Global Market Comments

October 5, 2015

Fiat Lux

Featured Trade:

(FRIDAY, OCTOBER 23 INCLINE VILLAGE, NEVADA STRATEGY LUNCHEON),

(IS THE US HEADED FOR NEGATIVE INTEREST RATES?),

(TLT), (USO), (CU),

(CHINA?S LONG AND WINDING ROAD),

(FSLR), (STPFQ), (YGE)

iShares 20+ Year Treasury Bond (TLT)

United States Oil (USO)

First Trust ISE Global Copper ETF (CU)

First Solar, Inc. (FSLR)

Suntech Power Holdings Co. Ltd. (STPFQ)

Yingli Green Energy Holding Co. Ltd. (YGE)

The bond market (TLT) thinks so.

The commodities markets (CU) think so.

The oil market (USO) absolutely thinks so.

Who am I to argue?

The disappointing August nonfarm payroll certainly took the wind out of the sales of stock market bulls and bond bears.

It also totally vindicates the decision by the Federal Reserve not to raise interest rates on September 17.

It all becomes so clear now, like when the morning fog lifts here in San Francisco. The things they were seeing and we weren?t were both important, and dangerous.

Who needs more expensive money anyway when wage growth is zero and the rate of hiring is falling?

Now that my former professor and friend, Janet Yellen, has Beijing, Tokyo, and Berlin on her speed dial, global economic turmoil is looming larger than ever.

And what did former Treasury secretary Larry Summers say about the whites of inflation?s eyes? I ain?t seeing no white eyes here.

And he?s not my friend. I doubt he has any.

Fed funds futures are now indicating that the Fed will not raise interest rates until March, 2016.

Wasn?t there a newsletter out there somewhere in the void that predicted all the way back in January that there would be no interest rate hike in 2015 (click here)?

It was certainly a challenge to put lipstick on this pig.

Headline unemployment stayed nailed at 5.1%. But private sector employment plunged to only 118,000.

Health care added a robust +34,000 jobs, but we knew that was coming. Professional and business services contributed +31,000, and retail +21,000.

But mining really took it in the shorts with a loss of -10,000. No wonder the stocks are in the dump. The labor participation rate hit the lowest level since October, 1977 at a basement 62.4%.

One bright spot was that the broader U6 measure of ?discouraged workers? dropped to an even 10%, the lowest since May, 2008.

Which all raises a frightening prospect. What if we go into the next recession with interest rates at zero? Janet will then have to reduce interest rates to negative numbers to stimulate the economy.

If the Fed doesn?t raise interest rates soon, it will have no other choice than to do the unimaginable, once we hit the next rough patch.

But then, there have been a lot of unimaginables lately.

Japan and Europe have had negative interest rates until recently, so why not us?

In fact, friends of mine at the Fed tell me that one voting member was already pushing for negative overnight rates at their September 17 meeting.

And we were expecting them to raise rates?

I don?t think it will get to that because of what I call ?The Great Contradiction?, or better yet, ?The Great Conundrum?.

Yesterday?s red-hot sales figures indicate that the US auto industry is headed for a blistering 18 million annual production rate.

The housing market is on fire. I just went to some open houses in the neighborhood today, and the listing agents tell me they are blown away by the incredible number of 30 something tech workers buying $2 million houses for cash!

Early signs of wage hikes are popping up everywhere. There is a shortage of 50,000 truck drivers. Fulfillment centers, such as at Amazon (AMZN), in nearby Nevada are having difficulty finding minimum wage workers.

It had to happen eventually.

And guess who got a job offer the other day?

A local charter air service called and asked if I wanted to go back to work as a pilot!

It seems my name still appears on a list of local commercial pilots. The pilot shortage has become so severe airlines have taken to cold calling lists to find them. It was about flying around someone ?important.?

Well HELLOOOO!

I?m told that the pilot situation in China is far worse, now that they have a staggering 1,000 wide body jets on order.

