Global Market Comments

November 18, 2015

Fiat Lux

Featured Trade:

(INTRODUCING THE MAD HEDGE FUND TRADER EXECUTIVE SERVICE),

(WHY WARREN BUFFETT HATES GOLD),

(GLD), (GDX), (ABX)

SPDR Gold Trust (GLD)

Market Vectors ETF Trust - Market Vectors Gold Miners ETF (GDX)

Barrick Gold Corporation (ABX)

I am pleased to announce the launch of the Mad Hedge Fund Trader Executive Service, a program that is aimed at our most valuable clients.

The goal is to provide high net worth individuals with the extra degree of assistance they may require in managing diversified portfolios. Tax, political, and economic issues will all be covered.

It is also the ideal service for the small and medium sized hedge fund that lacks the resources to support their own in-house global strategist full time.

The service includes the following:

1) A risk analysis of your own personal portfolio with the goal of focusing your investment in the highest return sectors for the long term.

2) A monthly phone call from John Thomas to update you on the current state of play in the global financial markets.

3) Personal meetings with John Thomas anywhere in the world once a year to continue your in depth discussions.

4) A subscription to Mad Hedge Fund Trader PRO.

The cost for this highly personalized, bespoke service is $10,000 a year.

To best take advantage of Mad Hedge Fund Trader Executive Service, you should possess the following:

1) Be an existing subscriber the Mad Hedge Fund Trader PRO who is already well aware of our strengths and limitations.

2) Have a liquid net worth of over $500,000.

3) Possess a degree of knowledge and sophistication of financial markets. This is NOT for beginners.

As my time is limited, we can only provide the Mad Hedge Fund Trader Executive Service to the first ten subscribers.

To subscribe to Mad Hedge Fund Trader Executive Service please click link: http://www.madhedgefundtrader.com/pro-exec.

Global Market Comments

November 17, 2015

Fiat Lux

Featured Trade:

(NOVEMBER 18 GLOBAL STRATEGY WEBINAR),

(THE PARIS ATTACKS AND YOUR PORTFOLIO),

(FXE) (EUO)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

I was on the phone to the Pentagon first thing this morning to get their take on the Friday Paris terrorist attacks.

Here is what I learned.

Are you wondering how French Mirages flying off an aircraft carrier in the eastern Mediterranean knew where to strike 24 hours after the attacks?

The US simply handed over 20 of their dozens of missions they are flying everyday, with exact GPS coordinates. It only took the French a minute to program their weapons.

Their carrier, the nuclear powered Charles de Gaulle, was pre positioned there only three days earlier for just such a contingency. Clearly, someone was aware that something bad was coming.

America also promised to replace any laser-guided bombs the French used in their campaign within seven days.

I know this because I used to fly these missions myself in beaten up old C-130?s that could magically change color overnight, thanks to quick drying paint.

My sources told me that we are winning the war against ISIS. We are killing about 1,000 a month, which they then replace with new recruits. The NSA and the CIA are keeping terrorist recruiting sites open to continue to funnel jihadi fighters into our target zones over there.

Close the sites down, and they become hard to find, or they migrate to the US.

Some lone wolves recruited and trained online will get through, as they have already done in Boston, Kentucky, and Fort Hood. These are impossible to completely guard against.

Such are the risks posed by the Internet, as it has lowered the gate over our moats. That will be our price to pay in this war. As for the financial cost, it is minimal, little more than a training exercise. That?s why there have been no supplementary budget requests.

While success in the battlefield is ongoing, don?t ever expect a victory parade down Main Street.

This is a war that will end as quietly and surreptitiously as it began. You will just no longer notice the headlines in the papers anymore. Such is the state of modern cyber warfare.

I hate making money off of a tragedy. Somehow, it doesn?t seem right. I feel I need to take a shower afterwards.

That's what happened when I went into 9-11 net short for a host of reasons having to do with the aftermath dotcom bust and a coming US economic slowdown.

A terrorist attack was only a tiny blip on the radar then, and certainly nothing of the scale of what occurred was even remotely imaginable.

