Global Market Comments

October 13, 2016

Fiat Lux

Featured Trade:

(THE DRUG BATTLE COMING TO A NEIGHBORHOOD NEAR YOU),

(PFE), (LLY), (MRK), (CVS), (UNH), (ANTM),

(WHY WARREN BUFFETT HATES GOLD),

(GLD), (GDX), (ABX),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS)

Pfizer Inc. (PFE)

Eli Lilly and Company (LLY)

Merck & Co., Inc. (MRK)

CVS Health Corporation (CVS)

UnitedHealth Group Incorporated (UNH)

Anthem, Inc. (ANTM)

SPDR Gold Shares (GLD)

VanEck Vectors Gold Miners ETF (GDX)

Barrick Gold Corporation (ABX)

No, I?m not talking about warring Latin American drug gangs.

I?m not even referring to the legalization of marijuana, which looks like a done deal in California?s November 8th election.

No, I?m talking about the Golden State?s latest attempt to regulate drug prices.

What?s at stake here is a bifurcation of the entire US health care industry. The impact on your portfolio could be huge.

This is a big deal because, if successful, it could lead to a national movement to cap drug prices and gut the profitability of major pharmaceutical companies like Pfizer (PFE), Eli Lily (LLY), and Merck (MRK).

On the other hand, health care providers and drug purchasers like CVS Health Group (CVS), United Health Group, (UNH), and Anthem (ANTM) would emerge as enormous winners.

Let me first tell you a story. In 1998 my late wife, Kyoko, was diagnosed with breast cancer.

Her doctor recommended a drug called Epogen which was highly effective at dealing with anemia during chemotherapy.

The problem was that since it was experimental, it was not covered by our insurance. It cost $1,000 a shot.

I said, ?No problem.? I was a hedge fund manger having a good year so I could afford it.

As Kyoko?s treatment progressed, she became friends with many other women undergoing the same process. The only problem was that they couldn?t afford the Epogen shots.

As a result, we watched them die one by one over a six-month period.

Kyoko got to live for another four years and passed? away in 2002.

Needless to say, I am somewhat sensitive to the issue of drug prices.

At issue is Proposition 61 which bars California?s health care plan, MediCal, from paying more for drugs than the US Department of Veteran Affairs.

Thanks to special negotiating power granted by the US Congress, the country?s 9 million veterans are able to obtain drugs on average 24% cheaper than typical consumers.

America?s 40 million Medicare recipients are barred by law from getting the same deal, thanks to decades of intense lobbying by conservative congressmen.

Nor are 4 million MediCal recipients who are currently costing California some $3.8 billion a year.

Competition from foreign drug suppliers is also similarly banned.

The battle over Proposition 61 promises to be the most expensive in US history. The pharmaceutical industry has so far poured more than $100 million into negative advertising to fight the measure.

Californians are now barraged with slickly-produced TV adds showing aged veterans begging you not to raise their drug prices.

At last count the polls are showing that Proposition 61 will pass with 70% of the vote.

AARP is a major supporter (please stop sending me those membership cards), as are AIDS activist groups. Veterans' groups oppose it.

It is all part of a nationwide backlash against the predatory practices of drug pricing.

This year has seen a 500% increase in the price of Mylan?s (MYL) EpiPens which are used to treat severe allergic reactions, tenfold price hikes for AIDS drugs and Hepatitis C treatments that cost $1,000 a pill.

Only last week, Mylan agreed to pay a $465 million fine for overcharging Medicare for EpiPens.

Drugs for chemotherapy, diabetes, and high blood pressure have also seen dramatic price increases.

It all vindicates my decision to take a vacation from the big pharma and health care space during 2016. Wide open to populist attack by both political parties, it is better to keep your cash out of the line of fire.

However, once the polls close there are going to be some great deals to be had in the shares of these reasonably growing industries.

My bet is that president Hillary is going to target the most egregiously offending companies, like Mylan, that only buy monopoly patents and mark prices up tenfold without doing any real medical research.

Mainstream big pharma companies like Pfizer and Eli Lily, which invest heavily in research, should not be affected.

By the way, Epogen is now covered by Obamacare. It works.

The Armageddon crowd must be slitting their wrists today watching gold hit a new four month low in the wake of the global interest rate rally.