The last time I said ?Yes? to an offer like that was to the United States Marine Corps. in 1990. My back still hurts from that one (semper fi).

But wait! There?s more!

Driving back from Lake Tahoe in August, I was struck by the number of out-of-state plates pulling U-Haul trailers over historic Donner Pass.

Some 350,000 are moving to the Golden State this year, chasing our newest gold rush, the much-desired high paying technology jobs of the San Francisco Bay area.

It is a migration of epic proportions, much like the influx of Oakies we saw arriving here during the Great Depression (think Grapes of Wrath).

I know of a dozen structures under construction in the San Francisco Bay area that will employee more than 10,000 each (the new Apple headquarters is a big one)!

I?m sorry, but none of this squares with a 2% GDP growth rate, and an August nonfarm payroll of 142,000.

Has the American economy really become that bifurcated?

Is the robust strength in California being horribly offset by weakness in Kentucky (coal), North Dakota (oil), Iowa (agriculture), Wyoming (mining), and Texas (more oil)?

Do we have one good economy and one bad economy all mixed up together in the data, obscuring the true picture?

The problem for we traders is that the government numbers usually reflect actual business conditions three to six months late. Yet, that?s all we have to go by, beyond what we witness with our own two eyes.

So what are these anecdotes telling us that the government data isn?t?

That a summer slowdown inspired by international economic turmoil is already in the rear view mirror, and that the next round of business data will be positive.

That means up for stocks for the rest of the year, and down for bonds, for the rest of 2015.

Gee, that short position in Treasury bonds I strapped on during Friday?s chaos is suddenly feeling pretty good.

Maybe I should pile on more?

In the wake of the latest round of pro democracy demonstrations in China, I spent the evening speaking to Gao Jie, a Beijing civil judge who left the bench to join China's growing environmental movement when her kids came home from school one day coughing and wheezing.

You only have to inhale in the capitol city these days to understand that they have a huge problem there. It?s a lot like Los Angeles was 50 years ago before the environmental movement arrived here. I remember it all too well.

One of the dirty little secrets of international trade for the last three decades has been the offshoring of high polluting industries from the US and Europe to China, which then vociferously complain about the emerging country's toxic environment.

Much of the Middle Kingdom's record carbon emissions these days have been imported from the West. 'Cancer villages' are now proliferating throughout the landscape.

China gets 80% of its power from coal, compared to only 36% in the US. As a result, scientists figure that China became the world's largest emitter of CO2 in 2006.

The central government is now asking the provinces to achieve both GDP and energy conservation goals at the same time, a difficult task at best.

Government policy dictates that air conditioners only kick in at 79 degrees. If you think that went down well, try spending a summer in Beijing sometime.

It is also pushing headlong into alternative energy, is already the technological leader in key areas like wind, and has an eye to exporting low cost platforms to the US.

China is also having Phoenix based First Solar (FSLR) build the world's largest thin film solar power plant in Western China, which, it turns out, looks a lot like Arizona.

The mammoth, 25 square mile facility will supply power to three million homes.

China's problems give one an inkling of how we might have ended up if we hadn't passed the Environmental Protection Act in 1970.

I first visited China during the Cultural Revolution, when they doused piles of bodies of those who died in the famine with kerosene and burned them, and anyone educated had to endure being paraded down a street in a dunce cap.

I had to pinch myself after seeing a sophisticated and well-educated woman like Gao Jie openly pursue her liberal goals, unfettered by a totalitarian regime.

