to move in predictable patterns on charts. In particular, they always seemed to advance and pull back around the numbers forecast by my friend, Fibonacci, seven hundred years earlier.

These people came to be known as ?technical analysts,? as opposed to fundamental analysts who look at the underlying business behind each company.

By the 1930s, Fibonacci numbers had worked their way into mainstream technical analytical theories, such as Elliot Wave. Today, most market tracking software and data systems, like Bloomberg, will automatically throw up Fibonacci support and resistance numbers on every stock chart.

Why am I talking about this? Because I am frequently asked how I pick the precise strike prices for the options in my proprietary Trade Alerts. I use a combination of moving averages, moving average convergance-divergance (MACD) indicators, Bollinger bands, Fibonacci numbers, and a chant taught to me by an old Yaqui Indian shaman.

And I do all of this only after going over the underlying fundamentals of the stock or index with a fine tooth comb. I can?t be any clearer than that.

Enter the high frequency traders (HFTs). Knowing that the bulk of us rely on Fibonacci numbers for our short term trading calls, they have developed algorithms that seek to exploit that preference.

They enter a large number of stop loss orders to sell just below a ?Fibo? support level, then put up fake, but extremely large offers just above it, which are usually cancelled. Only 1% of these orders ever get executed.

When conventional traders see these huge offers to sell, they panic, dump their stocks, and trigger the stop losses. The HFTs then jump in and cover their own shorts for a quick profit, sometimes only for a fraction of a penny.

The net effect of these shenanigans is to make Fibo numbers less effective. Fibo support is just not as rock solid as it used to be, nor is resistance. This is why the performance of several leading technical analysts has seriously deteriorated in recent years.

Although their importance is now somewhat diluted, I still enjoy Fibonacci numbers, as I see them in nature all around me. They occasionally have other uses, such as in cryptography.

When I watched The Da Vinci Code sequel, ?Angels & Demons?, and listened to the clues, I recognized the handiwork of my old friend, Leo. The rest of the audience sat there clueless, except for the group in the next row wearing who were wearing ?UC BERKELEY? hoodies.

For the fellow geeks and nerds among you, here are the precise Fibonacci numbers indicating support and resistance, which you will find on a stock chart.

Fibonacci Ratios

Leonardo Fibonacci (Maybe)

Leonardo Fibonacci (Maybe)

Thank John for his ceaseless banter. I enjoy this service so much. Great stories!!!!

I hope our paths cross soon.

Thank you.

Bill

North Carolina

Global Market Comments

December 28, 2016

Fiat Lux

Featured Trade:

(WILL SYNBIO SAVE OR DESTROY THE WORLD?),

(XLV), (XPH), (XBI), (MON), (IBM), (GOOG), (AAPL), (CSCO)

Health Care Select Sector SPDR ETF (XLV)

SPDR S&P Pharmaceuticals ETF (XPH)

SPDR S&P Biotech ETF (XBI)

Monsanto Company (MON)

International Business Machines Corporation (IBM)

Alphabet Inc. (GOOG)

Apple Inc. (AAPL)

Cisco Systems, Inc. (CSCO)

Some 40 years ago, when I was a biotechnology student at UCLA, a handful of graduate students speculated about how dangerous our work really was.

It only took us an hour to figure out how to synthesize a microbe that had a 99% fatality rate, was immune to antibiotics, and was so simple it could be produced in your home kitchen.

Basically, a bunch of bored students discovered a way to destroy the world.

We voiced our concerns to our professors, who immediately convened a national conference of leaders in the field. Science had outpaced regulation, as it always does. They adopted standards and implemented safeguards to keep this genie from getting out of the bottle.

Four decades later scientists have been successful at preventing a ?doomsday? bug from accidently escaping a lab and wiping out the world?s population.

That is, until now.