That is what happened last Friday when the first headlines on the Paris terrorist attack came across my screen. Within hours, a handful of casualties turned into France?s 9-11.

Only the day before, I added an (FXE) December $111-$114 vertical bear put debit spread to my model trading portfolio. This is a bet that the Euro will stay at, or below $111 by the December 18, 2015 expiration date.

For those who don?t trade options, I advised buying the ProShares Ultra Short Euro ETF (EUO).

I usually hate adding short positions after prolonged moves down in a security. But the outlook for the beleaguered continental currency is so dire I had no choice.

With the US planning to raise interest rates in December, and the ECB expected to cut them, a falling Euro has become everyone?s no brainer one-way bet in a year that has proved impossible to trade.

This is being driven by a US GDP growth rate of 2.0-2.50%, compared to a feeble 0-0.5% rate in Europe.

I merely jumped on the bandwagon. I never gave a thought about terrorism, ISIS, or any other geopolitical event.

Of course, the Euro collapsed on the news. The (FXE) December $111-$114 vertical bear put debit spread has rocketed by 11.5% in two trading days, adding 1.50% to my 2015 annual return.

It?s a classic case of the harder I work, the luckier I get.

If you had any doubts that the Euro is headed for parity against the greenback by year-end, you can banish those thoughts from your mind.

The immediate upshot of the Paris attacks is that the European Central Bank is going to have to step up their quantitative easing by quite a lot, and sooner. The drag created by the attacks offers no other choice.

France is the world?s largest tourist destination, with 75 million visitors a year (compared to a population of only 66 million).

Travel agents around the world are now offering emergency cancellations to their clients because of contractual force majeure contract clauses. French president Francois Holland has said nothing less than a state of war now exists, putting the kibosh on any planned romantic weekends.

This crisis gets piled on top of a new enormous social services bill for Europe to settle 400,000 Syrian refugees on short notice. There is also the clean diesel disaster at Volkswagen, one of Germany?s largest employers.

Let?s face it. Europe has suddenly become unlucky. But it?s a great time to be short the currency.

When the market hands you lemons, it?s time to make lemonade, or ?limonade?.

France?s ?Reposte?

France?s ?Reposte?

A Salute from San Francisco

A Salute from San Francisco

Global Market Comments

November 16, 2015

Fiat Lux

Featured Trade:

(SAUDI ARABIA?S SECRET PLAN FOR GLOBAL PROSPERITY),

(USO), (UNG),

(CHINA?S VIEW OF CHINA),

(FXI), (BIDU), (BABA), (JD)

United States Oil (USO)

United States Natural Gas (UNG)

iShares China Large-Cap (FXI)

Baidu, Inc. (BIDU)

Alibaba Group Holding Limited (BABA)

JD.com, Inc. (JD)

Friends of mine at my former employer, the Financial Times, have met with the senior Saudi leadership in recent weeks and confirmed what I already knew.

The implications for your trading account and retirements funds are nothing less than far reaching.

The Kingdom?s long-term strategic goal is to create a global economic boom.

If they are successful, the value of all assets sensitive to the business cycle will explode in value. Those include stocks, commodities real estate, precious metals, and commodities. Only bonds, and other fixed income investments will suffer.

Saudi financial planners are betting that such a comeback is only one to two years off.

They will accomplish this by creating a world wide economic recovery that will eventually take the price of oil back up to at least $70-$80 a barrel, close to the price they need to maintain the world?s most generous social service system and balance their budget.

But to get there, they have to keep the price lower for longer.

So far, so good.

Since Saudi Arabia began its war for market share 18 months ago, $40 West Texas Intermediate is 63% off its 2014 high, and 74% down from the 2011 all time high.

At today?s prices, the global tax cut amounts to $2.24 trillion a year ($67/barrel saved X 92 million barrels/day global consumption X 365 days).

Saudi Arabia can easily add 1%-2% to global growth simply by keeping oil prices at the present level.

They can do this because they have oil reserves far beyond the understanding of all but a few industry experts.