Global Market Comments

October 2, 2015

Fiat Lux

Featured Trade:

(OCTOBER 7 GLOBAL STRATEGY WEBINAR),

(PETER F. DRUCKER ON MANAGEMENT),

(THANK GOODNESS I DON?T LIVE IN SWEDEN), (EWD),

(PLEASE USE MY FREE DATA BASE SEARCH)

iShares MSCI Sweden (EWD)

Global Market Comments

October 1, 2015

Fiat Lux

SPECIAL BIOTECH AND HEALTH CARE ISSUE

Featured Trade:

(FRIDAY, MAY 15 SAN FRANCISCO STRATEGY LUNCHEON)

(BIOTECH AND HEALTH CARE STOCKS TO BUY AT THE BOTTOM),

(GILD), (AMGN), (BIIB), (REGN), (HCA),

(CELG), (AGN), (XLV), (IBB),

(KEEP GILEAD SCIENCES ON YOUR RADAR)

Gilead Sciences Inc. (GILD)

Amgen Inc. (AMGN)

Biogen Inc. (BIIB)

Regeneron Pharmaceuticals, Inc. (REGN)

HCA Holdings, Inc. (HCA)

Celgene Corporation (CELG)

Allergan plc (AGN)

Health Care Select Sector SPDR ETF (XLV)

iShares Nasdaq Biotechnology (IBB)

I am going to continue to use this correction in the stock market as an opportunity to put new names in front of you for inclusion in your investment portfolio.

That way, when the markets turn, you can strike with the speed of a rattlesnake in returning to a ?RISK ON? posture.

Major turnarounds are not the time to engage in deep, fundamental research. It is when you should be pulling the trigger on Trade Alerts, which you have wisely spent time lining up.

This brings me back to my three core sectors for long-term investment, technology, health care, and energy. For a four cyclical play, you can add the financials as an interest rate play.

Which brings me to one of my perennial favorites, Gilead Sciences (GILD). Long-term readers will recall this big momentum name, which I first recommended last December at $75 a share. It hit $125 in June, last week, and could fly as high as $200 in 2016.

Obamacare is proving to by one of the greatest windfalls in the history of the health care industry. More than 45 million new individuals now enjoy government guaranteed payments for health care services for the first time. In addition, millions more are signing up for private insurance.

One of the cleanest shots at this new profit stream is Gilead Sciences. The ticker symbol seems so appropriate for this new Golden Age for the health care industry.

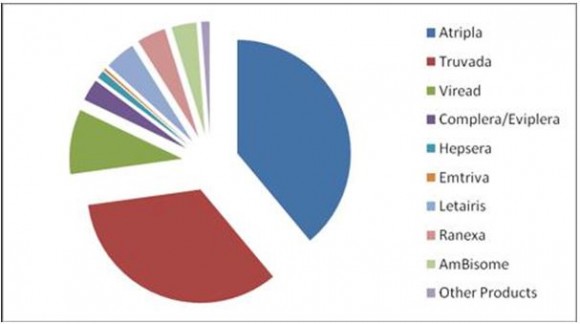

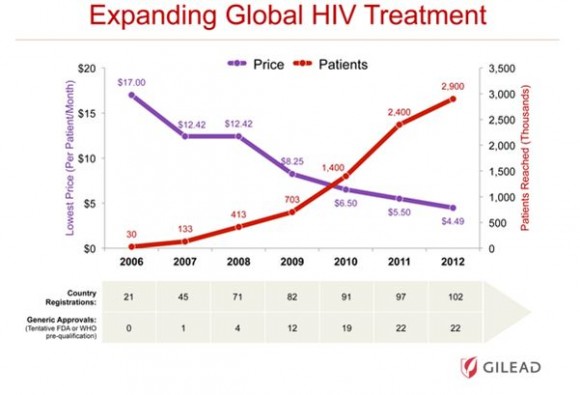

(GILD) is an American biotechnology company that discovers, develops and commercializes treatments for a range of different diseases. The California based firm initially concentrated on antiviral drugs to treat patients infected with HIV, hepatitis B, or influenza.

In 2006, Gilead acquired two companies that were developing drugs to treat patients with pulmonary diseases.

These are all expected to be huge growth areas in the future, and the company has become a favorite of hedge fund traders. Both the shares and the sector have been on fire all year.

Don?t rush out and buy (GILD) today. Rather, I?d wait until the last of the sellers get flushed out in this correction, which will probably not be until well into October.

Take a look at the charts below, and they suggest that the S&P 500 could reach as low as 1,976, or down another 160 handles from here.

