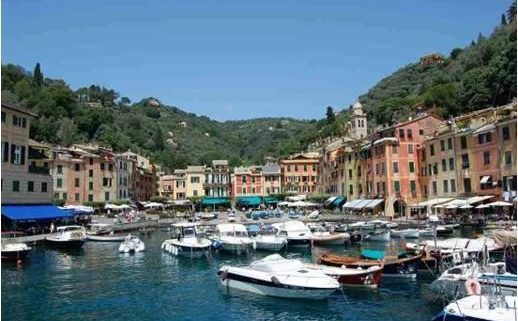

Come join John Thomas for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting near Portofino, Italy on the Italian Riviera, on Thursday, July 25, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

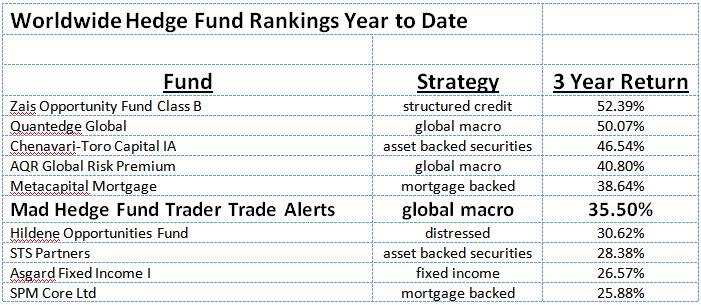

I'll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $205.

The lunch will be held at major hotel on the beach in the village of Santa Margherita Ligure, the details of which will be emailed with your purchase confirmation. The town is easily accessible by train from Genoa, and the hotel is about a ten-minute walk from the train station.

Bring your broad brimmed hat, sunglasses, and suntan lotion. You will need them. The dress is casual. Accompanying spouses will be free to use the beach below and bill drinks to the luncheon. Together we will plot the future of western civilization.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.