No flight to safety here.

The Armageddon crowd are the guys who are perennially predicting the collapse of the dollar, the default of the US government, hyperinflation, and the end of the world.

Better to keep all your assets in gold and silver, store at least a year?s worth of canned food, and keep your guns well oiled and supplied with ammo, preferably in high capacity magazines.

If you followed their advice, you lost your shirt.

I have broken many of these wayward acolytes of their money-losing habits. But not all of them. There seems to be an endless supply emanating from the hinterlands.

The Oracle of Omaha, Warren Buffet, often goes to great lengths to explain why he despises the yellow metal.

The sage doesn't really care about gold whatever the price. He sees it primarily as a bet on fear.

If investors are more afraid in a year than they are today, then you make money on gold. If they aren't, then you lose money.

The only problem now is that fear ain't working.

If you took all the gold in the world, it would form a cube 67 feet on a side, worth $5 trillion. For that same amount of money, you could own other assets with far greater productive earning power including:

*All the farmland in the US, about 1 billion acres, which is worth $2.5 trillion.

*8 Apples (AAPL), the largest capitalized company in the world, at $634 billion.

Instead of producing any income or dividends, gold just sits there and shines, making you feel like King Midas.

I don't know. With the stock market at an all time high, and oil trading at $50/barrel, a bet on fear looks pretty good to me right now.

I'm still sticking with my long term forecast of the old inflation-adjusted high of $2,300/ounce.

It is just a matter of time before emerging market central bank buying pushes it up there.

And who knows? Fear might make a comeback too.

Maybe Feeling Like King Midas is Not So Bad

Global Market Comments

October 12, 2016

Fiat Lux

Featured Trade:

(GOING BACK INTO THE GOLD TRADE),

(GLD), (GDX), (ABX), (NEW),

(CALLING THE TOP IN OIL),

(USO), (XLE), (XOM),

(TRADING FOR THE NON-TRADER),

(ROM), (UXI), (UCC), (UYG)

SPDR Gold Shares (GLD)

VanEck Vectors Gold Miners ETF (GDX)

Barrick Gold Corporation (ABX)

Newmont Mining Corporation (NEM)

United States Oil (USO)

Energy Select Sector SPDR ETF (XLE)

Exxon Mobil Corporation (XOM)

ProShares Ultra Technology (ROM)

ProShares Ultra Industrials (UXI)

ProShares Ultra Consumer Services (UCC)

ProShares Ultra Financials (UYG)

Let me tell you what is happening with the price of gold.

The barbarous relic snapped out of a five-year bear market in January, delivering a very smart 31.68% rally during the first half of 2016.

The big driver was the sudden collapse of European and Japanese interest rates to hugely negative levels, some to -0.40%.

That gave gold (GLD) a real positive return, some 40 basis points, compared to European and Japanese cash returns.

By July, gold reached a multiyear high at $1,350, and speculative longs in the futures market rocketed to all time highs.

There it levitated for three months, and the price for the yellow metal moved sideways.

Then, the Bank of Japan peed on the parade, allowing overnight rates to float back up to 0.10% by failing to expand quantitative easing, its hyper aggressive monetary program.

The European Central Bank followed suit. A flash fire ensued in the movie theater, French-frying many trading longs in gold and triggering massive stop loss orders to sell.

That took us down a gut churning 11.6% in short order. Speculative longs are now a shadow of their former selves.

Therefore, it is safe to stick your toe back in the water on the gold trade.

I believe we are only in the first year of a new 20-year bull market in gold.

China has to buy a 10,000 metric tonnes of the sparkly stuff worth $471 billion over the next 40 years to reach the same levels as Western central banks.

That works out to 250 tonnes a year. Recently, it has only been buying 250 tonnes a year on the open market. In other words, it is falling behind.

To read more luscious detail about the long-term fundamentals for gold ownership, click?Why China is Gold?s Best Friend .

It's rare to see a trade setting up on the two-year charts, but that?s what is happening today with gold.

I?m calling the top in oil right here, but only for this month.

Longer term, we are headed upwards. But that is more of a 2017 story.

If you can?t do options, buy the ProShares Ultra Short Bloomberg Crude Oil ETF (SCO) for a quick trade.