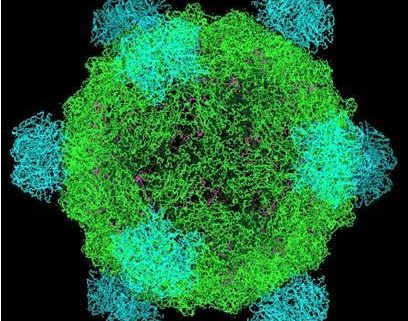

In 2010, Dr. Craig Venter created the first completely synthetic life form able to reproduce on its own. Named ?Phi X 174,? the simple virus was produced from a string of DNA composed entirely on a computer. Thus was invented the field of synthetic biology, better known as ?SynBio.?

Venter?s homemade creature was your basic entry level organism. Its DNA was composed of only 1 million base pairs of nucleic acids (adenine, thymine, cytosine, guanine, and uracil), compared to the 3 billion pairs in a human genome. Shortly thereafter, Venter one-upped himself by manufacturing the world?s first synthetic bacteria.

The work was hailed as the beginning of a brave new world that will enable biology to make the same dramatic advances in technology that computer science did in the 20thcentury. Dr. Drew Endy of Stanford University says that SynBio already accounts for 2% of US GDP, and is growing at a breakneck 12% per year. He predicts that SynBio will eventually do more for the economy than the Internet and social media combined.

You may recall Craig Venter as the man who first decoded the human genome in 2003. The effort demanded the labor of thousands of scientists and cost $3 billion. We later learned that the DNA that was decoded was Craig?s own. Some five years later, the late Steve Jobs spent $1 million to decode his own genes in a vain attempt to find a cure for pancreatic cancer.

Today, you can get the job done for $1,000 in less than 24 hours. That?s what movie star Angelina Jolie did, who endured a voluntary double mastectomy when she learned her genes guaranteed a future case of terminal breast cancer.

The decoding industry is now moving to low cost China, where giant warehouses have been built to decode the DNA of a substantial part of humanity. That should soon drop the price to $100. It?s all about full automation and economies of scale.

This technology is already spreading far faster than most realize. In 2004, MIT started the International Genetically Engineered Machine Contest where college students competed to construct new life forms. Recently, a high school division was opened, attracting 194 entries from kids in 34 countries. Gee, when I went to wood shop in high school it was a big deal when I finished my table lamp.

This will make possible ?big data? approaches to medical research that will lead to cures of every major human disease, such as cancer, heart disease, diabetes, and more, within our lifetimes. This is why the health care (XLV), biotechnology (XBI), and pharmaceutical (XPH) sectors have been top performers in the stock market for the past two years. It?s not just about Obamacare.

The implications spread far beyond health care. IBM (IBM) is experimenting with using DNA based computer code to replace the present simple, but hugely inefficient, binary system of 0s and 1s. ?DNA based computation? is prompting computer scientists to become biochemists and biochemists to evolve into computer scientists to create ?living circuit boards.? Alphabet (GOOG), Apple (AAPL), and Cisco (CSCO) have all taken notice.

We are probably only a couple years away from enterprising hobbyists downloading DNA sequences from the Internet and building new bugs at home with a 3D printer. Simple organisms, like viruses, would need a file size no larger than one needed for a high definition photo taken with your iPhone. They can then download other genes from the net, creating their own customized microbes at will.

This is all great news for investors of every stripe, and will no doubt accelerate America?s economic growth. But it is also causing governments and scientists around the world to wring their hands, seeing the opening of a potential?Pandora?s Box. What if other scientists lack Venter?s ethics? He went straight to President Obama for a security clearance before he made his findings public.

If we can?t trust our kids to drink, drive, or vote, then how responsibly will they behave when they get their hands on potential bioterror weapons? How many are familiar with Bio Safety Level 4 (BSL) standards? None, I hope.

In fact, the race is already on to weaponize SynBio. In 2002, scientists at SUNY Stonybrook synthesized a polio virus for the first time. In 2005, another group managed to recreate the notorious H1N1 virus that caused the 1918 Spanish Flu epidemic. Some 50-100 million died in that pandemic within 2 years.

