Global Market Comments

December 5, 2024

Fiat Lux

Featured Trade:

(LAUNCHING “TRADING OPTIONS FOR BEGINNERS”)

Global Market Comments

December 5, 2024

Fiat Lux

Featured Trade:

(LAUNCHING “TRADING OPTIONS FOR BEGINNERS”)

Global Market Comments

December 4, 2024

Fiat Lux

Featured Trade:

(AMERICA’S DEMOGRAPHIC TIME BOMB)

You can never underestimate the importance of demographics in shaping long-term investment trends, so I thought I’d pass on these two highly instructive maps.

The first shows a map of the world drawn in terms of the population of children, while the second illustrates the globe in terms of its 100-year-olds.

Notice that China and India dominate the children’s map. Kids turn into consumers in 20 years, stay healthy for a long time, and power economic growth.

The US, Japan, and Europe shrink to a fraction of their actual size on the children’s map, so economic growth is in a long-term secular downtrend there.

There is more bad news for the developed world on the centenarian’s map, which shows these countries ballooning in size to grotesque, unnatural proportions.

This means higher social security and medical costs, plunging productivity, and falling GDP growth.

The bottom line is that you want to own equities and local currencies of emerging market countries and avoid developed countries like the plague.

This is why we saw tenfold returns from SOME emerging markets (EEM) over the past ten and why there is an irresistible force pushing their currencies upward (CYB) over the long term.

Use any major meltdowns this year to increase your exposure to emerging markets, as I will.

Global Market Comments

December 3, 2024

Fiat Lux

Featured Trade:

(THE MAD HEDGE DECEMBER TRADERS & INVESTORS SUMMIT IS ON!)

(IT’S GROUNDHOG DAY)

(LAUNCHING "TRADING OPTIONS FOR BEGINNERS”

(SPY), (TLT), (TBT), (VIX), (VXX), (GLD), (SLV)

The election is over and a brave new world lies before us.

But the Fed may soon stop raising interest rates, inflation is rising, and tech stocks are flat-lining! Can a stock market crash be far behind?

What should you do about it?

Attend the Mad Hedge Traders & Investors Summit from December 3 - 5. Learn from 24 of the best professionals in the market with decades of experience and the track records to prove it. They are offering a smorgasbord of successful trading strategies.

Every strategy and asset class will be covered, including stocks, bonds, foreign exchange, precious metals, commodities, energy, and real estate.

Get the tools to build an outstanding performance for your own portfolio.

Best of all, by signing up you will automatically have a chance to win up to $100,000 in prizes.

Usually, access to an exclusive conference like this costs thousands of dollars. You can attend for free!

Listening to this webinar will change your life! To register, please click here.

It is always the sign of a great hedge fund manager when he makes money while he is wrong.

I have seen this throughout my life, trading with clients and friends like George Soros, Julian Robertson, Paul Tudor Jones, and David Tepper.

And wrong I certainly was in 2024.

I thought Trump would lose the election.

Then, I thought that markets would rocket no matter who won. Only the sector leadership would change.

How about one out of two?

The big question is: “Is a stock market crash now in front of us?” The answer is absolutely yes. It’s only a question of how soon.

At this point, we only know what Trump said. And as we all know, what Trump says and does, or can do are totally different things. It all adds a new and constant source of unknowns for the market.

Of course, it helps to have a half-century of trading experience, too. I like to tell my beginning subscribers, “Don’t worry, after the first 50 years, this gets easy.”

Except easy it is not, going into the next several couple of years.

In a few months, it will be Ground Hog Day, and Punxsutawney Phil will call the weather for the next six weeks from his hilltop in Gobbler’s Knob, Pennsylvania.

For the financial markets, it could mean six more MONTHS of winter.

Nobody wants to sell because they believe in a longer-term bull case going into yearend.

In the meantime, they are buying deregulation plays (JPM), (GS), (BLK), and Tesla (TSLA) as a hedge against the next Tweet.

We could see a repeat of the first half of 2017 when markets rocketed and then died.

This is what a Volatility Index (VIX), (VXX) is screaming right in your face, kissing the $13 handle.

The never-ending tweets are eroding the bull case by the day.

So, we’re at war with Canada now? Wait! I thought it was Mexico? No, it’s France. If it’s Tuesday, this must be Belgium.

And our new ally? Russia!

Even the Federal Reserve is hinting in yesterday’s statement that it is going into “RISK OFF” mode, possibly postponing a December interest rate cut indefinitely.

Unfortunately, that completely sucks the life out of our short Treasury bond trade (TLT), (TBT) for the time being, a big earner for us earlier this year.

Flat to rising interest rates also demolish small caps and other big borrowers (homebuilders, real estate, REITs, cruise lines).