The concept behind this trade is really very simple.

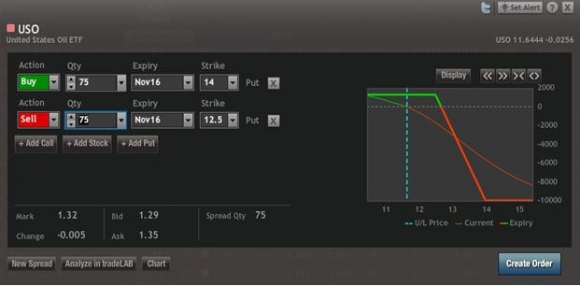

This is a bet that the United States Oil Fund (USO) will not rise above $12.50 by the November 18 expiration date, a new high for 2016.

An agreement to cap production at the Algiers OPEC meeting delivered a monster 20.40% short covering rally in oil. The quotas will be fixed at the next OPEC meeting in Vienna on November 30.

However, not a single person in the industry believes the agreement will be finalized, or if finalized, not honored. Cheating inside OPEC is legendary. The Saudis know this.

Therefore, I think oil will put in a short-term top here, and then trade sideways to down for the next month.

In addition, the current $51/barrel I see on my screen is going to stimulate a ton of new production from US frackers.

Thanks to rapidly accelerating technology, American drillers can turn oil production on and off faster than at any time before in history.

There are now over 1,000 DIP wells in inventory, wells that have been drilled, but not completed, and they can be brought online in months. That alone is worth 1 million barrels a day in new US production.

Also to consider are Iraq?s military victories against ISIS and the outbreak of stability in Libya, both of which will generate substantial new oil supplies.

I think the bear market in oil is over, thanks to a recovering global economy. I intend to write a major research piece as to why in a few days.

I just don?t think we are blasting though to a new yearly high in oil in the next 28 trading days, given the OPEC dynamics.

Hence, the short side (USO) trade alert.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage.? In today's market, investors need every advantage they can get.

Here are the specific trades you need to execute this position:

Buy 75 November, 2016 (SPY) $14.00 puts at????.?.??$2.41

Sell short 75 October, 2016 (SPY) $12.50 puts at.???.?..$1.09

Net Cost:????????????????????......$1.32

Potential Profit: $1.50 - $1.32 = $0.18

(75 X 100 X $0.18) = $1,350, or 13.64% profit in 28 trading days.

I like to start out my day by calling subscribers on the US east coast and Europe, asking how they like the service, are there any ways I can improve it, and what topics would they like me to write about.

After all, at 5:00 AM Pacific time, they are the only ones awake.

You?d be amazed at how many great ideas I pick up this way, especially when I speak to industry specialists or other hedge fund managers.

Even the 25-year-old day trader operating out of his mother?s garage has been know to educate me about something.

So when I talked with a gentleman from Tennessee recently, I heard a common complaint. Naturally, I was reminded of my former girlfriend, Cybil, who owns a mansion on top of the levee in nearly Memphis.

As much as he loved the service, he didn?t have the time or the inclination to execute my market beating Trade Alerts.

I said ?Don?t worry. There is an easier way to do this.?

Only about a quarter of my subscribers actually execute my Trade Alerts. The rest rely on my research to correctly guide them in the management of their IRAs, 401ks, pension funds, or other retirement assets.

There is also another, easier way to use the Trade Alert service. Think of it as ?Trade Alert Light?. Do the following:

1) Only focus on the four best of the S&P 500?s 101 sectors. I have listed the ticker symbols below.

2) Wait for the chart technicals to line up. Bullish long term ??Golden crosses? are setting up for several sectors.

? 3) Use a macroeconomic tailwind, like the ramp up from a 1.5% GDP growth rate to 3% we are currently seeing.

4) Shoot for a microeconomic sweet spot, companies and sectors that enjoy special attention.

5) Increase risk when the calendar is in your favor, such as during November to May.

6) Use a modest amount of leverage in the lowest risk bets, but not much. 2:1 will do.

7) Scale in, buying a few shares every day on down days. Don?t hold out for an absolute bottom. You will never get it.

The goal of this exercise is to focus your exposure on a small part of the market with the greatest probability of earning a profit at the best time of the year. This is what grown up hedge funds do all day long.