Then in 2011, Ron Fouchier of the Erasmus Medical Center in Holland announced that he had found a way to convert the H5N1 bird flu virus, which in nature is only transmitted from birds to people, into a human to human virus. Of the 565 who have come down with bird flu so far, which originates in China, 59% have died.

It didn?t take long for the Chinese to get involved. They have taken Fouchier?s work several steps further, creating over 127 H5N1 flu varieties, five of which can be transmitted through the air, such as from a sneeze. The attributes of one of these just showed up in the latest natural strain of bird flu, the H7N9.

The World Health Organization (WHO) and the Center for Disease Control (CDC) in Atlanta, Georgia are charged with protecting us from outbreaks like these. But getting the WHO, a giant global bureaucracy, to agree on anything is almost impossible, unless there is already a major outbreak underway. The CDC has seen its budget cut by 25% since 2010.

The problem is that the international organizations charged with monitoring all of this are still stuck in the Stone Age. Current regulations revolve around known pathogens, like smallpox and the Ebola virus, that date back to the 1960s, when the concern was about moving lethal pathogens across borders via test tubes.

That is, oh so 20th?century. Thanks to the Internet, controlling information flow is impossible. Just ask Muammar Gaddafi and Bashar al-Assad. Al Qaida has used messages embedded in online porn to send orders to terrorists.

Getting international cooperation isn?t that easy. Only 35 countries are currently complying with the safety, surveillance, and research standards laid out by the WHO. Indonesia refused to part with H5N1 virus samples spreading there because it did want to enrich the western pharmaceutical companies that would develop a vaccine. African countries say they are too poor to participate, even though they are the most likely victims of future epidemics.

Scientists have proposed a number of safeguards to keep these new superbugs under control. One would be a dedicated sequence of nucleic acid base pairs inserted into the genes that would identify its origin, much like a bar code at the supermarket. This is already being used by Monsanto (MON) with its genetically modified seeds. Another would be a ?suicide sequence? that would cause the germ to self-destruct if it ever got out of a lab.

One can expect the National Security Agency to get involved, if they aren't already. If they can screen our phone calls for meta data, why not high risk DNA sequences sent by email?

But this assumes the creators want to be found. The bioweapons labs of some countries are thought to be creating n

ew pathogens so they can stockpile vaccines and antigens in advance of any future conflict.

There are also the real terrorists to consider. When the Mubarak regime in Egypt was overthrown in 2011, demonstrators sacked the country?s public health labs that had been storing H5N1 virus. Egypt has one of the world?s worst bird flu problems, due to the population?s widespread contact with chickens.

It is hoped that the looters were only in search of valuable electronics they could resell, and tossed the problem test tubes. But that is only a hope.

I have done a lot of research on this area over the decades. I even chased down the infamous Unit 731 of the Japanese Imperial Army which parachuted plague infected rats into China during WWII, after first experimenting on American POWs.

The answer to the probability of bio warfare always comes back the same thing. Countries never use this last resort for fear of it coming back on their own populations. It really is an Armageddon weapon. Only a nut case would want to try it.

Back in 1976 I was one of the fortunate few to see in person the last living cases of smallpox. As I walked through a 15th?century village high in the Himalayas in Nepal, two dozen smiling children leaned out of second story windows to wave at me. The face of every one was covered with bleeding sores. And these were the survivors. Believe me, you don?t want to catch it yourself.

For those who want to learn more about SynBio, or participate in the discussion, please visit the BioBricks Foundation by clicking the link:

http://biobricks.org.

Sure, I know this doesn?t directly relate to what the stock market is going to do today. But if a virus escaped from a rogue lab and killed everyone on the planet, that would be bad for prices, wouldn?t it?

I really hope one of the kids competing in the MIT contest doesn?t suffer from the same sort of mental problems as the boy in Newton, Connecticut did.

I Think Wood Shop Would Have Been Easier

I Think Wood Shop Would Have Been Easier

Cause of the Next Bear Market or the End of the World?

Cause of the Next Bear Market or the End of the World?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.