The market is priced for perfection, and if perfection doesn’t show, we have a BIG problem.

All of this leads up to the good news that followers of the Mad Hedge Fund Trader enjoyed almost a perfect month in November.

Trade Alert Service in November

(DHI) 11/$135-$145 call spread

(GLD) 12/$435-$340 call spread

(TSLA) 12/$3.90-$400 put spread

(JPM) 11/$195-$205 call spread

(CCJ) 12/$41-44 call spread

(JPM) 12/$210-$220 call spread

(NVDA) 12/$117-$120 call spread

(TSLA) 12/$230-$240 call spread

(TSLA) 12/$250-$260 call spread

(TSLA) 12/$270-$275 call spread

(MS) 12/$110-$115 call spread

(C) 12/$60-$65 calls spread

(BAC) 12/$41-$44 call spreads

(VST) 12/$115-$120 call spread

(BLK) 12/$950-$960 call spread

The net of all of this is that 2024 is looking like a gangbuster year for the Mad Hedge Fund Trader, up 18.96% in November and 72.00% YTD, compared to only 26.62% for the S&P 500.

It seems that the harder I work, the luckier I get.

Hanging With David Tepper

Global Market Comments

November 29, 2024

Fiat Lux

Featured Trade:

(The Mad DeCEMBER traders & Investors Summit is ON!)

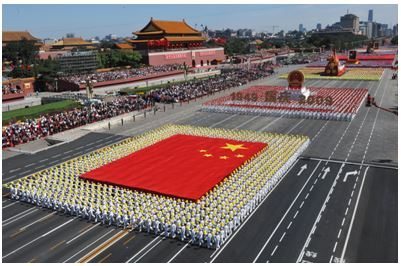

(CHINA’S VIEW OF CHINA),

(FXI), (BIDU), (BABA), (JD)

There was so much enthusiasm for China only a month ago.

A stimulus package was announced, a massive short-covering rally ensured, and finally, after a three-year hiatus, China was back in play. Several hedge funds announced major commitments to the Middle Kingdom.

Here we are only three weeks after the US presidential election, and China now looks so much rubble. Asst prices returned to their starting points. The hedge funds have so much mud on their faces. It’s back to a long wait.

Which gives us all plenty of time to think about what China is really all about.

I ran into Minxin Pei, a scholar at the Carnegie Endowment for International Peace, who imparted to me some iconoclastic, out-of-consensus views on China’s position in the world today.

He thinks that power is not shifting from West to East; Asia is just lifting itself off the mat, with per capita GDP at $12,969, compared to $81,695 in the US.

We are simply moving from a unipolar to a multipolar world. China is not going to dominate the world, or even Asia, where there is a long history of regional rivalries and wars.

China can’t even control China, where recessions lead to revolutions, and 30% of the country, Tibet and the Uighurs want to secede.

China’s military is almost entirely devoted to controlling its own people, which makes US concerns about their recent military build-up laughable.

All of Asia’s progress, to date, has been built on selling to the US market. Take us out, and they’re nowhere.

With enormous resource, environmental, and demographic challenges constraining growth, Asia is not replacing the US anytime soon.

There is no miracle form of Asian capitalism; impoverished, younger populations are simply forced to save more because there is no social safety net.

Try filing a Chinese individual tax return, where a maximum rate of 40% kicks in at an income of $35,000 a year, with no deductions, and there is no social security or Medicare in return.

Ever heard of a Chinese unemployment office or jobs program?

Nor are benevolent dictatorships the answer, with the despots in Burma, Cambodia, North Korea, and Laos thoroughly trashing their countries.

The press often touts the 600,000 engineers that China graduates, joined by 350,000 in India. In fact, 90% of these are only educated to a trade school standard. Asia has just one world-class school, the University of Tokyo.

As much as we Americans despise ourselves and wallow in our failures, Asians see us as a bright, shining example for the world.

After all, it was our open trade policies and innovation that lifted them out of poverty and destitution. Walk the streets of China, as I have done for four decades, and you feel this vibrating from everything around you.

I’ll consider what Minxin Pei said next time I contemplate going back into the (FXI) and (EEM).

China: Not All Its Cracked Up to Be

Global Market Comments

November 27, 2024

Fiat Lux

Featured Trade:

(THE REAL ESTATE CRASH COMING TO A MARKET NEAR YOU),

(THE FALLING MARKET FOR KIDS)

Hardly a day goes by when a reader doesn’t ask me when the Australian real estate bubble is going to burst.

They are right to be concerned.

In the table below, Sydney is ranked as the second most expensive market in the world at 12.2 times the local median pre-tax household annual income.