I have traveled in the Middle East for 48 years.

I covered the neighborhood wars for The Economist magazine during the 1970?s.

When representing Morgan Stanley in the firm?s dealings with the Saudi royal family in the 1980?s, I paused to stick my finger in the crack in the Riyadh city gate left by a spear thrown by King Abdul Aziz al Saud when he captured the city in the 1920?s, creating modern Saudi Arabia.

The only mistake I made in my Texas fracking investments is that I sold out too soon in 2005, when natural gas traded from $2 a BTU to $5, and missed the spike to $17.

So let me tell you about the price of oil.

I?ll make it easy, and distill everything down to one single fact.

Saudi Arabia?s entire production of 11.5 million barrels a day, 14% of the world?s total, comes from 11 major fields.

THEY HAVE 70 OTHER SUCH FIELDS, which have yet to be surveyed and drilled. We know they are there because the geology is identical and the ultrasound data pans out.

So if Saudi Arabia wants to increase production to the point where every other producer in the world goes broke, THEY HAVE THE RESOURCES TO DO SO FOR ANOTHER CENTURY!

Saudi Arabia is not undergoing their current aggressive strategy without any pain. They are currently running an unprecedented 20% budget deficit (compared to America?s 12% in red ink).

For the first time, they have also emerged as massive borrowers in the international debt markets to bridge the funding gap.

But don?t expect the Saudis to change their posture one iota at the upcoming December 4 OPEC meeting in Vienna. They clearly see the present low price strategy as in their own best interest.

In my many dealings with the Saudis I have learned one thing.

They are playing the long game, the very long game. They obviously believe that global oil consumption will be greater over the next decade by keeping prices lower for longer, now.

And if every producer in the Bakken shale, the Marcellus shale, the Eagleford shale, and the Monterrey shale goes bankrupt first, that?s fine too.

It?s all about maximizing long-term market share.

Saudis have grown weary of being the free de facto put option for the world?s high cost producers, like American shale, Canadian tar sands, the Arctic, and offshore anywhere.

There has long been a belief that if oil prices fell below $100 for any period of time, the Saudis would simply throttle back their production and bump it back up.

Those days are long gone.

I have another theory about what?s going on.

If alternative energy sources maintain their current rate of expansion, oil will be rendered worthless by 2035.

For example, California has mandated that 50% of its energy will come from alternatives within 15 years. Many other states and countries will follow.

Therefore, it?s in the Kingdom?s interest to shift as much of their inventory before prices collapse to their production cost of $5/barrel.

If they can accomplish this faster than their oil producing, hostile competitors in the Middle East and Russia, so much the better.

You may say this all sounds like pie in the sky stuff.

But I happen to know that the Saudis are massive investors throughout the entire alternative energy venture capital spectrum, including solar, wind, ocean waves, geothermal, and even biodiesel (which I don?t believe in for two seconds).

They are NOT doing this because they need new energy sources for themselves.

The irony here is that if the Saudi plan is successful, it will add another 2-3 years to the Great American bull market that is now entering its sixth year.

The Saudis are also one of the biggest foreign Investors in US shares. It?s in their own self-interest to keep prices rising.

You have more in common with the Saudi royal family than you think.

How Much Did You Say You Wanted?

How Much Did You Say You Wanted?

Global Market Comments

November 13, 2015

Fiat Lux

Featured Trade:

(NOVEMBER 18 GLOBAL STRATEGY WEBINAR),

(WOE THE AUSTRLIAN DOLLAR!),

(FXA), (BHP), (KOL), (GLD), (USO), (BABA), (BIDU), (JD)

(AMERICA?S DEMOGRAPHIC TIME BOMB), (EEM),

(TESTIMONIAL)

CurrencyShares Australian Dollar ETF (FXA)

BHP Billiton Limited (BHP)

Market Vectors Coal ETF (KOL)

SPDR Gold Shares (GLD)

United States Oil (USO)

Alibaba Group Holding Limited (BABA)

Baidu, Inc. (BIDU)

JD.com, Inc. (JD)

iShares MSCI Emerging Markets (EEM)

If I warned them once, I warned them 1,000 times!