That will give us another top to bottom pullback of 12.52%, which certainly qualifies as a healthy correction. This will be the time to load the boat with (GILD).

Keep close tabs on your text message service and email, and I?ll let you know when it is time to lay your cajones on the line once more.

Yes, It?s $1,000 a Pill

Yes, It?s $1,000 a Pill

Global Market Comments

September 30, 2015

Fiat Lux

Featured Trade:

(OCTOBER 12 PORTLAND, OREGON GLOBAL STRATEGY LUNCHEON),

(CARL ICAHN IS AT IT AGAIN),

(LNG), (FCX), (AAPL), (HYG), (JNK),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS)

Cheniere Energy, Inc. (LNG)

Freeport-McMoRan Inc. (FCX)

Apple Inc. (AAPL)

iShares iBoxx $ High Yield Corporate Bd (HYG)

SPDR Barclays High Yield Bond ETF (JNK)

Many ascribe Monday?s 312 point plunge in the Dow Average to an informational webinar posted by legendary corporate raider and hedge fund manager, Carl Icahn.

I have known Carl for 30 years, and I once owned and apartment in his building on the Upper East Side of Manhattan, near Sutton Place (which I later sold for a quick double).

Even then, he was opinionated, cantankerous, and never hesitated to make the bold move. Wall Street hated him.

At 79, he is nothing less than a force of nature. Whenever I see Carl, I say I want to be like him when I grow up.

I just watched the controversial video, entitled ?Danger Ahead ? A Message From Carl Icahn?, which has ruffled more than a few feathers in the establishment. But that has always been Carl?s strong suite.

Here are the high-points:

1) We should end the ?carried interest? treatment of hedge fund profits, which lets billionaire managers get off scot-free, while sticking a big tax bill with the little guy.

2) Foreign profits of US multinationals, some $2.2 trillion, should be brought home, taxed, and put to work.

3) Corporate inversions, whereby American companies reincorporate overseas to beat taxes, should be banned.

4) Corporate share buybacks, which amount to 4.5% of the outstanding float per year, are a short-term fix for company share prices only at the long-term price of a weaker balance sheets.

5) Some $4.5 trillion in borrowing by the Federal Reserve has crowded out the little guy. On this one, I disagree with Carl. With overnight rates at zero and ten year Treasury bonds yielding 2.06%, nobody is getting crowded out from anything.

6) Artificially low interest rates are fueling an unwarranted takeover boom and encouraging risky financial engineering.

7) Junk bonds (HYG), (JNK) are a bubble begging to pop. They are the result of a runaway Wall Street selling machine that saw big firms selling short their own issues to unwary customers.

Carl sums up by saying that while the Fed saved the US economy during 2008-09, they created the problem in the first place with Greenspan?s excessive easing in 2002-03.

He believes that the candidacy of outsider Donald Trump is a natural reaction to peoples? dissatisfaction with Washington and Wall Street.

I have to admit that Carl has brought up some serious points here. I agree with all, except the above-mentioned ?crowding out? issue. Combined, they are a detrimental tax on the long-term economic health of America.

Could this be an attempt by Carl to throw his hat into the political ring? Treasury Secretary in a future Trump administration was mentioned in later media interviews.

But at his age, even for Carl, that would be a reach.

While Icahn has been ringing the alarm bell on the stock market and junk bonds all year, he has been aggressively acquiring major stakes in in the energy and commodities sectors all year, while they are trading at generational lows.

He has zeroed in on two of my own favorite trades, Freeport McMoRan (FCX) and Cheniere Energy (LNG).

Carl is also holding a major position in Apple (AAPL), which he acquired two years ago just after I jumped in at $395. He believes the shares are absurdly cheap.

To watch the 15 minute video in full, please click: http://carlicahn.com.

Good for you, Carl Icahn!

?Those who do not learn from history are doomed to repeat it, and I?m afraid we?re going down that road,? said corporate raider Carl Icahn.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.