Sounds like a plan. Now what do we buy?

(ROM) ? ProShares Ultra Technology 2X Fund ? Gives you a double exposure to what will be the top performing sector of the market for the next six months, and probably the rest of your life. Click the link for details and largest holdings http://www.proshares.com/funds/rom.html.

(UXI) ? ProShares Ultra Industrial Fund 2X ? Is finally rebounding off the back of a dollar that will slow down its ascent once the first interest rate hike is behind us. . Onshoring and incredibly cheap valuations are other big tailwinds here. For details and largest holdings, click http://www.proshares.com/funds/uxi_index.html.

(UCC) ? ProShares Ultra Consumer Services 2X Fund ? Is a sweet spot for the economy, as tight-fisted consumers finally start to spend their gasoline savings, now that it no longer appears to be a temporary windfall. This is also a great play on a housing market that is on fire. It contains favorites like Home Depot (HD) and Walt Disney (DIS), which we know and love. For details and largest holdings, click http://www.proshares.com/funds/ucc.html.

(UYG) ? ProShares Ultra Financials 2X Fund ? Yes, after six years of false starts, interest rates are finally going up, with a December rate hike by the Fed a certainty. My friend, Janet, is handing out her Christmas presents early this year. This instantly feeds into wider profit margins for financials of every stripe. For details and largest holdings, click http://www.proshares.com/funds/uyg_index.html.

Of course, you?ll need to keep reading my letter to confirm that the financial markets are proceeding according to the script. You will also have to read the Trade Alerts, as we include a ton of deep research in the Updates.

You can then unload your quasi-trading book with hefty profits in the spring, just when markets are peaking out. ?Sell in May and Go Away?? I bet it works better than ever in 2017.

With the British pound (FXB) at a 31-year low, I?m booking my flat in central London for June already.

For Those Who Invest at Their Leisure

Global Market Comments

October 11, 2016

Fiat Lux

Featured Trade:

(DON'T MISS THE OCTOBER 12th LIVE GLOBAL STRATEGY WEBINAR),

(UPGRADE TO MAD OPTIONS TRADER NOW TO BEAT THE PRICE INCREASE),

(WELCOME TO THE EIGHT-WEEK YEAR),

(SPY), (QQQ), (IWM), (TLT), (BAC), (GS)

SPDR S&P 500 ETF (SPY)

PowerShares QQQ ETF (QQQ)

iShares Russell 2000 (IWM)

iShares 20+ Year Treasury Bond (TLT)

Bank of America Corporation (BAC)

The Goldman Sachs Group, Inc. (GS)

The $64,000 answer.

That was the reply I received from Mad Options Trader, Matt Buckley, known to his fellow traders as ?Whiz,? regarding my question about his two-month performance.

That is how much traders have made since the August 1 free trial started for our new Mad Options Trader service for each $100,000 of invested capital.

I knew Whiz had a hot hand. But when I heard those numbers, they blew me away.

I knew something big was happening when unsolicited testimonials started pouring in.

First, there was Frank in Dallas, Texas who said,

?I just wanted to tell you what a great find the Mad Options Trader was for you. I stumbled into two of his trades this week and made enough profit to pay for two years of his service. I know he may eventually cool off, but he is hot now.?

Then, I got another one from Bill in Richmond, Virginia who gushed, ?Trading with Whiz is like having a rich uncle. He cuts me a check once a week for $2,000. I've never been able to do this before.?

The last two weeks have been especially eye opening.

Whiz went into the September 17th Fed decision long volatility through the (VXX) and clocked a $12,000 winner in one week.

Then he flipped to the short side when Janet Yellen took no action on rates, picking up another $4,000.

He took a small hit going into the OPEC surprise Algiers deal with a short oil (USO) deal. He mitigated some of those losses with a long position in the S&P 500 (SPY).

What?s Whiz doing now?

He is scaling into ultra long dated positions in Goldman Sachs (GS) January, 2019 call options.

The bet is that sometime over the next two years, interest rates will rise, and Goldman shares will explode. He then trades against this position with weekly and monthly short positions.

It is all typical big hedge fund type stuff that the small individual retail trader never sees.