The Australian dollar (FXA) is going to fall.

That?s why I cautioned my Aussie friends to sell their homes, get the money the hell out of the country, and pay for their overseas vacations in advance.

As long as it is a de facto colony of China, the fortunes of the Land Down Under are completely tied to economic prospects there.

It is almost a waste of time looking at the Reserve Bank of Australia?s data releases. They have become a deep lagging, and really irrelevant indicators. You are better off going to the source, and that is in Beijing.

And therein lies the problem.

It is highly unlikely that the government in China has any idea what their economy is actually doing. Sure, they pump out the usual figures on a reliable basis like clockwork. These are educated guesses, at best.

Even in a perfect world, collecting numbers from 1.3 billion participants is a hopeless task. The US is unable to do these with any real accuracy, and we have one quarter of their population and vastly superior technology.

For what it is worth, Chinese President Xi Jinping has promised that his country?s GDP growth will not fall below a 6.5% annual rate for the next five years. At this pace, China is still creating more economic activity that any other country in the world.

Which leaves us nothing else to rely on but commodity prices to look at, far an away Australia?s largest earner. These are suggesting that the worst has yet to come.

Virtually the entire asset class hit new six year lows yesterday. I had to go to the weekly charts to see how ugly things really are.

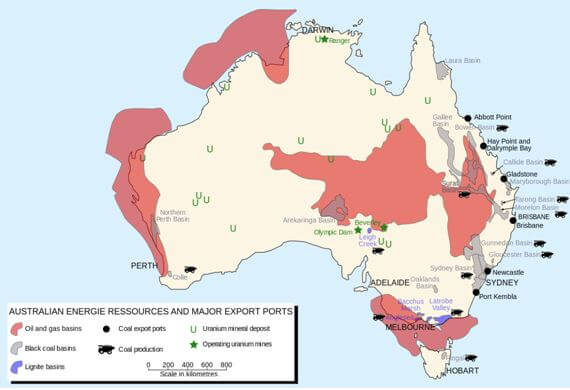

Australia?s largest exports are iron ore (26%, or $68.2 billion worth), coal (KOL) (16%), gold (GLD) (8.1%), and petroleum (USO) (5.7%). When the world?s largest consumer of these slows down, so does demand for these commodities.

BHP Billiton Ltd. (BHP), the largest producer of iron ore, has seen its shares plunge 57% from last year?s high.

But wait! It gets worse.

I have written at length about the transition of China from an industrial to a services based economy. You would expect this, as the Middle Kingdom has virtually no commodity resources of its own, but lots of smart people.

In a nutshell, they wish they had America?s economy. Where services now account for a staggering 68% of all economic activity.

This is why China?s future lies with Alibaba (BABA), Baidu (BIDU), and JD.com (JD). It does NOT lie with its steel factories and coalmines, which by the way, recently announced layoffs of 100,000, the largest in history.

To learn more about the structural remaking of China, please click here for ?End of the Commodities Super Cycle?.

There is one bright spot to mention. Australia is making a transition to a services based economy of its own. Tourism is rocketing, as is the influx of flight capital from the Middle Kingdom.

Walk the streets of Brisbane these days, and you are overwhelmed by the abundance of Asians coming here to learn English, attain a high education, or start a new business. When I came here 40 years ago, they were virtually absent.

How low is low?

It doesn?t help that the governor of the Reserve Bank of Australia, Australia?s central bank, Glenn Stevens, despises his nation?s currency.

He has used every rally this year to talk down the Aussie, threatening interest rate cuts and quantitative easing.

The hope is that a deep discount currency will allow the exporters to maintain some pricing edge on the commodities front.

The market chatter is that the Aussie will take a run as low as $0.55, the 2008-09 Great Recession low.

Whether we actually get that far or not is a coin toss.

And will even $0.55 below enough for Glenn Stevens?

Noted Aussie Dollar Hater

Noted Aussie Dollar Hater

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.