It is far behind Hong Kong, at 19.9 times, and just ahead of Vancouver, Canada, at 10.8 times.

Even Australian banking regulators are concerned about a “Dutch tulip” style mania developing in the Land Down Under.

They are worried that the coming price collapse will pose a major threat to their financial system.

Indeed, a home on Sydney Harbor owned by my former employer, the Fairfax newspaper family, sold for a staggering AUS$75 million, a new record for the country.

Sure, the views are great. But AUS$75 million?

I have been through a lot of these real estate booms over the past five decades.

There was the notorious Japanese bubble in 1990. I have been through at least three such booms in California. Here, real estate brokers can turn into Uber drivers in a heartbeat.

And they always follow the same predictable pattern.

How high is high? Think of an absurd, impossible number, and then double it. That always seems to be a good rule of thumb. Except that Australia is already past that last doubling.

When my Australian friends ask how high prices can go, I tell them to check out prices in Shanghai, where apartments go for twice as high for a quarter of the space.

In fact, identifying bubble tops is a fool’s errand. When markets become irrational, the last thing buyers care about is rationality, hard data, or valuations.

In the past, the music always stopped playing for the same reasons.

Central banks fearful of inflation slammed on the brakes and drove interest rates through the roof, as Paul Volker did in 1980.

An extraneous shock, such as the 1973 and 1979 oil price spikes or the 1991 Savings & Loan Crisis, can also let the air out of the balloon.

I remember that during the S&L Crisis, I was ushered in to see a California property, and the owner burst into tears when the agent mentioned the price because of the huge personal hit he was taking on his equity.

Except that this time, it’s different.

Real estate used to be local. Now, it’s global.

You have the same factor pushing up property in prime markets all over the world at the same time: Chinese buying.

For a decade now, buyers from the Middle Kingdom have been bidding up the prices of homes in London, Australia, New York, Vancouver, and elsewhere.

You know that nice little mansion I sold in London in 1994 for $2 million? It’s now worth $20 million.

In nearby Napa Valley, CA, the Chinese are snapping up trophy vineyards left and right, paying wildly inflated prices. Prices are up an eye-popping 16.6% year on year.

You can always tell when a property changes hands when the stone lions show up at the front gates.

Their goal is the same everywhere. Get their money out of China before the wheels fall off, be it for economic or political reasons.

The Chinese aren’t looking for retirement homes. They need bolt-hole places to hide out.

A stepped-up anti-corruption campaign by the Beijing government seems to have accelerated the trend.

The capital flows have been so enormous that the Chinese government has had to liquidate $1 trillion in foreign exchange reserves, a quarter of the total, primarily held in US Treasury bonds, notes, and bills, to support the Renminbi.

These gargantuan capital flows have created the same anomalies around the world, that of “ghost neighborhoods” owned for investment purposes only.

On the receiving end, the US government is taking measures to stem money laundering and tax evasion.

The IRS is using the Patriot Act to require proof of ownership for all real estate purchases over $2 million in New York and San Francisco.

Cayman Islands, British Virgin Islands, and Cook Islands nominee holding companies or LLC’s can no longer be used as identity shields.

Without real residents living there, local businesses, like dry cleaners, coffee shops, and supermarkets, die off for lack of customers.

Take a walk around the Mayfair district of London one of these days, and you’ll see what I mean.

Or ride up and down the elevators in the residential towers at New York’s Columbus Circle, where 60% of the apartments are foreign-owned.

I even have one of these at the end of my street here in San Francisco.

The home came on the market for $2.1 million three years ago and sold in a day for $2.3 million. It has been empty ever since.

(By the way, the opposite end of my street displays San Francisco’s other big problem, start-ups moving into cheaper residences to avoid sky-high commercial property rates. There, the lights NEVER go out.)

Real estate agents everywhere love the business.

Most of these deals are done for cash only with rushed due diligence. Loan approvals and appraisals, frequent deal killers for domestic buyers, never even enter the picture.

For the sake of full disclosure, I have to admit that I have been a happy participant in the property gold rush like everyone else, making a kings ransom on properties I bought during the 2011 bottom, at least on paper.

Look at the table below, and you’ll see that four of the world’s ten most expensive cities are in California. Perhaps I shouldn’t throwing stones in glass houses.

But at least here, you have multiple booms going on in technology, health care, alternative energy, and transportation, driving earnings, and, therefore, house prices.

Since the causes of this bubble are largely come from China, so must the end.

A serious economic slowdown in China would tip the balance. So would a trade war with the US.

Tougher controls on capital flows could stem the tide. So would political instability, never far below the surface in China.

Whatever the reason, leveraged owners of luxury real estate anywhere on the planet should always keep one thing in mind: Your fate is totally in the hands of China.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.