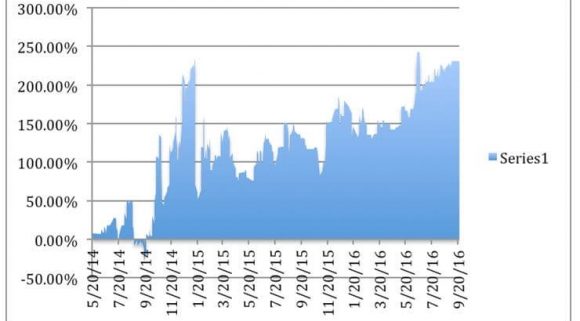

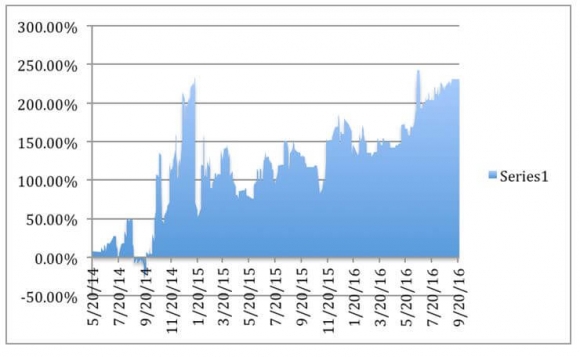

At the request of several readers, I have therefore conducted an audit of the long term trading performance of the Mad Options Trader.

The numbers blew my mind.

Since May 20, 2014, the Mad Options Trader has delivered A STUNNING 231.45% PROFIT, net of fees (see chart below).

This is during a period when the overall market performance was essentially zero.

As a result of this stellar performance, Whiz is raising his price for an upgrade to your existing Global Trading Dispatch from $1,500 to $2,000 a year.

And quite justifiably so.

It is only because we are fellow combat pilots that he is letting my regular subscribers get in at the old price one final time.

BUT ONLY IF YOU ACT THIS WEEK!

Nancy is taking orders now. You can email her directly with your request at support@madhedgefundtrader.com. Just put ?MOT UPGRADE? into the subject line.

The? Mad Options Trader service focuses primarily on the weekly US equity options expirations, with the goal of making profits at all times.

The trading will place in the S&P 500 (SPY), major industry ETFs like the Financials Select Sector (XLF), and large capitalized single names, such as Facebook (FB), JP Morgan Chase & Co. (JPM), and Apple (AAPL).

Matt?s performance works out to an eye-popping average 7.92% a month, and annualizes out to an incredible 95.11% a year.

Matt, a native of New Jersey, joined the Navy straight out of college, and rose to become an F-18/A fighter pilot. He attended the famous Top Gun school in Coronado, California. During the second Iraq War, Matt flew 44 combat missions.

Matt left the service in 2006, and immediately entered the hedge fund industry. A rapid series of promotions eventually took him to Peak6 Investments, L.P., a prominent Chicago hedge fund.

There, he soaked up the most crucial elements of technical market timing, fundamental name selection, risk control, and options trade execution.

These are the multiple skills that have enabled Matt to post such a blockbuster performance.

Matt, known to his friends by his old pilot handle of ?Whiz?, is an incredibly valuable addition to the Mad Hedge Fund Trader team. I have appointed him Head of Options Trading.

I have known for some time that fortunes were being made in the weekly options expirations, where stories of tenfold returns are not unheard of. It is a strategy that is perfectly suited to these highly volatile, uncertain times, with most options positions expiring within four days.

Matt allows us to fill that gap in our product offerings.

The Mad Options Trader provides essential support for the active trader, and includes:

1) Instant Trade Alerts sent out at key technical levels, an average of one a day. Alerts will be sent out on the opening and closing of every position.

2) Weekly Market Strategy Webinars held every Monday at 1:00 PM EST to give you a head?s up on the week ahead.

3) A weekly Live Trading Room held every Tuesday from 9:00 to 11:00 AM EST to give followers active real time trading experience.

4) Specialized Training Webinars on how to best execute Matt?s trades.

What I love about Matt is that he eats his own cooking.

Many of the Trade Alerts he recommends are executed in his own personal retirement account with real dollars.

I?ve never felt better about recommending a new product.

Good Luck and Good Trading,

John Thomas

Publisher and CEO of the Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.